- 1. Get text reminders to submit your receipts

- 2. Turn on hands-free receipt capture

- 3. Get to your cards with a single click

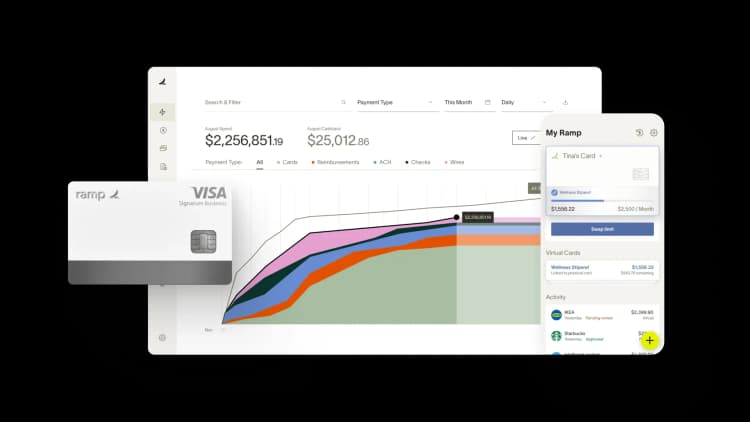

- 4. Control charges on your cards, down to the merchant level

- 5. Forward receipts from any email address

- 6. Pay with Apple and Google Wallet

- 7. Delegate a co-pilot to save even more time

- 8. Quickly check your company's policies

- 9. Easily bump up your spending limits

- 10. Submit your expenses on the fly

For most people, submitting receipts is one of the most tedious parts of their jobs. Not to mention the hoops they need to jump through if they somehow misplace that receipt or, worse, had to put the team dinner on their personal card.

But Ramp cardholders know there's a better way. Ramp’s expense reporting is automated, it’s efficient, and it never forces you to dig through the trash looking for a receipt.

Automatic receipt matching is just the beginning. There are so many other features that are unsung heroes in the world of Ramp. Below we lay out the path to becoming a power cardholder...can you check off all of these?

1. Get text reminders to submit your receipts

Add your phone number to Ramp and get a text after every purchase to submit your receipts ASAP—even if they are crumpled, blurry or in foreign currencies.

2. Turn on hands-free receipt capture

Take advantage of our Lyft and Gmail integrations to automatically submit the receipts you receive via those apps to Ramp.

3. Get to your cards with a single click

Your Ramp cards are at your fingertips with our Chrome extension. Easily populate your card information when making purchases on the web. You can even check your company’s travel policy through the extension when booking airfare and lodging.

4. Control charges on your cards, down to the merchant level

Request vendor-specific cards to prevent against fraud and ensure your work isn’t compromised even if your card is.

5. Forward receipts from any email address

Delegate your personal email address for email receipt forwarding so Ramp knows if you sent an e-receipt from your personal account to Ramp. We’ll even detect if you forward a receipt from your personal email to your work email and automatically nudge you to set this up.

6. Pay with Apple and Google Wallet

Add your virtual cards to your Apple/Google Wallet to easily access them on the go.

7. Delegate a co-pilot to save even more time

Give your assistant co-pilot permissions to help manage your expenses within Ramp.

8. Quickly check your company's policies

Find your team’s employee handbook in Ramp to make sure you’re up-to-date on what your expense and travel policies look like.

9. Easily bump up your spending limits

Need a few extra dollars this month to get your work done? No problem—simply request a temporary spend increase on your card. Your finance team gets a text and can update on the card level.

10. Submit your expenses on the fly

Avoid your card being locked by texting receipts, memos, and other necessary information as soon as the transaction occurs.

If you checked seven or more of these, you’re well on your way to becoming a Ramp power cardholder! If you have any questions, reach out to the Ramp team for quick help by emailing [email protected].

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits