Workflow automation platforms: What they are and how they work

- What is a workflow automation platform?

- Where did workflow automation platforms come from?

- How do workflow automation platforms work?

- Do workflow automation platforms matter?

- TL;DR

- The growing convergence of workflow automation and AI-driven decisioning

- AI agent for finance automation

What is a workflow automation platform?

Workflow automation platforms are designed to turn repetitive, manual tasks into automated sequences that run with minimal human input. By connecting different business tools and managing routine processes, they help teams work more efficiently and reduce the time spent on administrative overhead.

These platforms can handle a wide range of tasks, from simple approvals to multi-step, cross-department workflows that would otherwise consume significant time and attention.

Most workflow automation platforms allow you to define rules that automatically:

- Route information to the right person or system

- Update records in connected applications

- Send notifications when actions are required

- Trigger follow-up steps across your business tools

The shift toward automation has accelerated in recent years, especially with the growth of remote work, which demands consistent processes that do not rely on physical presence. Importantly, most modern platforms offer intuitive, drag-and-drop interfaces, enabling non-technical users to build workflows without writing code.

Where did workflow automation platforms come from?

Modern workflow automation platforms have their roots in business process management (BPM) systems from the 1990s. Those early tools helped document workflows but offered limited automation, often requiring heavy IT involvement for setup and maintenance.

Enterprise vendors developed comprehensive workflow tools during this time, but high costs and complex implementations meant they were out of reach for many organizations.

The arrival of cloud computing in the 2000s changed the landscape. New services brought affordable, user-friendly automation to small businesses and large enterprises alike.

Key improvements introduced by these newer platforms include:

- Enabling business users to create and update workflows without IT involvement

- Offering native connections to hundreds of popular apps and services

- Incorporating AI-driven suggestions to identify inefficiencies and propose optimizations based on real usage patterns

How do workflow automation platforms work?

Most platforms follow a trigger-and-action model: when a specific event occurs, the system automatically carries out one or more actions. This structure makes it easy to map real-world processes into automated sequences.

Workflows are typically built in a visual editor, where you can connect steps by dragging and dropping components. The platform handles the integrations between your apps and the movement of data from one step to the next.

Common features you’ll find in these platforms include:

- Form builders for structured data collection

- Approval workflows for sign-offs

- Conditional logic for branching processes

- Scheduling for timed or recurring actions

- Reporting dashboards to track performance and bottlenecks

To help teams get started quickly, most platforms offer templates for frequently used processes. More advanced options analyze your workflows over time and highlight areas for improvement.

For example, a marketing team could automate its content production workflow:

- A writer submits a draft via a form

- The system assigns the draft to an editor based on content type

- Notifications go to stakeholders when action is required

- The current status is visible to all involved without separate check-ins

- After approval, the system schedules publication and updates the content calendar

This replaces a process that previously relied on manual file transfers, constant follow-ups, and status meetings, freeing team members to focus on creative and strategic work.

Do workflow automation platforms matter?

Automation reduces the time spent on repetitive tasks, allowing employees to focus on high-value work. This not only improves productivity but also helps organizations handle greater workloads without proportional increases in headcount—an important advantage when resources are limited.

Real-time data flow between systems supports faster decision-making, while standardized processes improve collaboration and reduce miscommunication across departments. By removing low-value tasks, automation helps teams continuously improve their day-to-day processes.

TL;DR

Workflow automation platforms connect your tools, handle repetitive processes, and reduce the chance of errors—freeing up time for work that requires human expertise. For teams aiming to achieve more without adding headcount, these platforms provide a structured way to boost productivity and strengthen collaboration.

The growing convergence of workflow automation and AI-driven decisioning

Modern workflow automation platforms are no longer limited to rigid, rule-based task sequences; they’re increasingly enhanced with AI that can make context-aware decisions. This blend of automation and intelligence means processes don’t just move faster—they adapt in real time to changing conditions.

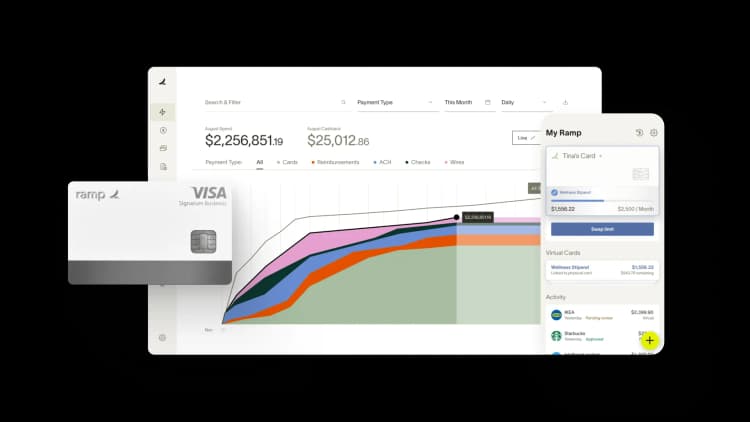

At Ramp, we apply this same philosophy in financial workflows: automation that eliminates manual effort while integrating AI-driven insights. Rather than only focusing on speed, it’s about building processes that continually learn and improve with each transaction.

AI agent for finance automation

Ramp recently introduced its first AI agent to handle the routine, repetitive tasks that consume finance teams’ time each month. Take a $5 latte: uploading the receipt, reviewing the charge, and coding the expense in NetSuite can add up to 14 minutes and more than $20 in labor for a single transaction. Multiply that by thousands of expenses and the cost is significant.

By automating these small but frequent tasks, the AI agent frees teams to focus on higher-value work and decision-making.

Explore how Ramp’s AI agents fits into your finance processes and where it could remove the most friction. Learn more about Ramp Agents.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits