How Ramp is bolstering the global workforce with modern finance experiences

- Intuitive spend management, built for the boundless employee

- Scale finance operations with your global team

- Expense management to power your global workforce

Too many finance teams are trapped by antiquated tools and processes. These deficient systems are causing them to waste their employees’ valuable time. The issue gets even worse as companies grow internationally. Today we’re excited to share the biggest expansion of our product capabilities to date—one that is focused on all of your employees, no matter where they’re located.

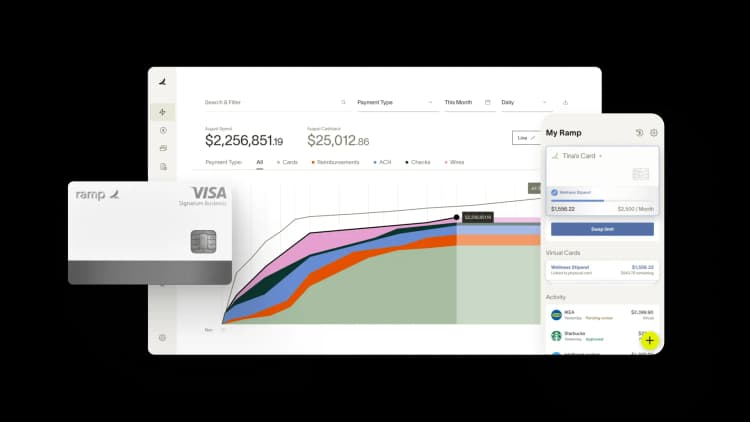

Over 10,000 businesses and 300,000 employees around the world rely on Ramp to control spend, automate tedium, and unlock time for more strategic work. Why do cutting-edge companies like Webflow trust Ramp? It boils down to our unparalleled user experience.

With more employees going remote, an effortless user experience across your tech stack has never been more critical to keep your organization agile. Finance teams need to equip team members with applications that serve them well, instead of making them jump through hoops when they’re spending for the business.

Our latest update equips you with powerful, yet easy-to-use features that you can use across multiple entities. With Ramp, you can now roll out a seamless, efficient financial experience any place where you have employees.

Intuitive spend management, built for the boundless employee

Workforces are becoming more multinational. Ramp provides your finance team with all the tools they need to manage your remote employees’ spending needs. Today’s release enables you to do the following.

1. Reimburse your employees no matter where they’re located

Usually, employees living outside of the U.S. get a subpar experience working for U.S. companies. Reimbursements can take weeks, putting unfair pressure on their personal finances.

Now you can offer each of your employees the Ramp experience, no matter where they’re located, with our new international reimbursements. Have a team member relocating somewhere warmer for the winter? They can work with confidence, knowing they can be paid within two days for any out-of-pocket expenses in their local currency. With our Ramp mobile app, employees have instant access to your expense policies and spend requests, so you can easily keep tabs on their spend.

International reimbursements unlock huge opportunities for where businesses can source talent. From the sharpest designers to developers, you can now hire employees from anywhere, without any worries about how you’ll pay them.

2. Send vendor payments in 195 countries and 50+ currencies

The U.S. dollar is rising and businesses are once again benefiting from working with international vendors. Except this time you don’t have to endure painful issues like delayed payment statuses, expensive fees, and hard-to-reconcile transactions that usually accompany cross-border commerce.

With Ramp's international payments, you can now pay global vendors in USD and, soon, popular currencies like euros and pounds in as little as minutes. This is especially useful if you’re a U.S. business with multiple entities because now you can now partner with a whole new segment of vendors—and easily pay them.

Candid—known for their high-quality dental aligners—is leveraging Ramp to scale their business:

“When we expanded our operations to Mexico last year, it was important to us that we maintained trust with our employees and our vendors. The last thing they should be worrying about is when they’ll get paid or reimbursed and in what currency.

With Ramp, our employees across the U.S. and Mexico can use our corporate cards with built-in controls and our vendors know that they can expect timely payments without any hassle. Best of all, we can track our domestic and international payments in one place, giving my team peace of mind that we’re staying lean and within compliance and regulatory requirements.”

- Dmitriy Lavrenkin, CFO, Candid

3. Enable your employees with preset budgets

Traditional expense management is reactive, leading to a lack of control and awkward conversations if employees spend out of policy.

We’re taking a radically new approach to spend management—one focused on empowering employees with preset amounts they can use for things like working from home, an international business trip, or their annual education stipend. With Ramp funds, employees will have the flexibility to spend from a set amount using their virtual card, physical card, or reimbursements. No matter how employees choose to spend, managers and finance teams stay in control over the amount.

4. Give your employees the magic of zero-touch expenses

Your employees are back on the road. Our mobile app lets them submit expenses and reimbursements the moment they swipe their card anywhere in the world. All they need to do is submit a quick photo of their receipt and memo, which are then matched with the correct transaction.

And even that’s not needed in some cases. With Ramp's receipt integrations with Gmail, Amazon Business, and Lyft, and our upcoming integration with Microsoft Outlook, your employees won’t have to lift a finger. All of these receipts automatically get submitted and matched in Ramp.

Over the last 30 days, Ramp has automatically processed 37,633 receipts on behalf of busy employees. At an average of three minutes per receipt, that’s over 47 weeks of work saved.

Scale finance operations with your global team

Now that you can reimburse employees and pay vendors anywhere, you need an operational platform that enables you to track, classify, and reconcile payments easily—no matter the currency, entity, or tax requirement. This is where the magic of Ramp’s software embedded into your payments truly shines.

Ramp's accounting integrations help teams automate tedious busywork and save time closing their books every month. Our NetSuite integration is among the most powerful in the industry, following the recent release of multi-entity support and new capabilities that include:

- International tax reporting: Many businesses don’t even bother claiming the input tax credits, leaving valuable money on the table in times of compressed margins. Now you can easily track VAT and GST paid on non-US purchases in the local currency, so you can file accurate returns.

- Multi-currency: Sync international transactions and reimbursements to NetSuite in the original currency

- Amortization: Ramp now connects directly to NetSuite’s amortization templates so you can set up, schedule, and record amortized payments seamlessly in Ramp Bill Pay.

As always, Ramp provides real-time reporting across all spend. With international bill payments and reimbursements flowing into Ramp, your centralized view across all spend just got a whole lot bigger.

"At Webflow we are remote first and Ramp’s modern solution allows us to quickly issue cards to anyone who needs them, keeping our finance team lean and efficient as the business scales and empowering our team members to take ownership of company finances."

- Ivan Makarov, VP of Finance, Webflow

Expense management to power your global workforce

Your growing, decentralized workforce wants systems that work with them, not against them. Exceed their expectations with Ramp. With these updates, we’re making the Ramp experience available to all of your employees, whether they’re global or local. Sign up for Ramp today to equip your employees with the best financial tools for their work.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°