Payment terms: Types, examples, and how to set them

- What are payment terms?

- Why payment terms matter

- Common types of invoice payment terms

- At a glance: Invoice payment terms compared

- How to set payment terms in 9 steps

- Negotiating payment terms

- Automate bookkeeping with Ramp

Clear payment terms set the stage for smooth financial operations. They establish when and how you expect to be paid, helping both parties avoid misunderstandings that can lead to tension or financial strain.

Well-defined payment terms also protect your cash flow and let customers know what to expect. By communicating expectations up front, you demonstrate reliability and business acumen while giving customers the information they need to make payments efficiently.

Let’s break down common invoice payment terms and their benefits and explore how to establish terms that work for your business.

What are payment terms?

Payment terms define how and when a buyer should pay a seller for goods or services. They outline the payment due date, accepted payment methods, and any early payment discounts or penalties associated with late payments. You'll usually set payment terms in an agreement or invoice so that both parties are clear on the expectations.

Why payment terms matter

Clear payment terms ensure timely compensation and establish professional boundaries, which can be especially important for small businesses. They also:

- Set up predictable cash flow

- Help assess customer reliability and reduce financial risk

- Reduce payment delays and disputes

- Help customers plan their payments

Well-defined payment terms create a foundation for steady cash flow while building trust with customers. This financial predictability helps your business thrive and strengthens long-term client partnerships through clear expectations.

Common types of invoice payment terms

Payment terms serve various business needs and customer relationships. Here are the most common options, each with distinct advantages and considerations for your specific situation:

Net 15

Net 15 means payment is due within 15 days of the invoice date. This term is commonly used for smaller purchases, professional services, or when businesses need faster cash flow to maintain operations.

Pros:

- Faster cash flow for the business

- Reduces accounts receivable aging

- Lower risk of customer payment default

- Easier cash flow forecasting

Cons:

- May pressure customers with tight budgets

- Could limit sales to price-sensitive clients

- Less competitive than longer payment terms

- May strain customer relationships

Example:

A freelance graphic designer completes a logo project for a local restaurant. The designer invoices with net 15 terms, ensuring quick payment to cover immediate business expenses.

Net 30

Net 30 payment terms require payment within 30 days of the invoice date. This is the most popular payment term across industries, offering a balanced approach between business cash flow needs and customer payment flexibility.

Pros:

- Industry standard that many customers expect

- Reasonable timeframe for customer budgeting

- Good balance of cash flow and flexibility

- Widely accepted in B2B transactions

Cons:

- Slower cash flow than shorter terms

- Increased risk of late payments

- More accounts receivable to manage

- Potential for customer disputes over time

Example:

A software company delivers a custom application to a mid-sized retailer. The net 30 invoice gives the retailer time to test the software before payment is due.

Net 60

Net 60 extends payment to 60 days after the invoice date. This term is typically used for larger orders, established customer relationships, or industries with longer payment cycles, such as manufacturing or construction.

Pros:

- Attracts customers who need extended payment time

- Suitable for large purchases or projects

- Can help close bigger deals

- Shows trust in customer relationships

Cons:

- Significantly delayed cash flow

- Higher risk of payment defaults

- More complex accounts receivable management

- May require stronger credit checks

Example:

An industrial equipment manufacturer sells machinery to a factory expansion project. Net 60 terms allow the factory to generate revenue from the new equipment before paying the invoice.

Net 90

Net 90 allows 90 days for payment and is primarily used in enterprise contracts, government dealings, or very large projects where extended payment cycles are standard business practice.

Pros:

- Enables very large contract negotiations

- Standard for government and enterprise clients

- Can differentiate from competitors

- Builds long-term customer loyalty

Cons:

- Major cash flow delays

- High risk of payment issues

- Requires strong financial reserves

- Complex collection processes

Example:

A consulting firm completes a 6-month organizational restructuring project for a Fortune 500 company. Net 90 terms align with the client's quarterly budget approval cycles.

Cash on delivery (COD)

COD requires payment at the time of delivery, either to the delivery person or through immediate electronic transfer. This method is common for new customers, high-risk transactions, or businesses with trust concerns.

Pros:

- Eliminates payment risk entirely

- Immediate cash flow

- No accounts receivable management

- Perfect for new customer relationships

Cons:

- May deter potential customers

- Requires cash handling logistics

- Less convenient for customers

- Can appear distrustful

Example:

An online retailer ships electronics to a first-time customer using COD terms. The delivery driver collects payment before releasing the package to the customer.

Cash in advance (CIA)

Cash in advance requires full payment before goods are shipped or services begin. This term is used for custom orders, international transactions, or when businesses want to eliminate all payment risk.

Pros:

- Zero payment risk

- Immediate cash flow for operations

- Eliminates collection efforts

- Funds production or service delivery

Cons:

- Requires high customer trust

- May limit customer base significantly

- Less competitive positioning

- Difficult for large purchases

Example:

A custom furniture maker requires 50% payment up front before starting a handcrafted dining set. This covers materials and establishes customer commitment to the custom order.

Line of credit (LOC)

A line of credit establishes a maximum credit limit for customers, allowing multiple purchases without individual payment approvals. This term is ideal for regular customers with a proven payment history.

Pros:

- Streamlines repeat customer transactions

- Builds stronger customer relationships

- Reduces administrative overhead

- Encourages customer loyalty

Cons:

- Requires extensive credit evaluation

- Risk of customers exceeding limits

- Complex account management

- Potential for large losses

Example:

An office supply company extends a $5,000 monthly credit line to a law firm. The firm can order supplies throughout the month and receive one consolidated monthly invoice.

2/10 net 30

This term offers a 2% discount if payment is made within 10 days; otherwise, full payment is due in 30 days. It incentivizes prompt payment while maintaining standard invoice payment terms.

Pros:

- Encourages faster customer payments

- Improves cash flow significantly

- Competitive advantage for price-conscious customers

- Reduces accounts receivable aging

Cons:

- Reduces profit margins on early payments

- Requires careful discount calculations

- May confuse some customers

- Administrative complexity tracking discounts

Example:

A wholesale distributor offers 2/10 net 30 to retail stores buying seasonal merchandise. Retailers who pay early save money, while the distributor gets faster cash flow for inventory replenishment.

End of month (EOM)

EOM terms require payment by the end of the month in which the invoice is dated. This approach simplifies accounting cycles and is popular with customers who process payments on monthly schedules.

Pros:

- Aligns with customer monthly budgets

- Simplifies payment processing

- Predictable payment timing

- Reduces administrative confusion

Cons:

- Variable payment periods depending on invoice date

- Potential for very long payment delays

- Inconsistent cash flow timing

- May require careful invoice timing

Example:

A marketing agency invoices clients on the 15th of each month with EOM terms. All clients pay by month's end, creating predictable cash flow for the agency's monthly expenses.

Late fees

Late fees are penalty charges applied when customers exceed agreed payment terms. Clearly communicate fee structures in contracts and invoices, then enforce them consistently to maintain their effectiveness.

Example:

A web design company charges 1.5% monthly late fees on overdue balances. When a client pays 15 days late, that client receives a follow-up showing the original amount plus the calculated late fee on the invoice.

Other types of payment terms

Aside from the most common invoice payment terms, you have several other options available:

- CBS (cash before shipment): Payment is required before the goods are shipped

- CWO (cash with order): The customer pays at the time the order is placed

- Partial payment: A portion of the total amount is paid upfront, with the balance due later

- Revolving credit: A credit agreement allowing customers to borrow and repay repeatedly up to a set limit

- Payment in arrears: Payment is made after the goods or services have been provided

Choosing the right payment terms depends on your cash flow needs, customer relationships, and industry standards. Consider your business model and customer base when selecting the most appropriate options. The payment term you choose will come down to what works best for your business while also keeping customers happy.

At a glance: Invoice payment terms compared

Here's a quick reference for invoice payment terms:

Payment term | Description | Ideal for |

|---|---|---|

Net 15/net 30/net 60/net 90 | Payment is due within 15, 30, 60, or 90 days from the invoice date; common for businesses able to offer longer periods for payment | Extending credit to reliable customers while maintaining cash flow |

Cash on delivery (COD) | Payment is due at the time of delivery | Small transactions, or first-time customers |

Cash in advance (CIA) | The customer must make full payment in advance before goods or services are delivered | High-risk transactions or first-time buyers with no credit history |

Line of credit (LOC) | Allows customers to make purchases on credit and pay in installments over time | Long-term business relationships with financially stable customers |

2/10 Net 30 | A 2% discount is offered if the invoice is paid within 10 days; otherwise, the full amount is due in 30 days | Encouraging early payments while giving flexibility to customers |

End of month (EOM) | Payment is due at the end of the month in which the invoice was issued | Businesses that want predictable cash flow by synchronizing with calendar months |

Net 30/60/90 terms are popular and easily accepted because they've become the industry standard, and buyers are familiar with them. They also offer a compromise, giving the buyer time to pay in full while not straining the seller's cash flow management.

At the same time, cash in advance is a readily accepted payment term as it's how most people shop for most goods.

What is the most common payment term?

Net 30 is widely recognized as the industry standard payment term, giving clients a 30-day window to complete payment after receiving an invoice.

How to set payment terms in 9 steps

Choosing invoice payment terms requires balancing your cash flow needs with market norms. Here's how to create terms that protect your business while maintaining positive customer relationships.

1. Assess your cash flow needs

Before setting invoice payment terms, analyze your business’s cash flow requirements. If you need faster cash turnover, shorter payment terms may be better for you. If you can afford to extend credit, offering longer payment periods might help attract and retain customers.

2. Research industry standards

Payment terms vary by industry, so it’s important to align with common practices to stay competitive. For example, net 30 and net 60 are standard terms in many industries, while cash-in-advance models are more common in high-risk transactions.

3. Evaluate customer payment history

Review your customers’ payment behavior and creditworthiness. Reliable customers who make timely payments may qualify for more flexible terms, while new or high-risk clients may require stricter conditions. Depending on your industry, consider running credit checks for added security.

4. Decide on invoice payment terms

Select payment terms that balance your cash flow needs with customer relationships. Consider your industry standards, client preferences, and how quickly your business needs payment to maintain healthy operations.

5. Put payment terms in writing

Draft legally binding contracts for larger transactions or long-term agreements to make payment obligations clear. Well-defined terms protect your business and can be upheld in court if necessary. If a customer fails to meet the agreed terms, an enforceable contract allows you to take legal action to recover payments or seek damages.

6. Offer multiple payment methods

Various payment options, such as bank transfers, ACH payments, credit cards, and digital wallets, can encourage faster payments. Customers are more likely to pay on time when convenient payment options are available.

7. Automate invoicing and accounts receivable processes

Use invoicing software to streamline the payment process by automating invoice generation, monitoring due dates, and sending payment reminders. Automation tools also help manage accounts receivable efficiently by reducing manual errors and tracking outstanding payments.

8. Establish a follow-up process for late payments

Even with clear invoice payment terms, some customers may delay payments. Build a structured follow-up process that includes reminder emails, phone calls, and, if necessary, late payment fees or collection procedures.

9. Review and adjust payment terms periodically

Business conditions, customer reliability, and market trends change over time. Regularly review your invoice payment terms to make sure they remain aligned with your financial goals and customer needs.

When setting payment terms, it’s also important to remain compliant with state and federal laws, especially regarding interest rates, late fees, and contract terms. Be sure you understand the Uniform Commercial Code (UCC) if you’re involved in the sale of goods because it governs commercial transactions and payment disputes.

Negotiating payment terms

Large clients and new customers often request customized invoice payment terms that differ from your standard offerings. When negotiating, focus on finding mutually beneficial solutions, perhaps offering small discounts for faster payment or accepting longer terms for guaranteed volume.

Always document agreed terms in written contracts to avoid disputes later. Legal clarity protects both parties and sets clear expectations. If clients push for extended terms, consider their payment history, order size, and your cash flow needs. You might offer graduated terms or require partial up-front payments for lengthy arrangements.

Approach negotiations as partnerships rather than battles. Flexibility can strengthen relationships while protecting your business interests.

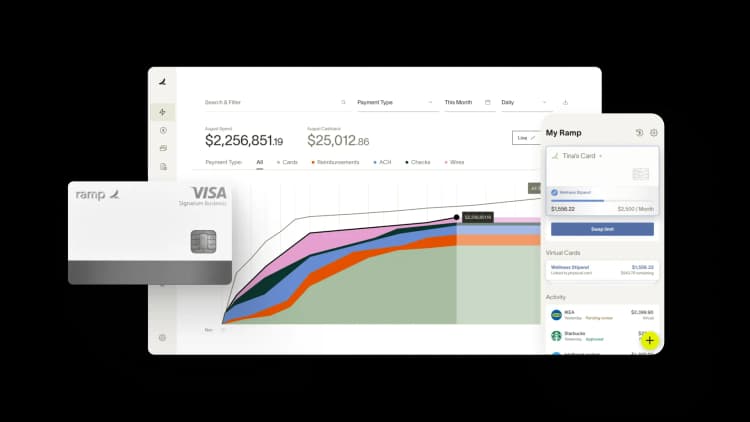

Automate bookkeeping with Ramp

Once you've set your payment terms, you need a way to manage your books that won't take up too much of your finance team's time. The best way to do that is with accounting automation.

Ramp simplifies bookkeeping with smart automation, helping finance teams streamline their workflows and reduce manual tasks. With Ramp, your team has access to:

- Expense management software: Eliminate manual expense reporting and enforce custom spending policies

- Business credit cards: Submit expenses effortlessly through SMS, mobile, and integrations while maintaining control over spending

- Accounts payable software: Manage 10x more invoices in half the time with OCR-powered automation for complex invoices and line items

Ramp also integrates seamlessly with QuickBooks, NetSuite, Xero, and other leading accounting platforms and ERPs, ensuring your financial data stays accurate and up to date.

Get started with Ramp's accounting automation software and take the manual work out of bookkeeping.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits