- What is an asset?

- What are the types of assets?

- Why you should track and monitor assets in accounting

- How to calculate and record assets in accounting

- Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

Whether you're the co-founder of a fast-growing startup or an aspiring business owner, understanding assets is essential to make informed business decisions. Assets are crucial in accounting and are the foundation for a healthy balance sheet. They provide a snapshot of your company's resources, current capabilities, and future growth potential.

We'll discuss the different types of business assets, their classification, and how to record them on the balance sheet. Continue reading to learn more about assets in accounting and understand the impact of assets on your business's financial health.

What is an asset?

An asset is any resource that provides financial value to a business or individual. A company's balance sheet includes all the assets that the organization owns. You can create assets through equity, debt, or outright ownership.

What are the types of assets?

Assets are classified into different categories based on the following parameters:

Based on convertibility

Convertibility refers to the time it takes to sell or convert an asset into cash. Depending on this parameter, assets can be classified as:

Current assets

These are assets that can be easily liquidated and converted into cash. They're crucial for the day-to-day operations of a business and are primarily used to fund short-term obligations. Examples include:

- Cash and cash equivalents include bank account balances, physical currency, and other highly liquid investments that can be quickly converted into cash if required.

- Inventory includes goods and products that a company sells to its customers.

- Accounts receivable refers to the amount clients and customers owe your business for goods and services purchased on credit.

- Short-term investments denote short-term bonds and marketable securities that can be easily converted into cash.

Fixed assets

Also known as non-current or long-term assets, fixed assets refer to goods and property held for the long term and not readily convertible into cash. They assist the company's operations over an extended period and contribute to long-term business revenue and operations. Examples include:

- Property, Plant, and Equipment refer to tangible, long-term assets like buildings, land, furniture, vehicles, machinery, and other equipment that aid business operations.

- Non-physical assets include intangible assets like trademarks, patents, brand names, copyrights, and intellectual property owned by the company.

- Long-term investments include financial instruments like shares, bonds, mergers, and acquisitions, purchased for extended periods and unavailable for immediate conversion into cash.

- Deferred charges are expenditures that are expected to provide benefits over an extended period, such as long-term prepaid insurance, prepaid rent, prepaid software licenses, and other prepaid subscriptions. Deferred charges are initially entered as assets on the balance sheets and are gradually recognized as expenses as you use the service.

Based on physical existence

Assets are classified into tangible and intangible based on physical existence and characteristics. Here are the primary differences between them:

Based on usage

You can also categorize assets based on their business usage, such as:

- Operating assets: As the name indicates, these assets play a crucial role in the company's daily operations. They generate revenue and help maintain the business workflow. Common examples include machinery and equipment that you use to manufacture goods.

- Non-operating assets:These are assets that the business owns but don't use for daily operations. For example, a piece of vacant land the company owns is classified as a non-operating asset as the business doesn't rely on it to complete daily workflow.

Understanding the different asset types can help you value and manage the company's asset portfolio accurately and make informed decisions about the business's financial health.

Why you should track and monitor assets in accounting

Assets provide valuable insights into your company's overall financial health. Here are a few reasons to track and monitor your organizational assets:

- To determine liquidity:Current assets like accounts receivable, inventory, and cash reflect your company's ability to meet short-term obligations and fund day-to-day operations. A higher proportion of liquid assets than current liabilities indicates a healthy financial position.

- For profitability analysis:Assets indicate a company's ability to generate income. By calculating the return on assets (ROA), you can evaluate your company's efficiency to build profits in the long term.

- To evaluate growth potential:Assets indicate a company's future potential. Investments in R&D, an extensive portfolio of intangible assets, and strategic acquisitions increase your company's market value and potential.

- To boost value and investor perception:Investors usually analyze a company's asset portfolio to determine its overall worth. A strong asset portfolio works to your advantage in attracting investors and can help you raise external funding.

- For risk management:A diversified asset portfolio helps to mitigate risks associated with market fluctuations or changing economic conditions. Furthermore, proper asset management enables you to identify and eliminate potential risks, thereby improving growth opportunities.

How to calculate and record assets in accounting

Step 1: List your assets

The first step is to make a list of all the assets that your business owns. You can classify them based on any of the three different types of assets mentioned above. For example, you can start by listing all your current assets and evaluating their value. Next, move on to your fixed assets and determine their long-term value. Make sure to include both tangible and intangible assets to get an accurate view of your company's worth.

Step 2: Prepare the balance sheet

The balance sheet is a financial statement that shows your company's net worth by listing all assets and liabilities. Use this step-by-step guide to create a detailed balance sheet for your small business.

Step 3: Record and value your assets

Ramp's accounting automation software makes it easy to track, record, and manage all your assets and liabilities across categories with just a click. If you do it manually, you can use a spreadsheet to record and track each asset and expense. Here's a quick overview of how to record and value assets in the balance sheet:

Recording assets

When your business acquires (purchases) an asset, you must record it in the general ledger. Usually, you include the asset's initial acquisition cost, purchase price, taxes, and other associated costs.

Valuing assets

You can use one of these valuation methods depending on the nature of the asset:

- Historical cost

- Fair value

- Amortized cost

- Impairment

Depreciating assets

Depreciation refers to an asset that gradually loses value due to wear and tear, consumption, or obsolescence over time.

Depreciating assets usually include computer hardware, vehicles, machinery, equipment, and furniture as they experience wear and tear and require repairs or replacement over time. As the asset depreciates, you systematically reduce its value in the financial statements. You can determine the asset's depreciation over time using any of the following methods:

- Straight-line depreciation

- Accelerated depreciation

- Units-of-production depreciations

By recording, valuing, and depreciating assets in your books, you provide transparency to stakeholders, align with accounting regulations, and gain a clear picture of your company's overall financial health. It also helps assess financial stability and make informed decisions to steer your company in the right direction.

Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

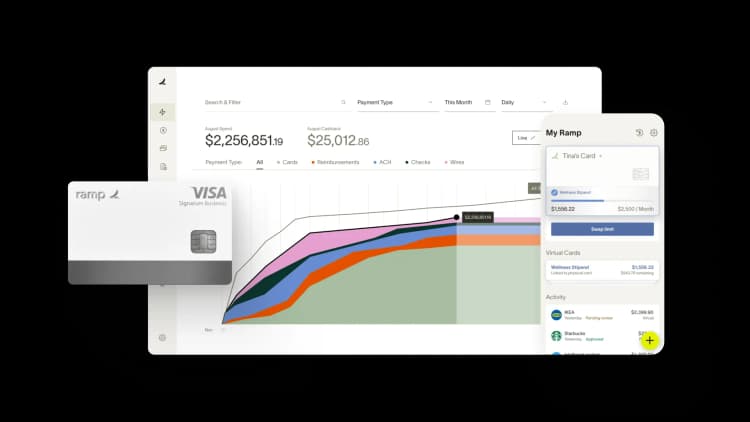

Month-end close is a stressful exercise for many companies, but it doesn’t have to be that way. Ramp’s AI-powered accounting tools handle everything from transaction coding to ERP sync, so teams close faster every month with fewer errors, less manual work, and full visibility.

Every transaction is coded in real time, reviewed automatically, and matched with receipts and approvals behind the scenes. Ramp flags what needs human attention and syncs routine, in-policy spend so teams can move fast and stay focused all month long. When it’s time to wrap, Ramp posts accruals, amortizes transactions, and reconciles with your accounting system so tie-out is smoother and books are audit-ready in record time.

Here’s what accounting looks like on Ramp:

- AI codes in real time: Ramp learns your accounting patterns and applies your feedback to code transactions across all required fields as they post

- Auto-sync routine spend: Ramp identifies in-policy transactions and syncs them to your ERP automatically, so review queues stay manageable, targeted, and focused

- Review with context: Ramp reviews all spend in the background and suggests an action for each transaction, so you know what’s ready for sync and what needs a closer look

- Automate accruals: Post (and reverse) accruals automatically when context is missing so all expenses land in the right period

- Tie out with confidence: Use Ramp’s reconciliation workspace to spot variances, surface missing entries, and ensure everything matches to the cent

Try an interactive demo to see how businesses close their books 3x faster with Ramp.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits