- What is an expense report?

- What’s included in an expense report?

- What expenses go into an expense report?

- The expense reporting process

- Using an expense report template

- How to fill out an expense report

- Are expense reports necessary?

- 3 common expense report mistakes to avoid

- How Ramp eliminates expense reports

- Say goodbye to manual expense reports

Key takeaways

- An expense report is an itemized list of business-related purchases an employee makes on behalf of your company, used for tracking, reimbursement, and tax purposes.

- Maintaining accurate expense reports is crucial for effective budgeting, ensuring fair employee reimbursement, and creating a clear record for tax deductions.

- A complete report should detail each purchase with its cost, date, and business purpose, and must be accompanied by a corresponding receipt for verification.

- You can prevent common errors and compliance risks by establishing a clear expense policy that outlines spending rules and documentation requirements before spending occurs.

- Ramp helps you eliminate manual expense reports by automating receipt collection and matching them to expenses, enforcing your expense policy in real time, and syncing data directly to your accounting software.

If your employees frequently make purchases on behalf of your business, you need a way to handle expense reimbursement. Even if your employees use corporate cards or preapproved stipends, you need to track these expenses to better understand your business spending.

That’s where expense reporting comes in. In this article, we take a closer look at what expense reports are, including how to create them and what information they should contain. We also explain why they’re so important for your business and highlight key reporting mistakes to avoid.

What is an expense report?

An expense report is a document that lists any business expenses incurred on behalf of the company within a given reporting period, whether those expenses were paid for with an employee’s own money, a corporate card, or another source of company funding.

Most businesses require employees to submit expense reports on a weekly, monthly, or quarterly basis. For employees who incur business expenses more sporadically, expense reports are more likely to be a one-off occurrence whenever necessary.

What are expense reports used for?

Expense reports allow companies to review the expenditures employees incur on their behalf, verify that they’re accurate and in line with their expense policy, and reimburse team members for these purchases as necessary. They also provide the necessary documentation for claiming business tax deductions, which is essential in the event of an audit.

What are expense categories?

Expense reports help you monitor budgets and manage out-of-pocket expenses. They also allow you to track business spending across different expense categories.

Expense categories provide a structured way to organize your costs into broader buckets. Use them to keep an eye on trends and make more informed spending decisions.

Typical expense categories might include:

- Employee benefits and training

- General and administrative (G&A)

- Rent and leases

- Marketing and advertising

- Employee training

- Travel expenses

- Software

- Maintenance and repairs

Who prepares an expense report?

Employees are responsible for filling out expense reports and submitting them for approval. They collect expense receipts and document each purchase to provide a detailed account for reimbursement. Employees then submit their reports to their manager or the finance team for approval, ensuring compliance with the company's expense policies and budget constraints.

What’s included in an expense report?

There’s no one “right” way of organizing the information in an expense report. What’s important is ensuring your expense reports contain all the essential information.

In addition to the submitter’s information (the name, contact information, and department of the employee submitting the report), an expense report should also include the following information about each purchase or expense:

- Purchase cost: How much did each purchase cost, including any taxes and fees?

- Purchase date: When was the expense incurred? This should match the date on the receipt submitted as part of the expense report.

- Purchase description: What was purchased, and what was the business purpose of the expense?

- Expense category: What business expense category does each purchase fall under?

- Seller: Who was the retailer, vendor, or supplier associated with each purchase?

- Account: Which account should the expense be charged to? The account can be tied to a department, client, project, event, etc.

- Subtotal by category: What was the total cost in each expense category?

- Grand total: How much was spent in total over the course of the reporting period (day, week, month, etc.)?

Again, employees must submit receipts or other documentation for each purchase included in their expense reports. This is especially important if you plan to write off deductible expenses on your tax returns: The IRS requires you to retain receipts for business expenses for at least seven years in the event that your company gets audited.

What expenses go into an expense report?

An expense report can include any legitimate business expense. There are three types of expenses:

- One-time: Things you can account for, but occur infrequently, like travel expenses for business trips, event costs, or relocation expenditures

- Recurring: Ongoing and regular costs, like rent, utilities, or salaries

- Long-term: Expenses you are planning for in the future, like maintenance, repairs or end-of-year bonuses

Regardless of the type, any expenses need to be accounted for on an expense report. Here are some specific examples:

- Travel expenses, like airfare, car rentals, or hotel costs

- Client lunches or dinners

- Office supplies

- Printing costs

- Professional memberships

- Conference fees

- Software subscriptions

- Telecommunications

- Insurance

- Training and continuing education

- Marketing and advertising campaigns

- Other miscellaneous expenses

The expense reporting process

Expense reporting is the term used to describe the overall process of filling out an expense report and submitting it for approval.

The expense reporting process is relatively consistent from business to business, even within different industries. The exact steps and the people involved may vary depending on a company’s policy, but typically you would follow a process like this:

- Incur an expense: You must first make a purchase on behalf of the business. Be sure to attach receipts or documentation related to the expense.

- Prepare an expense report: At the end of the reporting period, you generate an expense report according to the process outlined in the business’s expense policy.

- Submit the report: Once you’ve completed your report, submit for review. As part of the submission process, you must include any receipts or documentation related to the purchases.

- The report is reviewed: After you submit the expense report, it’s reviewed for accuracy, typically by your manager. The manager ensures the purchases comply with company policy, and that each expense is valid and associated with the right account.

- The report is approved or rejected: If your manager approves the report, they forward it to the finance department, where it’s officially processed and recorded. If the report is rejected, it typically gets returned to resolve any errors or discrepancies.

- Reimbursement: If necessary, the finance department will initiate your reimbursement, typically via check or direct deposit (ACH).

Using an expense report template

To make things easier for your team, you may want to create an expense report template. Different templates serve different purposes. For example, you may request different information for one-time, quarterly, or departmental expense reports. So it’s important to make sure you’re using the right one that fits your needs.

If your business doesn’t have a template for expense reports, you can download Ramp’s free, easy-to-use expense report template for both Google Sheets and Microsoft Excel.

Of course, manually creating expense reports can quickly become tedious. That’s why many businesses use expense reporting software to automate the process instead. These expense management platforms can track employee spending and automatically generate reports at the end of the reporting period.

Create your expense policy with Ramp's template

How to fill out an expense report

Creating expense reports doesn’t have to be hard—but it’s a lot easier once you know the steps involved. Follow these steps for creating an expense report:

1. Itemize your expenses

First and foremost, within your template, you need to itemize your expenses by splitting out each purchase line by line. As noted above, this should include a description of the item, the cost, the date of purchase, the name of the retailer, and a brief description of the business purpose. Depending on the template you chose, you might group purchases into expense categories (business travel, supplies, etc.), too.

2. Provide receipts

You must submit supporting documentation for each purchase included in your expense report. Depending on your company’s expense policy, these can be paper receipts, digital scans, or electronic receipts. In the absence of a receipt, your company may reject the report or require another proof of purchase, such as an invoice, canceled check, or credit card statement.

3. Total the cost

Before submitting the report, calculate the total of all your itemized expenses. If the template you’re using breaks out costs into different categories—which many do—you’ll first sum the subtotal for each expense category. And then, you add all the subtotals to find the total amount for your expense report.

4. Submit the report

Finally, submit the report and route it for approval to receive reimbursement. Depending on your company policy, you may be expected to either print the report and provide it to your manager, email the report to the person responsible for approvals, or else submit the report via expense management software. If you’re unsure of the specific process for submitting your expense report, you should review your company’s expense policy.

Are expense reports necessary?

Even if, as a small business owner, you are the only one making purchases on behalf of your company, it’s still important to have an expense reporting process. Expense reports are necessary for a few important reasons:

Budgeting and planning

A properly submitted expense report includes important information about each expense. Having insight into this information makes it easier to plan and budget for future expenses, identify areas to potentially cut back on spending, and simply stay organized and manage your cash flow.

Reimbursements

If your employees make business purchases with their own money, the fair thing to do is reimburse them for those expenses. In fact, reimbursements might even be required by law. Under the Fair Labor Standards Act (FLSA), employers must reimburse employee business expenses if those expenses drop the employee’s pay below the federal minimum wage.

Additionally, several states—and even some municipalities—have laws requiring reimbursement under a variety of circumstances. Employee expense reports make it easier to track expenses and ensure that you reimburse them according to the letter of the law.

Tax preparation

If you plan on deducting business expenses come tax time, it’s important to have a clear record of all your expenses. This includes knowing which expenses are deductible and which are non-deductible. It also includes collecting and organizing documentation (i.e., receipts) for each purchase in the event that the IRS ever audits your business. Expense reports fulfill all of these requirements.

3 common expense report mistakes to avoid

Expense reporting is important for your business, so work to avoid these common mistakes:

1. Not having a clear expense policy

A clear and comprehensive expense policy can have a big impact on the number of errors you see submitted in expense reports. Educating your team upfront on what is and isn’t reimbursable eliminates time wasted updating reports and fixing mistakes.

Your expense policy should explain who is allowed to make business purchases and what spending limits or expense category restrictions exist. It should also outline the approval process, indicate the documentation that must be submitted with each expense, define your expense reimbursement policy, and provide a template or form for employees to follow.

2. Accepting expense reports without supporting documentation

If you accept an expense report without a receipt or similar documentation, you open your business up to significant risk. This is especially true if you plan to claim tax deductions on business expenses. If your business is audited by the IRS and you don’t have documentation to support each expense, you could face hefty fines and penalties.

3. Miscategorizing expenses

To get a clear sense of how your business is spending money, you need to accurately categorize your expenses. Doing so gives you a more granular understanding of spending and makes real-time reporting much easier. It also makes it easier to claim any deductions come tax season. With this in mind, it’s important to review each expense to ensure that it’s properly categorized before you approve it.

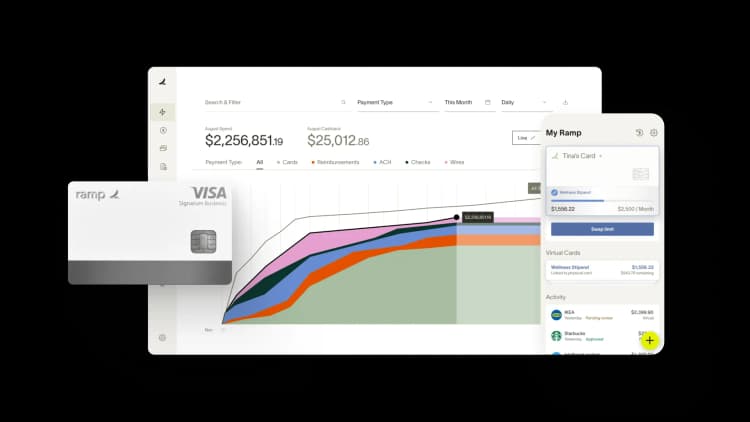

How Ramp eliminates expense reports

For finance teams, few tasks are as tedious and time-consuming as expense reporting. Chasing down receipts, manually entering data into spreadsheets, and trying to categorize a tangle of transactions can eat up hours every month. Fortunately, Ramp's industry-leading expense management software offers powerful features to streamline and automate this process, giving you back valuable time to focus on strategic work.

Ramp's AI-powered receipt matching automatically pairs transactions with their corresponding receipts, eliminating the need for manual reconciliation. Employees snap photos of their receipts with their smartphones and submit them to Ramp via web, mobile app, email, or even text. Ramp's advanced OCR technology extracts the key details and intelligently matches them to the right transactions from your Ramp cards—no more hunting for that missing hotel bill or sorting through a box of crumpled receipts.

Ramp also lets you upload your expense policy directly into the platform and automatically enforces your company's spend rules. Need different expense limits when employees travel internationally? Want to restrict access to certain merchant categories like bars? No problem. Ramp lets you set granular, real-time controls that prevent out-of-policy spend before it happens. And you can create smart rules that automatically request additional documentation for high-risk transactions, saving you from chasing down employees after the fact.

When it's time to post your expenses to the GL, Ramp keeps the automation going. Accounting software integrations enable you to sync expense data directly to QuickBooks, Xero, Sage Intacct, and more with just a few clicks. Customize the mappings to match your chart of accounts and let Ramp handle the rest. With a real-time, continuous sync, your books will always be audit-ready, and you can say goodbye to error-prone manual data entry.

Say goodbye to manual expense reports

Manual expense reports can be time-consuming and demanding to fill out, track, and review. But it doesn’t have to be that way.

Ramp’s expense management solution can instantly increase your team’s productivity. Our modern finance platform features automated expense reporting and approval workflows, spend controls, integrations with popular bookkeeping and accounting software, and a consumer-grade mobile app for capturing receipts on the go.

Unlimited physical and virtual business cards take the burden off your employees to pay out of pocket for business expenses and all but eliminate the need for reimbursements. Automatically enforce your expense policy, categorize expenses, and save an average of 5% a year across all spending with Ramp.

FAQs

The main differences between an invoice and an expense report have to do with their purpose and who’s creating them. An invoice is a request for payment issued by a seller to a buyer for goods or services provided. An expense report, on the other hand, is prepared by an employee to detail and seek reimbursement for expenses incurred on behalf of the company.

Generally, reimbursed expenses are not considered taxable income so long as they are submitted in a proper expense report with relevant documentation (receipts, invoices, etc.).

When building an expense report template, think of all of the relevant information you need to capture to process an expense. This should include:

- Employee name, department, and approving manager

- Dates

- Purpose of expenses

- Cost breakdowns

- Expense categories

- Payment information

- Employee and approver signatures

If you’re not quite sure how to get started, try our expense report template.

Don't miss these

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide.” ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn’t just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn’t exist in Zip. It’s made approvals much faster because decision-makers aren’t chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits

“More vendors are allowing for discounts now, because they’re seeing the quick payment. That started with Ramp—getting everyone paid on time. We’ll get a 1-2% discount for paying early. That doesn’t sound like a lot, but when you’re dealing with hundreds of millions of dollars, it does add up.”

James Hardy

CFO, SAM Construction Group