What is microlending? Definition, benefits, and how it works

- What is microlending?

- How microloans work

- Benefits of microloans for small businesses

- Risks and drawbacks of microlending

- Who uses microloans?

- How to get a microloan

- Top microlenders for small businesses

- Common microloan terms and requirements

- Microloans vs. other business financing options

- What is the difference between microlending and microfinance?

- Get the working capital you need with Ramp

Securing a traditional loan isn’t always realistic when you only need $50,000 or less to move your business forward. Many banks prioritize larger loans, leaving startups and small businesses with limited options.

Microlending fills that gap by providing small loans to entrepreneurs and underserved businesses that can’t access traditional financing. These microloans give you targeted capital to launch, stabilize, or grow without taking on more debt than you need.

What is microlending?

Microlending is a form of small business financing that provides loans, typically between $500 and $50,000, to entrepreneurs and businesses that can’t access traditional bank funding. These loans, called microloans, are offered by government-backed programs, nonprofit organizations, community development financial institutions (CDFIs), and online lending platforms.

Microlenders often focus on startups and historically underserved entrepreneurs, including women, immigrants, and business owners with limited credit history. You repay the loan in installments with interest over a fixed term, usually one to six years.

Here are the key characteristics that define microlending:

- Loan amounts: Smaller than traditional business loans, typically capped at $50,000

- Target borrowers: Startups, underserved entrepreneurs, and owners with limited credit history

- Lender types: Nonprofits, SBA intermediaries, CDFIs, and peer-to-peer or online platforms

- Added support: Many programs include mentoring, financial education, and business training

You can use microloans for equipment purchases, inventory, startup costs, marketing expenses, or short-term working capital needs.

How microloans work

Microloans follow a streamlined process designed to make small-dollar financing more accessible than traditional bank loans. Instead of relying strictly on credit scores and revenue history, many microlenders evaluate your business plan, experience, and ability to repay.

Three parties typically play a role in the process:

- Borrowers: Apply for and receive the microloan, then repay it according to the agreed terms

- Lenders: Nonprofits, SBA intermediaries, CDFIs, or online platforms that fund and administer the loan

- Platforms (when applicable): Online marketplaces that connect borrowers with lenders and facilitate underwriting and payments

The application process

Applying for a microloan usually requires a business plan, financial projections or statements, personal identification, and sometimes tax returns or bank statements. Requirements vary by lender.

Many microlenders look beyond your credit score. They may assess your business viability, character, community impact, and intended use of funds. Some programs also require training or workshops before approval.

Funding and disbursement

Once approved, funds are typically deposited into your business bank account. Timelines depend on the lender type.

SBA-backed microloans often take 30–90 days because approved intermediaries handle underwriting and documentation. Online and peer-to-peer platforms may disburse funds in a few days.

Repayment structure

Microloan repayment terms generally range from 1–6 years with fixed monthly payments. The Small Business Administration reports the average microloan size is about $13,000, and interest rates typically fall between 8% and 13%, depending on your credit profile and the intermediary lender.

Some lenders offer deferred or graduated payments to help new businesses manage early cash flow constraints. Before signing, confirm the repayment schedule aligns with your projected revenue.

Benefits of microloans for small businesses

Microloans give you access to capital when traditional banks won’t. They’re designed for startups and small businesses that need smaller funding amounts or don’t meet strict bank underwriting standards.

Access to capital with limited credit history

Traditional lenders typically require strong business and personal credit scores, a low debt-to-income ratio, and minimum revenue thresholds. Microlenders take a different approach. Many evaluate factors like your business plan quality, owner commitment, community impact, and intended use of funds rather than relying solely on credit history.

This makes microloans a viable option if you're a first-time entrepreneur or haven't had time to build a credit profile.

Smaller loan amounts for targeted needs

Larger banks often won't consider loans under $50,000. Microlending lets you borrow only what you need, whether that's $2,000 for initial inventory or $15,000 for equipment. You avoid taking on more debt than necessary, which keeps repayment manageable and your cash flow healthier.

Flexible qualification requirements

Microlending programs often have less stringent requirements than banks. You don't need the best credit score or the most impressive financial history to qualify. This accessibility opens doors for first-time entrepreneurs and business owners who've been turned away by traditional lenders.

Business training and support resources

Many microlenders pair loans with mentoring, technical assistance, and financial education. Depending on the provider, you may get access to business training, marketing support, networking opportunities, and personalized coaching.

Some microloan lenders also report your repayments to commercial credit bureaus such as Equifax, Experian, and Dun & Bradstreet, which can help build business credit and give you access to better financial products down the road.

Risks and drawbacks of microlending

Microloans are accessible, but they aren’t always the cheapest or most flexible option. Before applying, make sure the loan structure aligns with your cash flow and growth plans.

Higher interest rates than traditional loans

Because microlenders serve borrowers who may not qualify for bank financing, they often charge higher interest rates to offset risk. Rates commonly range from 8% to 13% or higher, depending on the lender and your credit profile. Over time, that higher rate can increase the total cost of borrowing compared to traditional bank loans.

Loan amounts may not cover all needs

Microloans typically cap at $50,000, and many programs offer significantly less. If you’re planning a major expansion, equipment purchase, or acquisition, a microloan likely won’t be sufficient on its own. You may need to combine it with other financing sources.

Shorter repayment periods

Repayment terms usually range from 1 to 6 years. While that keeps debt from lingering long term, it can increase your monthly payment relative to the loan size.

Some lenders also require personal guarantees or collateral. Before committing, confirm whether personal assets are at risk and ensure the payment schedule fits your projected revenue.

Who uses microloans?

Microloans primarily serve entrepreneurs who can’t access traditional bank financing. They’re especially useful if you’re early-stage, rebuilding credit, or operating in an underserved market.

Here are the groups that benefit most:

- Startups and new businesses: Many startups lack operating history or consistent revenue, which makes bank approval difficult. Microlending provides capital for inventory, equipment, and working capital while you build traction.

- Businesses with limited or bad credit: If your personal or business credit profile isn’t strong enough for traditional loans, microlenders may still consider your application. Some may impose additional loan requirements to manage risk.

- Underserved and minority entrepreneurs: Some nonprofit and mission-driven lenders focus on supporting women, immigrants, and minority-owned businesses that historically receive less institutional funding. Many pair loans with coaching and technical assistance.

- Small business owners with modest funding needs: If you only need $5,000–$25,000, a bank may not consider the loan worthwhile. Microloans help you fill smaller financing gaps without turning to high-cost alternatives.

Microlending expands access to capital for business owners who might otherwise struggle to secure funding.

How to get a microloan

Getting a microloan is more straightforward than applying for a traditional bank loan, but preparation still matters. If you come in with a clear plan and organized documentation, you’ll improve your approval odds.

1. Determine your funding needs

Calculate exactly how much capital you need and what you’ll use it for. Whether it’s inventory, equipment, working capital, or startup costs, defining the purpose strengthens your application and prevents overborrowing.

2. Research microlenders

Compare SBA intermediaries, CDFIs, nonprofit microlenders, and online platforms based on eligibility, location, loan size, and support services. Each lender sets its own underwriting standards, interest rates, and documentation requirements.

3. Gather required documentation

Most microlenders request some combination of the following:

- A business plan

- Financial projections or statements

- Tax returns

- Personal identification

- Bank statements

- Proof of business ownership

Requirements vary by lender, so review criteria before compiling documents.

4. Submit your application

Apply directly through the lender’s website or local office. Some programs require you to attend a workshop or complete training before final approval. Submit complete and accurate information to avoid delays.

5. Review and accept loan terms

Before signing, carefully review the interest rate, repayment schedule, fees, and any personal guarantee or collateral requirements. Confirm the payment structure aligns with your projected cash flow. If something isn’t clear, ask questions before accepting the loan agreement.

Top microlenders for small businesses

If you’re exploring microlending, start with established programs that specialize in small-dollar financing. Options range from government-backed intermediaries to nonprofit and online platforms.

SBA Microloan Program

The Small Business Administration (SBA) offers microloans of up to $50,000 for new and expanding small businesses. You can use funds for working capital, inventory, supplies, furniture, fixtures, and equipment.

The SBA doesn’t lend directly. Instead, it works through approved nonprofit intermediaries that set their own underwriting criteria and provide technical assistance to borrowers.

Community development financial institutions (CDFIs)

CDFIs are mission-driven lenders that focus on underserved communities. The Accion Opportunity Fund provides small business loans ranging from $5,000 to $100,000, particularly for businesses owned by women, people of color, and immigrants.

They accept applicants with Individual Taxpayer Identification Numbers (ITINs) and offer coaching, educational resources, and bilingual support.

Online microlending platforms

Kiva uses a crowdfunding model to provide loans of up to $15,000 at 0% interest. After initial approval, you invite supporters to fund your loan before it becomes available to Kiva’s broader lending network.

LendingClub partners with Accion Opportunity Fund to provide small business loans with fixed monthly payments and terms ranging from 1 to 5 years. Borrowers also receive access to dedicated advisors.

Nonprofit microlenders

Grameen America offers microloans starting at $2,000 to women entrepreneurs living below the federal poverty line. Borrowers form small peer groups, open savings accounts, and receive financial training alongside their loan.

You can also check with your local small business development center for regional nonprofit microlenders in your area.

Common microloan terms and requirements

Microloan terms vary by lender, but most programs follow a similar structure for loan size, pricing, and repayment.

| Factor | Typical range |

|---|---|

| Loan amount | $500–$50,000 (average: ~$13,000) |

| Interest rates | 8%–13%+, varies by lender and credit profile |

| Repayment term | 1–6 years |

| Collateral | Often not required; some lenders may request it |

| Credit standards | More flexible than traditional bank loans |

Beyond these baseline terms, microlenders typically evaluate your business plan, intended use of funds, repayment capacity, and owner commitment. Some programs weigh character references or community impact alongside financial metrics.

Because underwriting standards differ across SBA intermediaries, CDFIs, and online lenders, review each program’s specific requirements before applying.

Microloans vs. other business financing options

Microloans work best for smaller, targeted funding needs, but they’re only one option in the small business financing landscape. Comparing them to other products helps you choose the right fit.

Microloans vs. SBA 7(a) loans

SBA 7(a) loans can reach up to $5 million and are typically used for large expansions, commercial real estate, equipment purchases, or acquisitions. The underwriting process is more complex, and eligibility standards are stricter.

Microloans, by contrast, are capped at $50,000 and are better suited for startups or smaller, clearly defined expenses.

Microloans vs. business lines of credit

A business line of credit gives you revolving access to funds. You draw what you need, repay it, and draw again.

Microloans provide a fixed lump sum with a structured repayment schedule. If you need ongoing flexibility for variable expenses, a line of credit may be more appropriate. If you’re funding a one-time purchase, a microloan is simpler and more predictable.

Microloans vs. business credit cards

Business credit cards offer convenience and revolving access to capital, but they often carry higher interest rates if you carry a balance.

Microloans typically provide larger lump sums at lower rates than most credit cards, making them better for equipment, inventory, or startup costs. Credit cards are more practical for recurring operating expenses and short-term cash flow management.

What is the difference between microlending and microfinance?

Microlending and microfinance are related but not identical. Microlending, also called microcredit, refers specifically to small loans for individuals or businesses that lack access to traditional banking. Microfinance is a broader category that includes microlending plus other financial services such as savings accounts, insurance, and money transfers.

In simple terms, microlending is one component of microfinance. The concept gained global attention through institutions like Grameen Bank, founded by Muhammad Yunus in Bangladesh, which demonstrated how small loans could support entrepreneurship and economic self-sufficiency.

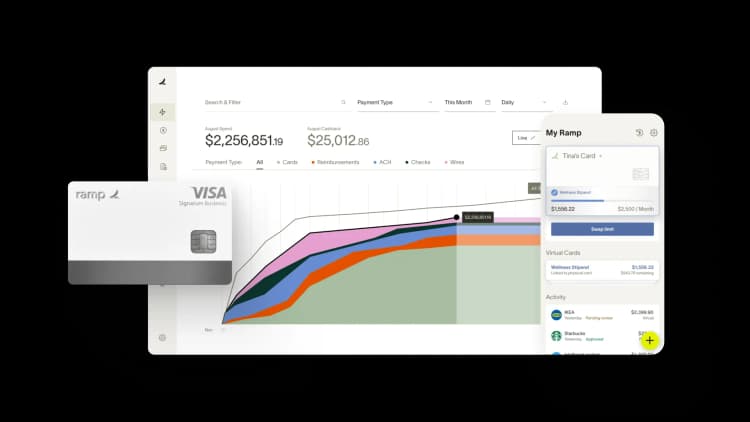

Get the working capital you need with Ramp

Managing cash flow is just as important as accessing capital. Ramp helps you control spending, track expenses in real time, and access credit without the friction of traditional underwriting.

Our automated expense management platform gives you visibility into company spend while simplifying approvals and reconciliation. With Ramp, you get access to corporate cards that function like traditional business credit cards but include built-in controls and real-time reporting.

Ramp doesn’t require a personal guarantee or a credit check. Most applicants receive a decision in less than 48 hours, and credit limits are typically higher than traditional business cards.

Get Ramp and build a financially stronger business from day one.

FAQs

Approval timelines vary by lender. Online and peer-to-peer platforms may fund loans within a few days, while SBA-backed microloans typically take 30–90 days depending on documentation requirements and the intermediary’s review process.

Yes. Many microlenders evaluate more than just your credit score. They may consider your business plan, experience, character, and repayment capacity. While lower credit may limit your options or increase your rate, microlending is specifically designed for borrowers who can’t qualify for traditional bank loans.

They can. Some microlenders report payment activity to commercial credit bureaus such as Equifax, Experian, and Dun & Bradstreet. Making on-time payments can help you build business credit and qualify for stronger financing options later.

Defaulting can damage your personal and business credit. The lender may pursue collections, and if you pledged collateral or signed a personal guarantee, those assets may be at risk. If you’re struggling to make payments, contact your lender early—many nonprofit microlenders are willing to discuss modified repayment options.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits