Q2 2022 spending benchmarks: where companies are cutting costs

It’s no longer a growth-at-all-costs environment—but that doesn’t mean the need for business growth has completely disappeared.

As a result, in Q2, we see companies trying to strike a delicate balance between growth-oriented spending and cost cutting measures for potentially tough times ahead. Our newest report, 2022 Q2 spending benchmarks, sheds light on the tough tradeoffs that finance leaders are being asked to make.

What you’ll find

Data on how business spending has shifted quarter-over-quarter

Spending in Q2 grew at a faster rate than in Q1. But while we saw transaction volume rise in most major categories, there were some notable exceptions. Companies held back on electronic spending, and fluctuating transaction volume month-over-month reflects uncertainty about the economy.

A closer look at how spending priorities change with company size

Differentiated spending patterns emerged when we cut expenses by company size. SMBs invested in general merchandise and T&E, but cut back drastically on electronics. Mid-market companies also saw a sharp increase in T&E spend while keeping their ad spend flat. Enterprise companies balanced increases in shipping and software expenses by reducing professional services.

Insights on how companies are adjusting their ad spend

Overall share of ad spend dropped 3.4pp on Ramp cards as compared to Q2 of 2021. Mid-market companies were the biggest driver of this decline, indicating that they are aiming to curb growth-related expenses. On the other hand, we saw enterprise ad spend tick up in the second quarter, with the average customer increasing spend by 17.7% in Q2.

Signs of optimism and uncertainty in T&E spending

On average, companies spent 46.7% more on T&E in Q2 vs. Q1. But that’s not the whole picture. While T&E transaction volume rose across the board, the average size of entertainment transactions decreased for nearly all business segments, indicating more discerning budgetary requirements for most companies. In June, we also saw companies tightening total allowable spend on business trips.

Get the full report

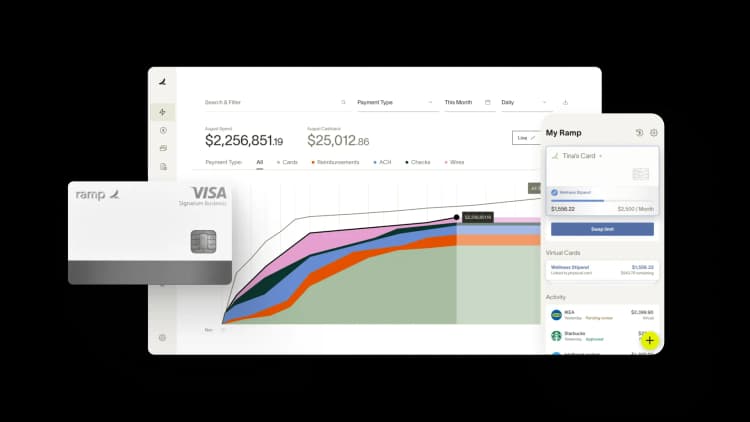

As you start to prepare your 2023 budget, download our report to see how your company’s spend compares with other businesses of your size or industry. Where do you need to trim costs? Where can you afford to spend more to stay on par with your peers’ investments? At Ramp, we’re committed to providing you with the financial intelligence and tools you need to optimize spend and drive long-term stability and success.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°