Statement balance vs. current balance: What’s the difference?

- What is a current balance on a credit card?

- Statement balance vs. current balance at a glance

- Should you pay statement balance or current balance?

- Does paying the statement balance avoid interest?

- How your credit card balance affects your credit score

- Where to find your statement and current balance

- Tips for managing your credit card balance

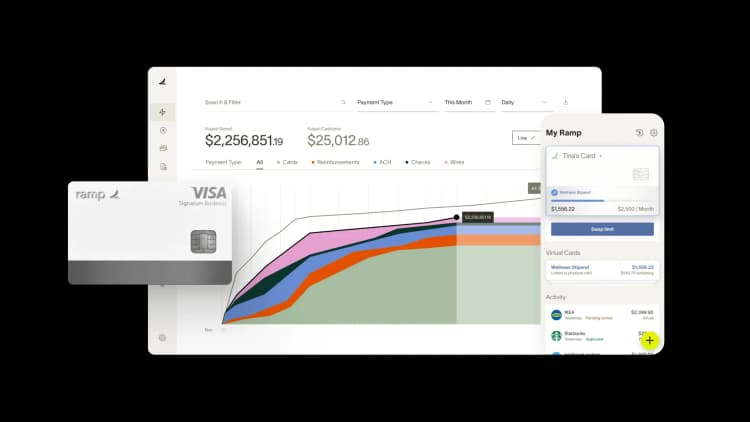

- Simplify corporate card management with Ramp

Your statement balance is what you owed at the end of your last billing cycle, while your current balance is what you owe right now. The difference matters because it determines whether you’ll pay interest, how much credit utilization gets reported, and how well you manage your business credit.

Understanding statement balance vs. current balance helps you decide what to pay, when to pay it, and how to avoid unnecessary interest charges.

Your statement balance is the total amount you owed when your last billing cycle closed. It includes all posted purchases, fees, and any interest charged during that cycle.

Your card issuer uses this number to calculate your minimum payment due, and it’s typically the amount reported to credit bureaus. Once your statement generates, this balance doesn’t change, even if you make payments or new purchases afterward.

Statement balance example

Say your billing cycle closes on January 31. During that cycle, you charged $500 in purchases. Your statement balance is $500, regardless of what you spend on February 1 or later.

Even if you make a payment on February 2, your statement balance remains $500 until your next statement closes. Your current balance, however, would reflect that payment immediately.

What is a current balance on a credit card?

Your current balance is the total amount you owe right now. It includes all posted purchases, payments, credits, and, in many cases, pending transactions made since your last statement closed.

Unlike your statement balance, which is fixed once your billing cycle ends, your current balance updates continuously as new activity hits your account. It reflects the real-time status of what you owe.

Current balance example

Continuing the example above: Your statement closes on January 31 with a $500 balance. On February 5, you spend $100 on gas. Your statement balance is still $500, but your current balance increases to $600.

If you then make a $200 payment on February 10, your current balance drops to $400. Your statement balance, however, remains $500 until your next billing cycle closes.

Statement balance vs. current balance at a glance

Here’s a quick comparison of how statement balance vs. current balance differ:

| Aspect | Statement balance | Current balance |

|---|---|---|

| What it shows | Amount owed at the end of the last billing cycle | Total amount owed right now |

| Updates | Once per billing cycle, on the statement closing date | Continuously as transactions post |

| Includes | Purchases, fees, and interest through close date | All posted activity since last statement, plus new charges |

| Used for | Avoiding interest and calculating minimum payment | Monitoring spending and available credit |

Should you pay statement balance or current balance?

In most cases, you should pay your full statement balance by the due date. That’s the simplest way to avoid interest charges and keep your account in good standing.

Paying the current balance isn’t required, but it can help you lower your credit utilization ratio and reduce overall debt faster.

Here’s how to decide:

- To avoid interest: Pay the full statement balance by the due date

- To lower utilization: Pay the higher current balance before your statement closes

- To stay current: Pay at least the minimum payment, knowing interest will accrue on the remaining balance

What if you can't pay the full statement balance?

If cash flow is tight, pay as much as you can above the minimum. You’ll be charged interest on whatever remains, but a larger payment reduces the balance that accrues interest and keeps your utilization lower.

Paying only the minimum is expensive over time. For example, a $10,000 balance at 18% annual percentage rate (APR) could take decades to repay if you only make minimum payments and you could end up paying thousands in interest.

Whenever possible, aim to pay the full statement balance. If that’s not realistic, focus on reducing the principal as quickly as your cash flow allows.

Does paying the statement balance avoid interest?

Yes. If you pay your full statement balance by the due date, you typically won’t be charged interest.

This works because of your card’s grace period, or the window between your statement closing date and your payment due date, usually 21–25 days. As long as you pay the full statement balance within that window, new purchases won’t accrue interest.

If you carry any portion of your statement balance past the due date, you’ll lose your grace period. Interest will apply to the remaining balance and may begin accruing on new purchases immediately until you return to paying in full.

How your credit card balance affects your credit score

Your credit utilization ratio, the percentage of your total available credit you’re using, is a major factor in your credit score. In most cases, card issuers report your statement balance to credit bureaus once per month.

Here’s what that means for you:

- What gets reported: Usually your statement balance, not your current balance

- Why it matters: High utilization signals greater credit risk and can lower your score. Many experts recommend keeping utilization under 30%.

- Strategic timing: Paying down your balance before your statement closes reduces the amount that gets reported

For example, if your credit limit is $50,000 and your statement balance is $15,000, your utilization is 30%. If you charge another $20,000 before your next statement closes and don’t make a payment, your reported balance could rise to $35,000—pushing utilization to 70%.

That spike can temporarily lower your credit score, even if you plan to pay the balance off later. Timing your payments around your statement closing date helps you manage what gets reported.

Where to find your statement and current balance

You can find both balances in your online account, but they appear in different places.

Your current balance is usually displayed at the top of your dashboard when you log in to your issuer’s website or mobile app. It updates throughout the day as transactions post.

Your statement balance appears on your most recent monthly statement and on the payment screen when you go to schedule a payment. It’s also listed alongside your minimum payment due and payment due date.

If you receive paper statements, look at the first page for your statement balance. For the most accurate current balance, check your online account or mobile app.

Tips for managing your credit card balance

Managing statement balance vs. current balance comes down to visibility and timing. A few consistent habits can help you avoid interest, control utilization, and prevent surprises.

1. Set up automatic payments

Autopay for at least the full statement balance is the easiest way to avoid missed payments and interest charges. If your cash flow fluctuates, set autopay for the minimum as a safety net, then make additional payments manually when you can.

2. Pay more than once per billing cycle

Making multiple payments during the month keeps your current balance lower. That reduces your credit utilization and prevents your statement balance from climbing too high before it’s reported.

3. Track spending in real time

Don’t wait for your monthly statement to see where you stand. Review your current balance regularly so you can catch unexpected charges early and adjust spending before the billing cycle closes.

4. Use expense management software for corporate cards

If you manage multiple business credit cards across a team, you need visibility into both statement and current balances for every cardholder. Tools like Ramp provide real-time spend tracking and automated receipt matching, so you’re not reconciling balances at the end of the month.

Simplify corporate card management with Ramp

Managing statement balance vs. current balance across a growing team requires real-time visibility and control. Without it, you’re reconciling after the fact instead of managing proactively.

Ramp gives you instant insight into company-wide spending, automated receipt matching, and built-in controls that help prevent overspending before it happens. You can monitor balances across every cardholder in one place, track utilization, and eliminate manual expense reports.

Instead of waiting for statements to understand what your team spent, you see transactions as they happen. That means fewer surprises, fewer errors, and better cash flow planning.

See if you're eligible for Ramp’s modern corporate business credit card.

FAQs

Your statement balance reflects what you owed when your billing cycle closed. It doesn’t change after the statement generates, even if you’ve made payments since then.

Check your current balance to see your real-time amount owed after recent payments or purchases.

This usually means you made a payment or received a refund after your last statement closed. Your current balance reflects that activity immediately, while your statement balance won’t update until the next billing cycle ends.

A remaining statement balance is what’s left after you make a partial payment. If your statement balance was $500 and you paid $300, your remaining statement balance is $200.

If that $200 isn’t paid by the due date, interest will accrue on it.

No. Paying more than required doesn’t hurt your credit score. In fact, paying your full current balance can lower your credit utilization, which may help your score.

Most issuers report your statement balance to credit bureaus once per month, typically on or shortly after your statement closing date—not your payment due date.

That’s why making a payment before your statement closes can reduce the balance that gets reported and improve your utilization ratio.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°