What is cash flow from operating activities (CFO)? Definition, formula, and examples

- What is cash flow from operating activities (CFO)?

- Why operating cash flow matters

- Direct vs. indirect methods to calculate cash flow

- Step-by-step operating cash flow calculation

- What cash flow from operating activities includes and excludes

- Examples of operating activities by industry

- Operating cash flow formula cheat sheet

- Limitations and red flags in analyzing operating cash flow

- How to improve operating cash flow with automation

- Strengthen operating cash flow with Ramp

Cash flow from operating activities (CFO) reveals the actual cash your business generates from its core operations, not just what shows up on your income statement. While net income tells you about profitability on paper, operating cash flow reveals whether you have enough cash to pay bills, invest in growth, and keep the lights on.

Understanding CFO helps you spot cash problems before they become issues and make better decisions about how to manage your working capital. This guide walks you through calculating operating cash flow, interpreting the results, and improving your cash position through better operational management.

What is cash flow from operating activities (CFO)?

Cash flow from operating activities is the cash your company generates from day-to-day business operations, such as selling products or services and paying suppliers, employees, and other operating expenses. Also called operating cash flow (OCF), it's the first section of the cash flow statement and arguably the most important because it shows whether your core business activities generate enough cash to sustain operations.

Unlike net income, which follows accrual accounting rules, operating cash flow tracks actual cash inflows and outflows. For example, you might show a profit on your income statement while struggling to pay bills if customers aren't paying invoices quickly enough. That's where CFO becomes essential for understanding your true financial position.

Why operating cash flow matters

Operating cash flow shows the actual cash moving through your business, while net income includes non-cash items like depreciation and changes in accounts receivable (AR) that don't immediately affect your bank balance. A company can report strong profits while having negative cash flow if it's not collecting receivables or if it's building up inventory.

Positive operating cash flow indicates your business generates enough cash from operations to cover expenses and fund growth without relying on external financing. Negative operating cash flow signals potential problems: You're burning through cash faster than you're bringing it in, which isn't sustainable over the long term, even if you're showing accounting profits.

Direct vs. indirect methods to calculate cash flow

You can calculate operating cash flow using two approaches: the direct method and the indirect method. Both arrive at the same number but take different paths to get there.

| Aspect | Direct cash flow | Indirect cash flow |

|---|---|---|

| Method | Lists all sources of cash receipts and payments in detail | Starts with net income and notes changes in working capital accounts to arrive at cash flow from operating activities |

| Reconciliation of net income | Not part of the reconciliation of net cash flow from operating activities | The starting point for cash generated from operating activities is net income |

| Accounting standard acceptance | Accepted under both U.S. GAAP and IFRS | Accepted under both U.S. GAAP and IFRS |

| Prevalence | Not widely used by most companies | The most commonly used cash flow presentation method |

Direct method

The direct method lists actual cash receipts from customers and subtracts cash payments for operating expenses like salaries, rent, and supplier payments. While this approach provides clearer visibility into specific cash flows, it's less common because tracking every cash transaction requires more detailed recordkeeping than most accounting systems provide by default.

Indirect method

The indirect method starts with net income from your income statement and adjusts for non-cash items and working capital changes. Since most companies already track net income and balance sheet changes, this method requires less additional work and is used by the vast majority of public and private companies.

Step-by-step operating cash flow calculation

The formula for calculating cash flow from operating activities using the indirect method is:

Operating cash flow = Net income + Non-cash expenses – Working capital changes

You’ll pull each of the figures from your income statement, so it’s essential that you’re working with accurate, up-to-date financial data.

1. Start with net income

Your starting point is net income from the income statement. This is the bottom line that shows your company's profit after all revenues and expenses.

Net income includes both cash and non-cash transactions, so you'll need to adjust it to reflect actual cash movement. Think of this as your baseline that you'll modify to get to the real cash number.

2. Add non-cash expenses

Non-cash expenses don't involve actual cash payments but reduce earnings on your income statement. The most common non-cash expenses are depreciation and amortization, accounting entries that spread the cost of assets over their useful life.

Since depreciation was deducted when calculating net income but didn't require a cash payment, you add it back to net income. Other non-cash expenses to add back include stock-based compensation, asset impairments, and losses on asset sales.

3. Adjust for working capital changes

Working capital equals current assets minus current liabilities. Changes in these accounts directly affect your cash position: Increases in AR or inventory consume cash, while increases in accounts payable (AP) or accrued expenses add cash.

Here's how each component affects your calculation:

- Accounts receivable increase: When accounts receivable increases, sales revenue on a cash basis decreases because customers purchased goods or services but haven't paid for them yet

- Inventory increase: When inventory increases, cost of goods sold (COGS) on a cash basis increases, creating a cash outflow

- Accounts payable increase: More unpaid bills mean you've kept cash that would have gone to suppliers, which improves cash flow

4. Subtract interest and tax cash outflows

Remove the actual cash payments for interest and taxes from your operating activities calculation. These represent real cash leaving your business for financing costs and government obligations.

Some companies include interest and taxes in operating activities, while others classify them separately. Double-check your company's accounting policies to ensure consistent treatment.

What cash flow from operating activities includes and excludes

Understanding what belongs in operating activities versus investing or financing activities helps you classify cash flows correctly and avoid mixing different types of business activities.

Cash inflows

Your primary sources of operating cash inflows include:

- Cash received from customers for products and services sold

- Interest received on short-term investments or loans made to others

- Dividends received from equity investments in other companies

Cash outflows

Operating cash outflows represent money spent on day-to-day business activities:

- Payments to suppliers and vendors for inventory and services

- Employee salaries, wages, and benefits

- Rent payments for office space, warehouses, or retail locations

- Utility payments for electricity, water, and internet services

- Tax payments to federal, state, and local governments

- Interest payments on loans and lines of credit

Examples of operating activities by industry

Different business models generate operating cash flow in unique ways:

SaaS company example

A software company collects $1 million in annual subscription revenue up front, but recognizes it monthly over 12 months. The operating cash flow shows the full $1 million as a cash inflow when received, while net income only includes the portion earned each month.

Customer acquisition costs like sales commissions hit cash flow immediately when paid. Meanwhile, the company adds back depreciation on laptops and amortization of capitalized software development costs since these don't require cash payments.

Retail and e-commerce example

A retailer buying inventory for the holiday season sees cash flow decrease when paying suppliers in October, even though sales won't come in until November and December. When those sales occur, AR might increase if customers use store credit cards, temporarily reducing cash flow despite strong sales.

The company's operating cash flow also reflects timing differences in supplier payments. Taking advantage of 30-day payment terms means expenses hit their income statement before cash leaves the bank account.

Healthcare services example

A medical practice bills insurance companies $500,000 for services but only collects $350,000 during the period due to claim processing delays. The $150,000 increase in AR reduces operating cash flow even though the practice recorded the full revenue.

Medical supply purchases paid in cash immediately impact cash flow. However, if the practice negotiates payment terms with suppliers, it can delay cash outflows while still recording the expense.

Operating cash flow formula cheat sheet

| Adjustment type | Effect on cash flow | Common examples |

|---|---|---|

| Non-cash expenses | Add back | Depreciation, amortization, stock compensation |

| Asset increases | Subtract | Higher accounts receivable, inventory, prepaid expenses |

| Liability increases | Add | Higher accounts payable, accrued expenses, deferred revenue |

| Asset decreases | Add | Lower accounts receivable, inventory, prepaid expenses |

| Liability decreases | Subtract | Lower accounts payable, accrued expenses, deferred revenue |

Limitations and red flags in analyzing operating cash flow

Operating cash flow doesn't tell the whole story about your company's financial health. It excludes capital expenditures needed to maintain or grow your business, and it can be manipulated through timing of payments and collections.

Watch for these warning signs in operating cash flow:

- Consistently negative CFO despite positive net income suggests collection problems or aggressive revenue recognition

- Sudden improvements from working capital changes may indicate unsustainable stretching of payables or aggressive collection tactics

- Large one-time adjustments can mask underlying operational issues

Timing differences between periods can distort the picture. A company might delay paying suppliers at year-end to boost cash flow, but this isn't sustainable and will reverse in the next period.

How to improve operating cash flow with automation

Better operational management through finance automation can improve your cash position without requiring external financing or cutting essential expenses.

Accelerate receivables

Speed up cash collection by automating your invoicing process to bill customers immediately upon delivery. Set up automated payment reminders that go out before invoices are due, reducing the likelihood of late payments.

Offer multiple digital payment options like ACH transfers, credit cards, and online payment portals. Customers pay faster when it's convenient, and automated processing means cash hits your account sooner.

Optimize payables timing

Set up automated approval workflows to efficiently process invoices and maximize the time before payment. This keeps cash in your account longer without risking late fees or damaging vendor relationships.

Take advantage of early payment discounts when they exceed your cost of capital. Automated systems can flag these opportunities and calculate whether paying early makes financial sense.

Control day-to-day operating expenses

Implement automated expense tracking to monitor spending in real-time rather than waiting for month-end reports. Set up alerts for unusual spending patterns or when expenses exceed budgeted amounts.

Create approval hierarchies that automatically route expenses to the right managers based on amount and category. This prevents unauthorized spending while keeping legitimate expenses moving through the system.

Automate expense and vendor workflows

Replace manual expense reports with automated capture and categorization of receipts. Employees snap photos of receipts, and the system extracts data and matches it to corporate card transactions.

Automate vendor onboarding and payment processing to reduce the time between invoice approval and payment. This improves cash flow predictability by standardizing payment cycles and eliminating processing delays.

Strengthen operating cash flow with Ramp

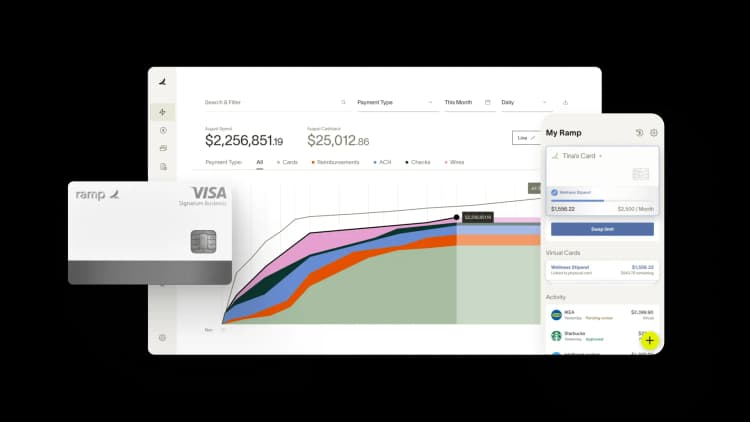

Ramp’s all-in-one finance operations platform can help your business track and improve cash flow from operating activities:

- Real-time expense tracking: Expense management features like automated expense categorization give you instant visibility into all your operating expenses

- Accounts payable automation: Ramp Bill Pay automates payment workflows that directly impact your operating cash flow

- Accounting and ERP integrations:

Ready to take control of your operating cash flow? Try an interactive demo and see how Ramp can help.

FAQs

Operating cash flow appears in the first section of the cash flow statement, typically labeled "Cash flows from operating activities." It's positioned above the investing activities and financing activities sections.

Stock-based compensation gets added back to net income when calculating operating cash flow because it's a non-cash expense. While it reduces reported earnings by recognizing the value of equity given to employees, no actual cash leaves the company.

Under U.S. GAAP, dividends received from investments are classified as operating cash flow. This differs from international accounting standards under IFRS, which typically classify dividend income as investing activities.

Lease payments appear as operating cash outflows since they represent cash paid for the use of assets. Under current accounting standards, you add back the depreciation portion of the right-of-use asset as a non-cash adjustment when calculating operating cash flow using the indirect method.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°