- What is payment processing?

- Why is payment processing important for businesses?

- Key components of a payment processing system

- Payment gateway vs. payment processor

- Payment processing tools by industry

- How payment processing works: Step by step

- How to choose a payment processor

- Best practices for payment processing

- Why security in payment processing is important

- Choosing the right payment solution for your business

Every sale depends on getting paid without delays or errors. Payment processing makes that possible by letting businesses accept money from customers, whether it’s through a card swipe, online checkout, or mobile tap. It’s the behind-the-scenes system that makes sure money moves safely from the customer to the business.

For both in-person and online stores of all sizes, a smooth payment process can make a big difference. It helps build trust with customers, keeps cash flow steady, and cuts down on unnecessary complications.

In this guide, we’ll walk through how payment processing works, its key components, and some best practices for efficiency.

What is payment processing?

Payment processing is the system that handles how money moves from your customer’s account to your business account after a sale. It verifies, authorizes, and transfers funds using card networks, banks, and service providers.

Payment processing covers the technology, services, and security protocols that verify, authorize, and transfer funds whenever a purchase is made. Essentially, it creates a secure bridge between the customer’s payment method and the merchant’s bank account.

The primary goal is to validate transactions while protecting sensitive financial data, whether payment is made online or in person. Payment processing ensures funds are available, confirms the legitimacy of the payment method, and moves money securely across financial networks.

This secure infrastructure supports several transaction types flowing through payment processing systems daily:

- Credit/debit cards: Card transactions involve three basic steps—authorization, authentication, and settlement. Card processors communicate with card networks to verify funds and transfer payment. Approval takes 2–3 seconds, but final settlement may take several days.

- ACH (Automated Clearing House): These are electronic transfers that include direct deposits, bill payments, and business-to-business transfers. They’re processed in batches, usually within 1–3 business days. If you're looking to accept ACH payments as a business, you'll need to set up the right infrastructure with your bank or payment processor.

- EFT (electronic funds transfer): A broader category that includes ACH, wire transfers, and digital wallet transactions. EFTs replace paper-based payment methods with secure electronic alternatives.

- Check: While less popular today, check processing still matters for many businesses. Modern systems often scan and digitally convert paper checks, blending traditional methods with digital processing.

Payment processing systems have evolved from simple cash registers to comprehensive digital systems supporting multiple payment methods across channels. The right solution should align with your business model, customer preferences, and operational needs.

Why is payment processing important for businesses?

Payment processing affects nearly every part of running a business. It directly tackles the biggest challenges businesses face when handling transactions, from unexpected fees that eat into margins to security vulnerabilities that keep owners awake at night.

Here’s how it plays a critical role across operations, customer experience, and security:

- Smooth business operations: Efficient processing speeds up cash flow and cuts administrative overhead. Fast, reliable settlements help you manage inventory, pay suppliers, and make smart decisions. Integrated payment systems also reduce manual reconciliation and free up staff for growth initiatives.

- Customer satisfaction: Payment experiences influence buying decisions. Today’s consumers expect convenience in the form of contactless payments, digital wallets, buy-now-pay-later options, and fast checkouts.

- Fraud prevention: Advanced payment processing uses multi-layered security to protect merchants and customers. Systems detect suspicious patterns, verify identities, and encrypt sensitive data to prevent breaches. Effective fraud prevention reduces financial losses and preserves both brand reputation and customer trust.

Getting payment processing right creates the foundation that lets your business operate smoothly, serve customers better, scale efficiently, and grow with confidence while protecting everyone involved.

Key components of a payment processing system

Behind every successful payment is a system of moving parts that work together to get money from your customer to your business safely. Depending on your business model, customer behavior, and sales channels, you might rely on different components to complete transactions smoothly.

Here’s a breakdown of the key players and tools that can be part of a payment processing setup:

Payment gateway

A payment gateway captures payment details securely and encrypts them before they’re transmitted to the processor. This component is critical for online and mobile transactions, acting as a digital bridge between your website or app and the financial networks.

Gateways are essential for online and mobile transactions. They handle sensitive data through tools like tokenization, SSL encryption, and PCI DSS compliance to prevent fraud and meet regulatory standards.

Popular payment gateways include Stripe, PayPal, and Authorize.net. These tools help businesses accept cards, digital wallets, and even recurring payments securely and efficiently.

Payment processor

A payment processor acts as the middleman, routing transaction data between the merchant, the card network, and the issuing bank. It manages the steps needed to approve, settle, and fund each payment.

These transactions move through payment rails, which are the underlying infrastructure networks that lets money flow between financial institutions. These systems verify account details, route payments between banks, and manage the settlement process that transfers funds to your account.

While a payment gateway captures and encrypts card details at checkout, the payment processor handles what happens after. Common payment processors include Square, Worldpay, and Fiserv, which provide tools for both in-store and online payments.

Merchant account

A merchant account is a dedicated account that temporarily holds customer payments before those funds are transferred to your business’s bank account. It’s managed by your acquiring bank or PSP and acts as a holding account before funds are transferred into your business’s bank account.

Most businesses need a merchant account to receive card payments. Funds are typically settled in daily batches and transferred within 1–3 business days, depending on your processor.

Payment service providers (PSPs)

PSPs bundle multiple payment components, such as gateways, processing, and merchant accounts into one service. They simplify the setup for businesses by offering everything needed to start accepting payments. For example, Stripe is a PSP. A business owner can sign up, get a card reader, download the app, and start accepting payments right away.

Point-of-sale (POS) system

Point-of-sale (POS) systems capture transaction data and send it to the appropriate payment processor for authorization and settlement. Modern POS systems can also go beyond basic payment acceptance. They help you manage inventory, sync sales with accounting tools, and track customer data across locations.

According to Grand View Research, the global cloud POS market reached $4.7 billion in 2023, reflecting growing demand for integrated tools that simplify business operations. Popular examples include Toast and Clover, which combine hardware and software to help businesses sell, report, and reconcile, all from a single device.

Credit card processing

Credit card transactions follow a specific flow that happens in seconds but involves multiple steps behind the scenes. When a customer swipes, inserts, or taps their card, the transaction data travels from your POS system through the payment gateway to the processor, which then communicates with the card network (Visa, Mastercard, etc.) and the customer's issuing bank for approval.

Processing fees typically include interchange fees, assessment fees, and processor markups. Depending on your business type and processing volume, they can range from 1.5% to 3.5% per transaction.

For businesses evaluating payment options, understanding how ACH and credit cards compare in terms of cost, speed, and use cases can inform better payment strategy decisions.

Issuing and acquiring banks

An acquiring bank (merchant bank) holds the merchant’s account and receives funds from successful transactions. It deposits the settled funds into the account.

The issuing bank provides payment cards to consumers. When a cardholder makes a purchase, the issuing bank verifies available funds or credit and sends approval or denial messages back through the network.

PCI compliance

The Payment Card Industry Data Security Standard (PCI DSS) is a set of security requirements that any business accepting credit card payments must follow to protect cardholder data from breaches and fraud.

Basic compliance steps include using secure payment systems, limiting access to cardholder data, regularly updating security software, and working with PCI-compliant service providers. Non-compliance can result in hefty fines from card brands and increased liability if a data breach occurs.

These components work together seamlessly to move money from customers to your business while maintaining security, compliance, and reliability throughout every transaction.

Payment gateway vs. payment processor

Payment gateways and payment processors serve distinct but complementary roles in transaction handling. Gateways focus on secure data capture while processors manage the actual movement of funds.

Feature | Payment Gateway | Payment Processor |

|---|---|---|

Primary role | Captures and encrypts payment information during checkout | Moves payment data between acquiring and issuing banks for authorization and settlement |

Function in workflow | Front-end tool that interfaces with the customer | Back-end engine that processes, approves, and settles the transaction |

Customer interaction | Customer sees and interacts with the gateway at checkout | Customer does not interact directly; the process is invisible |

Data security features | PCI DSS compliance, SSL encryption, tokenization | Fraud detection, velocity checks, chargeback monitoring |

Authorization | Sends the payment data to the processor for authorization | Contacts the issuing bank to approve or decline the transaction |

Settlement | Does not handle settlement | Initiates settlement and moves funds to the merchant account |

Failure handling | Flags incomplete or invalid payment data before it reaches the processor | Handles network failures, declines, and retry logic |

Cost structure | Often charged per transaction or monthly fees (gateway-specific) | Charged as part of processing fees, usually a percentage plus flat fee per sale |

Main use cases | Online stores, mobile apps, in-store POS with card-not-present support | Often includes built-in gateway functionality in all-in-one platforms. |

Businesses selling online or through mobile apps typically need both components working together. The gateway securely captures customer payment information from their website or app, while the processor handles the behind-the-scenes communication with banks and card networks.

However, many payment service providers bundle both functions into a single service, simplifying the setup process. Brick-and-mortar businesses with only in-person sales might work directly with a processor and skip the gateway entirely, since their POS terminals handle the secure data capture locally.

The choice depends on your sales channels and whether you prefer integrated solutions or separate specialized services.

Payment processing tools by industry

Reliable payment processing keeps operations running smoothly, creates better experiences for customers, and helps guard against fraud.

With the right system in place, you can support steady growth and stronger financial health. And because every business is different, it’s important to choose a solution that fits your specific needs. Here's how specialized tools can support your operations:

- Restaurants: Tableside payments and tip management streamline the dining experience, speed up service, and reduce staff workload

- Healthcare: HIPAA-compliant systems simplify patient payments, co-pays, and insurance claims while protecting sensitive data

- Subscription businesses: Recurring billing tools with automatic payment retries reduce churn and keep revenue steady, and many subscription businesses use B2B ACH payments for recurring charges due to lower transaction fees than card payments

- Retail: Unified payment systems connect online and in-store checkouts for a consistent customer experience and centralized reporting

Investing in the right payment processing solution for your business needs pays dividends in operational efficiency, customer trust and loyalty, security, and financial performance, becoming a vital foundation for sustainable growth.

How payment processing works: Step by step

Payment processing converts a customer's payment action into a completed fund transfer. Every transaction involves multiple players working behind the scenes to move money from your customer to your business.

The key parties include the payment gateway, payment processor, acquiring bank, issuing bank, and card network. Together, they handle authorization, fund movement, and settlement.

Here's how a typical transaction flows through the payment processing lifecycle:

Step 1: Transaction Initiation

The customer presents their payment method and the system collects necessary details, such as the card number, expiration date, and transaction amount. This happens whether someone's shopping online, tapping their card at a store, or using their phone to pay.

Step 2: Data Capture and Encryption

Payment details are encrypted using secure protocols. The payment gateway creates secure tokens to protect card details, transaction amount, and merchant ID from potential threats. This encryption happens instantly, making sure sensitive information stays safe from hackers.

Step 3: Authorization Request

The encrypted data goes to the payment processor, which routes it to the relevant card network. The card network forwards the request to the customer's bank to verify account validity and available funds. It's essentially a digital handshake between multiple financial institutions.

Step 4: Issuing Bank Verification

The issuing bank returns an approval or decline message, typically within 2–3 seconds. The merchant receives this response via their terminal or platform immediately. This quick response time keeps checkout lines moving and online shopping smooth.

Step 5: Fund Clearing

The merchant's processor sends finalized transaction details to the card network, which sorts and routes them to the issuing bank. Adjustments for tips, taxes, or currency conversions happen at this stage.

Step 6: Settlement

The issuing bank transfers funds to the acquiring bank, which deposits them into the merchant's account. This can happen within 24 hours, but may take 2–3 business days.

Step 7: Reconciliation and Reporting

The final step involves matching processed transactions with the merchant's records. Payment processors offer tools for tracking payments, declines, chargebacks, and fees across all transactions.

This entire payment processing cycle happens seamlessly behind the scenes, enabling secure commerce while protecting both merchants and customers throughout every transaction.

How to choose a payment processor

Selecting the right payment processor impacts your business operations and bottom line. Consider these key factors when evaluating different providers for your specific needs.

- Fees and pricing structure: Evaluate transaction fees, monthly fees, and any hidden costs that could affect your profit margins over time

- Supported payment methods: Make sure the processor accepts credit cards, ACH transfers, digital wallets, and other payment options your customers prefer using

- Security features: Look for PCI compliance, fraud prevention tools, and robust security measures that protect both your business and customer data

- Integration options: Check compatibility with your e-commerce platforms, POS systems, and APIs to ensure smooth operation with existing business tools

- Customer support and reliability: Assess the quality of technical support, uptime guarantees, and responsiveness when issues arise during critical business hours

- Settlement times and cash flow impact: Consider how quickly funds reach your account and how processing delays might affect your business operations

- Provider comparisons: Request demos from multiple vendors, read customer reviews, and carefully examine contract terms before making your final decision

- Scalability and future-proofing: Choose a processor that can grow with your business and adapt to changing payment technologies and customer expectations

When choosing a payment processor, focus on settlement times, reporting features, security, and integration with your existing business tools. Modern processors offer APIs and pre-built integrations with e-commerce platforms, accounting software, and CRMs. This minimizes manual data entry, reduces errors, and allows for unified reporting across all sales channels.

Best practices for payment processing

Smart payment processing strategies help businesses maximize revenue and minimize costs and risks. A thoughtful approach to payments can boost customer satisfaction, streamline operations, and improve financial results.

Cost optimization

Look at your total payment processing costs, not just the headline transaction rate. Negotiate pricing that fits your transaction profile. For example:

- High-volume businesses may qualify for volume discounts

- Merchants with larger average transaction sizes might benefit from percentage-based pricing

Don’t forget to include monthly fees, statement fees, PCI compliance fees, and chargeback fees in your calculations.

You should also make sure your business is classified under the correct merchant category code (MCC), as this impacts interchange rates. Using address verification and requiring CVV codes can help you qualify for lower card-not-present rates and reduce fraud-related costs.

To maintain consistency and accuracy, regularly audit processing statements. Watch for unexpected fee hikes or inefficiencies. Compare the effective rate (total fees divided by total processing volume) every quarter to check that it’s in line with industry benchmarks.

Payment method selection

Offer payment options that match your customers’ preferences while keeping things efficient. A 2025 study by Stripe found that including even one additional relevant payment method beyond cards led to a 7.4% increase in conversion rates.

Go beyond credit cards. Consider adding:

- Digital wallets

- ACH transfers for recurring payments

- Buy-now-pay-later options for high-value purchases

Balance convenience with cost. Some alternative payment methods are cheaper than credit cards but have longer settlement times. Create a payment mix that suits your audience—young consumers often prefer digital wallets and installment plans, while B2B clients may favor ACH or commercial cards.

Security implementation

Use layered security measures to protect transactions without adding excessive friction. Apply tokenization for stored payment credentials and end-to-end encryption for data in transit. Set up velocity checks to flag unusual activity, such as multiple declined attempts or many transactions from a single IP address.

Train your staff on security protocols and social engineering risks. Many breaches start with human error, not technology. According to Verizon’s 2024 Data Breach Investigations Report, 68% of data breaches involve a human element, including phishing and misuse. Set clear rules for handling payment information, including physical security for in-person payments.

Maintain detailed transaction logs, but follow data minimization principles. Keep only what you need for business and compliance, and securely dispose of data when it’s no longer needed.

Modern AI in payments systems can also help detect anomalies and flag suspicious patterns that humans might miss, adding an extra layer of protection.

Checkout experience

Streamline your checkout process to reduce cart abandonment and boost conversions. Keep the payment flow simple with minimal steps.

Display accepted payment methods clearly before checkout begins. Show security badges and SSL certificates to build trust. For online transactions, enable guest checkout options and autofill capabilities when possible.

Test your checkout process regularly across different devices and browsers. Mobile optimization is essential as mobile commerce continues to grow. For in-person payments, make sure your terminals are fast and reliable with backup systems ready.

Regular review

Schedule quarterly reviews of your payment processing setup and provider performance. Track key metrics, such as transaction success rates, decline rates, settlement times, and customer complaints related to payments.

Compare your costs against industry benchmarks and evaluate whether your current provider still meets your needs. Business growth or changes in transaction patterns might warrant renegotiating terms or switching providers.

Stay informed about new payment technologies and regulatory changes. Document any issues and their resolutions to identify patterns that need addressing.

Smart payment processing balances customer convenience with operational efficiency. Regularly optimizing your payment strategy directly affects your bottom line and customer satisfaction.

Why security in payment processing is important

Poor payment security exposes your business to significant risks. Fraud can drain revenue directly, while data breaches trigger expensive compliance penalties and damage customer trust. Chargebacks eat into profits and can lead to higher processing fees or account termination if they become frequent.

Here are several fraud prevention methods to consider to protect customer data:

- Tokenization: Replaces real card data with non-sensitive tokens, making stolen data useless. Tokens allow recurring payments without storing actual card details.

- End-to-end encryption: Encrypts payment data from the moment it is entered until it reaches its final destination, keeping it secure throughout the transaction. Even if intercepted, the data remains unreadable without the correct decryption key.

- Address verification service (AVS): Matches the billing address during checkout with the card issuer’s records. Mismatches flag potential fraud.

- Card verification value (CVV): Verifies the three- or four-digit security code on the card to confirm that the buyer has physical access to it. This helps prevent unauthorized use of stolen card numbers in online transactions.

- Machine learning fraud detection: Analyzes transaction patterns in real time to spot suspicious activity. These systems improve as they learn from new fraud attempts.

- 3D secure authentication: Adds an extra verification step for online purchases by requiring customers to confirm their identity through a one-time password or their banking app. This reduces the risk of fraud by ensuring that only the authorized cardholder can complete the transaction.

- PCI compliance: Follows PCI DSS standards for handling card data securely. Compliance reduces breach risk and avoids hefty penalties while building customer confidence in your payment security.

These fraud prevention methods work best when layered together. Combining multiple security measures creates stronger protection than relying on any single method alone.

Choosing the right payment solution for your business

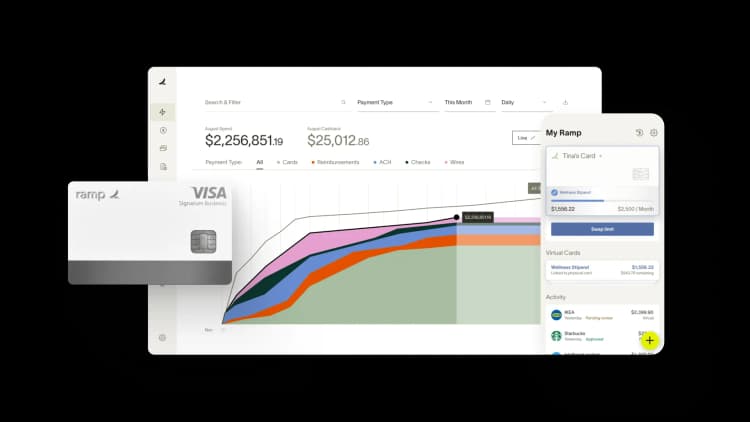

Understanding payment processing is essential for any business that wants to deliver smooth, secure, and efficient transactions. While Ramp is not a payment processor, we help businesses take control of what happens after payments are made—streamlining everything from vendor payments to employee expenses and overall spend visibility.

Ramp simplifies accounts payable by automating invoice approvals, payment scheduling, and vendor management. But our platform also extends beyond AP, offering powerful expense management tools that help finance teams track employee spending, enforce policy controls, and gain real-time insights into where money is going across the business.

Whether you're handling recurring vendor payments or managing team purchases on corporate cards, Ramp unifies these workflows in one intuitive platform. By combining AP automation with advanced spend management, Ramp helps businesses reduce manual work, improve accuracy, and make smarter financial decisions.

Optimize how your business manages spend with an all-in-one platform for accounts payable, expense tracking, and real-time financial visibility. Get started with Ramp.

FAQs

Interchange fees flow from your acquiring bank to the customer’s issuing bank on every card sale. They typically make up to 90% of your total processing expense, so even a small rate change quickly affects your margins.

If you run fewer than one million annual card transactions, you fall under PCI Level 4. You complete an annual self-assessment questionnaire and schedule quarterly network scans through an approved scanning vendor; using tokenization and hosted checkouts can shrink the scope and cost of this work.

Your processor stores card data in a secure token vault and flags each follow-up charge as merchant-initiated. This lets the issuing bank approve repeat payments without customer re-entry; many processors also retry failed payments and send dunning alerts to cut churn.

Yes. You need a processor with cross-border acquiring, multi-currency pricing, and settlement support in the currencies you hold. Dynamic currency conversion lets buyers pay in their local currency while you still receive funds in yours.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits