An invoice management system for inbox-clogged AP teams.

Invoice management software that pulls invoices from inboxes, routes them for approval, and pays them—so you never get another ‘just following up on this invoice’ email.

Software for invoice processing that doesn’t stop at approvals.

Ramp goes further—pulling invoice data, tagging line items, routing for approval, and syncing to your ERP. Minus the manual mess.

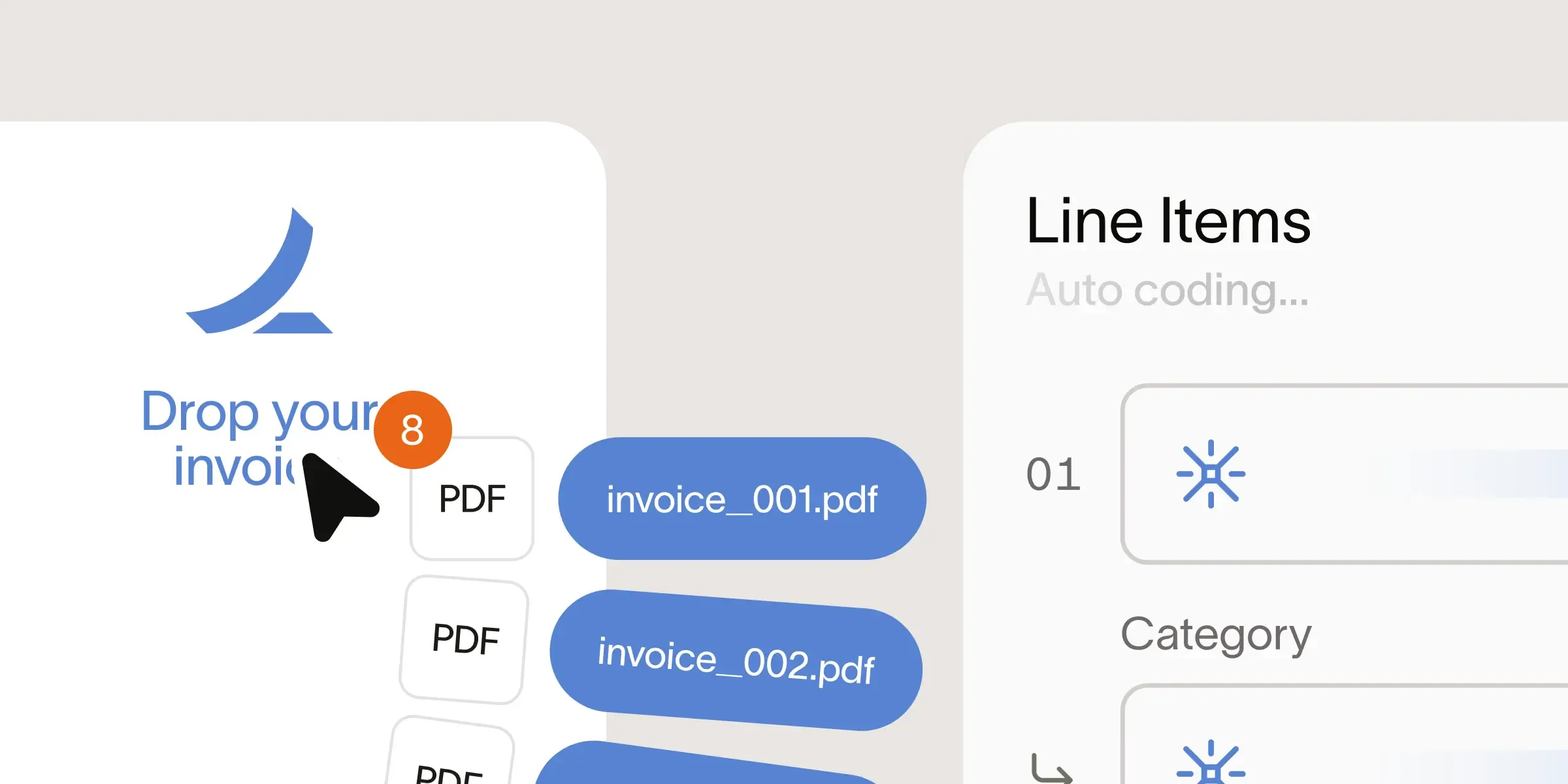

Accurate invoice data, captured automatically.

Ramp uses 99% accurate OCR to capture invoice details like vendor, date, amount, and line items. GL codes are suggested automatically so invoices are ready to post without manual entry.

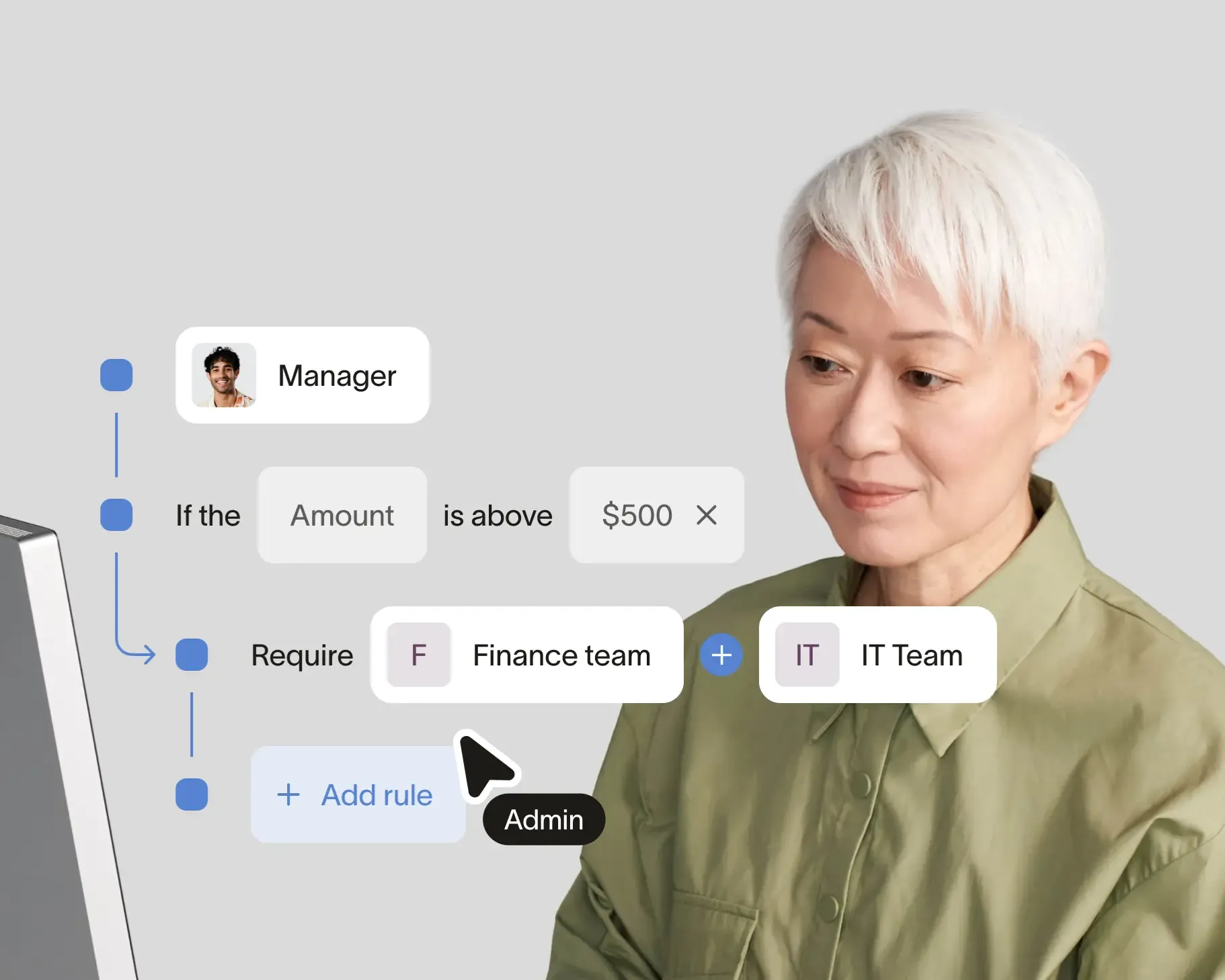

Custom approval workflows that follow your rules.

Ramp’s invoice management system uses customizable workflows to route invoices by amount, role, or department. Set thresholds and policy rules once—and let Ramp handle the routing.

Invoice matching that catches more.

Ramp’s procurement software uses two-way and three-way matching to compare invoices against POs and receipts. It flags overbilling, duplicate charges, and mismatches before anything gets approved or paid.

Procurement softwareSync payments and invoices to your accounting system.

Ramp connects directly to QuickBooks, NetSuite, Xero, and other accounting systems. Global payments made by card, ACH, or wire sync automatically, along with invoice data and approvals.

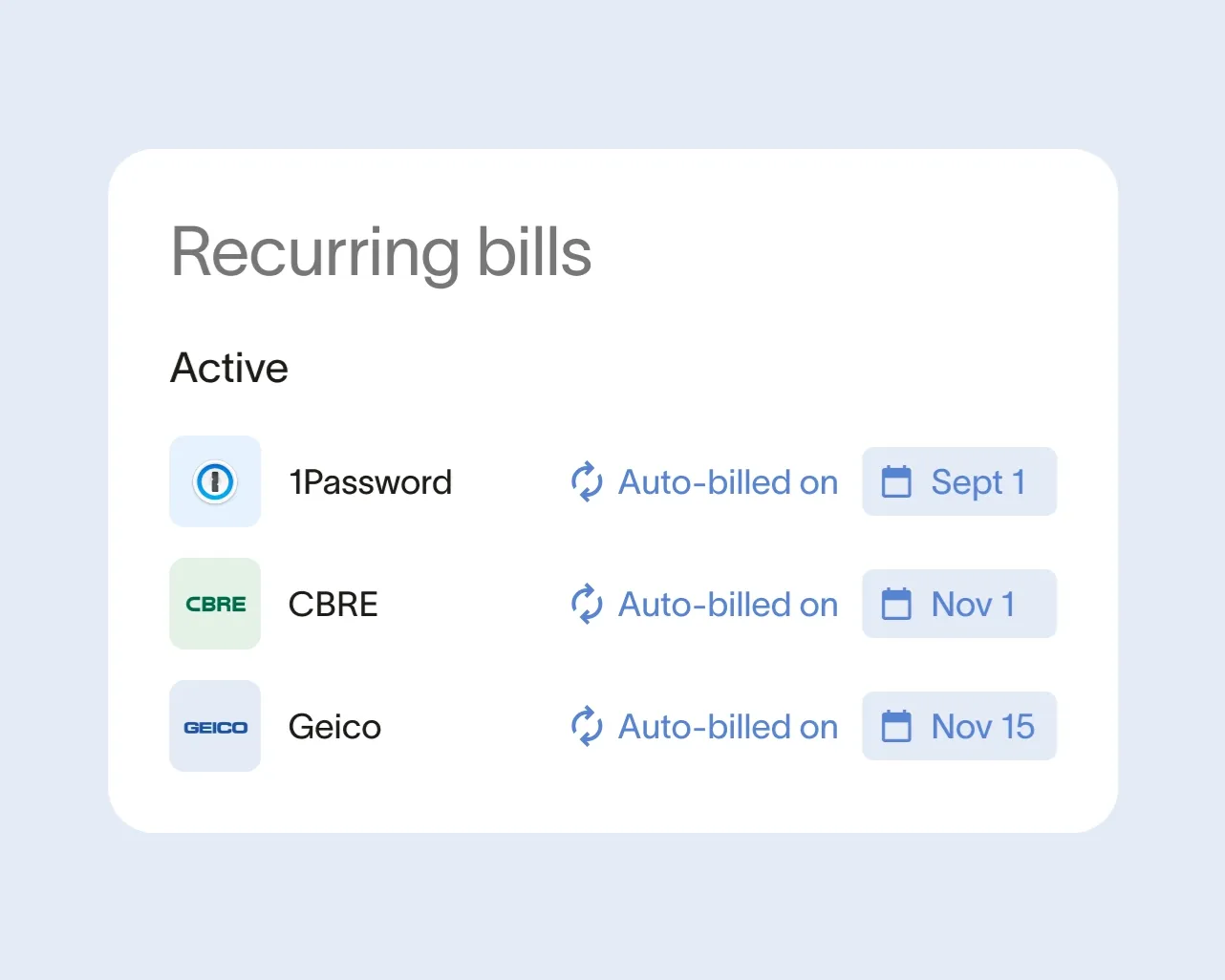

Batch and recurring payments, built in.

Make vendor payments scalable with an invoice management solution that supports batch and recurring payments. Group invoices, schedule repeat payouts, and track everything in one place.

AI agents that do the busywork.

Ramp’s AP agents auto-code invoices, flag fraud risks, and recommend approvals—turning manual tasks into intelligent, touchless workflows.

Eight more ways we simplify invoice management.

Why customers choose Ramp to automate invoices.

Before Ramp, the AP process for REVA took 15-20 minutes per invoice. With Ramp Bill Pay, it takes under 3 minutes. For a company processing 2500 invoices a month, that amounts to significant time savings.

“There’s never been an issue with payment. It’s 100% perfection. With Ramp, we reconcile every couple of days. By the fourth or fifth of the month, Ramp is reconciled and closed.”

Controller, REVA

FAQs

- Automated data capture: Extracts key invoice details using AI and OCR technology from PDFs, emails, and scans, eliminating manual data entry and reducing errors.

- Invoice matching and validation: Two-way and three-way matching to verify each invoice against purchase orders and receipts to prevent duplicate or incorrect payments.

- Approval workflows: Routes invoices to the right reviewers automatically based on company policies, spend thresholds, or departments.

- Payment processing and integrations: Enables secure electronic payments (ACH, card, wire) and syncs directly with accounting or ERP systems such as QuickBooks, NetSuite, or Xero.

- Real-time visibility and tracking: Centralizes invoice statuses—submitted, pending, approved, or paid—and provides dashboards for better control and forecasting.

- Audit and compliance management: Maintains detailed invoice histories, approval logs, and digital records to support audits and ensure policy compliance.

- Automated reminders and collaboration: Sends notifications to approvers and vendors, while enabling teams to communicate and resolve invoice issues in one place.

- Digital invoice storage: Archives all invoice and payment data in encrypted cloud storage for safe retrieval and long-term access.

- Time and cost savings: Automation handles data entry, routing, and approvals so teams can focus on more strategic work.

- Healthier cash flow: Faster approvals and digital payments keep bills on schedule and help avoid late fees.

- Fewer errors and less fraud risk: Built-in checks catch duplicates or mismatched invoices before payments go out.

- Better visibility and control: Dashboards make it easy to track invoice status and forecast upcoming payments.

- Simpler compliance and audits: Digital trails and secure storage make documentation easy to find when it’s needed.

- Stronger vendor relationships: Reliable, on-time payments strengthen trust and can lead to better terms.

- Built to scale: The system grows with your business—no extra headcount needed to manage more invoices.

- Smarter decision-making: Centralized data gives finance teams insights to improve payment timing and spending efficiency.

The second type are small business invoicing tools, which combine invoicing, payment collection, and light accounting in one platform. They’re typically built for freelancers or small teams that need to send invoices to clients, accept payments, and track income without complex financial workflows.

With Ramp, businesses can streamline approvals, gain better cash flow visibility, and manage invoices with greater efficiency and control.

- Small businesses and lean finance teams: Ramp removes repetitive tasks like manual entry and routing. AI-powered data capture, simple approval flows, and one-click payments help smaller teams process invoices faster with fewer errors.

- Growing mid-sized companies: Ramp automates invoice capture, approvals, and payments as invoice volumes rise. Features like vendor scheduling, multi-entity support, and accounting integrations help finance teams scale efficiently.

- Cost-conscious teams managing cash flow: Ramp enables smarter payments through scheduling, real-time visibility, and early-payment discount tracking—helping finance teams strengthen vendor relationships and control spend.

Yes, Ramp offers a free tier of Ramp Bill Pay, that automates invoice extraction, approvals, and payments. Unlike competitors that charge for these features, Ramp provides AI-powered OCR, automated workflows, and seamless accounting integrations at no cost—making it an ideal choice for small businesses looking to streamline invoice management affordably.

For mid to large-sized businesses, premium plans start at $15 per user per month, significantly lower than competitors’ entry-level plans.