- Ramp has consistently increased value delivered to customers

- Quantifying Ramp’s financial impact

- What we’ve released recently to deliver even more value

- Ramp has more than doubled revenue in 2022 due to increased demand

- How Ramp can help you deliver on your goals

As markets have cooled down, we’ve seen a wide range of reactions from financial services. Some companies have offboarded tens of thousands of companies that seemingly didn’t provide enough financial return, leaving customers to find another bank account with just 60 days notice. Others have chosen to quietly reduce the value of the rewards they offer their customers (1 → 2 → 3), rewarding loyal customers with diminishing value. And some legacy institutions have hardly reacted to customers’ shifting needs…even as years have passed by.

Screenshots of the American Express credit card page

Ramp has consistently increased value delivered to customers

In February 2020, Ramp launched with a counterintuitive mission: help customers spend less. We are resolute in our mission to save customers their most valuable resources—their team’s time and their shareholders’ capital.

At Ramp, we believe customers should come to expect more from their financial service partners each year. Not less. I’d like to take some time to lay out:

- How much financial impact Ramp has driven for customers

- What we’ve released recently to deliver even more value

- The increasing demand we’ve seen from businesses as a result

Quantifying Ramp’s financial impact

We measure ourselves by how much money and time we save our customers.

As of July 2022, Ramp has helped customers, from small businesses to enterprises, reduce their spend by more than $200 million. The 7,000+ businesses using Ramp are today, in aggregate, realizing $1 million in cost savings per day. This daily average has grown by almost 50% in just the last 100 days.

We’ve put more than $200M in total back in the accounts of businesses.

With Ramp, companies finally know where employees are spending and what their highest-ROI efforts are. Financial savings stem from:

- Straightforward savings: Save an average of 5% with Ramp

- Tools consolidation: Our finance automation removes the need for separate vendors across corporate cards (e.g. American Express, Brex), expense management (e.g. Expensify, Concur), bill pay (e.g., Bill.com), travel management (e.g. TripActions, Egencia), and accounting automation

- Real-time insights: Remove duplicate subscriptions and find better pricing with our automated alerts

- Greater spend management control: Manage your team’s spending down to the merchant level with multi-layered approvals and industry-leading controls

- Flexible capital: Finance more growth with our 30-day working capital cycles

- Negotiation services: Save an average of 27% on your contracts with the help of our Buyer team

- Partner rewards: Access a deep partner network of rewards, representing over $350,000 in value available to every Ramp customer

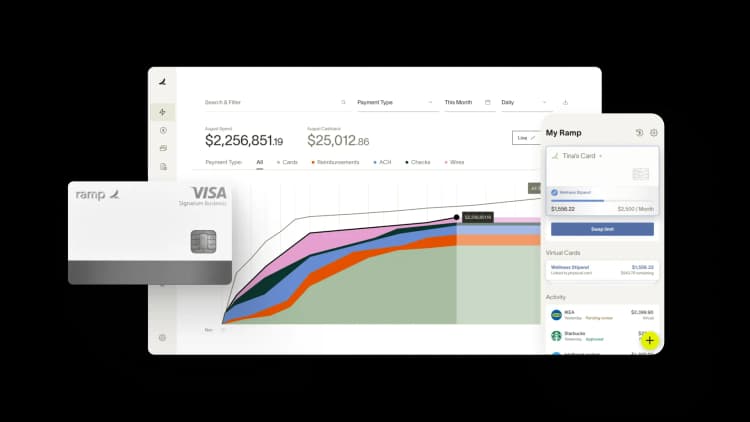

Ramp’s dashboard provides real-time savings insights

Ramp customers have saved 3,586,868 hours, and counting.

Time savings come from helping customers optimize the following areas:

- Expense management: Receipts are turned in by employees within 30 minutes of purchase on average, compared to industry average of 3-4 weeks of purchase

- Receipt matching: Employees enjoy zero-touch receipt collection through Gmail, Lyft, and Amazon Business integrations

- Month-end close: Finance teams are closing their books 8x faster and with greater accuracy, thanks to our QuickBooks, Sage Intaact, NetSuite, and Xero integrations

- Workflow automation: Spend controls, multi-layered approvals, and expense policies streamline employee, merchant, and vendor experiences

Take Causal, a business planning platform that helps customers model and visualize their data. Closing the books went from taking 15 hours to 5 hours per month once they switched from Brex to Ramp. Real-time visibility of how much employees are spending on their cards and invoices is improving the team’s forecasting.

What we’ve released recently to deliver even more value

Today, Ramp is the highest rated spend management platform on the market.

G2 ranking of spend management vendors

We engage deeply with our customers’ finance teams, owners, and employees to understand where they could be spending less time or money, and improve our platform rapidly based on our learnings. Our corporate card has also become the fastest growing in America because of our alignment with customers and our industry-leading pace of product delivery.

Business leaders are being asked to do more with less. Rather than shifting course when businesses need a partner like Ramp the most, we’re doubling down and pushing the boundaries of our finance automation to help customers save even more. Features like our Gmail integration are helping teams regain valuable time by automating over 60% of their receipt submissions. Our recently launched commerce-based underwriting is unlocking access to credit limitss that are up to 20x higher than traditional offerings. And our industry-first Stripe App is helping digital-native businesses get a single view into their money in and money out.

Next month, we look forward to announcing one of our biggest expansions to the Ramp platform yet. While others are reducing value available to customers, we believe this is a critical time for businesses like Ramp to deliver more value to businesses.

Ramp has more than doubled revenue in 2022 due to increased demand

Ramp’s ability to help businesses spend an average of 3.5% less is uniquely appealing and valuable to businesses in this macroeconomic climate. It is why Ramp has continued to grow at a rapid pace, bolstering our long-term commitment to customers.

Last month, Ramp closed 38% more new business than we did the month prior. We grew across all customer segments: ~300% in enterprise segment, ~50% in mid-market, and ~22% in SMB. The amount of new business that Ramp closed—from new customer sign-ups—in June is also more than double that figure just six month prior, meaning that Ramp is continuing to grow at an increasingly large scale. Revenue has grown twofold since our last fundraise. We’re grateful for the opportunity to support more businesses and are committed to helping them do more with less and thrive in these times.

How Ramp can help you deliver on your goals

The time to focus on your capital efficiency is now. Start by taking these actions:

- Improve your team's productivity: Give your teams the tools they need to automate tedious expense reports and close books 8x faster.

- Consolidate your tools. Don’t use two tools when one will do. With Ramp’s AI-powered bill payments and reimbursements, you don’t need Expensify or Bill.com.

- Cut wasteful spending. Get insights on where you could be saving. Save on software costs with the help of our expert contract negotiators and price intelligence.

Ramp is here to be your long-term partner. Others in the industry are pulling back, but we'll continue to invest in helping you cut wasteful spending and save time so you can get back to leading your business.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits