Cash flow statement: What it is, components, and example

- What is a cash flow statement?

- 3 components of a cash flow statement

- How to calculate cash flow: Indirect vs. direct

- How to prepare a cash flow statement

- How to interpret your cash flow statement

- Automate cash flow statements with Ramp's AI-powered categorization

Even healthy businesses can struggle with cash timing issues, from delayed customer payments to sudden expenses. Without reliable cash visibility, it’s difficult to stay ahead of upcoming obligations or know when to invest.

A cash flow statement helps you monitor cash patterns and anticipate needs before they become problems. Used consistently, it strengthens financial planning and supports smoother, more predictable operations.

Get Ramp's Free Cash Flow Statement Template

What is a cash flow statement?

A cash flow statement shows how much cash moves into and out of your business during a set period. It helps you understand whether you can cover expenses, invest in growth, and manage day-to-day operations without relying on external funding.

Company leaders, lenders, investors, and auditors use cash flow statements to assess financial health and risk. Because it’s a required financial report under ASC 230 and IAS 7, the statement also ensures your accounting practices follow established reporting standards.

Beyond compliance, a cash flow statement gives you visibility into future cash positions, upcoming funding needs, and the timing of major purchases or payments. Clear insight into cash movement helps you plan more confidently and support long-term financial stability.

Cash flow statement vs. income statement vs. balance sheet

A cash flow statement tracks actual cash movement, while income statements and balance sheets report broader financial performance and position. Together, these statements give you a complete view of profitability, liquidity, and net worth.

A balance sheet shows what your company owns and owes on a specific date. An income statement focuses on revenue, expenses, and profit over a period. A cash flow statement isolates cash activity, excluding non-cash items like depreciation or accrued revenue.

Use the three statements together to understand where cash is going, how profitable the business is, and whether your resources are being used efficiently.

| Feature | Cash flow statement | Balance sheet | Income statement |

|---|---|---|---|

| Purpose | Shows cash coming into and out of your business | Shows company’s financial position | Shows company’s profits |

| Focus | Cash | Assets, liability, and equity | Revenue, expenses, and profits/losses |

| Measures | Liquidity and cash at hand | Net worth | Profitability |

| Time frame | A defined period (month, quarter, year, etc.) | Specific date (e.g., June 30, 2025) | A defined period (month, quarter, year, etc.) |

| Primary question answered | “Where did my cash come from, and where did it go?” | “What do we own, what do we owe, and what is our net worth?” | “Did we make money during this period?” |

3 components of a cash flow statement

A cash flow statement groups cash activity into operating, investing, and financing categories. These sections show whether cash came from core operations, long-term investments, or funding sources like loans or equity.

Understanding each component helps you see how daily operations, strategic investments, and financing decisions affect your cash position.

Cash flow from operating activities

Operating activities capture the cash generated or used by your daily business operations. This includes cash received from customers and cash paid to suppliers, employees, and service providers. It may also include interest and tax payments depending on your accounting approach.

Examples of operating cash inflows include customer payments. Cash outflows include payments for inventory, salaries, rent, and utilities. This section matters because it shows whether your core business can sustain itself without relying on outside financing.

Cash flow from investing activities

Investing activities show how you use cash to acquire or sell long-term assets. Common cash outflows include spending on property, equipment, or other capital investments. Inflows often come from selling assets or investments.

These activities help you understand whether the business is reinvesting for future growth or divesting to generate cash. A negative investing number isn’t necessarily bad; many growing companies consistently invest in equipment or infrastructure.

Cash flow from financing activities

Financing activities reflect how your company raises and repays capital. Inflows come from issuing stock or taking on new loans, while outflows include dividend payments, loan repayments, and share repurchases.

This section shows how you fund the business and helps stakeholders understand your approach to debt and equity. Strong financing cash flow can support expansion, while negative financing cash flow might indicate debt repayment or reduced use of external capital.

Cash flow from financing activities

Financing cash flow reflects cash transactions that affect a company’s equity and borrowings. It includes cash received from issuing stocks or bonds, cash paid out as dividends, and cash used to repay debts or repurchase shares.

If your company raises cash by issuing new shares or taking out a loan, you’d put these under financing activities. Paying dividends to shareholders or repaying a loan are cash outflows. This section of the cash flow statement provides insight into how a company funds its operations and growth through external sources of capital.

Cash flow statement example

Cash flow statements might have slight variations among companies, but the three major components will remain the same. Here’s an example of a cash flow statement:

Get Ramp's cash flow statement template to streamline your financial tracking.

How to calculate cash flow: Indirect vs. direct

You can calculate cash flow using either the direct or indirect method. Both approaches are accepted under U.S. GAAP, and both should result in the same net cash flow from operating activities when applied correctly.

The direct method subtracts the cash you used for expenses from the cash you received from customers. It requires detailed records of cash receipts and payments, so it’s more time-consuming for most companies. The indirect method starts with your net income and adjusts for non-cash items and changes in working capital, making it easier to prepare from existing financial statements.

Indirect method

The indirect method starts with net income from the income statement and adjusts it to convert accrual-basis profit into operating cash flow. This requires adjusting for non-cash expenses such as depreciation and amortization and for changes in working capital accounts like accounts receivable, inventory, and accounts payable.

These adjustments help isolate the actual cash generated by your core operations. The indirect method is widely used because it draws directly from your existing balance sheet and income statement.

Example of indirect method

You’ll calculate operating, investing, and financing cash flows, then reconcile them to your beginning cash balance or net income.

- Net income: $50,000

- Operational cash flow: $110,000

- Investing cash flow: –$20,000

- Financing cash flow: $15,000

Here's what the calculation looks like:

- Total cash flow = Net income + Operational cash flow – Investing cash flow + Financing cash flow

- Total cash flow = $50,000 + $110,000 – $20,000 + $15,000 = $155,000

Direct method

The direct method lists all cash receipts and cash payments from operating activities. This includes cash received from customers and cash paid to suppliers and employees.

While the direct method provides more detail on cash transactions, it requires tracking each cash inflow and outflow individually. Companies with higher transaction volume often prefer the indirect method because it’s faster to prepare with existing documents.

Example of direct method

Start with your cash inflows from customers and subtract cash used for expenses.

- Cash received from customers/sales: $200,000

- Cash paid to suppliers: –$80,000

- Cash paid to employees: –$50,000

- Cash paid for operating expenses: –$20,000

The calculation would look like this:

- Cash flow from operational activities = Cash received from customers – Cash paid for expenditures

- Cash flow from operational activities = $200,000 – $150,000 = $50,000

How to prepare a cash flow statement

Preparing a cash flow statement starts with gathering accurate financial records, selecting your calculation method, and organizing cash activity into operating, investing, and financing categories. The goal is to reconcile the change in cash over the period with your beginning and ending cash balances.

Clear categorization and up-to-date documents make the process faster and help reduce errors, especially if you're using automated tools to manage transactions and reconciliations.

Step 1: Gather your financial documents

Collect the documents you’ll need based on the method you plan to use. For the direct method, this typically includes bank statements, sales receipts, payroll records, and tax documents. For the indirect method, you’ll also need your income statement, balance sheet, and working capital accounts.

Step 2: Determine the starting cash balance

Identify the cash balance at the start of the reporting period. You can find this figure on your balance sheet under cash and cash equivalents. This number serves as the baseline for calculating changes in cash over the period.

Step 3: Calculate cash flow from operating activities

Use either the direct or indirect method to calculate operating cash flow. This involves accounting for cash received from customers and cash paid for expenses such as salaries, rent, inventory, and utilities. If you’re using the indirect method, adjust net income for non-cash expenses and changes in working capital.

Step 4: Calculate cash flow from investing activities

Record cash activity involving long-term assets and investments. This includes cash used to purchase equipment or property and cash received from selling assets. Categorizing these transactions correctly helps distinguish between operational spending and long-term investment activity.

Step 5: Calculate cash flow from financing activities

Summarize cash flows related to funding the business. Include inflows from issuing stock or taking on new loans and outflows for dividend payments, loan repayments, or repurchasing shares. This section shows how capital structure decisions impact your cash position.

Step 6: Compute the ending cash balance

Add the net cash flows from operating, investing, and financing activities to your starting cash balance. The ending cash balance should match the cash and cash equivalents on your period-end balance sheet. If it doesn’t, revisit each category to ensure all transactions are recorded accurately.

How to interpret your cash flow statement

While a cash flow statement tracks cash movement, analyzing key metrics and trends can offer valuable business insights and cash flow projections. Understanding your cash flow through regular cash flow analysis helps you make strategic decisions, such as timing major purchases, adjusting credit terms, or exploring opportunities for growth.

Key cash flow metrics and ratios

The following metrics help you evaluate how efficiently your business generates and uses cash:

- Free cash flow: Cash remaining after operating expenses and capital expenditures; a strong free cash flow position suggests you can fund growth and repay debt

- Operating cash flow ratio: Measures whether operating cash flow can cover short-term liabilities; a high ratio indicates stronger liquidity

- Cash flow margin: Shows how effectively revenue converts to cash; a low margin may signal that sales aren’t translating into cash inflows

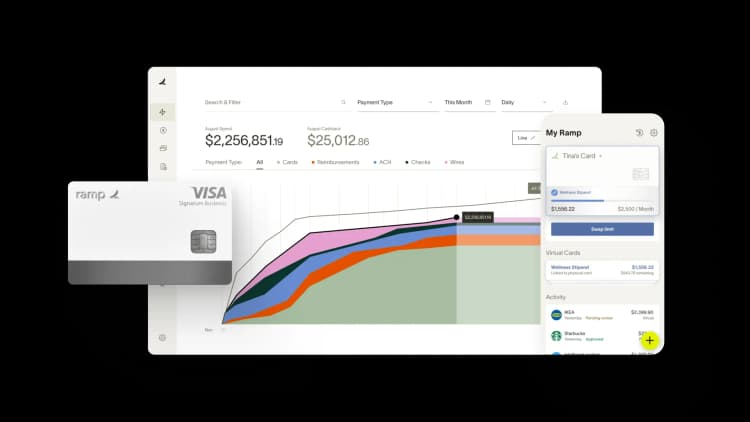

Automate cash flow statements with Ramp's AI-powered categorization

Manual cash flow preparation is time-consuming and error-prone. You're chasing receipts, categorizing transactions by hand, and reconciling data across multiple systems, all while trying to close your books on time. Ramp's accounting automation software eliminates this busywork by automating transaction coding, syncing, and categorization so your cash flow data is always accurate and audit-ready.

Ramp codes every transaction in real time using AI that learns your accounting patterns and applies the right categories across all required fields. When you make corrections, Ramp incorporates your feedback to improve future coding accuracy, delivering a 67% increase in zero-touch codings compared to rules-only automation. This means fewer manual adjustments and more time focused on analysis instead of data entry.

Here's how Ramp streamlines cash flow preparation:

- Real-time transaction coding: AI categorizes spend as it happens, so your cash flow data is always current and ready for reporting

- Automated receipt matching: Ramp collects and matches receipts to transactions automatically, eliminating 16+ hours of manual work every month

- Smart sync to your ERP: Ramp identifies in-policy transactions and syncs them to your accounting system automatically, reducing manual entry and reconciliation time

- Accrual automation: Post and reverse accruals automatically so all cash movements land in the right period without manual intervention

Try a demo to see how Ramp helps finance teams close their books 3x faster.

FAQs

Cash includes cash on hand and demand deposits. Cash flow statements also include cash equivalents, which are short-term, highly liquid investments that can be converted to cash quickly and aren’t likely to change in value before maturity.

Cash flow reflects the movement of cash into and out of your business and is reported on your statement of cash flows. Free cash flow is a calculation analysts use to measure how much cash is left after covering operating expenses and capital expenditures, and it helps assess your company’s financial flexibility.

Net income is based on accrual accounting and includes non-cash items. Operating cash flow adjusts net income to reflect the cash actually generated from core operations, giving you a clearer picture of liquidity and day-to-day financial strength.

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide.” ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn’t just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn’t exist in Zip. It’s made approvals much faster because decision-makers aren’t chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits

“More vendors are allowing for discounts now, because they’re seeing the quick payment. That started with Ramp—getting everyone paid on time. We’ll get a 1-2% discount for paying early. That doesn’t sound like a lot, but when you’re dealing with hundreds of millions of dollars, it does add up.”

James Hardy

CFO, SAM Construction Group