Building healthier businesses with the ultimate finance operations platform

Today, finance teams must both drive growth while keeping costs down amidst uncertain market conditions. As a result, more and more companies are seeking innovative finance tools to help them grow responsibly.

At Ramp, we’re dedicated to helping companies save time and money. And, with the help of our spend controls, automation capabilities, and intelligence layer, our customers have saved over $600M and 8.5M hours of work to date, plus:

- Across all customer segments, there were 22% more new business sign-ups in the last three months than the three months prior, with enterprise leading the pack (118%), followed by mid-market (58%), SMBs (38%), and micro-SMBs (8%).

- Ramp customers are becoming increasingly global: To-date, Ramp cards are used across 74 countries and the number of Ramp users with international operations has grown 100% in the last six months.

- Momentum will only increase as more growing businesses, including Virgin Voyages, Mindbody- Classpass, Poshmark, Barry’s, and Simple Mills, choose Ramp as their preferred platform.

Helping finance teams reach their full potential

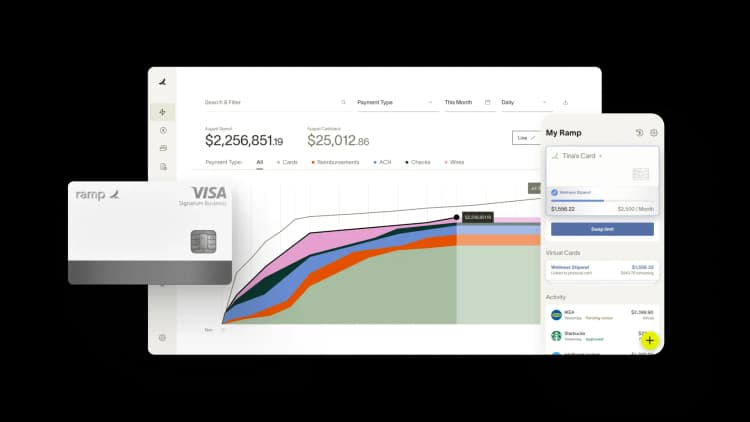

As finance leaders look to improve efficiency and the financial health of their organizations, they’re facing a hodgepodge of finance point solutions. This fragmentation increases friction and complexity for their teams, limiting visibility, control, and ultimately productivity. Ramp addresses this head on with its all-in-one platform, providing the ability to consolidate your corporate card, expense management, and accounts payable into one place that allows you to:

Prevent your company from overspending: Get full visibility and control of all spend in one place. End out-of-policy spending with custom policies that proactively block and flag non-compliant expenses. Make every dollar go further with Price Intelligence that uses spend information from thousands of Ramp customers to help you get the best deal on software.

Save time and focus on what matters: Eliminate manual finance work and increase operational efficiency with automatic receipt capture, AI-powered accounting coding, and more. Control spend from the beginning with configurable approval workflows and transaction alerts for the exceptions that matter.

Work with all your tools, so you don’t have to: Ensure accurate and secure information across all of your systems by using Ramp’s integrations and APIs to sync data in real time. Securely onboard employees to Ramp in seconds and update access as people come and go. Speed up monthly close with accounting integrations that auto-code and sync all of your transaction data to your ERP.

Scale with ease: Ramp is customizable to meet your local and global requirements so you can operate around the world. Send payments to 195 countries from your local bank account and reimburse employees in their local currency within two days. See spend across all of your domestic and international entities and feel confident from the start that our support team is always ready to help you throughout your journey.

Today, thousands of companies use the core Ramp platform to close their books up to 8x faster and save smarter. Our platform has delivered powerful functionality that ranges from being able to secure the best price on software to letting Ramp do your expenses for you. We have and will continue to invest in building solutions with cutting-edge tools like we have done since day one of Ramp. And we’re just getting started.

Ramp: a new way forward for finance

Ramp started four years ago offering a better card to save companies time and money. But the card was just the start to creating a better way forward for finance. Today, we're dedicated to building finance software that steers companies towards greater financial health. Give your team everything they need to meet their full potential. Sign up for Ramp today.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits