Ramp Surges to $22.5B Valuation With $500M Raise as AI Agents Transform Finance

- From manual workflows to AI agents

- The roadmap: parallel processing and autonomous finance

- Real impact for real businesses

- What's next for finance teams

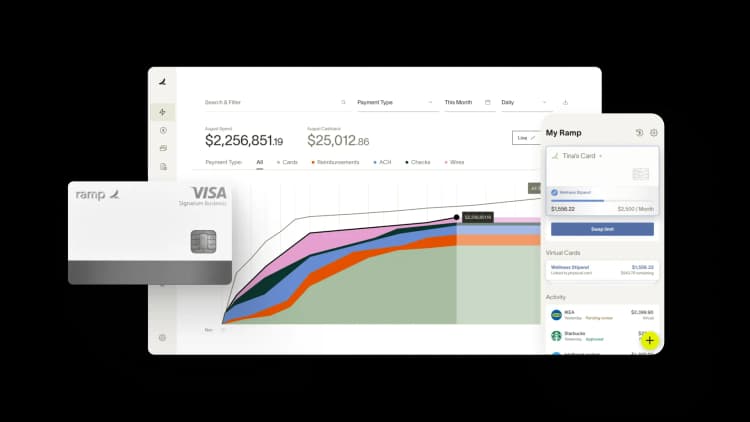

Ramp, the finance operations platform, announced today it raised $500 million at a $22.5 billion valuation just 45 days after securing $200 million at a $16 billion valuation. The rapid-fire fundraising reflects growing demand for AI-powered finance automation as businesses seek to eliminate manual busywork.

The company's mission remains simple: save businesses time and money without them noticing. With these latest rounds, Ramp will accelerate development of AI agents that handle routine finance tasks automatically.

From manual workflows to AI agents

Today, even basic transactions create cascading inefficiencies. When an employee buys a $5 coffee for a client meeting, it triggers 14 minutes of work across three people: uploading receipts, reviewing expenses, and reconciling books. That's $20 in overhead for a single purchase.

Ramp's AI agents are already changing this dynamic for early adopters like Notion, Webflow, and Quora. The agents review transactions, flag policy violations, and update accounting records around the clock. Companies using the beta report 85% fewer manual reviews and catch 15 times more policy violations automatically.

Sign up to try Ramp’s first set of agents built for controllers

"We didn't set out to create a better expense report, we set out to eliminate it," said Eric Glyman, Ramp's co-founder and CEO. The platform now completes more employee expense reports without human intervention than ever before and processing time per task has dropped by more than 50%.

The roadmap: parallel processing and autonomous finance

Ramp envisions three phases of finance transformation over the next three years.

By 2026, AI agents will handle most routine busywork. The company's first agent suite already approves low-risk expenses, answers employee questions via SMS, and flags true outliers for review. More specialized agents for procurement, treasury, and accounts payable are coming soon.

By 2027, finance operations will shift from sequential to parallel processing. Instead of waiting for each approval in a chain, multiple AI copilots will review contracts, negotiate terms, and pre-reconcile transactions simultaneously. The goal: help teams accomplish 30 times more per minute compared to two years ago.

By 2028, Ramp aims to enable truly autonomous finance with human oversight. Treasury agents will optimize cash positioning without prompting. FP&A agents will run real-time forecasts. Junior analysts will become "agent coaches" while senior leaders focus on strategic decisions rather than administrative tasks.

Real impact for real businesses

The efficiency gains aren't theoretical. Construction One reduced its accounts payable team's monthly close time by 75%, saving 360 hours last year. Poshmark hit free cash flow goals five months early by redirecting staff toward strategic projects. An industrial company processed $47 million through Ramp cards while preventing $4 million in out-of-policy spending.

These results come from Ramp's investment in engineering talent. The company spends over 50% of its payroll on research and development and employs 13 International Olympiad medalists in mathematics and informatics. In the first five months of 2025 Ramp shipped 270 features, more than the 207 in all of 2024.

What's next for finance teams

Despite saving its 40,000 customers billions of dollars and millions of hours annually, Ramp reaches just 1.5% of US companies. The latest funding will accelerate the expansion and development of new AI capabilities.

For finance professionals wondering about their role in an AI-powered future, Ramp sees technology as an enabler, not a replacement. The vision centers on redeploying talent up the value chain—from chasing receipts to making strategic decisions that drive business growth.

As Glyman noted in his fundraising announcement: "Let the robots chase receipts and close your books, so you can use your brain and build things. That's the way AI was meant to be."

See for yourself how Ramp can save your company time and money.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits