Statement balance vs. current balance: What’s the difference?

- What is the statement balance?

- What is the current balance?

- Statement balance vs current balance

- How these balances impact your business credit score

- Common mistakes to avoid in business credit card management

- The impact of interest charges, fees and grace periods

- Impact of late payments and missed payments

- How to avoid late payments

- Manage your business credit cards with ease

Statement balance is the total amount owed at the end of a billing cycle that appears on your monthly statement, while current balance includes all recent transactions and changes daily. Managing both balances helps maintain a healthy business credit score and optimize cash flow.

What is the statement balance?

Statement Balance

The total amount your business owes by the end of the billing cycle that determines the payment due.

As the total amount your business owes at the end of the billing cycle, the statement balance includes all purchases, fees, and interest charges accrued during that period. It appears on your monthly statement and is typically due by the due date.

This balance does not include any new purchases, cash advances, or balance transfers made after the statement closing date. The statement balance represents the amount that must be paid by the due date to avoid interest and late fees.

What is the current balance?

Current Balance

The real-time total your business owes, including all recent transactions made with your business credit cards, affecting your credit utilization ratio.

The current balance is the real-time total your business owes on its credit card account, including new purchases, balance transfers, cash advances, and any additional interest charges. Unlike the statement balance, the current balance fluctuates daily, reflecting the latest transactions on the account.

While the statement balance is fixed once your statement is issued, the current balance can change at any time, even before the next billing cycle ends.

Statement balance vs current balance

Your statement balance affects your payment due date and interest charges, while your current balance impacts your available credit and credit utilization ratio. Here are the main differences:

Statement Balance | Current Balance | |

|---|---|---|

Definition | Total amount due at the end of the billing cycle | Real-time total, including new purchases and fees |

What it includes | Purchases, interest, and fees up to the statement closing date | All transactions, including balance transfers and cash advances |

Impact on business credit | Affects credit utilization ratio for that billing cycle | Affects credit utilization rate in real time |

Due date | Payment due by the due date | No set due date - changes as your business makes purchases or payments |

How these balances impact your business credit score

A healthy business credit score relies on managing your statement balance and current balance. Your credit utilization ratio, which is the ratio of your credit balance to its credit limit, affects your creditworthiness.

- Credit utilization: A high credit utilization ratio—especially from a high statement balance—can harm your business credit score by showing that your business is over-reliant on credit

- Maintaining balance: Ideally, a credit utilization rate of under 30% will positively impact your business credit score

Common mistakes to avoid in business credit card management

Avoiding these specific errors can save your business thousands in unnecessary charges and protect your creditworthiness:

Paying only the minimum payment

Paying just the minimum payment increases your total cost significantly. For example, a $10,000 balance with 18% APR and a 2% minimum payment would take over 30 years to pay off and cost more than $20,000 in interest. This practice also keeps your credit utilization high, potentially lowering your business credit score by 30-50 points.

Not tracking new purchases

New purchases made after the statement closing date will affect your current balance but not your statement balance. If your credit limit is $50,000 and your statement balance shows $15,000, but you've since charged another $20,000, your credit utilization jumps from 30% to 70%. Credit bureaus may update this information before your next statement, potentially dropping your score by 20-40 points.

Ignoring interest rates and fees

A 1% difference in APR on a $20,000 rotating balance costs your business an additional $200 annually. Late payment fees, typically $35-$50 per occurrence, can add up to hundreds in unnecessary expenses each quarter. Foreign transaction fees of 3% on international purchases can silently inflate your expenses by thousands annually for businesses with global operations.

Not reviewing your billing cycle

Most business credit cards have a 21-25 day grace period between the statement closing date and payment due date. Missing this window can trigger immediate interest charges on your entire balance. Setting your payment date just one day after your due date could result in a 30-day late payment on your credit report, potentially lowering your score by 50-100 points.

Always aim to pay off your full statement balance, track your new purchases, and stay aware of your billing cycle and interest rates. Keeping on top of these details will help you avoid costly fees and maintain a healthy business credit score.

The impact of interest charges, fees and grace periods

Understanding these financial details can save your business thousands in unnecessary expenses and protect your credit standing:

Feature | Description |

|---|---|

Interest charges | If you carry a balance from your statement balance, your business will incur credit card interest on the remaining amount |

Late fees | Late payments can lead to significant late fees, which are added to your current balance. |

Grace period | If you pay the statement balance in full before the due date, you can avoid interest charges during the grace period, which is especially useful for cash flow management. |

Impact of late payments and missed payments

Just one 30-day late payment can drop your business credit score by 50-100 points and remain on your credit report for up to seven years, making future financing more expensive or difficult to obtain.

Here's how late payments and missed payments can affect your business:

1. Negative effect on business credit score

Payment history accounts for approximately 35% of your business credit score, making it the single most influential factor. Even one payment that's 30 days late can lower your score by 50-100 points, and multiple late payments can drop your score by 150-200 points, potentially moving you from "prime" to "subprime" lending status.

Credit bureaus such as Experian and Equifax report missed or late payments within 30 days, and these records can stay on your credit report for up to seven years, affecting your ability to secure favorable financing terms.

2. Late fees and increased interest rates

Late fees typically start at $25-$40 per occurrence but can increase to $50 or more after repeated late payments. For businesses with multiple cards, these fees can add up to hundreds of dollars quarterly.

Most business credit cards impose penalty APRs of 24-29.99% after late payments, potentially doubling your interest costs. On a $20,000 balance, this rate increase could cost your business an additional $2,000-$3,000 annually in interest charges alone.

3. Impact on credit limit and available credit

After a late payment, card issuers commonly reduce credit limits by 30-50%. If your $50,000 limit gets reduced to $25,000 when you have a $20,000 balance, your credit utilization immediately jumps from 40% to 80%, further damaging your credit score.

Some issuers also shorten grace periods from the standard 21-25 days to as few as 7-14 days after late payments, giving you less time to make future payments and increasing the risk of additional late fees.

4. Increased difficulty in securing financing

Lenders typically require a clean payment history for the past 12-24 months to qualify for the best rates. One late payment within this period can increase your interest rate by 2-5 percentage points. On a $100,000 loan, this equates to $2,000-$5,000 in additional annual interest costs.

5. Compromised vendor relationships

Vendors who extend net-30 or net-60 payment terms often run business credit checks. Late payments on your credit report can lead to shorter payment terms (net-15 or COD), higher deposits (25-50% upfront), or surcharges (1-3% on purchases), all of which strain cash flow and increase operational costs.

6. Ripple effect on business operations

A reduced credit score may require you to increase security deposits for utilities, telecommunications, and leases by 50-200%. Insurance premiums can rise by 10-20%, and you may face stricter contract terms with key suppliers and business partners, limiting your operational flexibility.

How to avoid late payments

To stay on track with payments and avoid late fees you should:

- Set up automatic payments to automate payments for the minimum payment or full statement balance to avoid missing due dates.

- Monitor due dates to keep track of the billing cycle and due dates to ensure payments are made on time.

- Build an emergency fund to have a cash buffer that helps cover unexpected expenses and avoid late payments when cash flow is tight.

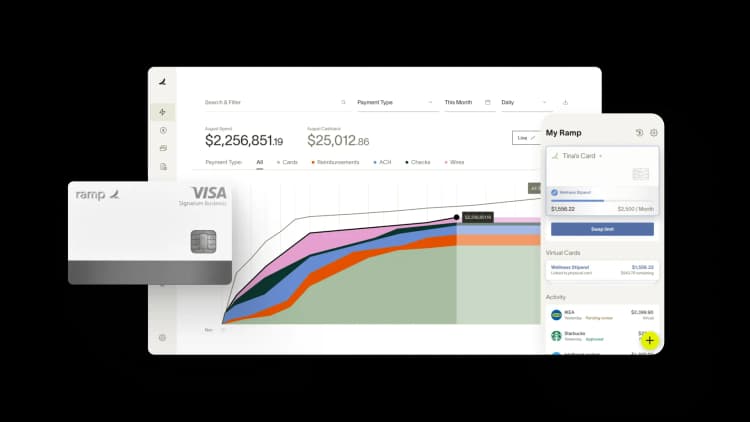

Manage your business credit cards with ease

When you properly manage your statement and current balances, you gain better control over your business finances. This helps you avoid unnecessary interest charges, maintain a strong credit score, and better allocate your capital.

Smart credit management gives you more financial flexibility, allowing you to negotiate better terms with vendors and qualify for advantageous financing when your business needs it. With the right tools and practices, you can transform your credit cards from potential liabilities into strategic assets that support your business growth.

FAQs

Paying your full statement balance is always a good idea. You may choose to pay your current balance to bring down your credit utilization. Always pay your statement balance minimum to avoid delinquent accounts.

This can happen if your business has made new purchases or cash advances after the statement closing date. These will be reflected in your current balance but not the statement balance.

Pay your credit card account’s statement balance in full and on time to:

- Avoid accruing interest charges and late fees on your credit card bill

- Maintain a healthy credit report

- Show lenders that you are worthy of credit (& extensions)

Paying the minimum payment only reduces your statement balance slightly and leaves you with a higher current balance. This results in additional interest charges and a higher credit utilization ratio, negatively affecting your business credit score.

To improve your business credit score, aim to pay off the full statement balance each month, keep your credit utilization rate below 30%, and avoid carrying a balance into the next billing cycle.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits