When does Bank of America report to credit bureaus?

- Which credit bureaus does Bank of America use?

- When does Bank of America report to credit bureaus?

- What information does Bank of America report?

- How Bank of America reporting affects your credit score

- How to monitor Bank of America's credit reporting

- Tips for optimizing your Bank of America credit reporting

- Forget credit utilization with the Ramp Business Credit Card

Bank of America typically reports account activity to the major credit bureaus each month. These Bank of America credit updates play an important role in shaping your overall credit profile and financial reputation, whether you manage personal or business accounts.

Knowing when and how Bank of America reports gives you better control over your credit health. That way, you can plan payments, manage balances, and understand how your activity is reflected on your reports.

Which credit bureaus does Bank of America use?

Bank of America reports credit information to different bureaus depending on whether you’re managing personal or business accounts. Here’s how reporting works for each type.

Personal accounts

When you apply for credit, Bank of America reviews your personal credit details with the three main consumer bureaus: Equifax, Experian, and TransUnion. Information such as payment history, credit limits, and account status is included in these reports.

Regular, on-time payments can strengthen your credit score, while late payments or high utilization may hurt it. Reporting to all three bureaus ensures your credit history is fully recorded, which can help when you apply for new credit or loans.

Business accounts

For business credit cards, loans, or lines of credit, Bank of America reports to Equifax, Experian, and Dun & Bradstreet (D&B). The three major business credit bureaus focus on business credit reporting, which follows a different schedule than personal accounts.

Business credit reports help your company build creditworthiness and financial stability, key factors for securing business loans, lines of credit, and favorable terms with vendors. Each month, the bank reports payment history, utilization, and any changes to credit limits or account status to help establish and maintain a strong business credit profile.

| Account type | Bureaus reported to | Typical frequency | Key details |

|---|---|---|---|

| Personal | Experian, Equifax, TransUnion | Monthly (30–45 days after statement close) | Includes payment history, balance, credit limit |

| Business | Experian, Equifax, Dun & Bradstreet | Monthly | Focuses on trade credit and business repayment data |

When does Bank of America report to credit bureaus?

Bank of America usually reports your account activity to personal and business credit bureaus once a month, typically within 30 to 45 days after your statement closing date. This schedule can vary slightly depending on the type of account, such as a business loan or credit card. Knowing this timing helps you plan payments to manage balances and maintain healthy credit utilization.

Credit card reporting timeline

For both personal and business credit cards, Bank of America reports balances and payment activity shortly after the statement closing date, not the payment due date. This determines which balance appears on your credit report.

If you pay down your balance before the statement closes, you’ll likely see a lower balance reported to the bureaus, which can help improve your personal and business credit scores. For example, if your statement closes on the 15th and your payment is due on the 10th of the following month, paying down your balance by the 14th ensures a lower amount is reported.

Lower utilization

Paying down your balance before the statement closes helps reduce your reported utilization ratio.

Loan and mortgage reporting timeline

Installment loans, such as business term loans, personal loans, and auto loans, are typically reported once per month. Mortgage accounts follow a similar schedule but may appear a few days later due to lender processing or payment grace periods.

For business borrowers, commercial loans and lines of credit are also reported monthly to business credit bureaus, helping your company build and maintain strong business credit over time.

| Account type | Reporting schedule | Notes |

|---|---|---|

| Credit cards | A few days after statement closes | Affects your reported balance and utilization |

| Loans | Monthly | May appear later due to processing |

| Mortgages | Monthly (30–45 days) | Can vary slightly by lender |

| Business accounts | Monthly | Builds company credit history and repayment record |

What information does Bank of America report?

Bank of America sends key account details to the credit bureaus each month, shaping both your personal and business credit history. These updates include your payment history, current balance, credit limit, account status, and credit utilization rate.

Both positive and negative information are shared: responsible credit use helps strengthen your score, while late payments or high balances can bring it down. Here’s how Bank of America reports your account details.

Payment history reporting

Bank of America reports whether payments are made on time or late. Payments that are 30, 60, or 90 days past due appear separately on your credit report, with longer delays carrying a stronger negative impact on your score.

Making on-time payments consistently helps you build a strong record and maintain good credit standing. Payment history is the most significant factor in most credit scoring models.

Credit utilization and balance reporting

Each month, Bank of America also reports your balance and total credit limit. Together, these determine your credit utilization ratio, the percentage of available credit you’re using. Keeping utilization below 30% is generally considered healthy, but staying under 10% can help maximize your score.

Paying down your balance before the statement closing date ensures a lower balance is reported to the bureaus, so your utilization reflects your most responsible spending habits.

| Factor | Weight | What it means |

|---|---|---|

| Payment history | 35% | On-time payments build trust and creditworthiness |

| Credit utilization | 30% | Lower balances improve your ratio |

| Length of credit history | 15% | Older accounts boost your score |

| New credit/inquiries | 10% | Too many new accounts can lower your score |

| Credit mix | 10% | A variety of credit types shows experience |

How Bank of America reporting affects your credit score

The information Bank of America reports each month directly affects your credit score. For personal credit, the most influential factors include payment history, credit utilization, length of credit history, new credit and inquiries, and credit mix.

Business credit bureaus consider similar factors but also weigh trade relationships, business size, and industry risk. In both cases, making on-time payments, keeping utilization low, and maintaining long-standing accounts are key to a strong credit profile.

Impact of hard inquiries

When you apply for a new Bank of America credit card or loan, the bank usually performs a hard inquiry. A hard inquiry, or hard pull, occurs when a lender reviews your credit report to make a lending decision.

This type of inquiry can temporarily lower your credit score and will appear on your credit report, visible to other lenders. Hard inquiries generally remain on your report for up to two years, though their impact fades after the first few months.

For prequalification or preapproval offers, Bank of America performs a soft inquiry instead. Soft inquiries don’t affect your score; they let the issuer evaluate creditworthiness without impacting your report. If you decide to move forward with an offer, a hard inquiry happens at that stage.

Authorized users and credit reporting

Bank of America also reports authorized users to the credit bureaus. When you add someone as an authorized user on your credit card, their information is shared with the bureaus.

The account’s activity then appears on the authorized user’s credit report, which can help them build or improve their credit history. It’s important to manage the account responsibly, as missed payments or high utilization can also negatively affect their credit. You can add or remove authorized users at any time through your Bank of America online account or mobile app.

How to monitor Bank of America's credit reporting

You can stay on top of what Bank of America reports by checking both your credit score and your credit reports regularly.

Can I find my credit score on Bank of America?

Bank of America offers free access to your personal FICO Score if you have an eligible credit card account. To find it:

- Log in to your Bank of America online banking account or mobile app

- Navigate to the FICO Score section, usually under Tools & Investing or Services

- If eligible, you’ll see your current FICO Score and the main factors affecting it

Bank of America doesn’t offer direct business credit monitoring tools, but you can track your company’s credit with Dun & Bradstreet (D&B), Experian, or Equifax. Each provides free and paid options to view your business credit profile, monitor new accounts, and track payments.

How do I get a copy of my credit report?

You can’t get a full credit report directly from Bank of America. Some banks offer access to your credit score through their portal or app, but this is different from your complete report.

You’re entitled to one free personal credit report each year from each of the three major bureaus—Experian, Equifax, and TransUnion—through AnnualCreditReport.com, the official government-authorized site. You can also purchase additional reports or enroll in monitoring to stay current on updates.

For business credit, you can request reports directly from Dun & Bradstreet, Experian, or Equifax to see how Bank of America’s reporting appears on your company’s profile.

Disputing errors in Bank of America’s reporting

If you notice incorrect information on your credit report, you can dispute it with both the credit bureaus and Bank of America:

- Contact the credit bureaus: File a dispute online or by mail. Include documentation such as payment confirmations or account statements to support your claim. The bureaus generally investigate within 30 days and notify you of the results.

- Contact Bank of America: If the issue originates with your Bank of America account, call or send a written notice to the bank. It will review your information, verify the data, and update the bureaus if corrections are needed.

- Track the results: Most disputes are resolved within 30 to 45 days. You’ll receive updated information from the bureau once any corrections are made.

Regularly checking your reports helps you spot and correct errors early, keeping your credit record accurate and up to date.

Tips for optimizing your Bank of America credit reporting

You can take a few simple steps to make sure Bank of America’s monthly updates reflect your best credit habits:

- Pay down balances before your statement closes: The balance on your statement, not your payment due date, is what’s reported to the bureaus

- Keep utilization below 30% (ideally under 10%): Lower utilization signals responsible credit use and supports a stronger score

- Avoid unnecessary new applications: Each hard inquiry can temporarily lower your score. Space out new credit requests to avoid multiple inquiries in a short period

- Review your reports regularly: Checking your credit reports each month helps you spot inaccuracies early and dispute any errors promptly

These small habits help you stay ahead of reporting cycles and maintain a healthy credit profile over time.

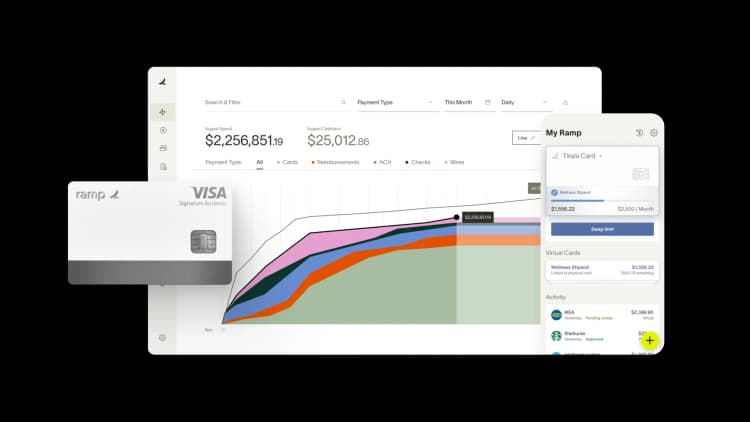

Forget credit utilization with the Ramp Business Credit Card

Traditional credit cards affect your credit score based on your credit utilization ratio. High utilization can negatively impact your credit score, making it difficult to keep it low.

Ramp offers a different model. The Ramp Business Credit Card must be paid in full each month, eliminating the concept of revolving credit balances. We don’t report your credit utilization, and your credit score isn't affected by your business spending.

This structure allows you to use your card as needed without worrying about its impact on your credit score. Our card is backed by robust spend controls, unlimited virtual cards, and real-time visibility into every transaction. You can set limits by vendor, category, or team to prevent out-of-policy spend before it happens, and automate expense submission.

Want to learn more? Explore a free interactive product demo.

Disclaimer: The information provided in this article has not been officially confirmed by Bank of America and is subject to change.

FAQs

Most banks, including Bank of America, report to the credit bureaus once per month. This usually happens on or around your statement closing date, not on a fixed day for all customers.

Bank of America uses the FICO Score, not VantageScore. Your FICO Score updates monthly and is available for free if you have an eligible Bank of America credit card.

The 2/3/4 rule is an informal guideline that limits how often you can be approved for new Bank of America credit cards: no more than two cards in two months, three in twelve months, and four in twenty-four months. Applying beyond these limits may result in automatic denial.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°