The accountant shortage: Causes, impact, and what comes next

- The accountant shortage by the numbers

- Root causes of the accounting shortage

- Impact on businesses and the economy

- The great mismatch: Skills gaps and the entry-level paradox

- Technology and automation: Doing more with less

- How to adapt and thrive during the accountant shortage

- Looking ahead: The future of accounting talent

- Automate accounting workflows so your team can do more with less

The accounting profession is facing one of its most severe talent shortages in decades. The Bureau of Labor Statistics projects more than 120,000 accounting and auditing openings each year, while the 2025 AICPA/NASBA Trends Report shows a shrinking pipeline of new CPAs and a workforce increasingly concentrated in later-career age groups.

This isn’t a short-term hiring cycle. Demographic shifts, declining interest in accounting programs, and changing expectations about work have combined to create a structural shortage that’s leaving roles open for months and pushing already-lean teams toward burnout.

The accountant shortage by the numbers

The accountant shortage isn’t anecdotal. It shows up clearly in hiring projections, workforce demographics, and the shrinking pipeline of new professionals entering the field. Together, these figures explain why finance teams are struggling to hire and why the pressure isn’t easing:

| Metric | Figure | Source |

|---|---|---|

| Annual accounting and auditing job openings | ~124,200 per year | U.S. Bureau of Labor Statistics |

| Projected employment growth (2024–34) | 5% | U.S. Bureau of Labor Statistics |

| Trend in CPA exam candidates | Sustained decline over the past decade | 2025 AICPA/NASBA Trends Report |

| Age profile of CPA workforce | Increasingly concentrated in later-career age groups | 2025 AICPA/NASBA Trends Report |

These numbers translate into real operational strain. When hiring cycles stretch for months, existing teams absorb the work, close timelines slip, and error risk rises. The challenge is compounded by the fact that fewer early-career accountants are entering the profession just as experienced CPAs are beginning to exit it.

Root causes of the accounting shortage

The accounting shortage isn’t driven by a single factor. It’s the result of several long-running trends that are converging at the same time, shrinking the talent pipeline while demand for accounting expertise continues to grow.

The retirement wave

A large share of today’s accounting workforce is approaching retirement age. As experienced CPAs step away, they take decades of institutional knowledge with them, leaving firms and finance teams with gaps that can’t be filled quickly by junior hires.

This dynamic is especially challenging because accounting expertise compounds over time. Replacing a senior tax or audit professional isn’t just about filling a seat; it requires years of training, client exposure, and judgment that can’t be rushed.

Declining interest among students

Fewer students are choosing accounting as a major, and the pipeline of future CPAs has been shrinking for years. Enrollment declines today translate directly into fewer entry-level hires now and a smaller pool of experienced accountants down the line.

Perception plays a role here. Many students still see accounting as rigid, stressful, or less financially rewarding than careers in technology or finance, even as the profession has shifted toward more strategic and advisory work.

| Student pipeline indicator | Trend | Source |

|---|---|---|

| CPA exam candidates | Sustained decline since mid-2010s | AICPA/NASBA CPA Trends Report (2023) |

| Accounting bachelor’s and master’s enrollment | Year-over-year declines in recent cohorts | AICPA Trends & Supply Data |

| Relative appeal vs. tech and finance | Accounting lags on compensation and flexibility | Bureau of Labor Statistics |

The 150-hour CPA requirement

Becoming a CPA requires 150 college credit hours, an extra year of education beyond a typical bachelor’s degree. For many students, that additional cost and delayed entry into the workforce is a meaningful deterrent.

The requirement has sparked ongoing debate within the profession. Research from MIT Sloan shows the rule has been associated with a significant decline in CPA candidates, particularly among lower-income and minority students, raising questions about whether it has narrowed access to the profession without clearly improving preparedness.

Work-life balance and career expectations

Traditional accounting career paths were built around long hours and intense busy seasons. That model no longer aligns with the expectations of many younger professionals, who place a higher value on flexibility, sustainability, and mental health.

Remote work and flexible schedules are now table stakes for many candidates. Firms and companies that can’t offer them often struggle to compete for talent, regardless of compensation.

A growing gap between demand and supply

At the same time the talent pipeline is narrowing, demand for accountants is rising. Regulatory complexity, expanded reporting requirements, and a shift toward advisory services all require more specialized expertise.

The result is a widening mismatch: fewer qualified accountants are entering the field just as businesses need more sophisticated financial support than ever.

Impact on businesses and the economy

The accountant shortage doesn’t just affect hiring plans. It creates cascading risks for financial operations, compliance, and decision-making across the economy, with the most immediate impact felt by teams responsible for day-to-day financial work.

Challenges for CPA firms

CPA firms are often the first to feel the strain. As experienced staff retire and open roles stay unfilled, firms face difficult tradeoffs between growth, quality, and workload:

- Existing staff absorb more work during busy periods, increasing burnout risk

- Firms turn away new clients or narrow service offerings due to capacity constraints

- Compressed timelines raise the likelihood of errors and rework

- Rising compensation costs put pressure on margins, especially for smaller firms

Over time, these pressures make it harder for firms to invest in training and succession planning, reinforcing the cycle that caused the shortage in the first place.

Struggles in corporate accounting departments

In-house accounting teams face a different set of challenges. When headcount doesn’t keep pace with complexity, routine financial processes begin to slow down.

Understaffed teams often see:

- Longer month-end and year-end close cycles

- Weakened segregation of duties as responsibilities are consolidated

- Increased friction during audits due to delayed documentation

- Higher risk of missed deadlines or reporting errors

For finance leaders, these issues aren’t just operational inconveniences—they limit visibility into performance and make it harder to support strategic decisions.

Small business implications

Small businesses are especially exposed. Many can’t match the salaries or flexibility offered by larger companies, making it difficult to attract experienced accounting help. As a result, owners may take on more financial tasks themselves or rely on limited external support. That increases the risk of compliance mistakes, cash flow blind spots, and missed opportunities for growth, especially during periods of rapid change.

The great mismatch: Skills gaps and the entry-level paradox

Despite the accountant shortage, many recent graduates struggle to land roles. The disconnect isn’t about overall demand; it’s about experience. Employers need accountants who can step into complex environments quickly, while most early-career candidates still require significant training and oversight.

This creates a paradox: firms are short on experienced professionals but hesitant to invest in developing junior talent, especially when workloads are already stretched. As senior accountants retire, that gap only widens.

Technical vs. soft skills in demand

Modern accounting roles require more than technical accuracy. Finance leaders increasingly look for professionals who can combine accounting fundamentals with technology fluency and business judgment.

| Skill category | What employers are looking for |

|---|---|

| Technical skills | Experience with cloud accounting platforms, ERP systems, data analytics tools, and current GAAP or IFRS standards |

| Soft skills | The ability to explain financial information to non-finance stakeholders, adapt to new systems, and provide forward-looking insight |

Why new graduates often feel unprepared

Most accounting programs still emphasize theory and exam preparation over practical, day-to-day work. New hires may understand accounting concepts but lack hands-on experience with ERP systems, close processes, or client-facing communication. That mismatch forces employers into a difficult choice: invest heavily in training while understaffed, or hold out for experienced candidates who are increasingly hard to find.

Technology and automation: Doing more with less

Technology won’t solve the accountant shortage on its own, but it can significantly reduce the strain on understaffed teams. By automating routine, time-consuming work, finance organizations can stretch limited headcount further and give accountants more room to focus on judgment-driven tasks.

How automation multiplies productivity

Modern finance tools handle many of the repetitive processes that once consumed hours of manual effort. For lean teams, these efficiency gains can be the difference between keeping up and falling behind.

| Function | Automation potential | Impact on workload |

|---|---|---|

| Expense categorization | High | Reduces manual entry and review time |

| Receipt matching | High | Cuts hours spent chasing documentation |

| Invoice processing | Medium–high | Shortens processing cycles |

| Bank reconciliation | Medium | Lowers error rates and rework |

| Report generation | Medium | Frees time for analysis and review |

These gains don’t just improve efficiency—they also reduce burnout by removing low-value work that often pushes teams into longer hours.

The changing role of the accountant

As routine tasks become automated, accountants spend more time interpreting results and advising the business. The role shifts away from data entry toward analysis, planning, and cross-functional collaboration.

For many professionals, this shift makes the work more engaging. It also raises the bar for skills, placing greater emphasis on communication, critical thinking, and comfort with technology.

Where human judgment still matters

Automation is effective at pattern recognition and process execution, but it can’t replace professional judgment. Accountants are still essential for:

- Navigating regulatory gray areas and complex tax planning

- Exercising professional skepticism and assessing risk

- Applying context to financial results and recommendations

- Communicating insights to leadership and external stakeholders

In practice, the most resilient teams combine automation with experienced professionals who know when and how to apply it.

How to adapt and thrive during the accountant shortage

Companies can’t wait for the accounting profession to fix its talent pipeline. Teams that perform best in this environment focus on making smarter use of the people and resources they already have, while staying flexible about how work gets done.

Rethink your hiring and retention strategy

Compensation matters, but it’s rarely enough on its own. In a tight market, hiring and retention strategies need to reflect what accountants actually value today.

- Benchmark roles against current market data, not last year’s ranges

- Offer flexible schedules and remote options where possible

- Hire for potential by considering candidates from adjacent fields and investing in training

- Create clear growth paths so experienced staff see a future with the organization

Retention often matters more than recruiting. Losing an experienced accountant is far more disruptive than delaying a new hire.

Maximize your team’s productivity with automation

Before adding headcount, look closely at where your team’s time goes. Manual processes often consume hours that could be redirected toward higher-value work.

Automating routine tasks such as expense reports, receipt matching, and reconciliations doesn’t reduce accountability. It reduces friction, giving accountants more capacity to focus on analysis, review, and decision support.

Use contract and interim talent strategically

Permanent hires aren’t the only option. Contract and interim professionals can help teams manage peak workloads, cover unexpected departures, or bring in specialized expertise.

Used thoughtfully, this approach provides flexibility without locking teams into long-term commitments. It also buys time to make better hiring decisions instead of rushing to fill critical roles.

Looking ahead: The future of accounting talent

The pressures driving the accountant shortage aren’t likely to ease in the near term. Retirements will continue to outpace new entrants, and demand for accounting expertise is expected to remain strong as regulatory and reporting requirements grow more complex.

In the short term, finance teams should plan for longer hiring cycles, higher compensation expectations, and continued strain on existing staff. Organizations that adapt their processes and staffing models now will be better positioned to operate through that pressure rather than react to it.

Over the longer term, the profession is likely to change in more fundamental ways. Technology will continue to absorb routine work, alternative pathways into accounting will expand, and careers will become less linear. These shifts won’t eliminate the shortage overnight, but they may help rebuild the pipeline and make accounting roles more sustainable and attractive over time.

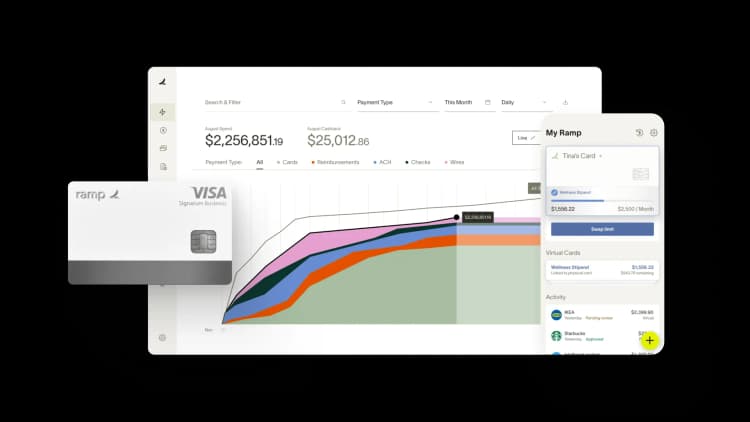

Automate accounting workflows so your team can do more with less

The accountant talent shortage forces finance teams to stretch thin, juggling manual tasks that waste valuable time and increase the risk of error. When you can't hire fast enough to keep pace with growth, you need technology that multiplies your team's capacity.

Ramp's accounting automation software handles the repetitive work that typically requires multiple full-time accountants. AI codes transactions across all required fields as they happen, learning your patterns and applying your feedback to maintain consistency. You'll see a 67% increase in zero-touch codings compared to rules-only automation, which means fewer transactions sitting in review queues waiting for manual attention.

Here's how Ramp extends your team's capabilities:

- AI-powered coding: Ramp codes transactions in real time across dimensions, subsidiaries, and custom fields, so your team spends less time on data entry and more time on analysis

- Automated receipt collection: Ramp texts cardholders for missing receipts and matches them to transactions automatically, eliminating the back-and-forth that typically consumes 16+ hours every month

- Smart sync and review: Ramp identifies in-policy spend and syncs it to your ERP automatically while flagging exceptions that need human judgment, so your team focuses only on what matters

- Streamlined reconciliation: Ramp's reconciliation workspace surfaces variances and missing entries automatically, cutting month-end close time by 3x and saving 40+ hours every month

The platform doesn't replace strategic accounting judgment, but it handles the volume work that typically justifies a new hire. You maintain control and visibility while Ramp manages the repetitive tasks in the background.

Try an interactive demo to see how Ramp can empower your accounting team to stay lean, move fast, and close confidently every month.

FAQs

The shortage is structural, not temporary. It’s driven by long-term trends, including retirements, declining CPA exam participation, and fewer students entering accounting programs. While technology and alternative career pathways may help over time, businesses should plan for continued talent constraints rather than a quick return to pre-2020 hiring conditions.

Hiring timelines have stretched significantly. Many accounting roles now take two months or longer to fill, with senior or specialized positions often taking even more time. Longer searches increase pressure on existing teams and can delay core processes like close, audits, and reporting.

Automation can significantly reduce the manual workload on accounting teams, but it doesn’t eliminate the need for accountants. Tools that automate tasks like expense reporting, reconciliations, and invoice processing free up time for analysis and oversight, allowing smaller teams to handle more work without sacrificing accuracy.

Common warning signs include longer close cycles, delayed audit responses, an increase in errors or rework, and sustained overtime during non-peak periods. When these issues persist, it’s often a signal that workloads, staffing levels, or processes need to be re-evaluated.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits