Financial performance: What it is and how to measure it

- What is financial performance?

- Key categories of financial performance metrics

- Profitability metrics

- Liquidity metrics

- Efficiency metrics

- Leverage and solvency metrics

- Understanding your financial statements

- How to use financial performance metrics effectively

- Common pitfalls in financial performance analysis

- How automation improves financial performance measurement

Financial performance shows how well your company turns revenue into profit, manages cash, and uses its assets to sustain operations over time. It’s one of the clearest signals of whether your business model is working and whether it can support growth without creating financial strain.

Strong financial performance goes beyond headline profitability. It reflects how effectively your company balances margins, liquidity, efficiency, and debt so you can make informed decisions and stay resilient as conditions change.

What is financial performance?

Financial performance is a measure of how effectively your company generates profit, manages expenses, and uses its assets over time. It reflects whether your business can sustain operations, meet obligations, and support long-term growth.

You evaluate financial performance by analyzing three core financial statements: the income statement, balance sheet, and cash flow statement. From those statements, you calculate ratios and metrics that show how your company is performing from the perspective of investors, lenders, and internal stakeholders.

Rather than focusing on a single number, financial performance looks at how multiple indicators work together. Revenue trends, margins, cash availability, and debt levels all contribute to a clearer picture of your company’s financial health.

Why measuring financial performance matters

Regular measurement replaces guesswork with data. When you understand how your company is performing financially, you can make decisions with confidence instead of reacting to problems after they surface.

Measuring your financial performance enables you to:

- Build credibility with stakeholders: Investors and lenders rely on financial metrics to assess risk, returns, and creditworthiness. Clear performance data makes it easier to secure funding and maintain trust.

- Support better decision-making: Tracking performance over time helps you spot trends, evaluate tradeoffs, and understand the financial impact of strategic choices

- Benchmark against peers: Comparing your metrics to past periods and industry standards shows where you’re outperforming competitors and where improvement is needed

Key categories of financial performance metrics

Financial performance metrics fall into several categories, each highlighting a different aspect of your company’s financial health. Looking at multiple categories together helps you avoid blind spots, such as strong profits paired with weak cash flow or healthy liquidity paired with excessive debt.

Rather than tracking every possible metric, start by understanding what each category is designed to measure and the kinds of questions it helps answer.

| Category | What it measures | Key questions it helps answer |

|---|---|---|

| Profitability | How effectively your company turns revenue into profit | Is the business model sustainable? Are margins improving or shrinking? |

| Liquidity | Your ability to meet short-term obligations | Can you pay bills on time? Do you have enough cash flexibility? |

| Efficiency | How well you use assets and working capital | Are resources being used productively? Where are bottlenecks? |

| Leverage | Your reliance on debt and ability to service it | How much financial risk are you taking on? Can you handle downturns? |

| Valuation | How the market assesses your company’s worth | How do investors price the business relative to earnings or growth? |

No single category tells the full story. A profitable company can still struggle if cash is tied up in receivables, while a highly liquid business may be underperforming if assets aren’t generating returns.

Profitability metrics

Profitability metrics show how effectively your company converts revenue into profit. They’re often the first numbers investors and lenders look at because they indicate how sustainable your business model is over time.

Rather than focusing on a single margin, it’s more useful to look at profitability from multiple angles. Each metric below highlights a different part of how profit is generated.

Gross profit margin

Gross profit margin shows how much revenue remains after covering direct production costs, also known as cost of goods sold (COGS). It’s a useful indicator of pricing power and cost control.

Formula:

Gross profit margin = (Revenue – COGS) / Revenue * 100

A higher gross margin gives you more room to cover operating expenses and invest in growth. Because margins vary widely by industry, comparisons are most meaningful when made against similar businesses.

Net profit margin

Net profit margin measures how much revenue turns into actual profit after all expenses, including operating costs, interest, and taxes. It’s the clearest view of overall profitability.

Formula:

Net profit margin = Net income / Revenue * 100

If revenue is growing but net margin is shrinking, expenses may be rising faster than sales. This often happens during expansion, when companies invest heavily in hiring or marketing.

Return on investment (ROI)

Return on investment measures the gain or loss from an investment relative to its cost. You can use it to evaluate marketing campaigns, capital purchases, or major strategic initiatives.

Formula:

Return on investment (ROI) = (Gain from investment – Cost of investment) / Cost of investment * 100

ROI makes it easier to compare different opportunities, but it doesn’t account for time. When evaluating long-term investments, consider how quickly returns are generated.

Return on equity (ROE)

Return on equity shows how efficiently your company uses shareholder capital to generate profit. Investors often rely on this metric to compare companies within the same industry.

Formula:

Return on equity (ROE) = Net income / Average shareholders’ equity * 100

A consistently high ROE can signal strong management performance, but unusually high values may also reflect heavy use of debt.

Return on assets (ROA)

Return on assets measures how effectively your company uses its total asset base to generate profit. It’s especially helpful when comparing businesses with different capital structures.

Formula:

Return on assets (ROA) = Net income / Average total assets * 100

Asset-heavy industries, such as manufacturing, typically have lower ROA than asset-light businesses like professional services. Trends over time are often more informative than a single-period result.

Liquidity metrics

Liquidity metrics measure your ability to meet short-term obligations without disrupting operations. Even profitable companies can run into trouble if they don’t have enough accessible cash to cover payroll, vendor payments, or debt coming due. These liquidity ratios help you understand how much financial flexibility you actually have.

Current ratio

The current ratio compares current assets, such as cash, accounts receivable, and inventory, to current liabilities like payables and short-term debt. It answers a straightforward question: can you cover what you owe in the next year?

Formula:

Current ratio = Current assets / Current liabilities

A ratio below 1.0 is often a warning sign. Many businesses aim for a range between 1.5 and 2.0, though what’s considered healthy depends on your industry and operating model.

Quick ratio

The quick ratio, sometimes called the acid-test ratio, is a more conservative liquidity measure. It excludes inventory because inventory can be slow or uncertain to convert into cash.

Formula:

Quick ratio = (Current assets – Inventory) / Current liabilities

This metric is especially useful for companies with long inventory cycles. For businesses that don’t carry inventory, such as software companies, the quick ratio and current ratio will be nearly identical.

Operating cash flow

Operating cash flow shows how much cash your core business activities generate. Unlike profit, it reflects actual cash moving in and out of the business.

Consistently positive operating cash flow indicates that your company can sustain itself without relying on external financing. Ongoing negative cash flow without a clear plan to reverse it is a serious risk.

Working capital

Working capital represents the funds available for day-to-day operations.

Formula:

Working capital = Current assets – Current liabilities

Positive working capital generally means you can meet short-term obligations, while negative working capital signals potential liquidity stress. Excessively high working capital, however, may suggest that cash isn’t being reinvested effectively.

Efficiency metrics

Efficiency metrics, often called turnover ratios, show how well your company uses its assets and working capital to generate revenue. Improving efficiency allows you to grow without taking on additional costs or capital. These metrics are especially useful for identifying operational friction, such as slow collections or underused assets.

Asset turnover ratio

The asset turnover ratio measures how effectively your company uses its total assets to generate sales. Higher turnover generally indicates more efficient use of resources.

Formula:

Asset turnover ratio = Revenue / Average total assets

A ratio of 2.0 means you generate $2 in revenue for every $1 invested in assets. Asset-light businesses typically post higher ratios than capital-intensive ones, so comparisons are most useful within the same industry.

Inventory turnover

Inventory turnover shows how many times inventory is sold and replaced during a given period. It’s a critical metric for retail, wholesale, and manufacturing businesses.

Formula:

Inventory turnover = Cost of goods sold / Average inventory

Higher turnover can signal strong demand or effective inventory management. Lower turnover may indicate overstocking, obsolete products, or slowing sales, all of which can tie up cash unnecessarily.

Accounts receivable turnover

Accounts receivable turnover measures how quickly customers pay what they owe. Faster collections improve cash flow and reduce the risk of bad debts.

Formula:

Accounts receivable turnover = Net credit sales / Average accounts receivable

If this ratio declines over time, customers may be taking longer to pay, or your collection process may need attention. Both can strain liquidity even when revenue appears strong.

Leverage and solvency metrics

Leverage and solvency metrics assess how much debt your company uses and how well it can meet long-term financial obligations. Some leverage can support growth, but excessive debt limits flexibility and increases risk during downturns.

These metrics are closely watched by lenders, investors, and boards because they indicate how resilient your balance sheet is under pressure.

Debt-to-equity ratio

The debt-to-equity ratio compares total liabilities to shareholders’ equity. It shows how much of your company is financed through debt versus owner or investor capital.

Formula:

Debt-to-equity ratio = Total liabilities / Shareholders’ equity

A ratio of 1.0 indicates an equal mix of debt and equity. Ratios above 2.0 often raise concerns for lenders, although acceptable levels vary by industry and growth stage.

Interest coverage ratio

The interest coverage ratio measures your ability to pay interest expenses from operating earnings. It’s a key indicator of whether debt obligations are manageable.

Formula:

Interest coverage ratio = EBIT / Interest expense

EBIT represents earnings before interest and taxes. A ratio below 1.5 suggests limited margin for error, while most lenders prefer to see coverage of 2.0 or higher.

Understanding your financial statements

Financial statements provide the raw data behind every financial performance metric. When reviewed together, they show how your company earns money, where it spends it, and how cash moves through the business.

Each statement highlights a different aspect of financial performance.

The balance sheet

The balance sheet shows what your company owns, what it owes, and the remaining value attributable to owners at a specific point in time. It forms the basis for liquidity, leverage, and solvency analysis.

Because assets must always equal liabilities plus equity, changes over time can reveal growing debt, improving liquidity, or shifts in capital structure.

The income statement

The income statement tracks revenue and expenses over a defined period, showing whether operations resulted in a profit or loss. It’s the primary source for profitability metrics such as margins, ROA, and ROE.

Because it reflects performance over time rather than a single moment, the income statement is especially useful for spotting trends in revenue growth and cost control.

The cash flow statement

The cash flow statement reconciles net income with actual changes in cash. It explains why a profitable company may still experience cash pressure.

It’s divided into three sections:

- Operating activities: Cash generated by core business operations

- Investing activities: Cash used for or generated by asset purchases and sales

- Financing activities: Cash from borrowing, debt repayment, or equity transactions

Reviewing cash flow alongside the income statement helps you distinguish between accounting profit and true liquidity.

How to use financial performance metrics effectively

Tracking financial performance metrics is only useful if you apply them consistently and tie them to real decisions. Start by focusing on the metrics that best reflect how your business actually operates, rather than trying to monitor everything at once.

Set benchmarks using your own historical data and relevant industry comparisons. Review metrics on a regular cadence so you can spot trends early and adjust before small issues turn into larger problems.

| Business type | Priority metrics |

|---|---|

| SaaS and software | Gross margin, customer acquisition cost, recurring revenue |

| Retail | Inventory turnover, gross margin, same-store sales growth |

| Manufacturing | Asset turnover, operating margin, inventory days |

| Professional services | Revenue per employee, utilization rate, net profit margin |

Some metrics, such as operating cash flow, benefit from weekly review. Others, including asset turnover or ROA, are better evaluated quarterly. The key is consistency and context, not frequency for its own sake.

Common pitfalls in financial performance analysis

Even well-chosen metrics can lead to bad decisions if they’re used in isolation or without proper context. These are some of the most common mistakes teams make when evaluating financial performance.

Focusing on a single metric

- Problem: No single metric captures your full financial picture. Strong margins can mask cash flow issues, and high liquidity can hide weak profitability

- Why it matters: Decisions based on one number increase the risk of overlooking structural problems

- Better approach: Evaluate a balanced set of metrics across profitability, liquidity, efficiency, and leverage

Ignoring industry context

- Problem: Financial benchmarks vary widely by industry and business model

- Why it matters: A ratio that looks healthy in one sector may be weak in another

- Better approach: Compare performance against peers of similar size, structure, and market dynamics

Overlooking trends

- Problem: Single-period results can be distorted by seasonality or one-time events

- Why it matters: Short-term snapshots don’t show whether performance is improving or deteriorating

- Better approach: Review metrics across multiple periods to identify meaningful trends

Neglecting qualitative factors

- Problem: Financial metrics don’t capture everything that affects performance

- Why it matters: Leadership quality, competitive positioning, and market conditions influence results but don’t appear in financial statements

- Better approach: Combine quantitative analysis with qualitative judgment for a more complete assessment

How automation improves financial performance measurement

Manual financial processes slow down performance measurement and make it harder to act on what the numbers are telling you. When data is delayed or error-prone, even well-chosen metrics lose their value.

Automation improves financial performance measurement by making data more timely and reliable. Transactions are captured as they happen, reducing the lag between activity and insight and giving you a clearer view of cash flow, spending patterns, and emerging risks.

Finance automation also reduces errors by eliminating manual data entry and enforcing consistent categorization across accounts. That consistency matters when you’re tracking trends over time or comparing performance across periods.

Faster close cycles are another advantage. Teams that automate can close their books in days instead of weeks, which allows leaders to review performance while there’s still time to adjust course.

Consider a company processing 500 vendor invoices each month. Manual processing can take more than 125 hours. Automation can reduce that to under 17 hours, freeing up time for analysis and decision-making instead of administrative work.

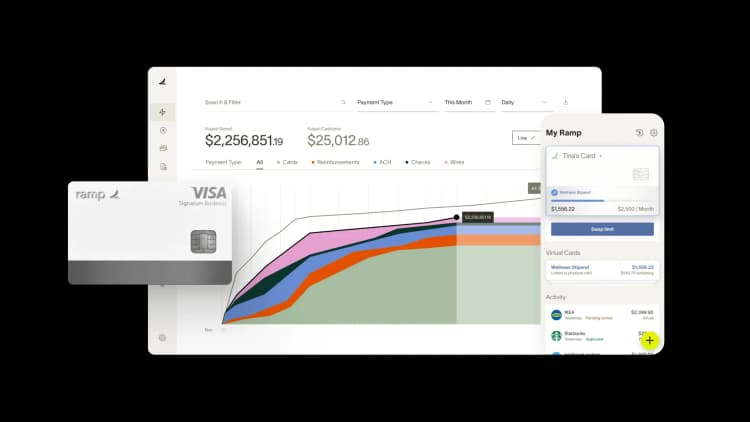

Turn insights into impact with Ramp

Manual financial reporting quickly becomes inefficient. Time spent collecting data and building spreadsheets represents hours you could use to thoughtfully analyze results. Ramp's real-time reporting eliminates lag by giving you instant visibility into financial performance across every part of your business.

With Ramp's live dashboards, you can monitor spending, cash flow, and profitability, and quickly respond to any potential issues. That clarity helps you spot trends early, adjust budgets with confidence, and strengthen your company’s financial health before small issues become bigger ones.

Better insight leads to faster action. Try an interactive demo to see Ramp's reporting capabilities in action.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°