One-click financing for invoices—now part of Ramp’s fastest-growing service, Bill Pay

- Helping finance teams regain over 520 hours per year

- Ramp Bill Pay: Speeding up the work involved in moving money

- Ramp Flex: Pay your vendors without harming your cash flow

- Unifying payments and financing drives business growth

- Ramp: the finance solution that all businesses need

The current state of bill payments is an exercise in wasted time and resources. Businesses move over $120 trillion annually to pay their vendors, but the outmoded way of payments is hampering businesses from operating efficiently, let alone scaling or funding new initiatives.

That's why we're announcing a significant addition to Ramp's platform today: Ramp Flex, a solution that allows our customers to extend the payment terms on their invoices, up to 90 days. With Flex, Ramp becomes the first integrated platform to offer expense management, accounts payable, and financing all in one place, radically simplifying how businesses manage their cash flow.

To help you understand the magnitude of this expansion, I’ll explain the following:

- The high cost of inefficient accounts payable work

- The speed that businesses have regained with Ramp Bill Pay, and why it’s become Ramp’s fastest growing service

- What we’re releasing today to help businesses move money even faster

Helping finance teams regain over 520 hours per year

Finance teams spend 520 hours a year on manual AP tasks. They’re wading through invoices to decide which vendors to pay and when, based on payment due dates and the state of their cash flow.

It’s followed by more tedious work: processing invoices, cutting checks, and entering data into accounting systems by hand.

Those who find themselves short on cash are calling vendors and banks to request extensions, cash advances, and credit lines.

This kind of payment Tetris may keep businesses afloat but they hardly position them for growth.

Ramp Bill Pay: Speeding up the work involved in moving money

At Ramp, we constantly take a critical look at the status quo and ask what can be improved to help businesses save time and money. It’s led us to ask questions like:

- Why is my credit card designed to get me to spend more, not less?

- Why do expense reports exist?

- Why should companies need three sets of software to close one set of books?

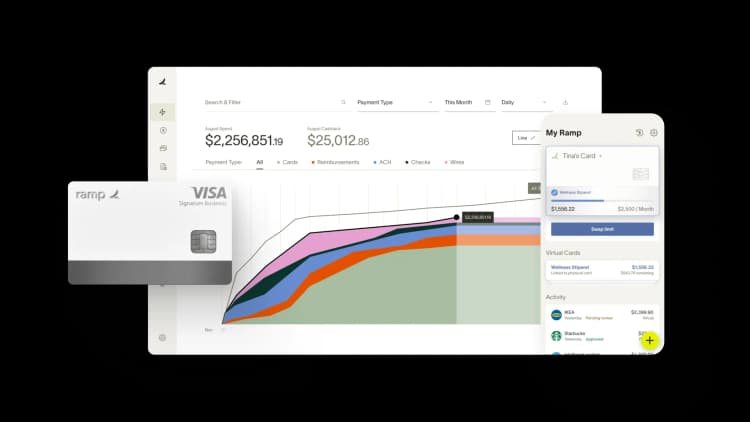

These questions led us to launch Ramp Bill Pay last year, an accounts payable software. Using Bill Pay, businesses are able to consolidate all cash outflows in one platform and cut invoice processing time by over 90%.

Recently, we’ve expanded to serving larger companies with our new NetSuite and Sage Intacct integrations that allow users to code bills to different entities—something not available with Bill.com or other mid-market accounts payable solutions.

As a result, we’ve seen traction that’s been nothing short of astounding. Launched just last fall, we're now processing more than a billion dollars a year in annualized volume through Bill Pay. It’s the fastest-growing part of Ramp.

Ramp Flex: Pay your vendors without harming your cash flow

We’re excited to share how we’re expanding Ramp Bill Pay to solve deeper cash management needs.

One question kept coming up when we were developing Bill Pay: Why can I get 30 days to pay when I swipe a card, but when I send a check or ACH to pay a bill, I can’t get any terms?

The more we thought about the question from first principles, the more convinced we were that customers were indeed right—this should be possible. Payments via cards have a built-in feature for buying items now and paying for them 30 days later. Why can’t businesses easily access longer terms for expenses that can’t be put on a card?

Today, we’re releasing Ramp Flex: our new capability embedded within Ramp Bill Pay that allows you to extend payment terms by 30, 60, or 90 days for a small fee. Ramp pays your vendors upfront and you pay Ramp back later.

With Flex, Ramp becomes the first platform in the world where you can effortlessly manage your cards, invoices, reimbursements—and now financing—in one place. You make payments at the optimal time for your business while ensuring your vendors are happy and get paid on time. The old playbook for financing, consisting of strict payment terms, complicated paperwork, and numerous cash flows that had to be tracked across disparate systems, no longer applies.

It sounds almost too simple. Yet, no other financial institution is providing this kind of integrated spend management.

Unifying payments and financing drives business growth

The new products we’re announcing today are part of our larger vision: giving business leaders their time back and helping businesses gain the ability to scale.

This vision is a reality for Ramp customers like Eight Sleep.

One of Ramp’s earliest customers, Eight Sleep has quickly evolved from an innovative product to an incredible brand. They became the most popular smart mattress and sleep fitness brand in America. But their success almost impeded their future growth.

Eight Sleep first started using our corporate card and spend management software to cut unnecessary SaaS spend and automate time-consuming manual data entry. But their finance needs evolved as rising demand for their product coincided with the pandemic. As the pandemic and ensuing supply chain snarls set in, mattresses that used to be delivered in one month started to take up to three months, tying up capital in inventory and prepayments to suppliers. In order to meet the rising demand, they were ordering many months worth of mattresses and managing an incredibly complex global supply chain.

Ramp Flex came to their aid. They used Flex to smooth their cash conversion cycle and unlock more favorable vendor terms. This in turn allowed them to build up their inventory, cover international shipping costs, and launch a new product line. Flex’s extended payment terms helped them meet their inventory demands and improve their vendor relationships, while still remaining well within 10% of their monthly cash utilization target.

“With Ramp, I can process my invoices and access extended payment terms on the same platform. We can smooth out our cash burn with precision by balancing a high cash-in month with cash outflows. Ramp Flex helped our business succeed and meaningfully improve our working capital cycles.” - Matteo Franceschetti, CEO at Eight Sleep

Ramp: the finance solution that all businesses need

At Ramp, we’re building our platform in lock-step with business needs, from small businesses all the way to our largest enterprise customers. Their pain points inform every aspect of our products. When we realized businesses were looking for a way to save instead of spend, we built enterprise-grade cards. When we realized they needed the ability to better manage bill payments and cash cycles, we created the cash flow solution they deserved by turning the traditional lending process on its head.

Only Ramp is able to build these new kinds of integrated financing solutions due to our access to customer spend data, cash flow positions to provide businesses with the credit limits they require, and payment schedules between companies to speed up or slow down payments. We aren’t just building products: we’re helping our customers make smarter cash flow decisions to increase overall profitability and efficiency.

Ramp is reimagining finance by eliminating friction in favor of effortless processes. All of your systems are now connected to Ramp, allowing you to access context on every transaction in real-time. Ramp provides a unified, seamless experience that covers all of your finance needs, from lending and finance intelligence to procurement and beyond.

*Ramp Flex is subject to credit approval and restrictions, and will not be available in all states. Loans issued by Ramp Financing Corporation and/or Lead Bank. Visit ramp.com/flex for more info.

“We’ve simplified our workflows while improving accuracy, and we are faster in closing with the help of automation. We could not have achieved this without the solutions Ramp brought to the table.”

Kaustubh Khandelwal

VP of Finance, Poshmark

“Our previous bill pay process probably took a good 10 hours per AP batch. Now it just takes a couple of minutes between getting an invoice entered, approved, and processed.”

Jason Hershey

VP of Finance and Accounting, Hospital Association of Oregon

“When looking for a procure-to-pay solution we wanted to make everyone’s life easier. We wanted a one-click type of solution, and that’s what we’ve achieved with Ramp.”

Mandy Mobley

Finance Invoice & Expense Coordinator, Crossings Community Church

“We no longer have to comb through expense records for the whole month — having everything in one spot has been really convenient. Ramp's made things more streamlined and easy for us to stay on top of. It's been a night and day difference.”

Fahem Islam

Accounting Associate, Snapdocs

“It's great to be able to park our operating cash in the Ramp Business Account where it earns an actual return and then also pay the bills from that account to maximize float.”

Mike Rizzo

Accounting Manager, MakeStickers

“The practice managers love Ramp, it allows them to keep some agency for paying practice expenses. They like that they can instantaneously attach receipts at the time of transaction, and that they can text back-and-forth with the automated system. We've gotten a lot of good feedback from users.”

Greg Finn

Director of FP&A, Align ENTA

“The reason I've been such a super fan of Ramp is the product velocity. Not only is it incredibly beneficial to the user, it’s also something that gives me confidence in your ability to continue to pull away from other products.”

Tyler Bliha

CEO, Abode