New York, April 8, 2021 - Ramp, the first corporate card designed to help businesses spend less, today confirmed $115M in new funding from D1 Capital Partners and Stripe, with support from Goldman Sachs, Founders Fund, Coatue Management, Thrive Capital, Redpoint Ventures, Box Group, Neo, and Contrary Capital.

The round brings total venture and debt financing raised by Ramp to $320M. With a valuation of $1.6B, Ramp has become the fastest growing New York based startup in history, and the first to surpass a $1B valuation in under two years from incorporation.

"Ramp has quickly become a key player in the financial services ecosystem by challenging business practices and assumptions that have existed for nearly 50 years,” said Dan Sundheim, Founder and Chief Investment Officer of D1 Capital Partners. “The company attracts new customers by providing value and savings, and empowers CFOs and finance teams to operate at a higher level of efficiency. We look forward to supporting Ramp during its next phase of growth."

“Like Square, Paypal, and Stripe, Ramp is rapidly emerging as a generational fintech company. Though it launched publicly just one year ago, Ramp is already viewed as the obvious choice for efficient spend management at the fastest-scaling, highest-performing startups.” said Keith Rabois, Partner at Founders Fund. “We are pleased to welcome Stripe, an innovative company that we deeply admire, to the Ramp team.”

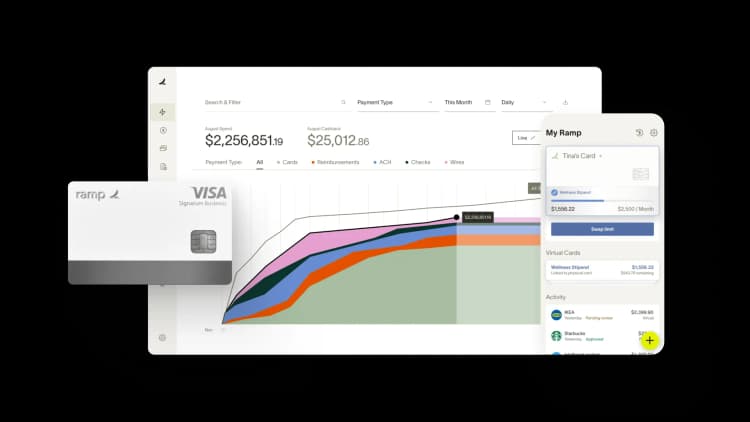

Over the past six months, transaction volume on Ramp has grown by approximately 400%, and is nearing annualized transaction volume of $1B. Whether at fast scaling unicorns like Ro, Better, ClickUp, Applied Intuition and more, or at more traditional businesses seeking higher financial efficiency, Ramp has quickly become the spend management platform of choice. A third of Ramp customers switched over from American Express, and more than 90% of customers adopted Ramp as a comprehensive spend management platform, replacing Expensify, Concur or manual solutions. Ramp has saved its customers over $10M through its proprietary software that identifies ways for businesses to spend less on purchases and an additional 5.4 days a month in administrative work for finance teams.

"Our transition to Ramp was memorable because it felt like upgrading from a flip phone to an iPhone. Ramp brings corporate cards into the future," said Aron Susman, CFO of Ro. "Within minutes of signing up, we were able to issue cards to employees and take full control of our spending. Thanks to Ramp’s superior product, we no longer have to manage a separate expense management software, we have full visibility into spend, and we are achieving efficiencies we never expected."

"Ramp is taking a novel approach to corporate cards and spend management. We’ve been impressed by their product velocity and user focus,” said Karim Temsamani, head of Stripe's banking and financial products. “With this investment, we’re excited to partner with Ramp, and to further expand access to the corporate cards and expense management tools that businesses need.”

Funds from the round will be used to support Ramp’s growth and product development, as Ramp adds novel features and new payments capabilities that have not been seen in the corporate card or expense management space before, like sophisticated card controls, automated savings, and accounting automation. With the recent hire of former Stripe and Goldman Sachs executive Colin Kennedy as Chief Business Officer, the company will also grow its partnerships, sales, and marketing efforts.

“Ramp has become the card of choice for high-growth companies that want to remove any operational barriers that could get in the way of their ambitious goals,” said Eric Glyman, co-founder & CEO, Ramp. “Mission-driven companies choose Ramp because they don’t have time to waste with inefficient processes, filing expense reports or optimizing points. We feel lucky to go to work for our customers and deliver software that helps companies operate higher performing businesses.”

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits