Credit card interest: What is is and how it works

- What is credit card interest?

- Understanding credit card APR

- How does credit card interest work?

- Credit card interest rates: What to expect

- How to calculate credit card interest

- How to avoid credit card interest

- Ramp: An interest-free corporate card alternative

You check your business credit card statement and notice an extra $247 in charges you didn’t recognize—except you did. That amount is interest, quietly adding up from last month’s unpaid balance. Credit card interest is the cost of carrying a balance past your payment due date, and it’s calculated as a percentage of what you owe.

Understanding how interest works helps you avoid unnecessary charges and make clearer decisions about when to use credit. Business credit cards can be valuable tools, but unmanaged interest can eat into margins and tighten cash flow.

What is credit card interest?

Credit card interest is what you pay your credit card company when you don’t pay your bill in full each month. It’s the cost of borrowing money when you carry a balance past your payment due date, similar to paying rent on the portion of your statement you haven’t paid off.

Interest only applies when you carry a balance beyond your grace period, which usually lasts 21–25 days after your billing cycle ends. Pay your full statement balance by the due date and you avoid interest. Miss it, even by a day, and interest starts accumulating on the remaining balance.

Interest is different from other charges such as annual fees, late fees, or foreign transaction fees. Those are fixed or percentage-based charges tied to specific actions. Interest compounds daily, meaning you’re charged on both your balance and any previously accrued interest, which can cause costs to rise faster than expected.

Understanding credit card APR

APR, or annual percentage rate, is the yearly cost of borrowing expressed as a percentage. Your card issuer uses this rate to determine how much interest you’ll pay when you carry a balance.

While APR and interest rate are often used interchangeably, credit card APR usually reflects the same figure as the card’s interest rate because most cards don’t bundle additional fees into the APR calculation the way loans sometimes do.

The average credit card balance among U.S. cardholders was $6,730 as of Q3 2024, up from $6,501 a year earlier, according to Experian. With typical APRs between 20%–25%, carrying that balance and making only minimum payments can lead to more than $1,300 in annual interest charges.

At what point do credit cards charge interest?

Credit cards charge interest when you carry a balance past the payment due date, which follows the grace period. Paying your full statement balance by the due date generally prevents interest charges.

Types of credit card APR

Business credit cards come with several APR types depending on how you use the card:

- Purchase APR: Applies to everyday expenses charged to the card

- Balance transfer APR: Applies when you move debt from another card, often with a temporary promotional rate

- Cash advance APR: Applies when withdrawing cash using your card and typically has no grace period

- Penalty APR: A higher rate triggered by late or missed payments

Each APR type affects your interest costs differently.

Fixed vs. variable APR

A fixed APR stays the same unless your issuer notifies you of a change, making costs easier to predict. A variable APR changes based on a benchmark rate, usually the prime rate, so it can move up or down as market rates shift.

Most business credit cards use variable APRs because they allow issuers to adjust rates quickly when economic conditions change.

How can I avoid paying interest on my credit card?

You can avoid interest by paying your full statement balance by the due date each month, allowing you to benefit from the grace period.

How does credit card interest work?

The grace period is the window when new purchases don’t accrue interest, typically lasting 21–25 days after your billing cycle closes. If you pay your full statement balance by the due date, you avoid interest entirely.

Interest starts accruing the day after the grace period ends when you carry a balance. Once you miss the deadline, your issuer begins calculating interest on the remaining amount. Cash advances and many balance transfers don’t include a grace period at all, so interest can start accruing on the transaction date.

Is credit card interest paid monthly or yearly?

Credit card interest is based on an annual percentage rate (APR) but accrues daily. You can make payments at any time to reduce your balance and the interest that builds on it.

Daily vs. monthly interest calculation

Credit card issuers calculate interest daily for accuracy. They divide your APR by 365 to find the daily periodic rate. For example, an 18% APR has a daily rate of about 0.049%, which is applied to your balance each day.

Your average daily balance determines how much interest you owe. The issuer adds up your balance at the end of each day in the billing cycle and divides by the number of days. This average is then multiplied by your daily periodic rate and the number of days in the cycle to calculate the interest charge.

Compound interest on credit cards

Credit card interest compounds daily, meaning each day’s interest is added to your balance before calculating the next day’s charge. You end up paying interest not only on what you borrowed but also on the interest already accrued.

This compounding effect makes credit card debt more expensive over time. For example, a $5,000 balance at 18% APR can lead to about $900 in interest over a year if you make only minimum payments.

Is a 26.99% APR high?

Yes, 26.99% APR is considered a high interest rate compared to typical credit card APRs.

Credit card interest rates: What to expect

As of August 2025, the Federal Reserve reported that the average credit card interest rate on accounts carrying a balance was 22.83%. Rates have climbed in recent years as the Fed raised benchmark interest rates to manage inflation.

Several factors influence the APR your issuer offers:

- Credit score: Higher credit scores typically qualify for lower interest rates, with excellent credit (740+) earning the most competitive terms

- Card type: Rewards cards often have higher APRs than basic cards, while secured cards may carry elevated rates because they serve borrowers with limited credit histories

- Economic conditions: Federal Reserve policy and the prime rate can cause credit card APRs to rise or fall as broader economic conditions shift

Your specific rate depends on how these factors align when you apply for a card.

Good vs. bad interest rates

A good APR for business credit cards is generally below 18%, with top-tier credit sometimes securing rates in the 14% to 16% range. Promotional 0% introductory APR periods offer the lowest short-term financing option if you can pay off the balance before the promotional window ends.

Compare your current rate with market averages and similar card offerings to understand how competitive it is. Issuers may also adjust rates for existing customers, so reviewing your card’s terms periodically is a good habit.

Is 11% a good credit card interest rate?

Compared to current averages, 11% is considered a very competitive interest rate for a credit card. Many cards have APRs in the mid-teens or higher.

How to calculate credit card interest

Calculating your credit card interest helps you predict costs before they appear on your statement and decide how much to pay toward your balance.

The credit card interest formula

The formula multiplies your average daily balance by your daily periodic rate and the number of days in your billing cycle:

Interest charge = Average daily balance * Daily periodic rate * Days in billing cycle

To find the daily periodic rate, divide your APR by 365. For example, an 18% APR becomes 0.000493 per day (18% / 365 = 0.000493). This small percentage adds up when it’s applied to your balance every day in the cycle.

Your average daily balance is calculated by adding each day’s ending balance in the billing cycle and dividing by the number of days. If your balance changes during the month because of purchases or payments, the calculation reflects those fluctuations.

Real-world calculation example

Let’s calculate interest on a $1,000 balance at 18% APR over a 30-day billing cycle. First, find the daily rate: 18% / 365 = 0.000493. Then multiply: $1,000 * 0.000493 * 30 days = $14.79 in interest for the month.

Here’s how monthly interest scales with different balances at 18% APR:

- $500 balance: $7.40 per month

- $2,500 balance: $36.98 per month

- $5,000 balance: $73.95 per month

- $10,000 balance: $147.90 per month

These examples assume no new purchases or payments during the billing cycle. Payments lower your balance, while new purchases increase it, changing your average daily balance.

Using online calculators

Interest calculators can run these calculations for you. Enter your balance, APR, minimum payment, and any additional payment amounts to estimate your interest costs and payoff timeline. Some calculators allow you to model changing payment amounts or recurring charges.

Do I get charged interest if I pay the minimum?

Yes. The minimum payment covers accrued interest and a small part of the principal. Any remaining balance continues to accrue interest until it’s paid off.

How to avoid credit card interest

You can avoid credit card interest by paying your full statement balance by the due date each month. Staying within the grace period ensures new purchases don’t accrue interest.

Relying on only the minimum payment can trap you in a cycle of rising interest charges. The minimum often covers just the interest and a small portion of the principal, leaving the remaining balance to keep accumulating interest.

Strategic payment timing

Paying your balance before the statement closing date can lower the balance that gets reported to credit bureaus. It can also reduce your average daily balance if you carry any amount into the next cycle, which helps limit interest charges.

Making multiple payments throughout the month has a similar effect. If you charge $3,000 but pay $1,500 midway through the cycle, your average daily balance drops compared to waiting until the due date to pay the entire amount.

Balance transfer cards

Balance transfer cards offer 0% introductory APR periods that typically last 12–21 months. Moving high-interest debt to one of these cards lets every payment go directly toward your principal during the promotional window.

Balance transfers can make sense when the transfer fee, usually between 3% and 5%, costs less than the interest you’d otherwise pay. Just be sure you can pay off the transferred balance before the promotional rate expires.

Other interest-saving strategies

These additional tactics can help reduce interest charges:

- Negotiate lower rates: Issuers may grant a lower APR if you have a strong payment history or competing offers

- Choose the right card for your habits: Cards with lower APRs are better if you occasionally carry a balance; rewards cards can make sense if you rarely do

- Set up automatic payments: Scheduling at least the minimum payment avoids late fees and penalty APRs

- Make more than the minimum payment: Paying more reduces your principal faster and lowers the interest you accrue over time

Combining multiple strategies can help you minimize or eliminate interest costs altogether.

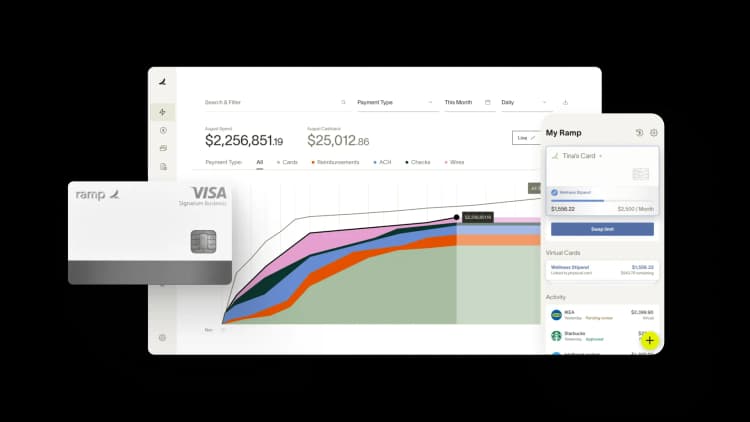

Ramp: An interest-free corporate card alternative

Whether it's simplifying expense management for your employees or discovering savings, Ramp can help you automate and monitor spending.

- Unlimited virtual and physical cards: Ramp's virtual cards offer all the benefits of a credit card without the interest. Our unlimited virtual credit cards for business are accepted by merchants everywhere.

- Easy expense controls: Card spending can get out of hand if you neglect it. Ramp helps you take control of expenses by allowing you to set digital policies so you can establish a healthy financial culture in your company.

- Seamless accounting: Ramp's automated accounting integrations pull data related to cards, bills, audit trails, and accounting, giving you a quick picture of financial performance. You can import financial data to popular accounting platforms for small businesses such as Xero, Sage Intacct, Netsuite, and Quickbooks with a few clicks.

- Easy savings: Ramp simplifies expense management and unearths savings thanks to pricing intelligence and expense reports. Ramp also alerts you to unused partner spending rewards, helping you squeeze more out of your subscriptions.

Try a demo to learn how Ramp streamlines expense management and saves you money.

FAQs

The amount of interest is charged daily on a credit card. Your credit card issuer will divide the APR by 365 to calculate the daily interest rate. Multiply this rate by your outstanding balance to calculate the daily interest amount. The money you owe will increase by this amount daily.

Credit card interest is expressed as an annual percentage called APR. However, it accrues daily. You can pay your outstanding balance at any time.

You can avoid paying interest on your credit card if you settle your outstanding balance before the payment due date.

No, Ramp's business cards do not charge interest.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits