Understanding cash flow forecasting and how to accurately forecast

- Understanding a cash flow forecast

- How businesses use a cash flow forecast

- Cash flow projection methods

- How to accurately forecast cash flow in 7 steps

- Ramp helps you build sound cash flow forecasts

Cash flow forecasting

Cash flow forecasting is a financial planning method that estimates future cash inflows and outflows over a specific period, enabling businesses to maintain adequate reserves and anticipate potential shortages.

Cash flow forecasting provides businesses with estimates of future cash positions and financial needs.

Most companies create forecasts monthly or quarterly to align with their financial reporting cycles, while industries like retail and hospitality often require weekly projections during peak seasons. The frequency of forecasting typically varies based on business type and income patterns, with seasonal businesses needing more frequent updates to adapt to changing conditions.

Understanding a cash flow forecast

A cash flow forecast, or cash flow projection, uses your company’s past financial performance to predict how much money will go in and out of your business during a given period of time.

Business owners and entrepreneurs use this forecasting model to manage business manage business cash flow, strategize how and when to use their funds, and prepare for any financial troubles on the horizon. After all, a lack of funds can spell trouble for small businesses—as many of them operate with thin margins or few savings.

Cash forecasting usually takes less than an hour a month to do, but the time you invest in this practice can mean the difference between a thriving, successful company and bankruptcy.

What is cash flow?

Cash flow represents the movement of money through a business during a specific period. It encompasses all incoming funds from sales and investments alongside outgoing payments for expenses, capturing the complete financial activity of an organization.

How businesses use a cash flow forecast

Cash flow forecasts rely on data from accounts receivable and accounts payable, rather than assumptions, to understand how much money you’ll have at the end of each month. Here are a few reasons this is so important for your business’s success.

Better overview of financial health

Even the most profitable businesses run out of cash if it’s not managed properly.

For instance, consider a service-based business with Net-30 payment terms. On paper, everything may look great because there’s a healthy flow of money coming in from work performed. But because the provider may not actually get the funds in their bank account until 30 days after performing the service, they can’t use the money until then. This poses a problem if they have upcoming bills and no other means to pay.

That’s why forecasting is important—cash flow forecasts help predict how much money goes in and out of your business each month so you can prepare your finances accordingly.

Indication of potential problems

It may be impossible to predict the future, but preparing for the most likely outcomes will help prevent your business from suffering.

By measuring financial performance regularly, you’ll know ahead of time whether you’ll have enough cash to cover your expenses. This is especially important for smaller organizations—a Federal Reserve Bank study found that 17% of small businesses would have to close if they suffered even a two-month revenue loss.

Cash forecasting helps you identify cash shortages early, so you have more time to prepare for these issues.

More predictable and stable business growth

Cash flow forecasting also helps you plan for future growth opportunities. If you know you’ll have a cash flow surplus in the next few months, you can use this time to decide whether you want to save it for the future or put it towards new initiatives—such as expanding operations with a new location, hiring more employees, or investing in new products and services.

Smarter decision making

According to QuickBooks, 59% of small business owners admit to making poor business decisions due to cash flow concerns.

Consider this a problem of the past with cash flow forecasting. Rather than making assumptions about the health of your business, cash flow projections allow you to base your decisions on actual data. You’ll arm yourself with the knowledge and confidence needed to make smart choices and avoid costly mistakes.

Cash flow projection methods

Businesses use two main cash forecasting methods: the direct method and indirect method. Both have their advantages and disadvantages, so let’s take a look at each approach and when it’s best to use them.

Direct forecasting method

The direct forecasting method offers a simple way to calculate your cash flow. Just use the following formula:

Cash flow = cash you expect to receive - cash you expect to spend

If your total is positive, you’re in a good place—you’ll have more cash coming in than you’re spending. But if your total is negative, you’re spending more than you’re making, and you’ll likely need to take steps to address the discrepancy.

Indirect forecasting method

The indirect forecasting method, often used for planning and budgeting, relies on past accounting data to predict future performance. Start with your net income and work backwards, adding items like taxes and depreciation, which impact your profits but not your cash. Then subtract items like sales that have been confirmed but haven’t been paid for yet.

How to accurately forecast cash flow in 7 steps

Here, we’ll focus on how to create a 12-month forecast for your business—but the same principles apply whether you’re doing a 12-month forecast, a 13-week projection, or a mixed-period one.

Step #1. Determine the main objective

Companies use cash flow projections to support a variety of financial goals. Some of the most common ones include management of operational funds, debt repayment, and long-term growth planning.

It’s important to choose your objective first, as it determines the method you’ll use, your time horizon, and the data needed to support your forecast. So before you dive into your projections, first decide what you will use the report for and what you hope to accomplish with it.

Step #2. Decide on the forecasting period and method

Next, decide how far into the future your forecast will look. Cash flow forecasting allows you to plan several weeks or months up to a year or more in advance.

Here’s a breakdown of the most common kinds of forecasts used:

- Short-term forecasts (30 days into the future): Best for meeting immediate financial obligations and identifying cash surpluses or funding shortfalls

- Medium-term forecasts (2-6 months into the future): Best for planning and budgeting for working capital or debt repayment

- Long-term forecasts (1-5 years into the future): Best for long-term planning and investing

Your time horizon will also determine the method you’ll use to forecast your cash flow. In the previous section, we saw that the direct forecasting method is better for short-term planning while the indirect one is best for long-term planning. So if you’re looking for better visibility into your weekly cash flow, for instance, you’d choose the direct method.

Don’t forecast too far into the future

The further into the future a forecast looks, the less accurate it will be. In addition to having less data to rely on, long-term forecasts are open to unexpected changes that can drastically change your predictions. So when you push your forecast further out, expect the data to change over time as well.

Step #3. Gather the information you need

Now that you know your forecasting method and time horizon, you can gather the data needed to put together your projection. You’ll find most of this information in your bank account statements, financial statements, and your accounting software.

You’ll also want to outline your assumptions for how cash moves through your business. In particular, get clear on how long it takes for you to receive payment from customers and when your bill payments are typically due.

For example, if you use Net-30 payment terms and the majority of your customers pay you exactly 30 days after the sale, you’d make that a key assumption for your projections.

Step #4. Estimate cash inflows

You’ll then use past data to predict your cash inflows—the amount of money coming into your business.

List out how much money you expect to earn each month, broken down by type of income. You may find it helpful to use your figures from previous years as a baseline for your future earnings.

Give each month its own column at the top of your Excel spreadsheet, and each type of income its own row on the left-hand side. Although sales will likely make up the majority of your future cash inflows, don’t forget other sources of cash for your business, such as:

- Asset sales

- Tax refunds

- Licensing fees

- Government grants

Once you’ve listed out all your expected income for each month, add up the totals in each column. This is your net income.

Be realistic about your earnings

Although ambitious numbers may make you feel hopeful about the future, it’s important to record the most accurate figures possible if you want your forecasts to be useful. You don’t want to find your finances overextended because you expected to have more money coming in than you should.

Step #5. Estimate cash outflows

Next, estimate your cash outflows, or the amount of cash coming out of your business, for the upcoming months. List out each type of expense or expenditure in the same column you listed each type of income.

You’ll need to look at three different kinds of expenses: fixed expenses, variable expenses, and one-off expenses.

Fixed expenses are ones that generally stay the same from month to month. This includes rent, insurance premiums, and employee salaries. You can add these numbers to your forecast as is.

Variable expenses change each month, often as a direct result of your sales. For instance, when sales go up, you can usually expect your raw material, packaging, and shipping costs to increase as well. Refer to your financial records to see how your variable costs are affected by changes in your business, and estimate these future expenses accordingly.

It’s easy to remember the expenses you see on a monthly basis, but including your one-off and annual costs are just as important for creating accurate cash flow projections. Some of the expenses you’ll want to include are:

- Loan origination fees

- Equipment purchases

- Extra pay periods

- Annual subscription payments

- Estimated tax payments

Once you’ve noted all your expenses, add up the total expenses in each column to get your net outgoings.

Account for seasonality

Since variable costs typically depend on sales volume, it’s helpful to think about where your busy and slow periods fall throughout the year. If you tend to sell fewer products in the summer or winter, for example, your variable costs will likely be lower during these times too.

Step #6. Compile the estimates

Now that you have all the data you need, it’s time to build your forecast. Take your ending balance from last month, and use it as the opening balance for this month.

Subtract your net outgoings from your net income for the month to get your projected cash flow. Remember, if this number is positive, it indicates that you’re making more money than you’re spending. If it’s negative, you’re losing money.

Combine your projected cash flow with your opening balance to get your closing cash balance for the month. Use that figure as the following month’s opening balance, and repeat the process for the rest of the columns to complete your 12-month forecast.

Step #7. Review your projections against actual data

Your 12-month projection may be complete, but the process isn’t over just yet. For best results, review your forecast numbers against your actual data at the end of the month to see how they stack up against each other.

Were your inflow and outflow estimates accurate? If not, what needs improvement? Perhaps you underestimated the impact seasonality would have on your bottom line, or maybe a greater percentage of customers paid late compared to previous years.

Look for ways to improve the data collection and forecasting processes—with software, for example—to help ensure greater accuracy for your future projections.

Finally, extend your forecast by another month so you’ll always have a 12-month view of your future finances.

Example of a real-life cash flow forecast

Below is an example of what a 3-month forecast might look like for your business.

Note that January and March have positive cash flows, while the business can expect to see a negative cash flow of $3,000 in February.

But now that you’ve identified this, you can take steps to mitigate it. Since you’re coming into the year with a $30,500 profit, you can save some of that cash to cover the rest of your expenses in February, or purchase less inventory in January and March to make up for the deficit.

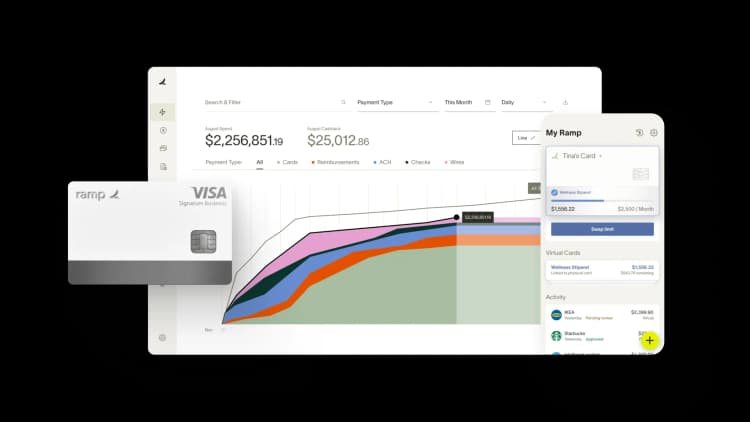

Ramp helps you build sound cash flow forecasts

Just like cash forecasting, Ramp is a practical tool that helps improve cash flow management and provides small business owners with a comprehensive view of their historical spend.

As an expense management platform, our software gives businesses insight into their past spending habits so they can develop sound projections. Its extensive integration offerings also means you’ll have all your financial data in one place—no more switching between platforms to get the figures you need for your forecast.

And beyond cash flow projections, Ramp helps companies limit spend, flag duplicate expenses, and automate expense workflows so you can maximize your profits and channel surplus funds into new growth opportunities.

Learn how our software can help you prepare for a bright financial future by taking a walkthrough of the platform today.

FAQs

Most businesses benefit from monthly updates, but the frequency depends on your industry and business cycle. Retail businesses often need weekly updates during peak seasons, while stable businesses might update quarterly. The key is maintaining a regular schedule that aligns with your financial reporting cycles.

While 100% accuracy isn't possible, aim for projections that are reliable enough to prevent cash shortages. Focus on major cash movements and maintain a buffer of at least 20-30% for unexpected expenses. Remember that according to studies, even a two-month cash shortage can threaten 17% of small businesses.

The direct method calculates simple cash in minus cash out, making it ideal for short-term planning and immediate cash management. The indirect method starts with net income and adjusts for non-cash items, making it better suited for long-term planning and budgeting decisions.

Common pitfalls include forgetting to account for payment timing (like Net-30 terms), overlooking one-time expenses and annual payments, not adjusting for seasonality in your industry, making overly optimistic revenue projections, and failing to regularly compare forecasts with actual results.

Don't miss these

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide.” ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn’t just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn’t exist in Zip. It’s made approvals much faster because decision-makers aren’t chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits

“More vendors are allowing for discounts now, because they’re seeing the quick payment. That started with Ramp—getting everyone paid on time. We’ll get a 1-2% discount for paying early. That doesn’t sound like a lot, but when you’re dealing with hundreds of millions of dollars, it does add up.”

James Hardy

CFO, SAM Construction Group