Brex customer? We'll give you $1,000 to see the better option.

Get $500 when you take a demo and share a recent Brex or Capital One statement, and another $500 when you become a Ramp customer.

Budgets vs. actuals, faster answers, and clearer permissions

Tracking budgets against real activity shouldn’t require spreadsheets or month-end cleanups. This month’s updates focus on helping teams close the loop between planning and execution — so budgets, approvals, and day-to-day activity stay aligned as work happens.

Here’s what’s New on Ramp in January:

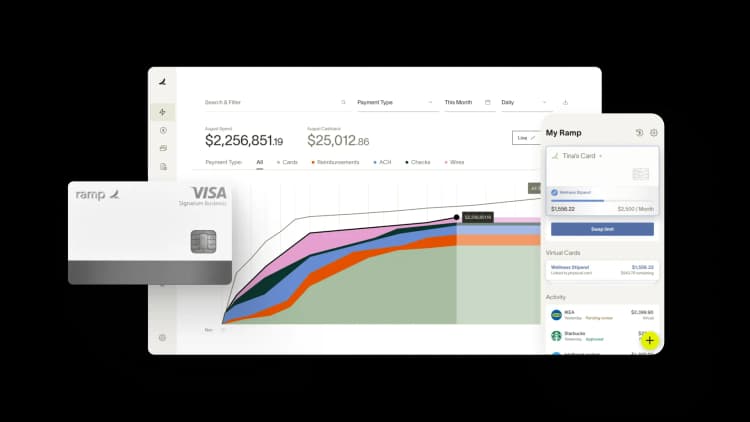

New: Track budgets vs. actuals as money moves

Seeing where budgets stand shouldn’t be a guessing game.

With Ramp Budgets, teams can track live activity against budgets across cards, reimbursements, Bill Pay, and purchase orders. Approvals happen with context, budget owners always know what’s left, and finance teams get alerts before overages turn into surprises.

Upload your budget once, and Ramp keeps it connected to every transaction — so planning reflects reality, not last month’s numbers.

Learn more about Ramp Budgets →

New: Search your data in plain English

Finding answers in tables shouldn’t mean rebuilding views or stacking filters.

Ramp now lets you search tables using plain-English phrases like “SaaS vendor payments over $10K” to instantly group, filter, and sort data. It’s a faster way to answer planning and close-related questions—without leaving Ramp or exporting to spreadsheets.

Pay multiple bills at once — without manual runs

Manual payment runs create unnecessary cleanup at close.

Automated bill batching groups approved bills into a single payment across ACH, SWIFT, and international rails. Fewer payments to track means fewer open items and a cleaner path into month-end close.

Learn how automated bill batching works →

Grant the right permissions for each role

Planning holds up when everyone has the access they need — and nothing more.

Custom AP clerk roles let you control who can submit bills, edit drafts, or view payment details, keeping bill status clear heading into close.

View-only admin roles give auditors visibility into expenses and accounting without the ability to make changes — supporting reviews without increasing risk.

Together, these controls reduce back-and-forth and keep responsibility clearly defined across teams.

Explore role-based permissions on Ramp →

See Ramp Budgets in action

To go deeper, we’re hosting a short session on how teams use Ramp Budgets to move from month-end surprises to real-time visibility.

We’ll walk through real workflows and show how budgets stay connected to approvals and activity as work happens.

Want to stay up to date on everything we’re shipping? Visit ramp.com/product-releases to see the full changelog.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits