6 types of working capital financing and how to choose

- What is working capital financing?

- Types of working capital financing

- How to choose the right working capital financing option

- Pros and cons of working capital financing

- How to apply for working capital financing

- How Ramp helps you grow and manage working capital

Many businesses take out loans early on to fund big purchases or long-term investments. But what happens when you’re running a healthy operation and still come up short on cash for payroll or rent? That’s when working capital financing can help you finance working capital and keep operations running smoothly.

Seasonal businesses like summer camps, holiday shops, and e-commerce brands often need extra funds to stay afloat during slower months. Others might need a short-term boost to bridge gaps between revenue cycles or cover new opportunities that require upfront spending.

Working capital financing gives you fast, flexible funding to manage day-to-day costs and maintain stability when cash flow is tight.

What is working capital financing?

Working capital financing is a short-term form of business financing designed to cover day-to-day operations such as payroll, rent, and inventory purchases. Unlike long-term loans that fund expansion or equipment, this type of short-term funding helps manage immediate financial obligations.

By reviewing your balance sheet, you can gauge whether your current assets are sufficient to cover short-term liabilities or if additional financing is needed to fill the gap.

You might seek working capital financing when your business experiences temporary cash shortfalls or seasonal dips in revenue. For instance, a summer camp or holiday retailer might need extra funds to cover expenses during slower months, while an e-commerce business could use it to restock inventory after a busy sales period.

Working capital = Current assets – Current liabilities

This formula shows how much liquidity a business has to fund operations and meet short-term obligations.

How working capital financing differs from other business loans

Working capital financing is designed for short-term use, with repayment periods typically measured in months rather than years. These loans help businesses handle operational expenses like payroll, rent, or supplies while waiting for incoming revenue.

Compared to traditional business loans, working capital financing generally has a simpler application process, faster approval times, and lower borrowing limits. The goal is to bridge cash flow gaps, not to fund long-term investments or expansion projects.

Here’s how they differ at a glance:

| Feature | Working capital financing | Traditional business loans |

|---|---|---|

| Purpose | Cover short-term operational expenses | Finance long-term investments or expansion |

| Term length | Weeks to months | Several years |

| Funding speed | 1–10 days | 2–8 weeks |

| Collateral | Often unsecured | Often requires collateral |

| Borrowing limit | Lower | Higher |

| Repayment | Frequent (daily or weekly) | Monthly or quarterly |

For example, a retailer might use a working capital loan to stock up for holiday sales, while a traditional loan would be better suited for opening a new store location.

Signs your business needs working capital financing

Consider working capital financing when short-term obligations outpace incoming cash and you need a bridge to keep operations steady.

- You’re experiencing cash flow gaps between accounts payable and accounts receivable

- You face seasonal dips in revenue or demand that strain day-to-day expenses

- You need to cover payroll, rent, or inventory during slower sales cycles

- You’ve taken on a new order or contract that requires upfront spending before payment arrives

- You see a near-term growth opportunity that could temporarily stretch cash reserves

Types of working capital financing

There are several ways to access working capital. To choose the best option for your business, start by evaluating your current revenue, outstanding invoices, and where you plan to use the funds—each method serves a different need, from stabilizing cash flow to funding short-term growth.

| Financing type | Ideal for | Typical term | Cost structure | Speed of funding |

|---|---|---|---|---|

| Working capital loan | Established businesses covering short-term gaps | 3–24 months | APR (often 7%–25%) | 1–3 weeks |

| Line of credit | Fluctuating cash flow with recurring small needs | Ongoing draw/repay | Variable APR + possible draw fees | 2–10 days |

| Invoice factoring/financing | B2B firms waiting on customer payments | Until invoices are paid | Advance + fee (e.g., 1%–5% per month) | 1–5 days |

| Purchase order financing | Large confirmed orders with upfront supplier costs | Until customer pays | Monthly fee on financed amount | 1–2 weeks |

| Merchant cash advance | High daily card sales needing fast cash | Until advance is repaid | Factor rate (often 30%+ effective APR) | 1–3 days |

| Short-term loan | Small, urgent needs with clear payback plan | 3–18 months | Higher APR than long-term loans | 1–5 days |

Working capital loans

A working capital loan is a short-term business loan for everyday expenses like payroll, rent, or inventory—not long-term investments or equipment. Typical terms range from 3–24 months, and rates depend on credit and performance, often 7% to 25% APR. They fit established businesses with predictable revenue that need a temporary boost to keep operations running smoothly.

Lines of credit

A business line of credit (often called a working capital revolver) gives you ongoing access to a set limit that you can draw, repay, and draw again—similar to a credit card, but for business expenses. If your lender sets a $10,000 limit and you borrow $3,000, you’ll have $7,000 left; repay $2,000 and your available balance increases to $9,000. This flexibility suits businesses with fluctuating cash flow, but it requires discipline to avoid overborrowing.

Invoice factoring and financing

Invoice factoring and invoice financing unlock cash tied up in unpaid invoices, but they work differently:

- Invoice factoring: You sell unpaid invoices to a factoring company, which advances ~80%–90% and takes over collections

- Invoice financing: You borrow against invoices as collateral and keep control of collections

Example: If you have $20,000 outstanding, a factor might advance $17,000 (85%) and pay the remainder, minus fees, after your customer pays. These options work well for B2B companies with reliable customers but inconsistent payment cycles.

Purchase order financing

Purchase order (PO) financing helps you fulfill large customer orders when you don’t have enough cash for upfront supplier costs. The lender pays your suppliers so you can complete the order; when your customer pays, you repay the lender plus fees. It’s useful when growth opportunities outpace current liquidity.

Merchant cash advances

A merchant cash advance provides a lump sum in exchange for a percentage of future daily card sales. Approval is fast and based on sales volume, but the effective cost can be high (often 30%+). MCAs can still fit businesses like restaurants or retailers that have strong daily sales and need funding quickly but don’t qualify for traditional loans.

Short-term business loans

Short-term business loans offer a lump sum with 3–18 month terms. Rates are higher than long-term loans, but applications are faster and require less documentation—many online lenders decide within days based on revenue, time in business, and credit. These loans work well if you have a clear plan to repay quickly.

How to choose the right working capital financing option

Choosing the right working capital option comes down to timing, cost, and repayment fit. Match the product to your cash flow pattern and why you need funds.

| If you need… | Consider… | Why it fits |

|---|---|---|

| Fast funding based on strong daily sales | Merchant cash advance | Sales-driven eligibility and rapid disbursement |

| Flexible access for seasonal swings | Line of credit or working capital loan | Draw/repay as needed; predictable payments |

| Cash while you wait on invoices | Invoice financing or factoring | Turns receivables into near-term cash |

| Supplier prepayment for large orders | Purchase order financing | Pays vendors so you can fulfill the order |

Assessing your business needs

Start by sizing the gap you’re trying to close and how quickly you can repay it.

- What specific expenses do you need to cover—inventory, payroll, rent, or supplier costs?

- Is this a one-time spike or a recurring seasonal pattern?

- How long before the borrowed funds generate a return or cash inflow?

- Can your cash flow support the repayment cadence (daily/weekly/monthly) without strain?

To estimate the amount, review recent cash flow statements, your income statement, and your balance sheet to understand short-term liquidity. For example, if you run an $8,000 shortfall for three months during slow season, you’ll need roughly $24,000, plus a modest buffer, to stay on track.

Comparing costs and terms

Not all options price risk the same way. Make apples-to-apples comparisons by translating to total repayment and, when possible, effective APR.

- Calculate the total repayment: Loan amount * rate (APR or factor) + fees

- APR vs. factor rates: APR includes interest and most fees on an annual basis. Factor rates (often used with MCAs) are quoted as a decimal applied upfront and can translate to a much higher effective APR.

- Watch for fees: Origination, draw fees, early payoff penalties, and late fees can shift the true cost

Example (APR)

Borrow $50,000 at 18% APR for 12 months with a 2% origination fee. Estimated cost baseline ≈ $50,000 * 0.18 = $9,000 interest (simplified) + $1,000 fee = $10,000 total cost (actual amortization will vary).

Example (factor rate)

Borrow $50,000 at a 1.35 factor with daily remittances. Total payback = $50,000 * 1.35 = $67,500 (before any additional fees), which can imply a much higher effective APR depending on repayment speed.

Qualification requirements

Each option has different thresholds for revenue, time in business, credit profile, and documentation. Use this as a directional guide (lenders vary).

| Financing type | Typical requirements | Approval time |

|---|---|---|

| Working capital loan | 1+ year in business, revenue history, good credit (≈650+) | 1–3 weeks |

| Line of credit | 6–12 months in business, consistent cash flow, fair–good credit | 2–10 days |

| Invoice financing/factoring | Unpaid invoices from reputable clients, proof of sales | 1–5 days |

| Purchase order financing | Verified POs and reliable customers | 1–2 weeks |

| Merchant cash advance | Strong daily card sales, no major credit issues | 1–3 days |

| Short-term loan | 6+ months in business, verifiable revenue | 1–5 days |

What do lenders evaluate?

Lenders typically review cash flow and revenue consistency, business credit history, time in business, debt obligations, and any collateral if required. Present clear financials and a realistic repayment plan to strengthen your application.

Pros and cons of working capital financing

Like any loan, working capital financing comes with both advantages and drawbacks. Understanding each side can help you determine whether this short-term funding aligns with your business’s needs.

Benefits of working capital financing

- Quick access to funds: Approval is typically faster than traditional loans, giving you cash when you need it most and helping you maintain your overall financial health

- Flexible use of funds: Apply the money toward payroll, rent, inventory, marketing, or other day-to-day expenses

- Scales with your business: As your revenue and credit improve, your borrowing capacity may increase

- Maintain full ownership: You retain 100% equity and control, unlike equity financing or investors

- Build business credit: Consistent, on-time repayments can strengthen your business credit profile and improve future loan eligibility

Potential drawbacks to consider

- Higher borrowing costs: Short-term loans and advances often have higher interest rates or fees than long-term financing

- Tighter cash flow: Frequent or rapid repayments can strain liquidity, especially during slower months

- Risk of debt cycles: Repeatedly borrowing to cover operating expenses can lead to ongoing debt and financial instability

- Qualification hurdles: Many lenders require minimum revenue, time in business, or a solid credit score to approve funding

How to apply for working capital financing

Applying for working capital financing follows a straightforward process, but preparation can help you secure approval faster and on better terms.

1. Choose your lender

Decide whether a bank, credit union, or online platform fits your business best. Traditional institutions may offer lower rates but require more documentation and time. Online lenders often provide quicker approvals with simpler requirements.

2. Gather your documents

Collect the materials most lenders request: tax forms, financial statements, a business plan, and your business credit score. These help lenders verify your company’s stability and repayment capacity.

3. Submit your application

After you apply, expect timing differences by lender. Banks and credit unions can take weeks to complete underwriting, while online platforms often respond within days.

4. Review your offer

Once approved, carefully review repayment schedules, rates, and any fees before signing to ensure terms align with your cash flow and business goals.

How to strengthen your application

Lenders typically evaluate cash flow consistency, business credit history, time in business, debt-to-income ratio, and collateral (if required). Present organized financials and a clear repayment plan to improve approval odds.

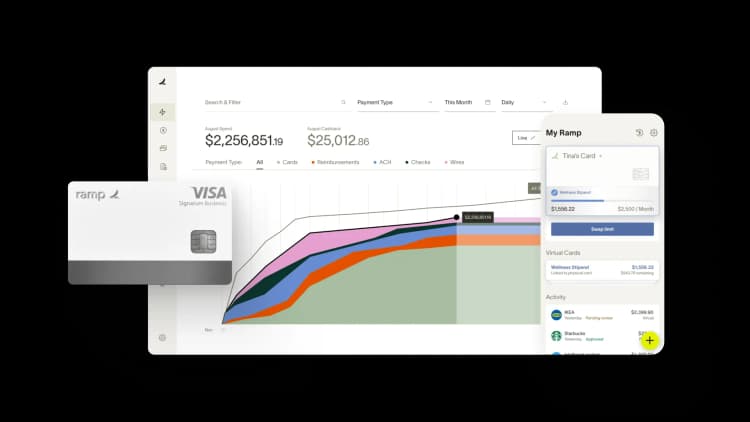

How Ramp helps you grow and manage working capital

Not all lenders keep up with how modern businesses operate. Ramp offers commerce sales-based underwriting to give growing companies access to flexible working capital when traditional loans fall short.

Let your revenue speak for you

Traditional underwriting focuses on cash on hand as the main indicator of business health. That doesn’t always fit how modern businesses run—especially inventory-based operations. Ramp’s commerce sales-based underwriting lets your access to working capital grow with your sales volume.

Control your capital with automated expense management

Ramp goes beyond financing by offering spend management tools that show exactly where borrowed funds are going. With your spending centralized, you can make data-driven decisions on where to cut costs or reinvest in growth.

Build your business credit for the future

If your long-term plans include taking out loans or credit lines with traditional institutions, Ramp can help you build business credit along the way. Building credit early helps secure better terms as your company scales.

Ready to get started? Explore a free interactive product tour.

FAQs

The cost depends on the type of financing, your credit profile, and the lender’s terms. Short-term loans and merchant cash advances often carry higher effective rates than long-term loans, but they provide faster access to funds. Always compare total repayment and fees before committing.

The main components are current assets, current liabilities, accounts receivable, and accounts payable. Together, they show how efficiently a business manages short-term resources and obligations.

You can calculate working capital by subtracting a company’s current liabilities from its current assets:

Working capital = Current assets – Current liabilities

This figure shows how much liquidity a business has to cover short-term obligations.

A healthy working capital ratio (or current ratio) generally falls between 1.2 and 2.0. Below 1 suggests liquidity issues, while a much higher ratio may indicate underused assets.

Working capital financing is short-term funding for day-to-day operations. Long-term financing supports larger investments or projects that take years to repay.

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide.” ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn’t just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn’t exist in Zip. It’s made approvals much faster because decision-makers aren’t chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits

“More vendors are allowing for discounts now, because they’re seeing the quick payment. That started with Ramp—getting everyone paid on time. We’ll get a 1-2% discount for paying early. That doesn’t sound like a lot, but when you’re dealing with hundreds of millions of dollars, it does add up.”

James Hardy

CFO, SAM Construction Group