- What is a digital wallet?

- How do digital wallets work?

- Are digital wallets safe?

- Benefits of using digital wallets

- Drawbacks and limitations of digital wallets

- Popular digital wallet options

- How to use digital wallets

- Digital wallet security best practices

- Digital wallets for business expense management

- Streamline payments and accounting with Ramp

Digital wallets let you store payment information on your phone, computer, or wearable so you can pay without pulling out a physical card. They’re now common for everything from in-store tap-to-pay purchases to online checkouts and in-app transactions.

Beyond convenience, digital wallets rely on technologies like tokenization and biometric authentication to reduce fraud risk. For finance teams, understanding how digital wallets work is also key to evaluating their role in expense tracking, payment security, and visibility into company spending.

What is a digital wallet?

A digital wallet is a software application that securely stores payment information, such as credit cards, debit cards, or bank account details, and lets you make electronic payments from a phone, computer, or wearable device. Instead of sharing your actual card number, the wallet uses secure technology to process transactions on your behalf.

Most digital wallets do more than store cards. Many also hold loyalty programs, transit passes, tickets, or peer-to-peer payment balances, making them a central hub for everyday transactions across physical and digital environments.

Types of digital wallets

Not all digital wallets work the same way. The main differences come down to where the wallet lives and how it’s used.

| Type | Description | Best for | Examples |

|---|---|---|---|

| Mobile payment wallets | Device-based wallets used for contactless payments | In-store purchases | Apple Pay, Google Wallet, Samsung Pay |

| Online payment platforms | Web- and app-based wallets for online checkout and transfers | E-commerce and peer-to-peer payments | PayPal, Venmo, Cash App |

| Closed-loop wallets | Wallets limited to a single brand or merchant ecosystem | Loyalty programs and repeat purchases | Starbucks app, Walmart Pay |

| Bank-integrated wallets | Digital wallets built into a bank’s mobile app | Existing bank customers | Bank of America digital wallet |

| Cryptocurrency wallets | Wallets designed to store and transact digital assets | Crypto transactions | MetaMask, Coinbase Wallet |

How do digital wallets work?

Digital wallets act as a secure intermediary between your payment method and the merchant. When you add a card to a digital wallet, the wallet doesn’t store your actual card number. Instead, it creates an encrypted representation that can be used only when you authorize a transaction.

This setup allows electronic payments to be processed without exposing sensitive card details. Each transaction is verified in real time, ensuring the merchant receives payment confirmation while your financial information stays protected.

The technology behind digital wallets

Several core technologies make digital wallet payments possible:

- Near Field Communication (NFC): Enables contactless payments by allowing your device to communicate wirelessly with a payment terminal at very short range

- Tokenization: Replaces your card number with a unique, encrypted token so merchants never see your real payment details

- Biometric authentication: Uses fingerprints, facial recognition, or a device PIN to confirm that you approve each transaction

Together, these layers reduce fraud risk while keeping the payment process fast and easy to use.

The payment process step by step

When you pay with a digital wallet, the transaction typically follows this sequence:

- You select your digital wallet at checkout

- The wallet generates a one-time transaction token

- You authenticate the payment using biometrics or a passcode

- The token is sent to the merchant’s payment system

- The payment network verifies the token and approves the transaction

- Both you and the merchant receive confirmation

Because each token is unique, intercepted data can’t be reused for another purchase.

Backend infrastructure and APIs

Behind the scenes, digital wallets rely on secure application programming interfaces (APIs) to communicate with payment processors, card networks, and banks. These APIs handle authorization, settlement, and confirmation in real time.

For businesses, this infrastructure also makes it possible to connect digital wallet transactions to accounting, reporting, and expense management systems, reducing manual reconciliation and improving visibility into spending activity.

Are digital wallets safe?

Digital wallets are generally safer than using a physical card. They’re designed so your actual card number is never shared with merchants, which significantly reduces the risk of card data being stolen during a transaction.

Instead of transmitting your card details, digital wallets rely on tokenization, encryption, and device-level authentication. Even if transaction data were intercepted, it wouldn’t be usable outside that single purchase.

| Feature | Digital wallet | Physical card |

|---|---|---|

| Transaction speed | 1–2 seconds | 5–10 seconds |

| Security | Tokenization and device authentication | Card number exposed, PIN or signature |

| Lost or stolen risk | Can be remotely locked or wiped | Must cancel and replace card |

| Merchant acceptance | Growing but not universal | Nearly universal |

| Transaction records | Automatically logged | Receipts managed manually |

Security features that protect your information

Digital wallets use multiple safeguards to protect your payment data:

- Encryption: Payment information is encrypted while stored on your device and during transmission

- Tokenization: Merchants never receive your real card number

- Biometric locks: Fingerprint or facial recognition prevents unauthorized use

- Remote controls: Lost devices can be locked or erased to disable payments

- Real-time alerts: You receive notifications for each transaction

- Fraud protection: Most providers offer zero-liability policies for unauthorized charges

Benefits of using digital wallets

Digital wallets simplify how you pay while adding security features that physical cards can’t offer. The benefits show up differently depending on whether you’re using a wallet for personal purchases or managing spend across a business.

For individual users, digital wallets make everyday payments faster and easier to manage:

- Faster checkout with tap-to-pay or one-click online purchases

- Stronger protection through tokenization and biometric authentication

- Multiple cards stored in one place, without carrying a physical wallet

- Automatic records of transactions that are easy to review

- Less reliance on cash or physical cards

For businesses and finance teams, digital wallets can improve visibility and control around spending:

- Faster payments with fewer manual steps at checkout

- Real-time transaction data that improves cash flow visibility

- Cleaner expense tracking when transactions are digitally recorded

- Easier reimbursement workflows with faster receipt capture

- Lower fraud risk compared to traditional card usage

- Better compatibility with accounting and expense management tools

Drawbacks and limitations of digital wallets

Digital wallets aren’t the right fit for every situation. While they offer convenience and security, there are still practical limitations to consider before relying on them exclusively.

- Limited merchant acceptance: Some smaller retailers and international locations don’t support digital wallet payments

- Device dependency: Payments require a charged, functioning phone or wearable

- Setup and adoption effort: Initial configuration and user training can slow adoption

- Privacy considerations: Wallet providers may collect transaction or usage data

- Connectivity constraints: Certain features require internet access

- Platform restrictions: Some wallets only work within specific device ecosystems

These trade-offs don’t negate the value of digital wallets, but they do shape where and how they’re best used.

Popular digital wallet options

The digital wallet ecosystem includes a mix of device-based wallets and online payment platforms. Each option is designed for slightly different use cases, from in-store purchases to online payments and peer-to-peer transfers.

Apple Pay

Apple Pay is built into Apple devices, including iPhones, Apple Watches, and iPads. It supports contactless payments at compatible terminals and can also be used for online and in-app purchases. Transactions are authorized using Face ID, Touch ID, or a device passcode.

Google Wallet

Google Wallet works across Android devices and Wear OS smartwatches. In addition to payments, it supports storing items like transit passes, tickets, and loyalty cards. Google Wallet can be used for in-store, online, and in-app transactions where supported.

Samsung Pay

Samsung Pay supports contactless payments on Samsung devices and works with many standard payment terminals. It offers similar functionality to other mobile wallets, though availability and features can vary by device model and region.

PayPal and Venmo

PayPal is widely used for online payments and supports both consumer and business accounts. Venmo, owned by PayPal, focuses on peer-to-peer transfers and social payments, with limited in-store and online checkout support depending on the merchant.

Business-focused considerations when choosing a provider

When evaluating digital wallets for business use, it’s worth considering how each option fits into your existing financial systems:

- Transaction fees and payment processing costs

- Compatibility with accounting or expense management tools

- Reporting and reconciliation capabilities

- Employee ease of use and adoption

- Security and compliance standards

How to use digital wallets

Using a digital wallet is straightforward once it’s set up. Most smartphones and many computers already include a wallet app, which means you can start using one with minimal configuration.

Setting up your digital wallet

Before you can make payments, you’ll need to add and verify your payment methods:

- Open the digital wallet app on your device or download it from the app store

- Add a credit card, debit card, or bank account

- Verify the payment method through your bank’s authentication process

- Choose a default payment option and set security preferences

- Enable transaction notifications so you can monitor activity

Once setup is complete, the wallet is ready to use across supported merchants and apps.

Making payments with a digital wallet

Digital wallets can be used in several common scenarios:

In-store payments

Look for the contactless payment symbol at checkout. Hold your device near the terminal and authenticate the transaction using your fingerprint, face scan, or passcode.

Online and in-app purchases

At checkout, select your digital wallet as the payment method. The wallet automatically fills in payment details and prompts you to approve the purchase.

Peer-to-peer transfers

Some digital wallets let you send money directly to other people. You typically select a contact, enter the amount, and confirm the transfer within the app.

ATM transactions

Certain banks support cardless ATM withdrawals through their wallet or banking app. These transactions usually require authentication through the device or a temporary access code.

Digital wallet security best practices

Keeping your digital wallet secure depends as much on how you use it as on the technology itself. Following these basic practices can significantly reduce the risk of unauthorized access or fraud:

- Secure your device: Use a strong passcode and enable biometric authentication

- Turn on transaction alerts: Review activity in real time so you can spot issues quickly

- Keep software up to date: Install operating system and app updates as soon as they’re available

- Avoid unsecured networks: Don’t make payments over public Wi-Fi when possible

- Review statements regularly: Check wallet and card statements for unfamiliar charges

- Use additional authentication: Enable multi-factor authentication if the wallet supports it

- Limit stored balances: Transfer funds out of wallets that hold cash balances rather than leaving money idle

What to do if your device is lost or stolen

If your device goes missing, act quickly to protect your accounts:

- Use a device-locator tool to find, lock, or erase the device remotely

- Change passwords associated with your wallet and payment accounts

- Contact your card issuers to flag the device as lost

- Monitor recent transactions for unauthorized activity

- Report the loss to local authorities if required

Digital wallets for business expense management

Consumer digital wallets work well for individual purchases, but they fall short when businesses need visibility, control, and automation across company spending. Finance teams are responsible for enforcing policies, reconciling transactions, and understanding where money is going, which consumer wallets aren’t designed to support.

This gap becomes more obvious as teams grow. What works for a single user doesn’t scale when dozens or hundreds of employees are making purchases on behalf of the company.

Limitations of consumer digital wallets for business use

Most consumer digital wallets lack features finance teams rely on:

- No built-in expense policy enforcement

- Limited categorization and reporting tools

- No direct integration with accounting systems

- Little to no centralized visibility across employees

- Manual reconciliation still required after purchases

How modern expense platforms extend digital wallet functionality

Modern expense management platforms bridge this gap by pairing digital wallet convenience with financial controls. Employees can add corporate cards to Apple Pay or Google Wallet for fast, contactless purchases, while finance teams retain oversight.

Behind the scenes, these platforms can automatically:

- Capture and match digital receipts to transactions

- Categorize expenses using merchant and transaction data

- Enforce spending policies in real time

- Sync transactions to accounting software

- Provide up-to-date visibility into company-wide spending

This approach gives employees flexibility at checkout without sacrificing control, accuracy, or compliance.

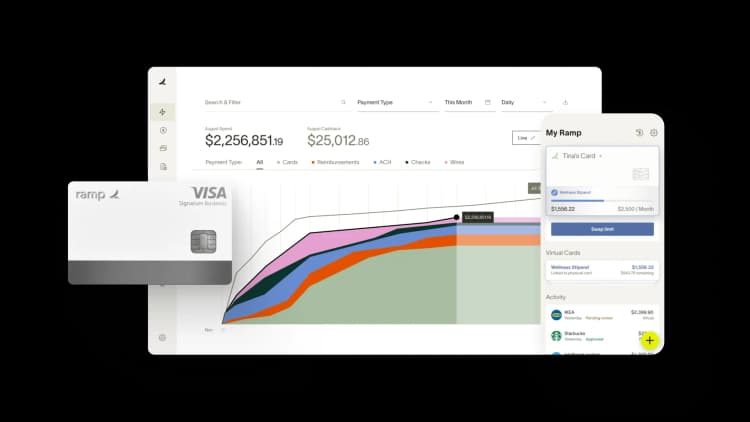

Streamline payments and accounting with Ramp

Implementing digital wallets gives your business faster checkouts, stronger security, and happier customers. However, the real value lies in how those payments seamlessly integrate with your back office.

Ramp’s accounting automation software integrates directly with your payment flows, automatically categorizing wallet transactions, syncing them to your general ledger, and generating real-time insights into spending patterns. This eliminates manual data entry, reduces errors, and helps you stay in control while your customers enjoy payment flexibility.

Get started with a free interactive product demo.

FAQs

Yes. Most devices support more than one digital wallet app at the same time. For example, you might use Apple Pay or Google Wallet for in-store purchases and PayPal for online payments.

Many major digital wallets work internationally wherever contactless or online payments are accepted. Availability varies by country and merchant, and your bank may charge foreign transaction fees depending on the card linked to the wallet.

A digital wallet stores multiple payment methods and can be used across many merchants. A mobile payment app may focus on a narrower function, such as peer-to-peer transfers or payments within a single platform or brand.

Most digital wallets don’t charge fees for standard purchases. Fees may apply for certain actions, such as instant bank transfers or using a credit card for peer-to-peer payments. Any fees typically come from the wallet provider or payment processor rather than the merchant.

Consumer digital wallets don’t provide centralized visibility into employee spending. To track, categorize, and control company expenses, businesses need expense management platforms that integrate with digital wallets and corporate cards.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°