What is liquidity? Definition, ratios, and examples

- What is liquidity?

- Types of liquid assets

- What is liquidity risk?

- How to measure liquidity: Key liquidity ratios

- Why is liquidity important in a business?

- How to improve business liquidity

- How Ramp helps improve cash flow management

- Strengthen your financial liquidity with Ramp

A company can look profitable on paper yet still struggle to pay its suppliers or employees on time. That’s a liquidity issue—when a business can’t convert its assets to cash quickly enough to cover immediate expenses.

Financial liquidity refers to how easily an asset can be turned into cash without losing significant value. It’s what allows individuals and businesses to meet day-to-day financial obligations and stay resilient during disruptions.

Liquidity sits at the core of financial health. Understanding what it is and how to measure it helps you ensure your business can cover short-term needs, seize opportunities, and avoid cash-flow strain.

What is liquidity?

Liquidity reflects how easily assets can be converted into cash without significantly affecting their value. It determines whether an individual or business can meet short-term obligations using readily available resources.

Not all assets are equally liquid. Your company may own valuable equipment or property, but those assets can’t be quickly sold to cover an upcoming bill. Cash, on the other hand, can be used immediately, making it the most liquid asset.

To illustrate, imagine you own two assets: shares of Apple stock and a rare vintage sports car. If you needed to raise cash quickly, the Apple stock would be far easier to sell at market value, while the car might take weeks or months to find a buyer. In this case, the stock is more liquid because it can be converted to cash faster and with less loss in value.

Liquidity vs. solvency

Liquidity measures how easily a business can meet short-term obligations using assets that can quickly convert to cash. Solvency, by contrast, reflects its ability to meet long-term debts. A company can be profitable and solvent yet still face short-term liquidity challenges.

Financial liquidity vs. market liquidity

Financial liquidity is your ability to pay near-term bills with assets you can quickly turn into cash, like reserves, receivables, or short-term investments. Market liquidity is how easily an asset can be bought or sold without moving its price, signaled by tighter bid-ask spreads and higher trading volume. In practice, strong financial liquidity keeps bills paid on time. Strong market liquidity lets you exit or enter positions quickly at fair prices.

What does it mean when a company has high liquidity?

High liquidity means a company can easily meet its short-term obligations using assets that can be quickly converted to cash. This indicates financial health and stability, as the company can readily pay its bills and handle unexpected expenses.

Types of liquid assets

Liquidity exists on a spectrum. An asset is considered liquid if it can be quickly converted into cash without losing much value. Assets that require more time, negotiation, or specialized buyers are illiquid and harder to sell at full value.

Examples of highly liquid assets

Highly liquid assets can be quickly converted to cash with little to no loss in value. These are often held to cover short-term obligations or manage cash flow.

- Cash and cash equivalents: Physical cash, checking accounts, savings accounts, and money market funds

- Marketable securities: Stocks, bonds, exchange-traded funds (ETFs), and mutual funds that trade frequently on public exchanges

- Accounts receivable: Outstanding customer payments expected within a short period

- Short-term investments: Treasury bills, certificates of deposit (CDs), and other investments maturing in under a year

- Cryptocurrency: Certain widely traded coins can be liquid, depending on market demand

Examples of illiquid assets

Illiquid assets, or non-liquid assets, are harder to convert into cash quickly without taking a loss. They often require time to find a buyer or involve higher transaction costs.

- Real estate: Houses, land, and commercial properties that often take months to sell

- Equipment and machinery: Specialized business assets that lose value or require niche buyers

- Long-term investments: Private equity, venture capital holdings, or restricted shares

- Intellectual property: Patents, trademarks, and copyrights that are difficult to value or sell quickly

- Collectibles and personal property: Fine art, jewelry, and classic cars

| Asset type | Example | Liquidity level |

|---|---|---|

| Cash | Checking/savings accounts | Highest |

| Marketable securities | Stocks, ETFs, mutual funds | High |

| Accounts receivable | Customer invoices | Moderate |

| Inventory | Unsold goods | Low |

| Fixed assets | Real estate, equipment | Lowest |

What is liquidity risk?

Liquidity risk is the danger that arises when an asset cannot be bought or sold quickly enough to prevent or minimize a loss. This risk is particularly relevant for investors holding illiquid assets such as real estate, private company shares, or thinly traded securities.

There are two main types of liquidity risk. Funding liquidity risk occurs when your business can’t access enough cash or borrowing to meet short-term obligations like payroll or supplier payments. Market liquidity risk, on the other hand, happens when assets can’t be sold quickly without sharply reducing their price, often during periods of low demand or market stress.

For example, say you’re a real estate investor who owns several rental properties. If you suddenly need cash to cover an unexpected expense, you may be forced to sell one of your properties at a discount due to the time it takes to find a buyer. Similarly, if your company has a large inventory of unsold products, it may struggle to raise cash if sales decline unexpectedly. Persistent liquidity challenges can eventually create solvency concerns if short-term cash shortfalls become ongoing structural issues.

Common causes of liquidity problems

Liquidity challenges can arise for many reasons, often tied to how a business manages its cash flow, assets, and growth:

- Poor cash flow management: When inflows and outflows aren’t tracked or forecasted properly, your business can run short on cash even when sales are strong

- Over-investment in illiquid assets: Tying up too much capital in property, equipment, or long-term projects limits your ability to generate cash quickly when expenses arise

- Unexpected market conditions: Economic downturns, rising interest rates, or tighter credit markets can make it harder to sell assets or secure financing

- Rapid business growth without adequate planning: Scaling too quickly can strain working capital and create temporary liquidity crunches

Warning signs of liquidity issues

Spotting liquidity problems early gives you the chance to take corrective action before they affect operations or creditworthiness. Keep an eye out for these indicators:

- Difficulty meeting payroll or supplier payments

- Increasing reliance on credit lines to fund daily operations

- Declining quick or current ratios over several periods

- Extended cash conversion cycles that keep cash tied up in operations

How to measure liquidity: Key liquidity ratios

Liquidity ratios are essential for assessing your company’s short-term financial health. They show whether your business has enough readily available assets to cover its immediate obligations, helping you spot potential cash flow issues before they become serious problems.

Current ratio

Current ratio = Current assets / Current liabilities

The current ratio measures your company’s ability to pay short-term debts with assets that can be converted to cash within one year. A ratio greater than 1.0 generally indicates healthy liquidity, meaning your company can cover current obligations as they come due. However, what’s considered healthy varies by industry—capital-intensive businesses often operate with lower ratios, while service-based companies may maintain higher ones.

Example: If your business has $200,000 in current assets and $120,000 in current liabilities, your current ratio is $200,000 / $120,000 = 1.67.

Quick ratio (acid-test ratio)

Quick ratio = (Cash + Short-term investments + Accounts receivable) / Current liabilities

The quick ratio is a stricter version of the current ratio because it excludes inventory and other less liquid assets that can’t be quickly turned into cash. This ratio is particularly useful if your company has slow-moving inventory or unpredictable sales cycles. A higher quick ratio signals stronger liquidity and more flexibility, while a lower ratio suggests your company may struggle to meet short-term obligations without selling assets or borrowing.

Example: If your company has $100,000 in cash, $50,000 in receivables, and $30,000 in short-term investments against $120,000 in current liabilities, your quick ratio is ($100,000 + $50,000 + $30,000) / $120,000 = 1.50.

Cash ratio

Cash ratio = Cash and cash equivalents / Current liabilities

The cash ratio is the most conservative measure of liquidity because it focuses only on cash and near-cash assets. It indicates the extent to which current liabilities can be paid immediately using cash on hand. This ratio is especially relevant if your business operates in volatile industries or prioritizes strong cash reserves.

Example: If you hold $80,000 in cash and have $120,000 in current liabilities, your cash ratio is $80,000 / $120,000 = 0.67.

What is a good liquidity ratio?

A higher ratio (or ratio greater than 1) indicates that a company has sufficient liquid assets to cover its short-term obligations, while a lower ratio suggests potential liquidity problems.

Why is liquidity important in a business?

Liquidity is crucial for businesses, investors, and financial markets as a whole. For your business, having sufficient liquidity ensures you can meet short-term obligations such as paying bills, salaries, and taxes without interruption.

Maintaining strong liquidity also provides flexibility, reduces financial stress, and supports long-term stability. If your company has poor liquidity, on the other hand, it could struggle to operate smoothly and may face financial distress or even bankruptcy.

Typical current ratios vary by sector. Manufacturers often operate around 1.5, while service-based companies average closer to 2.0. Comparing against peers helps you gauge whether your liquidity position is strong or weak.

Benefits of strong liquidity

Strong liquidity offers clear advantages that enhance stability, growth, and financial health:

- Ability to seize growth opportunities: With sufficient cash on hand, you can quickly invest in new projects, expand operations, or pursue time-sensitive deals

- Better negotiating power with suppliers: Strong liquidity allows you to pay invoices early, qualify for discounts, or secure more favorable terms

- Reduced financial stress and risk: Maintaining a liquidity buffer helps you weather unexpected expenses or revenue dips without resorting to high-interest loans

- Improved credit ratings and loan terms: Lenders and investors view businesses with strong liquidity as lower risk, often resulting in better financing options and lower interest rates

Consequences of poor liquidity

Poor liquidity can quickly create challenges for your business. Without enough cash on hand, you might have to pass up profitable opportunities or delay growth plans. Late or inconsistent payments can also strain relationships with suppliers and make future deals harder to secure.

Ongoing cash shortages can eventually put your business at risk of insolvency if you can’t meet short-term obligations. Lenders may also view your company as higher risk, leading to steeper borrowing costs or limited access to credit.

Discover Ramp's corporate card for modern finance

How to improve business liquidity

Improving your company’s liquidity starts with balancing short-term cash management and long-term financial planning. The right mix of strategies can help you strengthen your cash position, reduce financial stress, and give your business more flexibility to grow.

Short-term liquidity improvements

If your business needs to free up cash quickly, start by improving how you manage receivables, payables, and inventory.

- Invoice promptly and follow up: Send invoices right away, set clear payment terms, and follow up on overdue balances to accelerate collections

- Offer early-payment incentives: Provide small discounts to encourage faster customer payments and improve cash inflows

- Align payables with inflows: Negotiate longer terms or flexible schedules to better match outgoing payments with incoming receipts

- Optimize inventory: Use forecasting and real-time tracking to reduce excess stock and free up cash

- Consider near-term financing options: Invoice factoring or invoice financing can convert receivables into working capital without taking on long-term debt

Long-term liquidity strategies

Building durable liquidity takes consistent planning and disciplined financial management.

- Implement a rolling cash flow forecast: Identify upcoming gaps, seasonality, and timing risks so you can act early

- Maintain an operating cash reserve: Set aside several months of expenses to cushion unexpected costs or slower periods

- Diversify revenue streams: Reduce reliance on any single product, customer, or market to stabilize inflows

- Secure flexible credit lines in advance: Establish facilities before you need them so funding is available when conditions tighten

- Strengthen core finance processes: Use working capital management practices to improve collections, payables timing, and inventory turns

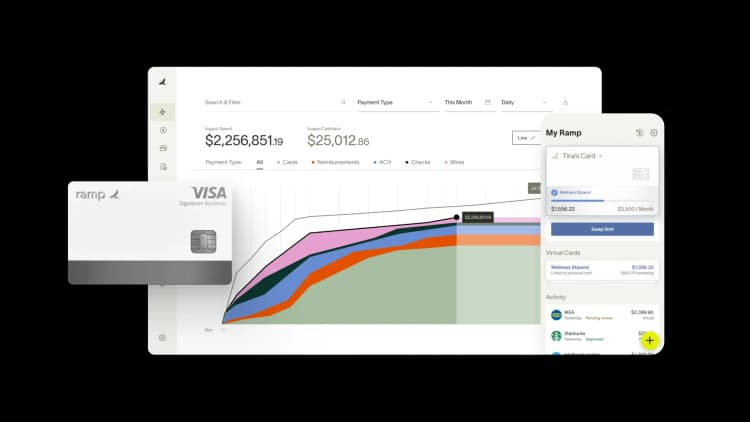

How Ramp helps improve cash flow management

Managing business liquidity while juggling short-term obligations can be challenging. You're constantly monitoring cash positions, chasing down receipts for reimbursements, and trying to optimize payment timing—all while ensuring you have enough working capital to cover immediate needs.

Ramp's expense management software directly tackles these liquidity challenges through automated workflows that accelerate cash recovery and provide real-time visibility into your financial position. AI-powered receipt matching captures expenses instantly, cutting out manual delays in reimbursements.

Control spend and optimize cash flow in real time

Beyond accelerating reimbursements, Ramp's real-time spend tracking gives you visibility into cash outflows before they hit your accounts. The platform's customizable spend controls let you set precise limits by category, vendor, or time period, preventing unexpected expenses from disrupting your liquidity planning. You can also configure automatic alerts when spending approaches predefined thresholds, giving you advance warning to adjust payment schedules or secure additional funding if needed.

Ramp also streamlines bill payments through accounts payable automation, which centralizes vendor payment details and provides flexible payment timing options. You can schedule payments to optimize cash flow, taking advantage of early payment discounts when liquidity allows or extending payment terms when cash is tight.

Turn liquidity management into a strategic advantage

The platform's unified dashboard displays all upcoming obligations alongside your current cash position, allowing you to make informed decisions about payment prioritization. This comprehensive view transforms liquidity management from reactive firefighting to proactive optimization.

Strengthen your financial liquidity with Ramp

Want to strengthen your liquidity position? The Ramp Business Credit Card gives you access to credit limits higher than traditional business credit cards. Combined with automated expense management that saves your team hours of manual work, we help you preserve cash while maintaining complete control over spending.

Ready to improve your liquidity management? Explore an interactive demo.

FAQs

Investors value liquidity because it lets them buy and sell assets quickly, adjust portfolios, and respond to changing market conditions. This flexibility helps manage risk and capture opportunities.

Liquidity in crypto refers to how easily a digital asset, such as Bitcoin or Ethereum, can be bought or sold without significantly affecting its price. Highly traded coins on major exchanges are more liquid.

The most liquid assets include cash, checking and savings accounts, and cash equivalents like Treasury bills or money market funds. Among securities, large-cap stocks and government bonds are typically the most liquid due to high trading volume.

No. Liquidity is about meeting short-term obligations with assets you can quickly convert to cash; solvency is about meeting long-term debts. A company can be solvent yet face a temporary liquidity crunch.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits