Introducing Ramp Flex: Simplify cash flow management with extended payment terms

- Today, cash flow management is essential for growth

- Ramp Flex: cash flow management on your terms

- Ramp Flex changes the game for growth-forward businesses

Every day, businesses struggle to navigate a messy web of terms, conditions, and limits from their vendors and banking partners. They’re trying to balance smoothing out their cash flows and scaling their business while controlling expenses that live in disparate tools. This balancing act results in vastly inefficient processes that threaten to chip away at these businesses’ most valuable resources—their team’s time and capital.

At Ramp, we believe our customers should demand more out of their relationships with financial service partners over time—never less. That’s why today, we’re launching Ramp Flex.

Ramp Flex allows you to extend your payment terms directly within Ramp Bill Pay. With Flex, let Ramp pay your vendors upfront and choose to pay Ramp back in 30, 60 or 90 days.

Flex allows you greater flexibility in paying your vendors, better cash flow management as well as helps consolidate and simplify all payment workflows. You can now go back to focusing on what matters: scaling your business, on your terms.

Today, cash flow management is essential for growth

At Ramp our job is simple: engage with our customers, understand their pain points, and build towards how the world should be.

Many businesses on Ramp have repeatable activities like purchasing inventory, materials, or equipment. These activities often have long cash conversion cycles, as they require upfront cash before they generate revenue, tying up precious capital and impairing cash flow, which can become especially acute as these processes scale.

As a result, finance teams spend an inordinate amount of their time manually controlling cash flow. They run up against these issues:

Vendors may have strict repayment terms

To manage their cash conversion cycle, finance leaders often spend days going back-and-forth with vendors who may demand upfront payment or provide terms that don’t extend beyond 30 days. Because of this, a significant amount of time is often spent by businesses trying to balance vendor relationships while aiming to gain flexibility in repayment terms.

Financing is a pain to navigate

Unfortunately, when businesses look for solutions to these problems through alternative funding, they find that today’s offerings are inflexible. Some options involve a painfully long and tedious application process while others have onerous collateral requirements: personal founder guarantee, ceding control over future revenues, or even warrants that may convert into future equity.

Disparate tools make spend visibility impossible

As a result, businesses wind up with highly manual, slow, and logistically daunting processes for managing cash flows. Their spend becomes strewn across a slew of different platforms for AP, T&E, treasury, and more. The patchwork of solutions they are forced to stitch together not only falls short of providing the flexible, automated solutions they need, it also creates layers of wasted time and inefficiency.

Ironically, these cash conversion cycle issues often hit hyper-growth companies the hardest. Companies that are scaling rapidly need greater flexibility in payment terms to maximize their opportunities to increase ROI and scale efficiently.

Ramp Flex: cash flow management on your terms

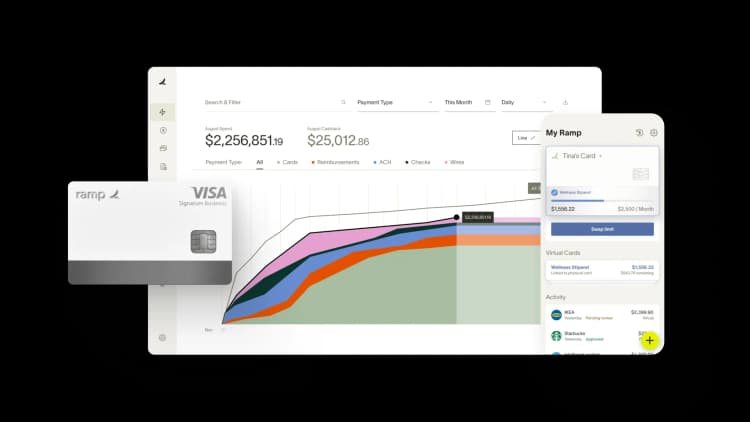

Enter Ramp Flex, a modern extended payment terms solution embedded within Ramp’s Bill Pay. Last year, we introduced Bill Pay as a way to help businesses automate payments and digitizing invoices. As a result, teams have been able to save countless hours by automating what was once a highly manual process. But we couldn’t stop there.

We believe best-in-class cash flow management tools should enable smoother vendor relationships and integrate with the rest of your finance stack.

Ramp Flex allows you to extend payment terms with one click, right when you pay your bills. When combined with Ramp Bill Pay, it enables:

- Vendor payment flexibility

- Automated cash flow management

- Total spend consolidation

Pay your vendors when and how you want

View and select from 30, 60, or 90 day terms for bill payments in seconds upfront. Prepay if plans change with the click of a button—we’ll prorate the original fee. The days of tense back-and-forth with vendors are over.

Manage cash flow in seconds

Extend payment terms seamlessly in Bill Pay with one click—no admin work or additional software required. Because Flex is embedded within Bill Pay, you can leverage automated invoice OCR, approval flows, and accounting integrations to pay with confidence. Time to kiss the old cash flow management grind goodbye.

Consolidate all spend

You can unify, control, and report on all spend in one place: Ramp. You don’t have to deal with a kluge of disparate financial tools anymore. Ramp’s finance automation platform is a powerhouse that allows you to bring together corporate cards, bill payments, extended payment terms, and reimbursements with continuous syncs to your core ERP.

Ramp Flex changes the game for growth-forward businesses

At Ramp, we believe that the best businesses should demand the best finance automation platform. Ramp Flex for bill payments reflects that belief: deepening automation and simplifying the AP function with a next-generation approach to extended payment terms.

“Flex is a game changer…we can manage our cash better while keeping vendors happy…it saves time, so we’re not focused on administrative tasks, we’re focused on work” - Irish Rose, Financial Controller at Eight Sleep

No more back-and-forth with vendors. No more manual cash flow management. No more splintered spend. Yes to investing in growth and paying vendors on your terms. Yes to focusing on scaling your business. Yes to unparalleled visibility and control over spend in one unified place.

Ramp Flex is subject to credit approval and restrictions, and will not be available in all states. Loans issued by Ramp Financing Corporation and/or Lead Bank. Visit ramp.com/flex for more info.

“We’ve simplified our workflows while improving accuracy, and we are faster in closing with the help of automation. We could not have achieved this without the solutions Ramp brought to the table.”

Kaustubh Khandelwal

VP of Finance, Poshmark

“Our previous bill pay process probably took a good 10 hours per AP batch. Now it just takes a couple of minutes between getting an invoice entered, approved, and processed.”

Jason Hershey

VP of Finance and Accounting, Hospital Association of Oregon

“When looking for a procure-to-pay solution we wanted to make everyone’s life easier. We wanted a one-click type of solution, and that’s what we’ve achieved with Ramp.”

Mandy Mobley

Finance Invoice & Expense Coordinator, Crossings Community Church

“We no longer have to comb through expense records for the whole month — having everything in one spot has been really convenient. Ramp's made things more streamlined and easy for us to stay on top of. It's been a night and day difference.”

Fahem Islam

Accounting Associate, Snapdocs

“It's great to be able to park our operating cash in the Ramp Business Account where it earns an actual return and then also pay the bills from that account to maximize float.”

Mike Rizzo

Accounting Manager, MakeStickers

“The practice managers love Ramp, it allows them to keep some agency for paying practice expenses. They like that they can instantaneously attach receipts at the time of transaction, and that they can text back-and-forth with the automated system. We've gotten a lot of good feedback from users.”

Greg Finn

Director of FP&A, Align ENTA

“The reason I've been such a super fan of Ramp is the product velocity. Not only is it incredibly beneficial to the user, it’s also something that gives me confidence in your ability to continue to pull away from other products.”

Tyler Bliha

CEO, Abode