Accumulated depreciation: definition and how it works

- What is accumulated depreciation?

- How accumulated depreciation works

- Accumulated depreciation vs. depreciation expense

- Methods for calculating accumulated depreciation

- How to report accumulated depreciation

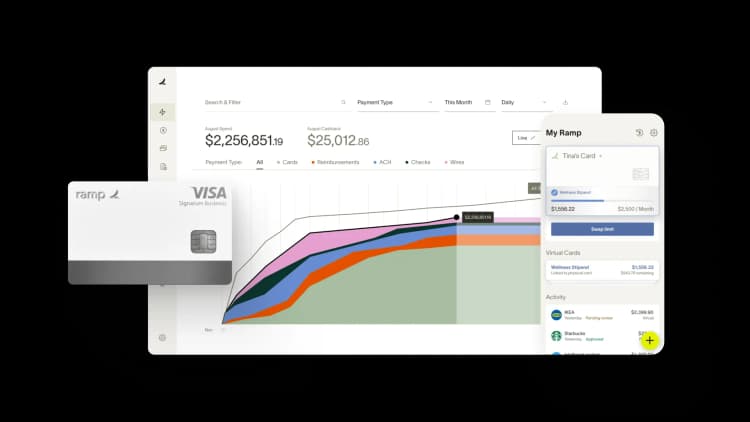

- Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

Key takeaways

- Accumulated depreciation tracks an asset's total loss in value over time and reduces its book value.

- It appears as a contra-asset account on the balance sheet and offsets the asset's original cost.

- Depreciation expense is recorded yearly, while accumulated depreciation grows until the asset is fully depreciated or sold.

- Choosing the right depreciation method impacts tax savings, cash flow, and financial planning.

- Automating depreciation tracking improves accuracy, reduces manual work, and ensures compliance.

What is accumulated depreciation?

Accumulated depreciation

Accumulated depreciation is the total amount of depreciation recorded on an asset since its purchase. It tracks how much value an asset has lost over time and appears on financial statements to show its reduced worth.

Unlike regular depreciation, which is recorded yearly as an expense, accumulated depreciation keeps adding up. It lowers the asset’s book value, giving you a clearer picture of its actual worth.

You can depreciate tangible, long-term assets like equipment, vehicles, and office furniture. The IRS allows you to spread the cost over time instead of deducting it all at once. This helps match expenses with revenue. Businesses, on average, deduct nearly $400 billion per year using tax incentives and depreciation.

On your balance sheet, accumulated depreciation appears as a contra-asset account. Asset accounts are increased using a debit entry, while contra-asset accounts are increased by posting a credit entry. Accumulated depreciation offsets the asset’s original cost to show its true value. This prevents overstatement of your company’s worth. Investors and lenders use this information to assess financial health.

How accumulated depreciation works

Accumulated depreciation shows how much value an asset has lost over time. It increases each year as you record depreciation expenses. Instead of deducting the full cost of an asset in one year, you spread the expense over its useful life. This process matches depreciation expense with the revenue generated using the asset, which keeps your financial statements accurate and reflects the asset’s true value.

Each year, you record depreciation as an expense on your income statement. At the same time, you add it to the accumulated depreciation account on your company’s balance sheet. This continues until the asset is fully depreciated or removed from use.

For example, if you buy equipment for $100,000 and depreciate it by $10,000 per year, after five years, accumulated depreciation reaches $50,000. That means the asset’s book value is now $50,000 (cost less accumulated depreciation), not its original cost.

Accumulated depreciation helps you track asset wear and tear, plan for replacements, and stay compliant with tax rules. Without it, you might overstate profits or miscalculate the value of the asset, leading to inaccurate financial reports.

Accumulated depreciation vs. depreciation expense

Accumulated depreciation and depreciation expense both track how fixed assets lose value, but they serve different tax purposes. Depreciation expense is the amount you deduct for an asset in a single accounting period. Accumulated depreciation is the total depreciation recorded since the asset was purchased.

Depreciation expense appears on your income statement as a yearly cost. It lowers your taxable income, reducing your tax burden. The IRS allows you to deduct depreciation using straight-line or accelerated depreciation methods.

Accumulated depreciation appears on your balance sheet. It offsets the asset’s original cost, showing its reduced value over time. Unlike depreciation expense, accumulated depreciation keeps increasing until the asset is fully depreciated or sold.

For example, assume you buy a company vehicle for $40,000 and expect to use it for five years. You decide to use straight-line depreciation, which means you will deduct the same amount each year.

In this case, you record $8,000 per year ($40,000 ÷ 5 years) as depreciation expense. This appears on your income statement as a yearly business expense, reducing your taxable income.

At the same time, accumulated depreciation keeps increasing. After three years, accumulated depreciation reaches $24,000 ($8,000 × 3). The vehicle’s book value on your balance sheet is now $16,000 ($40,000 - $24,000).

This process continues until the asset is fully depreciated or sold.

Methods for calculating accumulated depreciation

Businesses use different methods based on how quickly an asset loses value and financial goals. Some assets wear out evenly over time, while others lose value faster in their early years. The IRS offers multiple depreciation methods, each suited for different types of company’s assets. Choosing the right method impacts tax savings, financial reporting, and asset management.

It's important to note that total depreciation expense is the same, regardless of the depreciation method you choose. The difference between methods is only in the timing of the expense.

Straight-line depreciation method

The straight-line depreciation method is the easiest and most commonly used way to calculate depreciation. It spreads the cost of the asset evenly over its useful life. This makes it simple to track and predict expenses. Small businesses use this method for assets that wear out gradually, like office furniture, buildings, and machinery.

You can calculate straight-line depreciation using this depreciation formula:

Annual Depreciation Expense = (Asset Cost − Salvage Value) / Useful Life

For example, if you buy equipment for $50,000, expect it to last 10 years and estimate a $5,000 salvage value. The deduction would come out to $4,500 each year for 10 years as depreciation expense.

Many businesses choose this method because it is consistent, predictable, and easy to apply. It also follows GAAP (Generally Accepted Accounting Principles), making financial reporting clear. However, this method may not work for assets that lose value faster in their early years.

Declining balance method

The declining balance method lets you deduct more depreciation in the early years of an asset’s life. It helps reduce taxable income sooner and reflects how assets lose value over time. This method is useful for assets that wear out or become outdated quickly, such as vehicles, machinery, and technology.

Instead of spreading the asset’s depreciation evenly, you apply a fixed percentage to the asset’s book value each year. The most common version is the double declining balance method (DDB), which depreciates assets at twice the straight-line rate.

For example, if you buy equipment for $50,000 with a five-year useful life, the straight-line rate would be 20% per year. With DDB, you double the depreciation rate to 40%. In the first year, depreciation is $20,000. In the second year, depreciation applies to the new book value of $30,000 ($50,000 - $20,000), resulting in a $12,000 deduction. This continues until the asset reaches its salvage value.

This method benefits businesses by providing larger tax deductions upfront, reducing the tax liability in the early years of an asset’s usable life.

Units of production method

The units of production method calculates depreciation based on how much you use an asset, not just the passage of time. This makes it ideal for equipment, vehicles, or machinery that experience uneven wear and tear. Instead of spreading depreciation evenly, this method ties it directly to output or usage, giving a more accurate picture of an asset’s value.

First, find the depreciation per unit by dividing the asset’s cost minus salvage value by its total expected output to calculate depreciation. Then, multiply that rate by the number of units produced in a given period.

For example, if you buy machinery for $100,000, expect it to produce 500,000 units, and estimate a $10,000 salvage value, the depreciation per unit is $0.18. If the machine produces 50,000 units in one year, depreciation for that year would be $9,000.

This method helps you match depreciation with actual wear and tear, making financial reporting more precise. It also benefits businesses with changing production levels since depreciation expenses adjust accordingly. Industries like manufacturing, mining, and transportation often use this approach to track the value of an asset more accurately.

Sum-of-the-years'-digits method

The sum-of-the-years’-digits (SYD) method is an accelerated depreciation approach that deducts more depreciation in the early years of an asset’s life. This helps business owners recover costs faster and match depreciation with how assets lose value. It works best for assets that decline in efficiency quickly, such as machinery, vehicles, and technology.

SYD assigns higher depreciation in the first years and gradually decreases it over time. To calculate it, first find the sum of the years’ digits by adding up all the years in the asset’s useful life. For an asset with a 5-year lifespan, the sum is:

5 + 4 + 3 + 2 + 1 = 15

Each year, you apply a fraction of the asset’s depreciable value (cost minus salvage value) based on the years remaining. In the first year, the fraction is 5/15. In the second year, it’s 4/15, and so on.

For example, if you buy equipment for $50,000, expect a $5,000 salvage value, and use a 5-year lifespan:

- Total depreciable value = $50,000 - $5,000 = $45,000

- First-year depreciation = (5/15) × $45,000 = $15,000

- Second-year depreciation = (4/15) × $45,000 = $12,000

This pattern continues until the asset is fully depreciated. SYD helps you take larger tax deductions early, reducing taxable income when expenses are higher.

This method provides a balance between straight-line and double-declining balance depreciation. It works best for assets that lose value quickly but still offer long-term benefits.

How to report accumulated depreciation

You report accumulated depreciation on your balance sheet as a contra-asset account. It reduces the original cost of an asset to show its net book value. This helps keep your financial statements accurate.

When reporting, list the asset under property, plant, and equipment (PP&E) at its original purchase price. Below it, record accumulated depreciation as a negative amount. Subtracting this from the asset’s cost gives you the net book value.

For example, if you own machinery worth $100,000 and accumulated depreciation reaches $40,000, your balance sheet will show:

- Machinery: $100,000

- Less: Accumulated depreciation: ($40,000)

- Net book value: $60,000

You update accumulated depreciation each year as you record depreciation expenses. This balance grows until the asset is fully depreciated, sold, or retired. If you remove an asset, you must also remove its accumulated depreciation from the balance sheet.

Accurate tracking is essential for financial reporting, tax compliance, and audit readiness. However, manual tracking can lead to errors, missing entries, and time-consuming reconciliations. Automating depreciation-related transactions helps businesses maintain error-free financial records and reduce the risk of compliance issues.

Many businesses use accounting integrations to simplify this process. For example, Ramp syncs with QuickBooks, Xero, and NetSuite, ensuring that depreciation-related transactions update automatically. This eliminates manual data entry and ensures that recorded depreciation matches actual expenses. Automated transaction tracking and receipt-matching also improve compliance, making audits and year-end reporting less stressful.

Investors and lenders look at accumulated depreciation to understand a company’s financial position. A high accumulated depreciation balance may mean you are using older assets that could need replacement soon.

Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

Month-end close is a stressful exercise for many companies, but it doesn’t have to be that way. Ramp’s AI-powered accounting tools handle everything from transaction coding to ERP sync, so teams close faster every month with fewer errors, less manual work, and full visibility.

Every transaction is coded in real time, reviewed automatically, and matched with receipts and approvals behind the scenes. Ramp flags what needs human attention and syncs routine, in-policy spend so teams can move fast and stay focused all month long. When it’s time to wrap, Ramp posts accruals, amortizes transactions, and reconciles with your accounting system so tie-out is smoother and books are audit-ready in record time.

Here’s what accounting looks like on Ramp:

- AI codes in real time: Ramp learns your accounting patterns and applies your feedback to code transactions across all required fields as they post

- Auto-sync routine spend: Ramp identifies in-policy transactions and syncs them to your ERP automatically, so review queues stay manageable, targeted, and focused

- Review with context: Ramp reviews all spend in the background and suggests an action for each transaction, so you know what’s ready for sync and what needs a closer look

- Automate accruals: Post (and reverse) accruals automatically when context is missing so all expenses land in the right period

- Tie out with confidence: Use Ramp’s reconciliation workspace to spot variances, surface missing entries, and ensure everything matches to the cent

Try an interactive demo to see how businesses close their books 3x faster with Ramp.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°