How to solve the spend management issues wrecking your budget

- Problem: lack of control

- Solution: customize spend controls

- Problem: limited expense tracking

- Solution: automate expense tracking

- Problem: faulty analysis

- Solution: use AI to surface unique insights

- Problem: lack of optimization

- Solution: automate workflows

- Save time and money with Ramp

Spend management is like the hot potato of corporate finance; no one wants to handle it. It often feels overwhelming, and because of the challenges teams face with spend management, they often avoid it altogether or treat it with a hands-off approach.

According to Ardent Partners, the average organization manages less than two-thirds of their total company spend, despite the fact they could save between 6% and 12% of every dollar placed under spend management. One Harvard Business School professor found that overspending is a significant reason why two out of every three startups fail.

So, why aren’t companies taking control of total company spend? They often lack supporting tools, processes, and people to manage spend effectively. These companies then miss out on savings and growth opportunities.

The good news? Companies can address common spend management challenges by automating their financial processes and customizing spend controls. If you’re not sure where to start, here are the most common spend management challenges finance experts see company’s run into, and how to solve them.

Problem: lack of control

With a traditional spend management workflow, employees will submit their expense reports after already making a purchase and often several weeks or months later, usually without purchase orders. In addition to this challenge, some of the charges may not even belong to the cardholder since they often share corporate credit cards with unauthorized employees due to limited access.

So controllers aren’t finding out about out-of-policy spend until after the fact (when it’s much harder to address), and sometimes avoid addressing it altogether because of the tension it can create among teams.

Many finance teams react to overspending by tightening expense policies. However, it’s nearly impossible to account for every situational expense without also hurting the procurement planning processes.

Without a dynamic expense policy solution, including timely pre-approvals and personalized expense policies, finance teams often feel like they have two choices: allowing overspending or completely shutting down purchasing power. This struggle results in reactive processes rather than ones that are preventative and proactive.

In the end, finance teams are left in a constant state of crisis management where maverick spend or out-of-policy spend, overspending for services, and even duplicate spend become the norm.

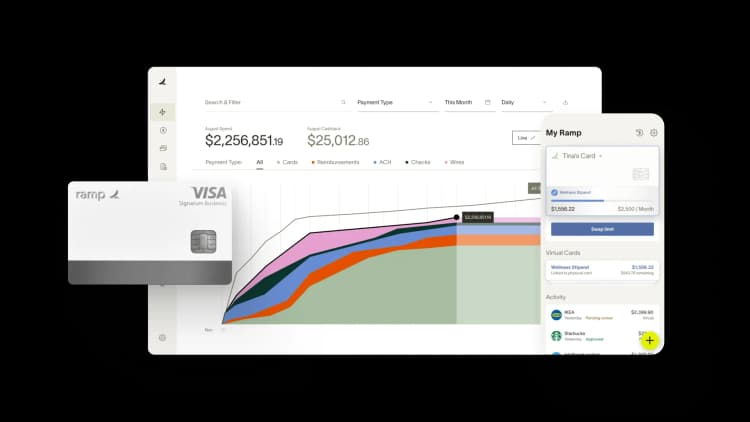

Solution: customize spend controls

Gone are the days of reactive spend management. With a spend management software solution that syncs with unlimited corporate cards (both virtual and physical), you can consistently enforce policy with automated custom card controls. These guardrails improve your decision-making processes and empower your team while protecting your bottom line.

“With Ramp, I can put money in my employee’s hands and be confident that spend is controlled and reviewed,” says Ro CFO, Aron Susman.

With spend management software, you can set personalized card controls (down to the day, time, vendor, and transaction amount) and establish approval chains for a better benchmark. In addition, the software will prompt cardholders to request pre-approval for expenses that fall outside of the personalized limits. Approvals can happen in real-time with a single click, which streamlines the process.

“Having different entities in different states with card limits and expirations has been very helpful,” says Michelle Penczak, CEO of Squared Away.

Problem: limited expense tracking

It isn’t easy to analyze spend or build a strategy for managing it when you don’t have complete knowledge of company spending in the first place. Unfortunately, lack of real-time visibility is a common problem.

This lack of visibility is especially true for growth-stage startups with an overwhelming amount of capital expenditures (CAPEX), small or nonexistent finance departments, and a lack of concrete processes to handle expenditures and budgeting. These factors also result in scattered financial records and incomplete spend data.

It’s time-consuming to track down financial information when it’s scattered across email chains, billing statements, paper receipts, and forms—and it’s almost impossible to gain a complete picture of spend without these. When you lack a process to aggregate data, it’s difficult even to know what you’re missing.

Prior to implementing a spend management solution, Shortcut was manually processing expenses, which led to accounting difficulties.

“There wasn’t really any visibility on what employees were spending on and how much, so there was no control over when the sync would occur,” says Shafak Ilyas, Senior Accountant at Shortcut. “This lack of visibility led to a timely, inefficient, and inaccurate process.”

As a company evolves and business needs fluctuate, the issue of visibility compounds further for controllers scrambling to keep up. Many expenses end up not being correctly categorized or even tied to operating budget line items at all. They often get lost in a bloated “miscellaneous expenses” category and silently wreak havoc on companies’ budgets. This lack of visibility often leads to duplicate spend hiding in plain sight. For example, SaaS creep and shadow IT, among others.

Lack of spend visibility is especially critical when you consider how many tool subscriptions companies have. According to Blissfully, the average company has between 102 and 288 SaaS application subscriptions (which doesn’t even include the number of duplicate subscriptions). At the average midsize company, 5.8 of those are duplicate subscriptions, wasting around $135,000 annually.

With a traditionally manual spend management process, it’s next to impossible to maintain visibility on this many subscriptions. And managing SaaS subscriptions is just one example of what controllers are trying to keep up with.

Solution: automate expense tracking

A spend management system centralizes all of your cash flow management into a single platform for ultimate visibility and functionality. This design reduces context switching and helps you avoid scattered audit trails by automatically updating data fields as the transaction happens.

“With Ramp, people are no longer hiding behind their expenses,” says Teo Evanick, Financial Controller at Mode. “Everyone can log in and see every transaction the instant it happens, forecast spend, and correct wasteful behavior. What a relief.”

Problem: faulty analysis

Faulty analysis is the result of two things: inaccurate reporting and lack of skill that leads to erroneous conclusions.

To manage spend effectively, you need reports that will accurately reflect the state of your financials. Too often, reports have incomplete or faulty data—which leads to weak financial forecasting.

Manual data entry processes often lead to errors—such as duplicate entries, missing or unreported data, amounts attributed to the wrong accounts, and inaccurate financial statements with no clear audit trail to validate the data. In fact, according to the Global Business Travel Association, 19% of expense reports have errors.

Jose Ramon-Batista, a former Staff Accountant at WayUp, says their old manual process of data entry was at the core of issues with their financial reports.

“Employees wouldn’t submit their expense reports until two months later,” says Ramon-Batista. “That wasn’t great for the accuracy of our financial reporting.”

It’s also difficult to manually analyze spend data. You may have an abundance of data, but without the right spend analysis process, your finance teams will struggle to track and manage it all.

According to McKinsey, “...at one midsize manufacturing company with approximately $2 billion in annual revenue ... procurement had data on more than 20,000 transactions for a single category, each with four to five statistically significant drivers of price.” In other words, it’s no surprise that finance teams are overwhelmed and find it hard to keep accurate reports.

Red Antler faced this same issue prior to finding a new spend management solution.

“Given our volume of purchases, expense management was an incredibly cumbersome process,” says Head of Creative Production at Red Antler, Christina Cooksey. “Because client work and timelines dominate, expenses were often put off.”

Without a skilled finance team, even the most accurate data is hard to apply to spend management. Especially if your team doesn’t include a strong financial analyst to surface actionable insights from the data and draw critical comparisons, the data will not be very useful.

For example, according to a Flexera report, survey respondents estimated 12% of total IT spend is wasted, but research shows it’s actually 30% or more. Businesses that don’t have a financial team capable of uncovering these insights may not even know that they’re missing wasted spend in their reporting.

Solution: use AI to surface unique insights

Spend management software uses AI-driven technology to draw out details and make connections that even a full finance department would have difficulty realizing. These insights are surfaced through automated cost-savings prompts and visualization dashboards that highlight cost-saving opportunities. No financial analyst needed.

“Ramp constantly sends me reminders to change certain plans in order to save money for the business,” says Penczak. “For example, I know that I need to go in and change our Asana [pricing] plan because I’ve gotten 15 reminders from Ramp that doing so can save us $1,000.”

Here are just a couple of examples of companies that have found significant savings through spend management software:

- Candid immediately found over $250,000 in savings after implementing an expense management software.

- Eight Sleep was able to reduce AWS costs and saved over $5,000 in Amazon Web Services alone after being notified of duplicate spend by their expense management software.

Problem: lack of optimization

Let’s talk about the elephant in the room. Especially if you’re part of a small team, you don’t have the time to painstakingly tackle inconsistencies—like hunting down that missing documentation, addressing data sourcing issues, or taking advantage of savings opportunities. Lack of time ultimately makes it feel impossible to optimize spend management.

Penczak said her team faced this situation prior to finding a new strategy.

“I didn’t have the time to search [for cost savings], and I didn’t delegate it to my team, because they honestly had bigger and better things [to do],” says Penczak.

Solution: automate workflows

Spend management software reduces the tasks employees spend hours doing manually via automation and AI so your team can fully optimize spend with minimal time or effort.

“What I like about Ramp compared to any other solution is the fact that we can automate manual workflows for every employee,” says JJ Fliegelman, Co-Founder at WayUp. “We can create rules for vendors and specific categories that automate spend management. The more we can automate, the better, and that’s the power of Ramp.”

The software also automatically collects and categorizes expense data. For example, employees are prompted via email or SMS to submit receipts for expenses at the point of purchase. This data is then automatically matched to the transaction in the software, so there are no lost receipts or guessing which expense they belong to.

“Expenses are completed the day of purchase, often within minutes,” says Cooksey. “All we have to do is text their receipt and a message with charge details.”

Time savings don’t end with data collection and categorization. Spend management software also can sync with bookkeeping software like QuickBooks to automate a significant amount of accounting functions. For example, Squared Away saved 50 hours per month with spend management software, and Shortcut now closes its books 86% faster since implementing a spend management platform.

“With Ramp, everything is quicker,” says Ilyas. “I can sync whenever I want. Closing the books used to take a couple of days, and now it takes about an hour a month.”

Save time and money with Ramp

Here at Ramp, we don’t think you should have to choose between effectively managing your company’s spend and having enough time to run the rest of your business. Learn more about how we’ve helped save our customers over $10 million and close their books five times faster each month with our spend management solution.

Spend management and expense policies go hand-in-hand. Without an effective expense policy, you'll create a void in your spend management. But what exactly makes an expense policy effective? Read our e-book to learn how to create a policy that works for you, your team and your business. You can also check out our expense policy generator here.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits