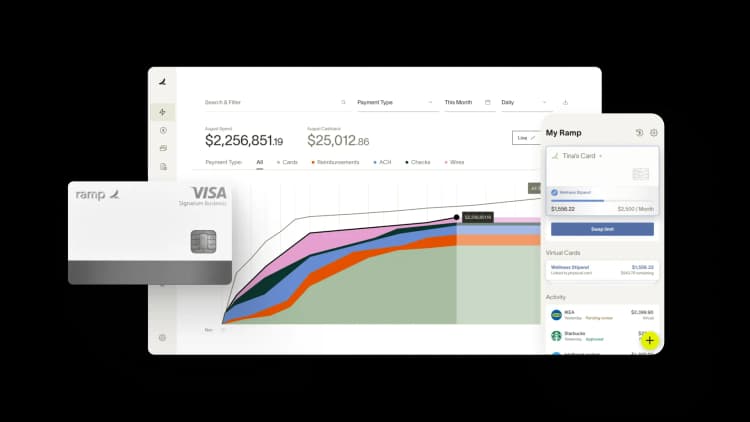

Ramp Rewind: Smarter spend controls, visibility, and efficiency

- Best-in-class spend controls, down to the vendor level

- Visibility into the expenses that matter

- Efficient accounting reconciliation

- Even more savings with Plastiq

Editor’s note: This is the first in a series of quarterly Ramp Rewind posts to get you up to speed on the latest product updates we’ve built.

Time is money—the more time you spend on tedious tasks like fixing expense report errors, the less time you spend actually growing your business. Here’s what we’ve been building recently to help Ramp customers to work smarter and save more time and money.

Best-in-class spend controls, down to the vendor level

To properly manage spend, finance teams need the ability to quickly issue cards with the right controls and specify which vendors employees can spend with. Google for paid ads?Yes. Starbucks for your daily caffeine kick? No.

Ramp is the only corporate card that gives you granular merchant-level controls to block unapproved vendors from charging company cards. Blocking bad merchants on company cards is now as easy as blocking spam callers on your phone!

In addition to daily, monthly, and annual card limits, you can also issue cards with weekly limits now, perfect for those employee lunch benefits.

Our card programs let you roll out cards to your whole company with a single click. Create card templates for common benefits and activities like annual education stipends, home office setup, and team lunches. Got new team members joining? Speed up onboarding by specifying default cards that should be automatically issued to new team members.

Visibility into the expenses that matter

You want to know about the $250k Salesforce spend before the receipt lands on your desk. Ramp admins can now create multi-step approval processes to route card and reimbursement requests based on spend amount and ensure the right folks are in the know.

If you live and breathe by your Slack notifications, use our integration to easily review and approve requests directly in Slack. You can also set it up to ping when important transactions happen. We’ve partnered with Slack to offer 25% off eligible plan upgrades (Ramp users, you can find this discount in the Insights tab).

Admins can also set up fine-grained email alerts for transactions that exceed a certain dollar amount in different categories, merchants, or departments. Specify who should get alerted and create flag rules to automatically mark those transactions as being out of policy.

Ramp’s daily digest emails help admins stay on top of other important changes to company finances, such as:

- Large transactions

- Increases in vendor spend

- Upcoming bills

- New vendors

- New cards issued

Line managers need visibility as well. They now have better insight into how much their team is spending and opportunities to save within the platform.

Efficient accounting reconciliation

The easiest way to annoy your accounting team is to make them spend time correcting expense reports. Thankfully, Ramp admins can reduce errors by filtering the accounts that are visible by team. For instance, marketing teams should only see—you guessed it—marketing categories.

Now admins can go one step further and relabel cryptic-sounding GL accounts in Ramp so employees can quickly find the right ones when submitting their reports. The less guesswork they do, the fewer errors you have to fix.

Use NetSuite? Our Built for NetSuite integration automatically codes transactions, syncs transactions across multiple entities, splits transactions, and more.

If managers and finance teams spot an unauthorized transaction, they can directly flag it on the dashboard to trigger an alert to the employee.

Even more savings with Plastiq

For vendors who don't accept cards, use Plastiq to charge your Ramp card and send out payment via check, ACH, or wire transfer. That way, you can get cashback for big expenses like inventory, office leases, and logistics while preserving your cash reserves. Ramp users pay a discounted 2.5% fee for Plastiq vs the standard 2.85%. Learn more about our Plastiq partnership

Want to see if Ramp can help you with your spend management? Sign up for free. Want to join our mission to help businesses save more money? Check out our open roles

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits