Introducing Ramp Plus: freeing finance teams to do the best work of their lives

- Ramp Plus: A faster and simpler way to scale your business—on one complete platform

- Sign up for Ramp and experience Ramp Plus today

At Ramp, our mission is to set finance free to build healthier businesses. As we've scaled to support over 15,000 customers, larger and more complex companies have joined the modern finance movement and chosen Ramp as their ultimate finance platform. They’ve saved over $600M and 8.5M hours of work—and these savings have tripled year-over-year.

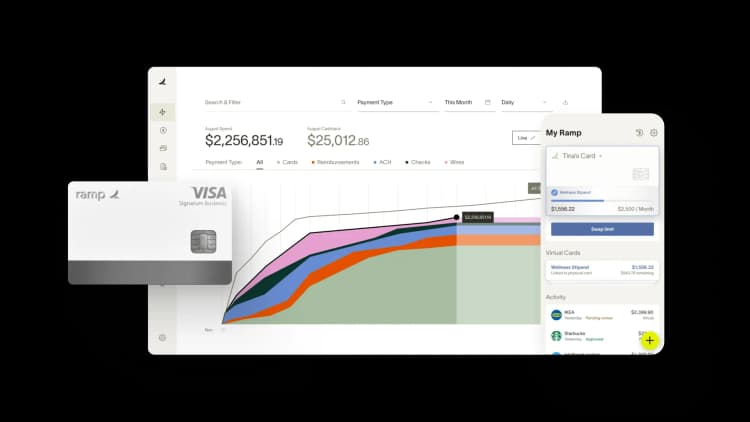

We’ve listened deeply to the needs of these scaled and growing businesses and are proud to share that we’re launching an enhanced edition of Ramp’s core platform—Ramp Plus, available today. With Ramp Plus, we are helping growing companies with their most complex financial operations. Innovative companies—like Shopify who chose Ramp as its exclusive expense provider for its 10,000+ global employees—are helping us understand what they need to equip and free their finance teams. What we’ve heard: more flexibility, scale, and integration with existing systems.

Ramp Plus: A faster and simpler way to scale your business—on one complete platform

With Ramp Plus, your finance team has access to the following powerful, all-in-one functionality:

Control spend with a new procure-to-pay solution: As companies scale, so does the volume of unmanaged employee purchases dispersed across teams. Cost-cutting is top of mind for finance teams as 77% of CFOs have reported they are looking to adopt new cost-cutting measures and 76% are re-negotiating supplier contracts.

Control spend and manage the full procure-to-pay process with our automated and customized procurement solution. Capture requests in one centralized location, loop in the right teams for approval, and track purchase orders through to payment.

Operate anywhere in the world with global expenses and payments: Companies are becoming more global and businesses are plagued with poor experiences, such as manual currency conversions for international transactions and managing their global entities with fragmented tools. Issue card limits, budgets, and spend programs in multiple currencies and consolidate all global spend with multi-entity support for your accounting software, international tax code support, and international debiting (available for CAD, UK, and EU over the next few months).

Revenue management software “Beyond” now manages its international, multi-entity spend entirely through Ramp rather than multiple different bank accounts, and has sped up their reconciliation time by eight times.

With the launch of Ramp Plus, Ramp is becoming the first unified platform designed to meet the demands of finance teams’ most complicated operations.

Automate your complex processes with our workflow builder: As businesses grow, so do the demands of their finance operations. Increase efficiency across your operations using Ramp’s rules-based workflow builder, from automated employee onboarding to procurement and payment approvals.

With customizable workflows, Shopify was able to streamline onboarding and card issuance for new employees. Simplifying the expense process across their 10,000+ global employees has added up to hundreds of thousands of hours back to focus on meaningful work.

Prevent overspending with smart policies that enforce themselves: For scaling businesses, every dollar counts. Prevent overspending with enhanced controls and policy enforcement. Auto-lock employee cards when receipts aren’t submitted, mandate manager transaction reviews, and, if there are any out-of-policy expenses, smart transaction reviews will automatically flag them and alert you for additional review.

Advanced controls for customers like Virgin Voyages help prevent overspending and automatically enforce policies at scale.

Integrate within your existing stack:Scaling can result in operational growing pains, and require switching existing vendors in favor of ones that can accommodate your business’ new needs. Upgrade and customize your existing stack as you expand without having to reconfigure your tools with a wide suite of HRIS and accounting solutions.

Deep integrations with NetSuite help multi-product businesses like Glossier automate more of their accounting processes and save five hours/week.

Sign up for Ramp and experience Ramp Plus today

Ramp Plus is an optional, paid plan. Ramp’s core product, which includes the fastest-growing corporate card and bill payment software in America, will remain free. We’re excited to offer more flexibility and help companies at all stages of growth spend smarter—check out our recent webinar to learn more.

With the introduction of Ramp Plus, companies of all sizes can rely on Ramp as the ultimate finance platform to save time and money at every step as they scale. But don’t take our word for it: try Ramp today and see how Ramp Plus can help your business reach its potential.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits