How to do a cash flow analysis: Methods and best practices

- What is cash flow analysis, and why is it important?

- Types of cash flow in a statement

- Direct vs. indirect cash flow methods

- Step-by-step cash flow statement analysis

- Key ratios for evaluating cash flows

- How to improve and forecast cash flow

- Automating cash flow analysis

- Get cash flow analysis with Ramp

Cash flow analysis shows how money moves in and out of your business to reveal your true financial position. Unlike accounting profit, it focuses on liquidity—whether you have enough cash to pay bills, invest in growth, and handle surprises.

For finance teams managing complex operations, cash flow analysis turns scattered transaction data into visibility on liquidity and runway. It helps you spot cash crunches before they happen, time investments more effectively, and avoid emergency borrowing that disrupts plans.

What is cash flow analysis, and why is it important?

Cash flow analysis measures how cash moves through your business over a specific period, demonstrating real liquidity and solvency. It highlights how much cash you actually have to run operations, rather than profits that might still be tied up in accounts receivable (AR) or inventory.

This analysis is critical for ensuring you can meet short-term obligations like payroll, supplier payments, and taxes. Without clear visibility into cash movements, even profitable companies can struggle to cover basic expenses.

Cash flow analysis also enables better investment and financing decisions by revealing when you'll have excess cash for growth initiatives or when you'll need additional funding. This helps you avoid cash shortages and emergency borrowing that often come with unfavorable terms and high interest rates.

Consistent and accurate cash flow analysis provides clear visibility into working capital, funding needs, and runway. You'll understand exactly how operational changes impact liquidity and can make data-driven decisions about everything from payment terms to capital expenditures.

Types of cash flow in a statement

All cash movements fall into three categories that help you understand where money comes from and where it goes:

- Operating activities cover day-to-day cash movements from core operations like receivables, supplier payments, and payroll

- Investing activities include cash related to long-term assets such as equipment purchases, property sales, and acquisitions

- Financing activities cover cash flowing to and from capital providers, including debt, equity, dividends, and repayments

Your cash flow statement should list each category separately to give you a clear picture of how money moves in and out of your business.

Operating activities

Operating activities generate cash flows from your core business operations. Customer payments represent your primary cash inflow, while refunds and chargebacks reduce available cash. On the outflow side, you'll track vendor payments for inventory and services, along with payroll, benefits, and taxes.

Working capital movements significantly impact operating cash flow through changes in AR, inventory, and accounts payable (AP). When receivables increase, you're essentially extending credit to customers, which reduces cash even if sales are strong. Similarly, inventory buildups tie up cash, while increases in payables temporarily preserve it.

Investing activities

Investing activities reflect cash flows related to long-term assets and investments that support future operations. Purchases of equipment, vehicles, and technology represent cash outflows as you invest in operational capacity.

Business acquisitions or divestitures often represent the largest investing cash flows, fundamentally changing your asset base and operational footprint. You'll also track capitalized development costs that improve long-term value and any inflows from asset disposals when you sell or retire equipment.

Financing activities

Financing activities capture cash flows from external funding sources and changes to your capital structure. Proceeds from loans and bond issuances provide cash inflows when you need additional capital for growth or operations. Equity investments and capital contributions from owners or investors also boost available cash.

On the outflow side, dividend payments and share buybacks return cash to shareholders, while repayments of debt and lease liabilities reduce your outstanding obligations. These activities directly impact your leverage ratios and cost of capital, making them critical for long-term financial planning.

Direct vs. indirect cash flow methods

There are two approaches to calculating operating cash flow, each with distinct advantages depending on your data availability and reporting needs: the direct method and the indirect method.

- Direct method: Lists gross cash receipts and cash payments by category, showing exactly how much cash you collected from customers and paid to suppliers or employees. This approach requires detailed cash transaction records and disbursement schedules from your accounting system.

- Indirect method: Starts with net income and adjusts for non-cash items like depreciation, amortization, and stock compensation, plus working capital changes. You'll need just your income statement and balance sheet—no granular transaction logs required.

Most companies use the indirect method because it's simpler to prepare from existing financial statements and aligns with GAAP and IFRS presentation norms. The reconciliation from net income to cash flow also helps stakeholders understand the relationship between profitability and liquidity.

When to use the direct method

The direct method works best for detailed cash tracking and transparency, showing exactly where cash comes from and where it goes. You'll see specific line items for cash received from customers, cash paid to suppliers, and cash paid for operating expenses.

This approach requires comprehensive, accurate transaction-level records and robust system integrations to capture all cash movements. Your accounting system must track cash receipts and disbursements at a granular level, which can be challenging for companies with high transaction volumes.

Despite the additional effort, the direct method provides clearer visibility into cash drivers for operational decision-making and controls. You can quickly identify which customer segments generate the most cash or which expense categories consume the most liquidity.

When to use the indirect method

The indirect method begins with net income and adjusts for non-cash items and working capital changes to arrive at operating cash flow. This reconciliation approach helps you understand how accrual-based profits translate into actual cash generation.

It's easier and faster to prepare using standard financial statements with minimal additional data preparation. You don't need detailed cash transaction logs—just your income statement, balance sheet, and a few supplementary schedules for non-cash items.

The indirect method is more commonly accepted in practice and often preferred for external reporting. Investors and lenders are familiar with this format, making it easier to compare your performance against industry benchmarks and competitors.

Step-by-step cash flow statement analysis

A clear process helps you analyze cash flow accurately and make decisions based on real liquidity, not assumptions:

Step 1: Collect source data

Start by gathering bank statements, general ledger exports, income statements, balance sheets, AP/AR aging reports, and transaction records for your analysis period. Having complete, accurate source data is essential for meaningful analysis.

Reconcile bank balances to the general ledger to ensure completeness and correct cutoffs. Resolve any discrepancies between your books and bank records before proceeding with the analysis.

Validate large or unusual transactions by reviewing supporting documentation and confirm foreign exchange rates where applicable. This validation prevents errors from distorting your cash flow picture.

2. Categorize transactions

Sort each cash movement into operating, investing, or financing categories based on its nature and purpose. Operating activities include customer receipts, vendor payments, payroll, and taxes—the regular flows from running your business.

Investing activities cover capital expenditures, asset purchases and sales, and acquisitions that affect your long-term asset base. Financing activities encompass debt and equity inflows, dividends, principal repayments, and lease liabilities that change your capital structure.

Use consistent classification criteria across periods and document judgment calls for transactions that could fit multiple categories. This consistency ensures your analysis remains comparable over time.

3. Adjust for non-cash items

Remove non-cash expenses like depreciation, amortization, and stock-based compensation from operating activities when using the indirect method. These expenses reduce net income but don't actually consume cash.

Adjust for working capital changes by following these rules:

- Increases in AR subtract from operating cash (you've earned revenue but haven't collected cash)

- Decreases in AR add to operating cash (you've collected on previous sales)

- Increases in inventory subtract from cash (you've paid for goods not yet sold)

- Decreases in inventory add to cash (you've sold previously purchased goods)

- Increases in AP and accruals add to cash (you've delayed payment)

- Decreases in AP and accruals subtract from cash (you've paid down obligations)

Exclude non-cash accruals and reclassify any misposted items to ensure your adjustments accurately reflect cash movements.

4. Determine net cash flow

Sum the net cash from operating, investing, and financing activities to calculate total net cash flow for the period. This figure represents the actual change in your cash position.

Reconcile your calculation by confirming that beginning cash plus net cash flow equals ending cash, including any restricted cash balances. This reconciliation proves your analysis captures all cash movements.

Investigate and resolve any reconciliation differences immediately. Even small discrepancies can indicate classification errors or missing transactions that could distort your analysis.

5. Compare numbers period over period

Review quarter-over-quarter and year-over-year trends to understand how your cash generation evolves. Look for patterns in operating cash flow that indicate improving or deteriorating business fundamentals.

Identify seasonal patterns, growth-related cash needs, and the sustainability of your operating cash flow. Understanding these patterns helps you anticipate future cash requirements and plan accordingly.

Track specific drivers, including pricing changes, DSO/DPO shifts, capital expenditure cadence, and debt service requirements, and benchmark your performance against internal targets and industry norms.

Key ratios for evaluating cash flows

Use these cash flow metrics to assess cash health and liquidity, providing quantitative measures of your company's ability to generate and manage cash.

- Operating cash flow ratio: Measures your ability to cover short-term obligations with cash generated from operations. Calculate it by dividing operating cash flow by current liabilities. A ratio greater than 1.0 suggests stronger short-term liquidity.

- Free cash flow margin: Reveals how efficiently you convert revenue into discretionary cash after covering operating needs and maintenance capital. Calculate it by subtracting capital expenditures from operating cash flow and dividing by revenue. Higher margins indicate greater capacity to fund growth, pay down debt, or return capital to shareholders.

- Cash conversion cycle: Measures how long it takes to convert investments in inventory and receivables back into cash. Calculate it as days sales outstanding (DSO) plus days inventory outstanding minus days payables outstanding (DPO). Shorter cycles improve working capital efficiency and reduce funding needs by accelerating cash recovery.

How to improve and forecast cash flow

Optimizing cash flow requires improving collections, controlling spending, and planning for multiple scenarios. These strategies help maintain liquidity and prepare your business for growth or uncertainty.

1. Shorten receivables cycles

Invoice immediately after delivery or project milestones, and use clear payment terms that include late-payment penalties. Fast invoicing starts the collection clock sooner and reinforces customer expectations.

Offer early-payment discounts to select, high-value customers or during cash-constrained periods. Accept multiple payment methods, such as ACH transfer, wire, and credit card, to remove friction from the process.

Automate reminders and dunning sequences to reduce DSO. Consistent follow-up improves cash flow without damaging customer relationships.

2. Slow nonessential outflows

Negotiate longer payment terms with reliable suppliers who value your business relationship. Align payment runs with cash inflows to smooth timing and prevent crunches.

Review all vendor and subscription costs regularly to identify savings or deferrals, and postpone non-critical capital expenditures when liquidity is tight. Every dollar you delay spending improves short-term flexibility.

3. Run scenario-based forecasts

Build both 13-week rolling forecasts for near-term liquidity and 12–18-month forecasts for strategic planning. Short-term forecasts help manage operational cash, while long-term views guide financing decisions.

Model best-, base-, and worst-case scenarios by adjusting key drivers like sales volume, gross margin, DSO, and capital expenditure timing. Use these models to stress-test debt covenants and liquidity thresholds, ensuring you have contingency plans ready.

Scenario planning turns uncertainty into actionable insight. When conditions shift, you’ll already know which levers to pull to maintain stability.

Automating cash flow analysis

Automation eliminates manual reconciliation, reduces errors, and delivers faster visibility into your cash position. Integrated tools help finance teams shift from backward-looking reports to real-time decision-making.

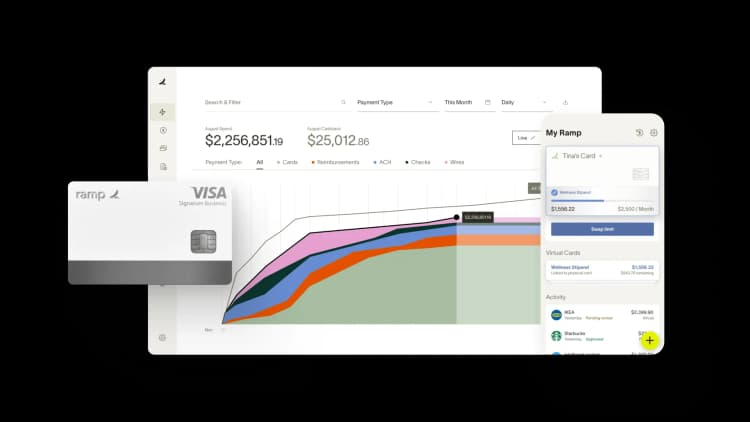

Comprehensive finance operations platforms like Ramp integrate expense management, corporate cards, and accounts payable to centralize spend data and automate reconciliation. This unified approach gives finance teams real-time visibility into every cash movement and greater confidence in liquidity decisions.

Automation enables continuous cash flow management. When your systems handle the heavy lifting, finance teams can focus on insights that improve liquidity and growth.

| Automation feature | What it does | How it improves cash flow analysis |

|---|---|---|

| Bank and ERP integrations | Connect bank accounts, credit cards, and ERP or general ledger systems for real-time data synchronization. Standardize your chart of accounts to ensure consistent categorization and eliminate manual uploads. | Keeps your data current and reconciled automatically, saving hours each month and improving accuracy in every report |

| Real-time dashboards | Consolidate data from AP, AR, and expense systems to show cash position, runway, and variances against forecast. Allow drill-down into accounts receivable aging, accounts payable pipelines, and capital expenditure trends. | Provides instant visibility into key drivers of liquidity so you can act on issues before they affect operations |

| Alerts and approval workflows | Automate notifications for low balances, forecast variances, or large unapproved transactions. Route spending approvals by policy to maintain control without slowing operations. | Prevents surprises and improves governance by flagging anomalies early and enforcing spend discipline automatically |

Get cash flow analysis with Ramp

For your cash flow analysis to be effective, it needs to be accurate. Otherwise, you risk painting an incomplete picture of how funds are moving through your business.

Ramp unifies expense management, corporate cards, accounts payable, and accounting integrations to deliver real-time visibility into cash movements. You’ll see every transaction as it happens instead of finding month-end surprises. Automated expense categorization, reconciliation, and spend controls reduce manual work and eliminate errors that distort cash flow analysis.

Try an interactive demo to see how Ramp provides the real-time visibility you need to run consistently accurate cash flow analyses.

FAQs

A monthly cash flow analysis works for most businesses operating in stable conditions. During periods of rapid growth, seasonality, or tight liquidity, increase the frequency to weekly. Frequent analysis helps you monitor trends, anticipate shortfalls, and respond quickly to changes in operating cash flow.

An operating cash flow ratio above 1.0 indicates good liquidity, meaning operations generate enough cash to cover current liabilities. Optimal levels vary by industry, so focus on consistency and improvement over time rather than a single benchmark.

Regular cash flow analysis can uncover unusual or unauthorized transactions. Unexpected timing of inflows and outflows, unexplained adjustments, or irregular payment patterns can signal fraud or control issues. Routine analysis and variance reviews strengthen internal controls by forcing regular scrutiny of cash movements.

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits

“More vendors are allowing for discounts now, because they're seeing the quick payment. That started with Ramp—getting everyone paid on time. We'll get a 1-2% discount for paying early. That doesn't sound like a lot, but when you're dealing with hundreds of millions of dollars, it does add up.”

James Hardy

CFO, SAM Construction Group