4,200* teams chose Ramp over Brex.

Our product velocity, driven by customer dedication, has consistently won over 50,000 companies. Yours could be next.

Opens ChatGPT in a new tab.

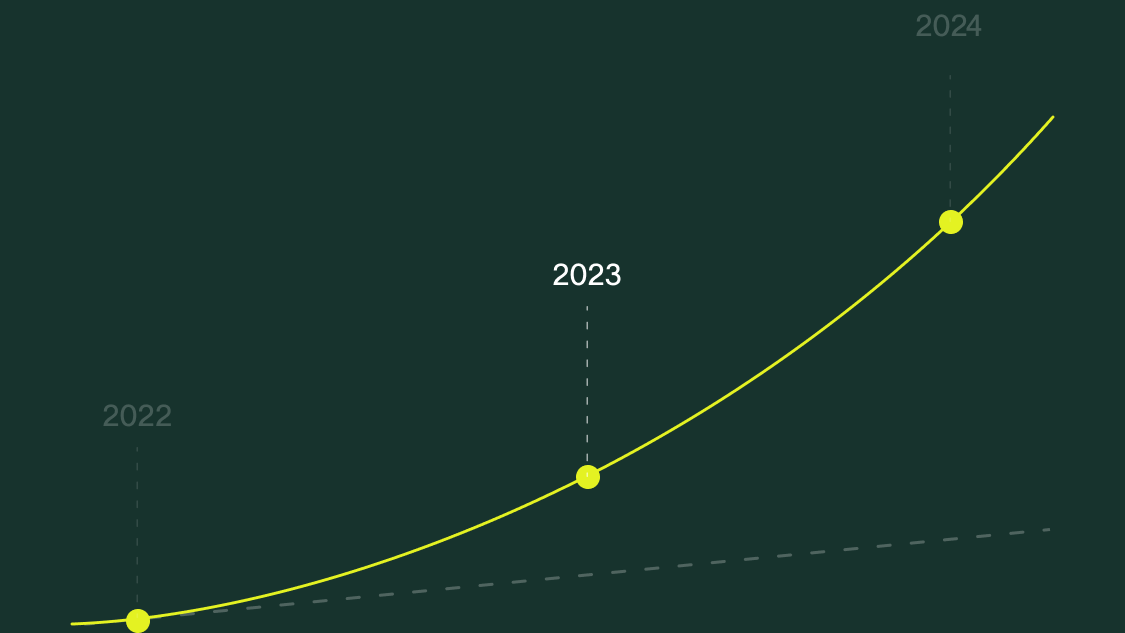

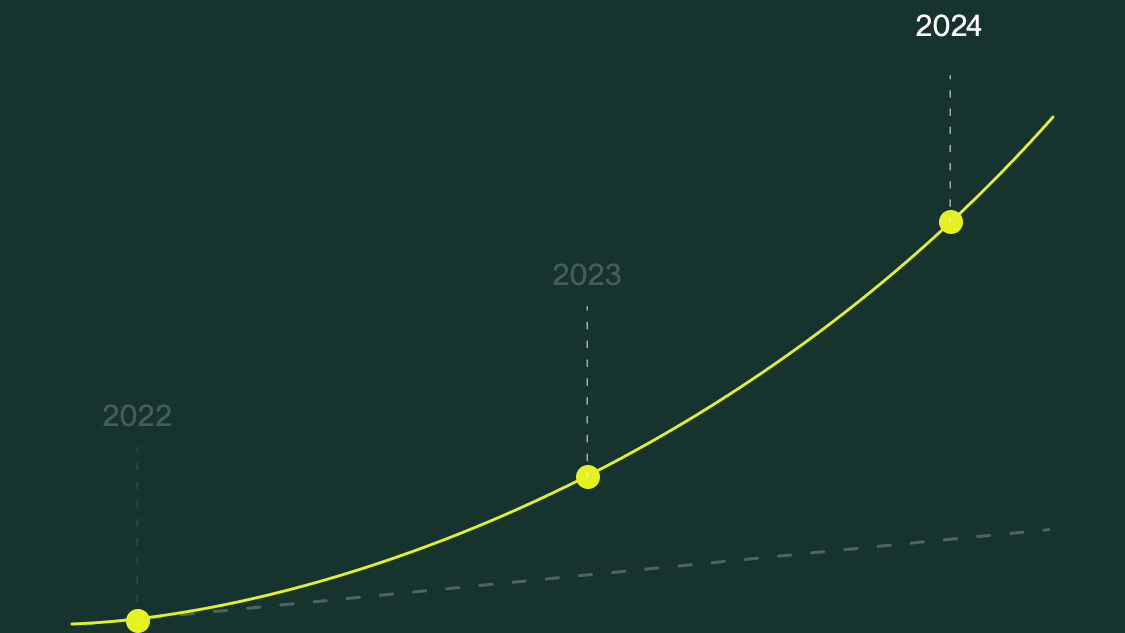

Projections lie. Numbers don't.

Ramp over the past

three years

• 150+ releases including Ramp Intelligence and Ramp Procurement

• 2x revenue growth

• 15,000+ customers

• 30,000+ customers with 1M+ users

• Raised a series D-2 round• 200+ releases to date including Ramp Travel

• 300+ new AI innovations, including Policy & AP agents

• Local card issuing in 40+ countries

• Launched Ramp Treasury

Here’s why businesses choose Ramp over Brex.

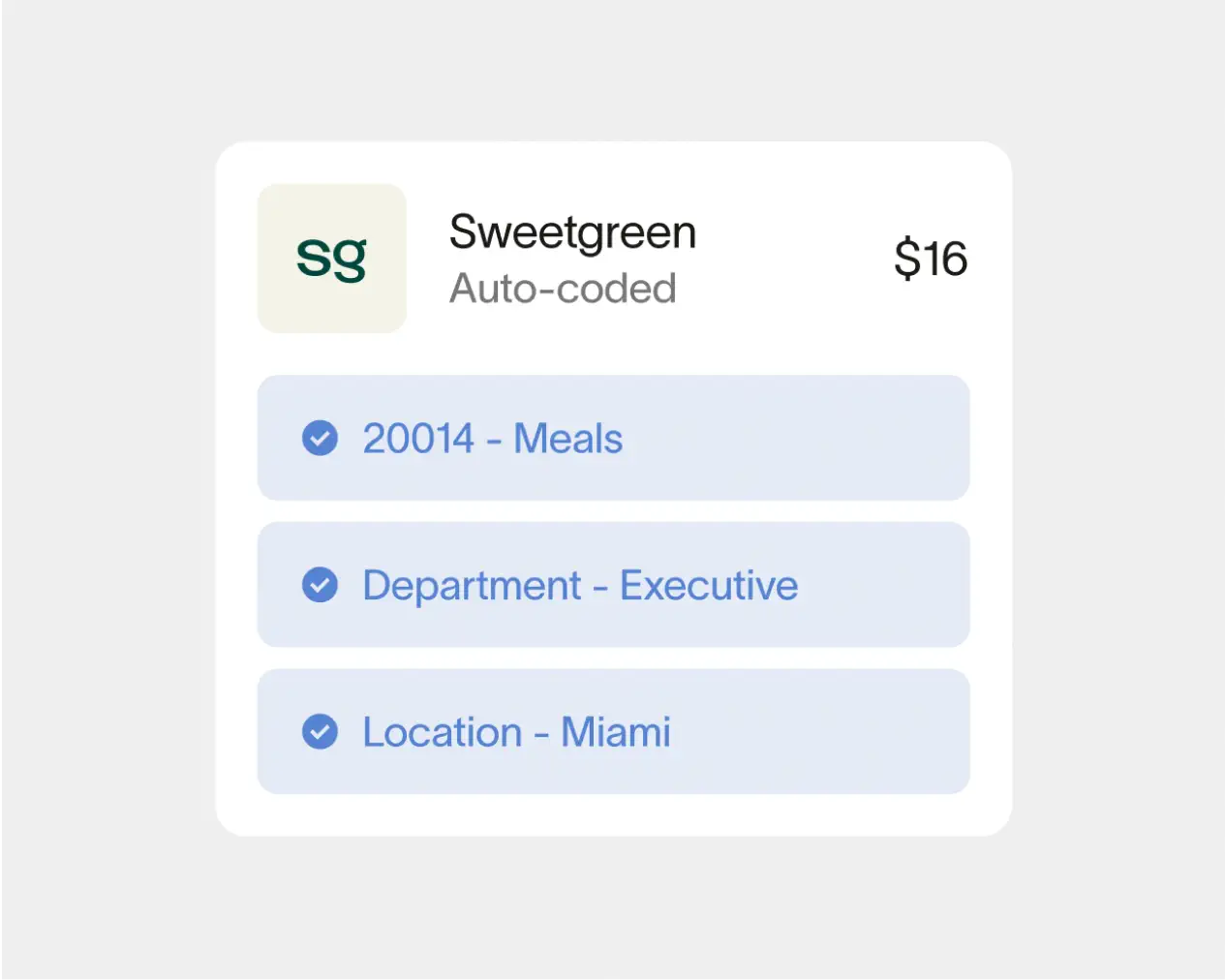

Proven AI agentic workflows

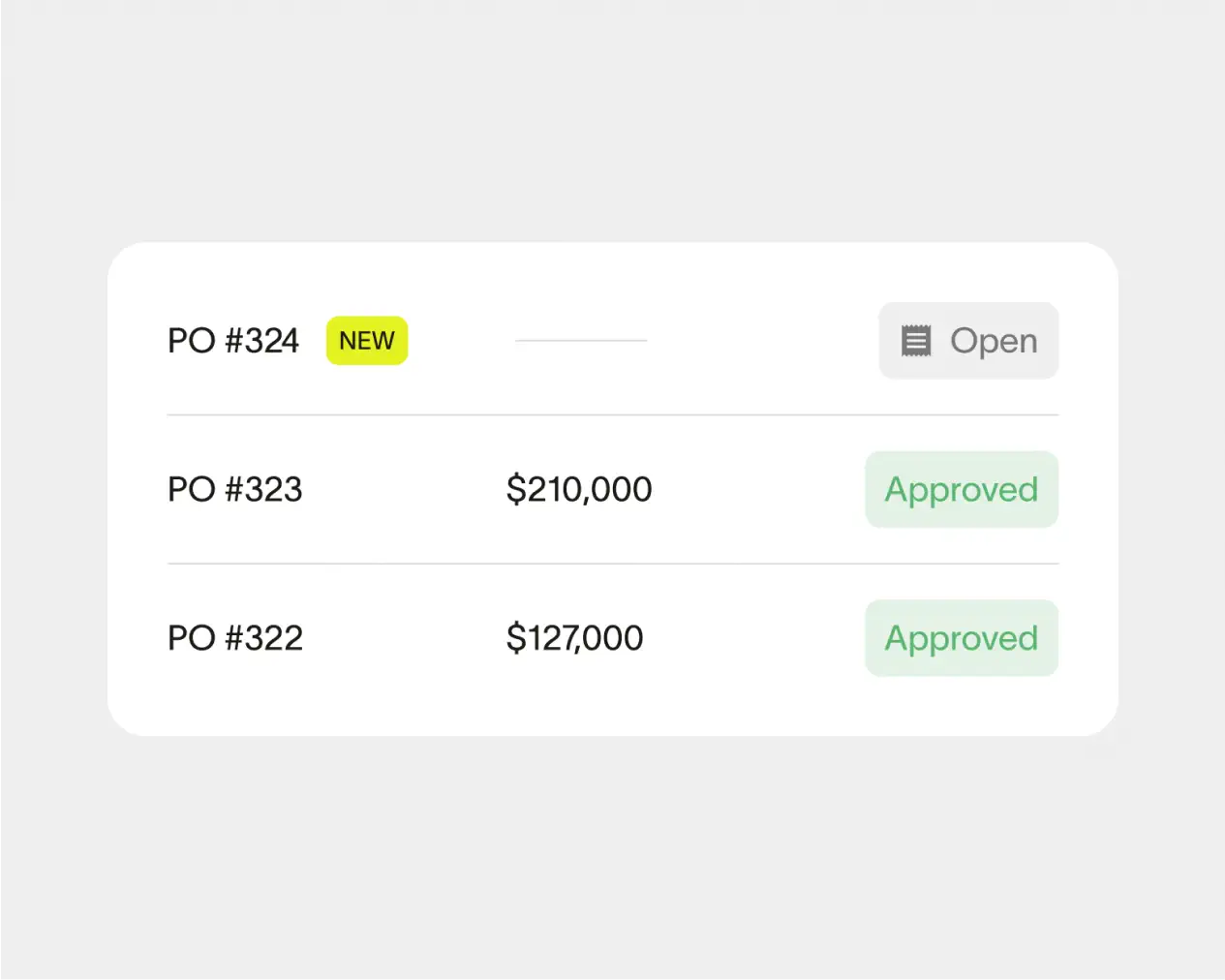

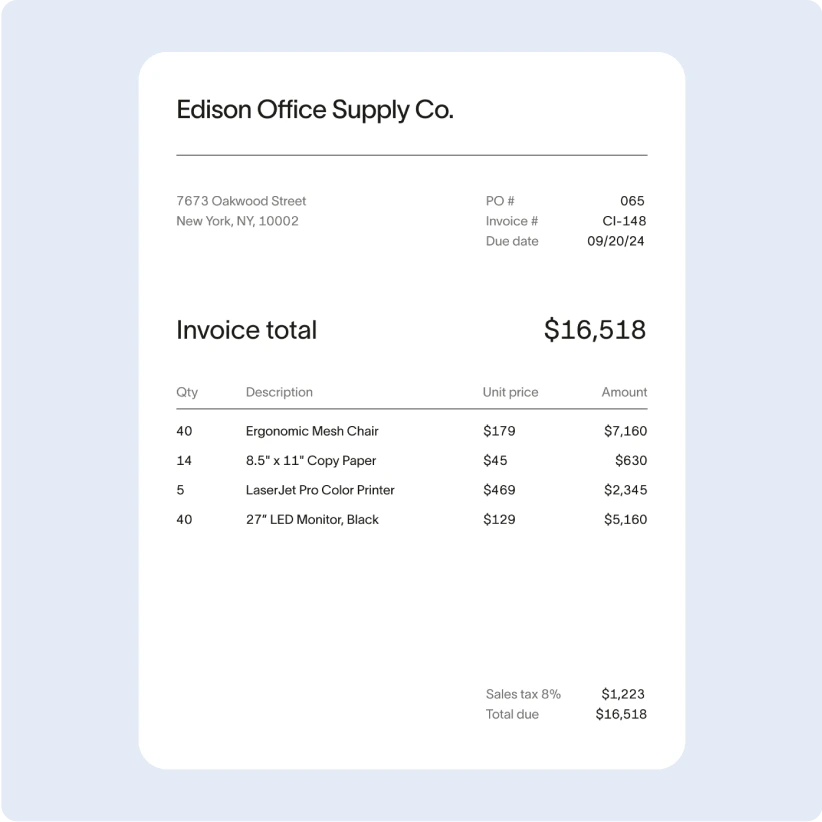

Easiest Procure-To-Pay

ERP depth determines month-end velocity.

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end — that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

Get started in minutes.

Whether you’re building your business, expanding internationally, or cutting costs, Ramp just works.

Up to

more out-of-policy spend captured¹

Up to

transaction reviews automated²

Up to

policy enforcement accuracy³

Webflow

“Our finance team and employees alike love Ramp for its ease of use, spend visibility, and excellent customer service. Its modern spend controls help us all take accountability for the operating efficiency of the company.”

- Ivan Makarov, Former VP of Finance

Piñata

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

- Lily Liu, CEO

Crowdbotics

“Rather than have to go to a different screen, system, or spreadsheet, I can look at an individual invoice and easily see what I have remaining. Having it all in one spot saves me a ton of time.”

- Miles Lavin, VP of Strategic Finance

Expect more from your financial operations platform.

Prioritizing speed?

Ramp is built for you.

Ramp is the preferred choice for modern finance teams.

Ramp’s AI does the work for you.

Procure it all, and pay in one place.

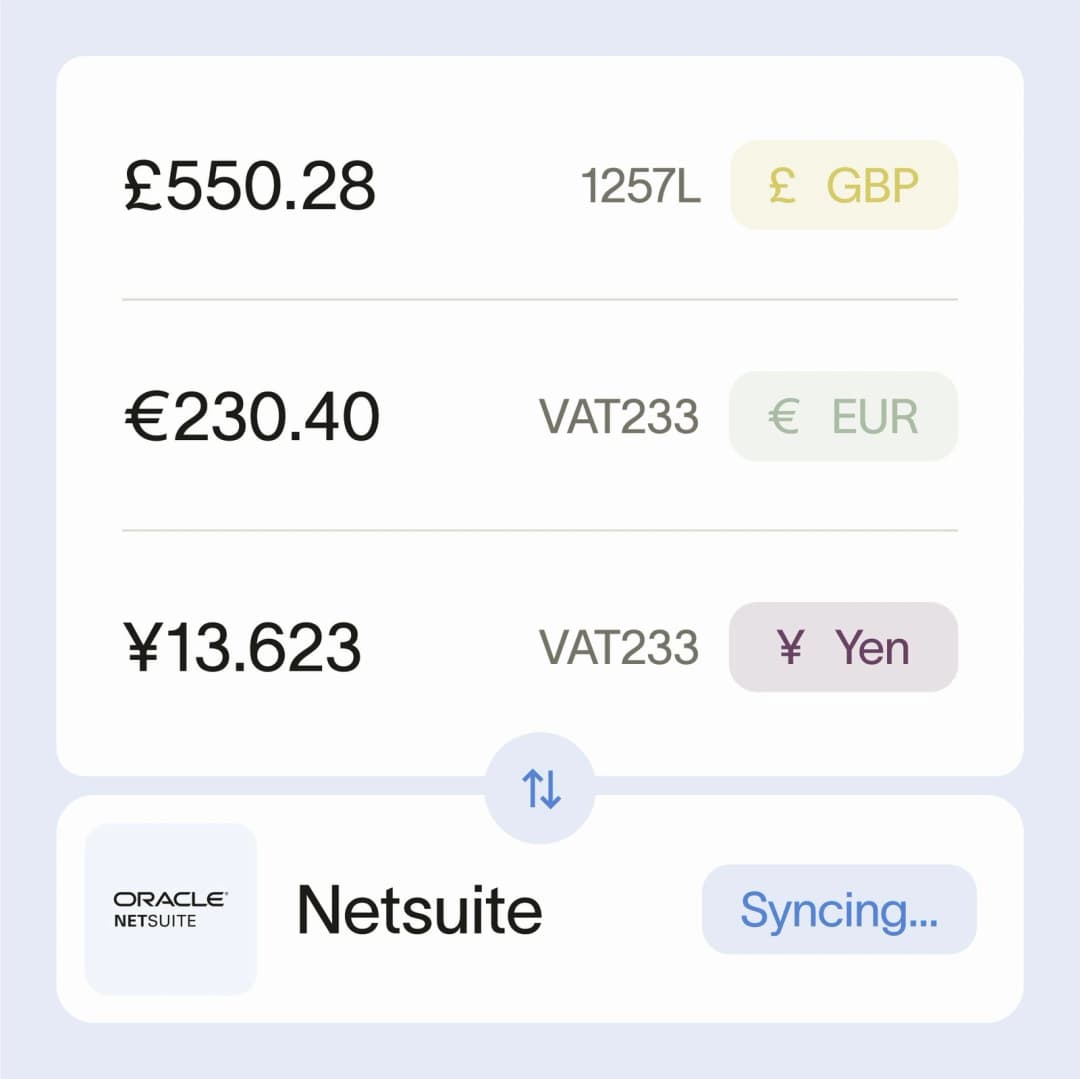

Automate global finance in local currency.

FAQ

Switching business credit cards is typically straightforward. Companies can apply for a new provider and migrate spend incrementally to avoid operational downtime. This allows teams to test new workflows before a full cutover. Ramp can approve applications within 48 hours, enabling a fast transition—and in 2024, 98.51% of businesses that adopted Ramp chose to stay.

Yes. Ramp's spend management platform is trusted by private multinationals and over 330+ publicly traded companies, including Visa, CBRE, and Shopify, to manage expense programs, vendor payments, procurement, and corporate card spend at scale.

Ramp is purpose-built for complex organizations and offers multi-entity support, customizable approval workflows, granular roles and permissions, real-time spend controls, and deep ERP integrations with Oracle Fusion Cloud, Workday, and more. These capabilities help finance teams improve compliance, reduce overhead, and eliminate wasteful spend, with AI agents continuously reviewing transactions, enforcing policies, and surfacing issues in real time.

Ramp's enterprise platform is built for global operations, supporting spending across 190+ countries with comprehensive multi-entity and local currency capabilities.

Global spending and payments:

- Issue corporate cards in local currencies across 40+ countries including CAD, GBP, EUR, AUD, SDG, JPY and more.

- Send payments to vendors in 185+ countries with free unlimited international wires through Ramp Treasury

- Reimburse employees in their local currency across 65+ countries

- Fund AP payments, card statements, and reimbursements from local bank accounts in select markets, reducing intercompany transfers and reconciliation complexity

Multi-entity management:

- Manage multiple entities from a single Ramp account with entity-level visibility controls

- Separate statement payments and funding accounts by entity

- Track transactions and reconcile spend in each entity's local currency

- Set budgets, approvals, and controls at the entity level while maintaining centralized oversight

International accounting and compliance:

- Automatic VAT capture and multi-currency reconciliation

- Direct ERP integrations with Oracle Fusion Cloud, Workday, NetSuite OneWorld and Sage Intacct and more

- Real-time reporting across all entities and currencies without manual conversions