I’m excited to share that Ramp has closed a $115 million Series B funding round co-led by D1 Capital Partners and Stripe, which values our spend management platform at $1.6 billion. This new fundraising reflects the stellar growth Ramp has experienced—transactions have grown by approximately 400% over the past 6 months, and we’re nearing annualized transaction volume of $1 billion.

Co-founding a fintech unicorn was never my plan, and almost feels crazy given my job 12 years ago was selling t-shirts and jeans. As a teenager working at a fashion retailer in Las Vegas, I distinctly remember watching families come in on Saturdays to buy clothing at a 20% discount, only to see prices drop another 25% just a few days later. It was strange to watch a company profit by being less than transparent with its customers.

Years passed, I finished college and started working, and I felt what it was like to be a consumer on the other end. I didn’t like it. After learning these price adjustment policies existed for most online retailers, I reconnected with Karim—a good friend and fellow Harvard alum—to discuss an idea that would become our first business together. The idea was to build software aligned with—and protective of—consumers.

Together with Gene, we launched Paribus in May 2015 with a mission to save consumers time and money by automating the price adjustment refund process. One year later—after saving 700,000+ consumers millions of dollars—we partnered with and ultimately sold the company to Capital One’s credit card division.

Our time at Capital One opened our eyes to the innovation barriers that exist in the corporate card industry and sparked a new idea inspired by our desire to put customers first. With our new startup, we would build software that was aligned with—and protective of—businesses.

We quit our jobs at Capital One and started interviewing hundreds of startup founders to build a hypothesis. We identified three main problems with incumbent corporate cards.

- Misaligned incentives: The “products” card companies built and optimized were complex rewards programs designed to encourage wasteful spending.

- Bloated expense management software: Businesses were forced to use legacy expense tracking software that slowed everybody down.

- Lack of spending oversight: Payments were scattered across multiple systems, so businesses lacked a single view of how employees were spending.

We founded Ramp in March 2019 with a mission to increase the lifespan of businesses with intelligence and automation. Our vision was to design a corporate card and spend management platform that actually helped businesses spend less. Here were our guiding principles:

- Ease of use: Corporate cards with simple cash back—rather than complex rewards—integrated with software that’s easy to set up and easier to use.

- Control at scale: Controls, limits, and automation that help businesses manage employee spend as the company grows.

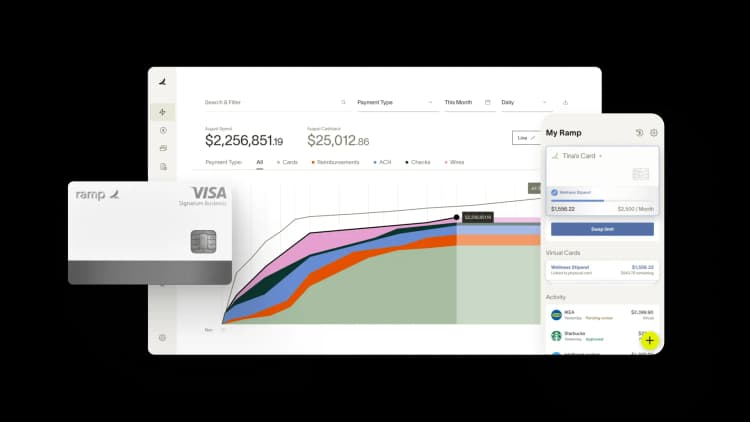

- Real-time intelligence: One view of company spend paired with intelligence that automatically identifies waste and cuts costs to optimize every dollar spent.

From day one, we’ve vowed to put the customer first and drive cohesion, automation, transparency, and efficiency for finance teams so companies can save time and money. Our core offering was an unlimited 1.5% cashback corporate card integrated with spend management software designed to help businesses spend less.

We welcomed our first customer in August 2019, launched publicly in February 2020, and have been amazed at the response from the market, especially from some of the most innovative companies in the world. Fast-scaling unicorns like Ro, Better, and ClickUp, as well as traditional businesses seeking greater financial efficiency all have chosen Ramp as their spend management platform of choice. Our customers depend on Ramp to manage their finances during hypergrowth and inflection points within their company trajectories—when things can get especially messy and complicated for finance teams.

To date, Ramp has helped 1,000+ customers identify over $10M in wasteful spend, eliminate expense reports, and streamline financial operations to close their books 86% faster. We’re proud to hold the title of #1 rated spend management vendor on peer review sites like G2 — users of our software love us for our ease of use, accounting automation, and customer service experience.

Our growth is only just beginning. Over the past six months, transaction volume on Ramp has grown by approximately 400%, and we’re nearing an annualized transaction rate of $1B. All of this has resulted in the exciting milestones we are announcing today:

- Ramp has raised $115 million in Series B funding at a $1.6 billion valuation—making us one of the top 10 fastest-growing US startups ever.

- Fintech pioneer and the most valuable private US startup, Stripe, co-led our latest funding round with D1 Capital Partners.

- Our backers include some of the most well known leaders in financial services, including both incumbents and innovators such as Founders Fund, Coatue Management, Thrive Capital, Redpoint, and Box Group.

- Meanwhile, Goldman Sachs, a 150 year old financial institution, backed Ramp with a $150m line of debt financing.

After surpassing a $1 billion valuation in under two years, Ramp is also the fastest-growing startup ever to come out of New York. While most of our employees have worked remotely for the last year, New York remains an important part of our company's DNA and culture, which makes this an especially meaningful honor for us. We've been energized by the innovation that has come out of our city in recent years and are proud to play a leading role in the NYC ecosystem.

We have spent the last two years focused on building the best possible product for our customers and have designed an incredible user experience and capabilities not found in any other corporate card or spend management platform. During our next phase of growth, we plan to expand our efforts to bring the value of Ramp to more businesses in more places and to transform the way more companies do business.

If you’re a US-based business leader looking to eliminate expense reports, consolidate your company spend, and automate financial workflows, don’t hesitate to try out Ramp. And if you’re looking to join New York’s fastest-growing startup, love solving complex problems, or want to help build the financial stack of the future, check out our careers page.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°