The top 4 controls that modern finance teams are using to control spend

- How mid-market modern teams are controlling spend in real time

- Top controls used by mid-market Ramp customers

- See how Ramp can help you proactively control spend

Employee overspending and fraudulent practices are costing businesses valuable time and money. Expense reimbursement fraud makes up 11% of all fraud cases, with a median loss of $40k. 29% of all fraud cases are due to a lack of internal controls.

A focus on modernizing tech stacks via finance automation to gain greater operational efficiency and control over employee spend can not only prevent fraud, but help teams drive growth and achieve greater profitability. In fact, our data study shows that businesses have seen a positive ROI from distributing corporate credit cards with spend controls to employees versus relying on traditional corporate cards (56% vs 40%). They are 10% less likely to say they find it difficult to manage and enforce employee expense policy compliance.

We took a deep-dive into the top controls used by our mid-market customers over the past year, defined as 100-1000 FTE, to see exactly how growing companies are utilizing technology to encourage better spend controls, decrease busy work, and meet their potential.

How mid-market modern teams are controlling spend in real time

Mid-market finance teams are harnessing the power of advanced card controls to support more spend oversight. Examples of these controls include customizable approval trails, point of sale restrictions, and employee auto-notifications for out-of-policy spend.

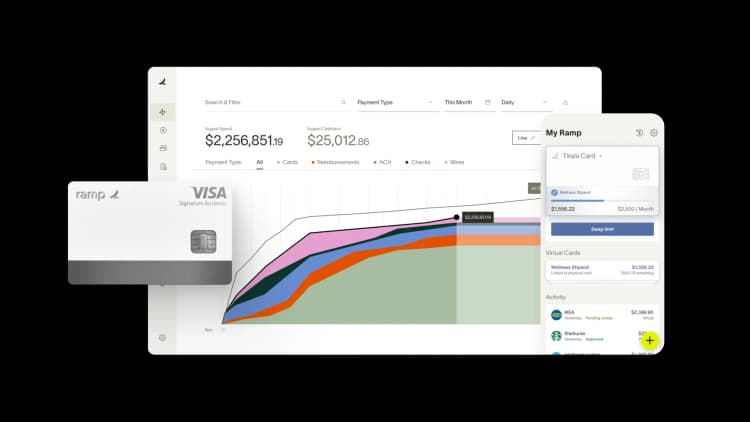

At Ramp, our customers are relying on the following capabilities to reduce wasted spend:

1. Spend controls

When issuing a Ramp virtual or physical card, admins can select both a limit amount and frequency, e.g., non-recurring limits for one-time spend such as a home office stipend, or recurring (daily, monthly or yearly) limits for items like SaaS spend. They can also decide which spend categories are allowed or blocked across 40+ categories.

The total declined amount due to spend controls over the past year came out to over $770M.

And with blocked transactions, admins can set a maximum amount per transaction; charges over that amount will be declined.

2. Alerts

Admins can establish spend guidelines to determine what’s allowed to be purchased with a card. Alerts can be sent to specific employees to increase visibility, e.g., an alert sent whenever a home office purchase exceeds $500. Flags can also be sent for out-of-policy transactions, e.g., an email sent to both the cardholder and their manager when the cardholder

On average per business, Ramp auto-flagged or alerted 178 transactions over the past year.

3. Auto-lock

With auto-lock, finance teams can automatically lock cards if employees don’t submit the required receipt or materials after a set period of time. Admins can select a future date when a card will stop accepting transactions, which can be helpful in use cases like monthly software trials or week-long business trips.

Ramp locked an average of 21 cards per business. Cards locked due to missing items over the past year came out to 57. Overall, approximately 15% of cards were locked at least once during the year.

4. Employee repayments

Ramp repayments facilitate employee payback of out-of-policy transactions on their corporate card. Admins/managers can easily request repayment and employees can securely add their bank account information to make payment.

This amounted to a total of $1,579,394 in reimbursements overall.

Top controls used by mid-market Ramp customers

While all businesses on Ramp have memo and receipt requirements, 85% also enforce spend limit amounts to cap individual employee spend.

Over a third of mid-market businesses (36%) auto-lock cards due to missing items and 31% have vendor restrictions. Almost a quarter of these finance teams (24%) rely on transaction amount limits to put a ceiling on purchases, 23% use transaction flags, and 22% use card auto-lock dates. Lastly, 20% of mid-market finance teams control travel spend via flight budgets.

How Ramp helped Barry's increase spend compliance

Barry’s legacy finance and accounting systems were impeding the finance team’s ability to focus on strategic initiatives. Their finance team decided to onboard Ramp to automate its expense management.

Ramp cards allowed managers to set their own card rules, create vendor-specific virtual cards, and automatically enforce spend limits. Barry’s saved employees 400 hours spent on expense reports per month. Ramp and Barry’s together enabled employees to engage in more meaningful work, freed up more bandwidth on the accounting team, and increased spend compliance.

See how Ramp can help you proactively control spend

With advanced card functionality, successful mid-market finance teams can proactively rein in out-of-policy spend, save valuable time, and achieve greater operational efficiency. Sign up for Ramp today to see how advanced controls can help your business.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°