When does American Express report to credit bureaus?

- When does American Express report to credit bureaus?

- What information does American Express report?

- Which credit bureaus does American Express report to?

- Does American Express report authorized users to credit bureaus?

- American Express hard inquiries and new accounts

- Tips for managing your American Express credit reporting

- Forget credit utilization with a Ramp corporate card

Knowing when your credit card activity hits your credit reports can make the difference between a good score and a great one. Timing your payments and balances around reporting dates gives you more control over how lenders see your creditworthiness.

American Express reports to all three major credit bureaus, which means your Amex account activity plays a significant role in shaping your credit profile. Getting familiar with their reporting schedule helps you optimize your credit utilization and potentially boost your score before applying for loans or new credit.

When does American Express report to credit bureaus?

American Express generally reports to credit bureaus once a month. The specific timing can vary but usually occurs a few days after your billing cycle ends. This means that the details of your account activity, including your balance, payments made, and any changes in credit limits, will be updated on your credit reports approximately every 30 days. Additionally, American Express may report when the balance is paid down to zero.

The key relationship to grasp here is between your statement closing date and the reporting date. Your statement closing date marks the end of your billing cycle and determines the balance that appears on your statement. Shortly after that date, Amex sends that statement balance and payment information to the credit bureaus. In most cases, the balance showing on your credit report is whatever you owed when your last statement closed, not your real-time balance.

Amex reporting at a glance

| Event | Typical timing | What hits your report | Why it matters |

|---|---|---|---|

| Statement closing date | Last day of your billing cycle | Statement balance + payment status | Sets the balance most bureaus will receive |

| Amex sends data to bureaus | ~2–3 business days after statement end | Prior cycle's balance, limits, status, history | Drives utilization and payment history tracking |

| Score/credit file reflects data | Varies by bureau update cadence | New balance and any status changes | Your score may lag the report by days to weeks |

| $0 balance reporting | When balance is paid to zero | $0 balance | Can temporarily improve utilization |

Personal card reporting timeline

American Express reports all personal credit cards to the three major bureaus, including Equifax, Experian, and TransUnion, on a monthly basis. Reporting typically happens two to three business days after your statement closing date, though it can vary slightly from month to month.

This timing has a direct effect on your credit utilization ratio, the percentage of available credit you’re using. The balance that Amex reports is your statement balance, not your current balance. That means if you make a large purchase right before your statement closes, that higher balance will appear on your credit report even if you pay it off immediately afterward.

On the flip side, if you pay down your balance before your statement closes, the lower amount gets reported, helping your utilization ratio and potentially boosting your credit score. You can use this timing strategically: making payments before the statement closing date rather than just before the due date often results in a better reported balance and healthier utilization numbers.

| Situation | What to do before statement closes | Why it helps |

|---|---|---|

| Big purchase just posted | Make a pre-close payment | Lowers the balance that gets reported |

| Utilization creeping above ~30% | Request a limit increase or pay mid-cycle | Improves utilization percentage |

| Multiple Amex cards | Spread spend across cards | Keeps single-card utilization low |

| Planning a loan or credit application | Aim for <10% utilization at reporting | Presents strongest possible profile |

Business card reporting schedule

American Express business card activity normally doesn’t appear on your personal credit report. The exception is when an account becomes seriously delinquent (usually 60+ days past due) or goes into default. When you apply for an Amex business card, the company may perform a hard inquiry on your personal credit file, but ongoing activity stays separate.

That separation makes Amex business cards popular among business owners who want to build business credit without affecting their personal utilization or credit history.

What information does American Express report?

American Express sends a full snapshot of your account every month, covering balances, limits, payment patterns, and account status. These data points shape how lenders and scoring models view your credit.

| Item reported | What Amex sends (typical) | How scoring models use it (at a glance) |

|---|---|---|

| Payment history | On-time/late status by month | Biggest factor; late marks harm for up to 7 yrs |

| Balance | Statement-ending balance | Drives utilization percentage |

| Credit limit/HDL | Preset limit or highest balance (some NPSL) | Used with balance to compute utilization |

| Account status | Open/closed/current/delinquent | Derogatory statuses depress scores |

| Account age | Open date and history | Longer history generally helps |

| Account type | Revolving vs. charge | Contributes to credit mix |

Payment history reporting

American Express reports your payment status monthly, marking whether you paid on time or missed the due date. Paying by the due date keeps your account current, the single most important factor in your credit score.

If you’re more than 30 days late, Amex will report that missed payment to the bureaus, and it can stay on your report for up to seven years. The impact worsens at 60 and 90 days late, when you risk default or account closure. The good news is that Amex usually doesn’t report a late payment until you’ve crossed that 30-day threshold, so catching up early can prevent lasting damage.

Credit utilization reporting

Your credit utilization ratio measures how much of your available credit you’re using at any given time. For instance, a $3,000 balance on a $10,000 limit equals 30% utilization.

Because Amex reports your statement balance, not your real-time balance, a big purchase right before the statement closes can inflate your utilization, even if you pay it off the next day. Conversely, paying down your balance before that date can show a lower utilization rate and boost your score.

How to optimize your credit utilization

Here are practical ways to optimize your utilization before Amex reports:

- Make mid-cycle payments: Don't wait until your due date. Pay down your balance before your statement closes to reduce the amount that gets reported.

- Request a credit limit increase: A higher limit with the same balance automatically lowers your utilization percentage. Amex often approves increases for customers with good payment history.

- Spread purchases across cards: If you have multiple cards, distributing spending can keep individual card utilization low, which often scores better than having one maxed-out card and others with zero balance

- Pay multiple times per month: Making several smaller payments throughout your billing cycle keeps your balance consistently lower, reducing the chance of a high statement balance

- Track your statement closing date: Mark this date on your calendar and plan major purchases around it when possible. Large purchases made right after your statement closes give you the full billing cycle to pay them down before they're reported.

Which credit bureaus does American Express report to?

The credit bureaus American Express reports to depend on whether the account is personal or business. Understanding this distinction can help you manage both your personal and business credit more strategically.

Personal accounts

American Express reports credit data for all personal cards to the three major credit bureaus: Equifax, Experian, and TransUnion. This includes key details like payment history, credit limit, account balance, age, and status.

Paying on time and keeping balances low can strengthen your credit across all three bureaus, while high utilization or missed payments can hurt it. Because Amex reports to all of them, every positive step you take, such as consistent on-time payments, helps build your credit profile more evenly.

Business accounts

For business cards, American Express reports to Equifax, Experian, and Dun & Bradstreet, which focus on business credit profiles rather than consumer credit. These reports track how your business manages debt and repayment, influencing your ability to qualify for loans, credit lines, and vendor terms.

This separation benefits business owners who want to grow their company’s credit reputation without increasing their personal utilization or affecting their personal score. Unless your account becomes seriously delinquent (typically 60+ days past due), Amex business activity won’t appear on your personal credit report.

How to check your American Express reporting

You can verify what American Express reports about your accounts by reviewing your credit files directly. Every consumer is entitled to one free credit report per bureau each year through AnnualCreditReport.com, the only federally authorized source for free reports.

When you check your reports, look for your Amex accounts under “revolving credit” or “charge cards.” Review these key details carefully:

- Account status: It should show as open and current if you’re in good standing. Any “past due” or “charge-off” marks deserve immediate attention.

- Payment history: Confirm that all on-time payments are reported correctly. Inaccurate late marks can significantly affect your score.

- Balance: The reported balance should match your statement balance from around your reporting date. Discrepancies may signal an error.

- Credit limit or high balance: For cards with preset limits, confirm the limit shown is accurate. Cards without preset limits may display your highest balance instead.

- Account opening date: Ensure this matches when you first opened your Amex card. Incorrect dates can shorten your reported credit history.

- Personal vs. business accounts: Business cards generally won’t appear on your personal credit report unless you’ve had serious payment issues. Their absence is normal.

If you find any inaccuracies, contact the credit bureau that issued the report first. Each bureau offers an online dispute process, and you can also reach out to American Express directly to correct information at the source. Keep records of all communications, and follow up if disputes aren’t resolved within 30 days, the standard investigation window under federal law.

Does American Express report authorized users to credit bureaus?

Yes, American Express reports authorized user accounts to the major credit bureaus. This means being added as an authorized user on someone else’s Amex card can affect your credit report and score—often in a positive way if the account is managed responsibly.

When a primary cardholder adds you as an authorized user, the account typically appears on your credit report within one to two billing cycles. The information Amex reports includes the account’s payment history, balance, credit limit (if applicable), and the date the account was opened. Because Amex often reports the full account history, you may benefit from that positive history even if you were added recently.

The effect on your credit depends on how the primary cardholder manages the account. Consistent on-time payments and low balances can help strengthen your score, while missed payments or high utilization can hurt it.

Authorized user account policies

American Express allows authorized users, including minors in many cases, although requirements can vary by product. The authorized user doesn’t always need a Social Security number at the time they’re added, but providing one ensures faster and more accurate reporting to the credit bureaus. Without it, the account might take longer to appear or may not appear at all until that information is updated.

Adding an authorized user is often used by parents or partners who want to help someone build credit history. However, because the account appears on both credit reports, the primary cardholder assumes full responsibility for payments, and both parties’ credit can be affected by how the card is used.

Benefits of becoming an authorized user

- Immediate payment history boost: The account’s on-time history typically appears on your report within 1–2 cycles, which can help thin files build momentum

- Longer credit history: Many Amex accounts report the full age of the primary account, so you may benefit from years of history even if you were added recently

- Lower utilization math: A high limit with low balances can reduce your overall utilization, which scoring models tend to favor

- Credit mix signal: Adding a well-managed revolving or charge account can diversify your profile, a minor positive factor in most models

- Low lift for the AU: You gain profile benefits without taking on primary-holder responsibilities like payments and account management

Risks to consider

- Shared consequences: Late payments and high balances by the primary cardholder can show up on your report and hurt your score

- Utilization spikes: If the card runs a high balance, your reported utilization can jump even if you never use the card

- Tradeline removal effects: If you’re removed later, the account may disappear from your report, which can shorten average age and affect scores

- Reporting delays or mismatches: If your SSN isn’t on file at add-time, the account may report slowly or inconsistently until updated

- Limited control: The primary cardholder controls limits, payments, and whether you remain on the account; you can’t directly prevent mismanagement

American Express hard inquiries and new accounts

Applying for an Amex card usually triggers a hard inquiry on your personal credit report. Hard pulls can cause a small, temporary dip in your score, and multiple inquiries in a short window can compound the effect, spacing out applications helps keep your profile steady. Once approved, your new account typically appears on your reports within 30–60 days, often after your first statement posts. That new line may briefly lower your average account age, but consistent on-time payments help the score recover over time.

How to manage the impact:

- Check your utilization and pay down balances before you apply

- Consider prequalification to gauge odds before a hard pull

- Set up automatic payments for at least the minimum due

- Avoid stacking multiple applications within the same month

- Monitor your reports to confirm the new account appears accurately

First statement reporting

Most new American Express accounts show up across the three major bureaus shortly after the first statement closes. You’ll see the open date, initial limit, and your statement balance reported. If the trade line doesn’t appear after two cycles, contact Amex and the bureau to investigate and correct any reporting delays.

Tips for managing your American Express credit reporting

Managing how American Express reports your account isn’t just about paying on time—it’s about timing when and how much you pay. A few small adjustments can make a noticeable difference in your utilization and score over time.

- Pay before your statement closes: Making a payment a few days before the statement close date lowers the balance that Amex reports to credit bureaus

- Automate your payments: Schedule automatic payments for at least the minimum due so you never miss a reporting cycle

- Track multiple cards: If you have several Amex cards, mark each statement closing date on your calendar to stay ahead of utilization swings

- Keep balances under 30% of your limit: Staying below this threshold shows lenders you’re managing credit responsibly; aiming for under 10% is even better before new credit applications

- Request periodic credit limit increases: A higher limit automatically lowers your utilization ratio as long as spending stays the same

- Split large purchases across billing cycles: This keeps your statement balance from spiking and maintains a steadier utilization trend

- Make two payments per month: A mid-cycle payment and another before statement close can help you maintain a consistently low reported balance

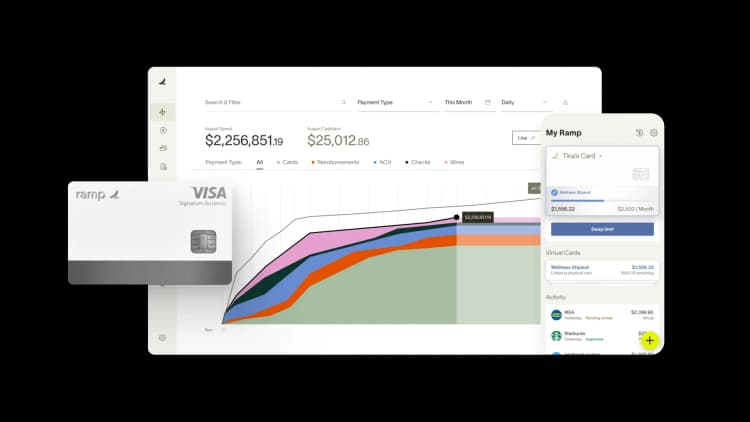

Forget credit utilization with a Ramp corporate card

Traditional credit cards impact your credit score based on how much of your available limit you’re using, or your credit utilization ratio. High utilization can weigh down your score, even if you pay on time.

Ramp offers a smarter model. Our charge card must be paid in full each month, so your business spending doesn’t report as revolving debt or affect your personal credit utilization. You can spend what your business needs, manage expenses efficiently, and avoid the credit-score stress that comes with traditional cards.

Apply for a Ramp corporate card and start building your business without worrying about utilization or revolving balances.

The information provided in this article has not been officially confirmed by American Express and is subject to change.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°