Corporate tax planning strategies for growing businesses

- What is corporate tax planning?

- Why tax planning matters for growing businesses

- 7 corporate tax planning strategies for businesses

- Tax planning strategies by business structure

- Year-end tax planning for businesses

- How to develop an effective tax strategy

- Common tax planning mistakes to avoid

- When to consult a tax professional

- How Ramp simplifies tax planning

Corporate tax planning is about making informed choices throughout the year to legally reduce what you owe, keep more cash in your business, and stay on the right side of IRS rules. It's not something you do once in April—it's an ongoing practice that directly affects your bottom line.

When you save money on taxes, you free up capital to hire, invest in equipment, or expand into new markets. And when you plan proactively, you avoid the penalties, surprise bills, and missed opportunities that catch reactive businesses off guard.

Below, you'll find practical strategies to optimize your 2026 tax position, whether you're running a startup, scaling a mid-market company, or managing a complex multi-entity structure.

What is corporate tax planning?

Corporate tax planning is the legal process of structuring your finances, timing income and expenses, and leveraging deductions and credits to minimize your tax liability. It applies to businesses of all sizes, from early-stage startups to enterprises with large finance teams.

The key distinction is between planning and preparation. Planning is proactive and happens year-round. Preparation is the act of filing returns after the fact. The businesses that save the most on taxes are the ones treating it as a continuous discipline, not a once-a-year scramble.

- Tax planning vs. tax preparation: Planning involves making financial decisions throughout the year to reduce your tax burden. Preparation is compiling documents and filing returns—by then, most opportunities have passed.

- Legal tax minimization: Tax planning uses available business tax deductions, credits, and timing strategies within the law. It's entirely distinct from tax evasion, which is illegal.

Effective corporate tax planning requires ongoing strategic decisions throughout the year to legally minimize tax liability and maximize financial efficiency.

Why tax planning matters for growing businesses

As your revenue increases, so does your tax complexity. A deduction you overlooked at $500 thousand in revenue could cost you tens of thousands at $5 million. Proactive tax planning directly affects profitability and the cash available to reinvest in your business.

Reduce overall tax liability

Strategic planning lowers the total taxes you owe by maximizing legitimate deductions and credits. Without a plan, you're likely leaving money on the table—sometimes year after year without realizing it.

Improve cash flow management

When you time income and expenses intentionally, you control when cash leaves the business. Deferring income or accelerating deductions during growth phases keeps more working capital on hand when you need it most.

Ensure regulatory compliance

Proper planning helps you meet federal, state, and local tax obligations on time and in full. That means fewer penalties, fewer audit triggers, and less time spent cleaning up compliance errors after the fact.

Support business growth and reinvestment

Every dollar saved on taxes is a dollar you can put toward hiring, equipment, marketing, or expansion. For that reason, you should treat tax planning as a growth enabler that compounds over time.

7 corporate tax planning strategies for businesses

These strategies work best when you implement them as part of a year-round plan rather than rushing decisions in December. Each one is actionable and designed for growing businesses, including pass-through entities like LLCs, S corporations, and partnerships.

1. Maximize business tax deductions

Business tax deductions directly reduce your taxable income, making them one of the most straightforward ways to lower your tax bill. The key is tracking and categorizing expenses properly so you capture every eligible deduction.

Common deductible expenses include:

- Operating expenses: Rent, utilities, insurance, and other day-to-day costs that keep your business running

- Professional services: Legal, accounting, and consulting fees

- Employee costs: Salaries, benefits, training courses, conferences, and certifications

- Business travel and meals: Travel expenses and 50% of meals with clients or business partners (subject to specific IRS limits)

- Home office deduction: A portion of mortgage/rent, utilities, and maintenance based on your office's percentage of total home space

If your business has $100,000 in revenue and $30,000 in deductible expenses, you'd only pay taxes on $70,000. Don't overlook deductions such as professional memberships, business insurance premiums, accounting and legal fees, and equipment or supplies needed for operations.

2. Claim all available tax credits

Tax credits provide dollar-for-dollar reductions in taxes owed—far more valuable than deductions, which only reduce taxable income. A $1,000 credit saves you $1,000 in taxes, while a $1,000 deduction might only save $250–$370 depending on your bracket.

- R&D tax credit: Rewards businesses that invest in developing new products, processes, or software improvements through qualified research activities

- Work Opportunity Tax Credit (WOTC): Available for hiring employees from targeted groups, including veterans and long-term unemployed individuals

- Energy credits: Clean energy investments under the Inflation Reduction Act can qualify for significant credits

- Small employer credits: Helps small businesses offset the cost of providing health insurance or retirement plans to employees

Many businesses miss credits simply because they don't realize they qualify. Cross-reference your activities against available federal and state credits each year.

3. Leverage depreciation and bonus depreciation

Depreciation lets you deduct the cost of business assets over their useful life, providing ongoing tax benefits from major purchases. Two accelerated options can front-load those savings.

Section 179 of the IRS tax code allows an immediate deduction of up to $2.56 million (2026 limit) for qualifying equipment purchases. Bonus depreciation lets you deduct 100% of certain assets' costs in the first year if they were purchased and placed in service after Jan 19, 2025.

For example, buying a $50,000 company vehicle in December could provide an immediate $50,000 deduction under Section 179, saving a business owner in the 24% federal bracket around $12,000 in federal income tax. This improves cash flow by accelerating deductions into the current year.

4. Optimize retirement plan contributions

Contributing to retirement plans reduces your current taxable income while building long-term wealth for you and your employees. It's one of the most reliable ways to lower your tax bill.

For 2026, 401(k) contribution limits are $24,500 for employees under 50 and $32,500 for those 50 and older. SEP IRA contributions can be up to 25% of compensation, up to $72,000. SIMPLE IRAs offer another option for smaller teams.

Review your contributions before December 31 to maximize current-year tax benefits. Even a last-minute contribution can meaningfully reduce your tax liability.

5. Time income and expenses strategically

The timing of when you recognize income and claim expenses can shift your tax burden between years. This is one of the most flexible tools in your tax planning toolkit.

If you use cash-basis accounting, you can delay invoicing clients until January to push income into the next tax year, or accelerate deductible purchases before December 31 to claim them this year. Accrual-basis businesses have different rules but can still use strategies such as installment sales to defer income recognition.

This works best when you have a clear picture of your projected income for both the current and following year. If you expect lower revenue or higher deductions next year, deferring income now can reduce your overall tax rate across both periods.

6. Manage net operating losses

A net operating loss (NOL) occurs when your allowable tax deductions exceed your taxable income in a given year. Rather than losing that benefit, you can carry NOLs forward to offset future taxable income.

Under current rules, NOL carryforwards can offset up to 80% of taxable income in any given year, with no expiration on the carryforward period. This makes NOLs particularly valuable for businesses that experience uneven revenue, like startups with heavy upfront investments or companies navigating cyclical markets.

Track your NOLs carefully and factor them into your multi-year tax projections. A qualified tax professional can help you apply them in the years where they'll deliver the most benefit.

7. Use expense management software for tax compliance

Accurate recordkeeping is the foundation of every strategy. If you can't document a deduction, you can't claim it.

Manual tracking leaves too much room for error. Automated expense management software ensure every transaction is captured, categorized, and matched to a receipt in real time. That means you're not scrambling at year-end to reconstruct records or guessing which expenses qualify as deductions.

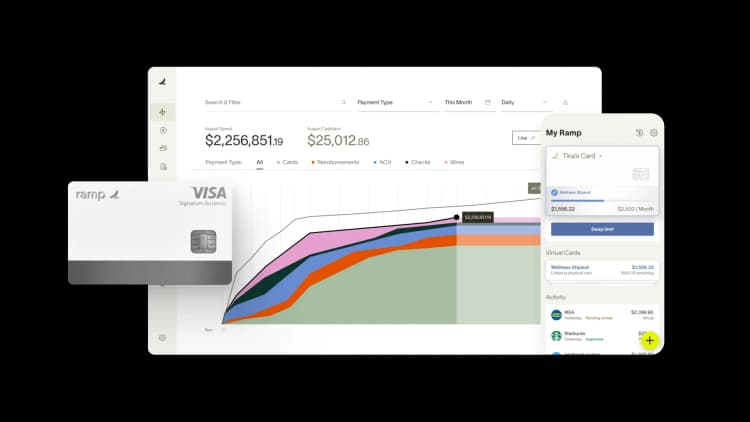

Ramp automates receipt capture and expense categorization, giving you real-time visibility into spending that supports year-round tax planning. When your records are audit-ready by default, you spend less time on compliance and more time on strategy.

Tax planning strategies by business structure

Your entity type determines how income is taxed and which strategies apply. Choosing the right structure, and revisiting that choice as you grow, is a tax strategy in itself.

C corporations

C corporations pay corporate income tax on their profits at a flat 21% federal rate, established by the Tax Cuts and Jobs Act (TCJA) of 2017. This structure separates business income from personal income, which can be helpful for companies looking to retain and reinvest earnings.

C corps can implement strategies such as deferring income, accelerating deductions, or investing in R&D to qualify for tax credits. However, double taxation—where profits are taxed at the corporate level and again as shareholder dividends—is a real consideration for this structure.

S corporations and pass-through entities

S corporations, along with sole proprietorships and certain LLCs, pass income directly to owners, who report it on their personal tax returns. This avoids double taxation and simplifies compliance for many small business owners.

Pass-through owners can benefit from the qualified business income (QBI) deduction, which allows eligible taxpayers to deduct up to 20% of their pass-through income. For S corp owners specifically, balancing salary versus distributions is critical. Reasonable compensation must be paid, but distributions above that amount aren't subject to payroll taxes.

LLCs and partnerships

LLCs and partnerships offer flexible tax treatment. An LLC can elect to be taxed as a partnership, S corporation, or C corporation depending on what makes the most sense for its owners.

Active members of LLCs and partnerships should pay close attention to self-employment tax, which applies to their share of business income. Electing S corp treatment can reduce this burden, but it comes with additional compliance requirements.

| Structure | Tax treatment | Key planning consideration |

|---|---|---|

| C corporation | Entity-level tax + shareholder dividends taxed | Retain earnings; access broad deductions |

| S corporation | Pass-through to owners | Balance salary vs. distributions |

| LLC/Partnership | Flexible (elect treatment) | Self-employment tax; QBI deduction eligibility |

Year-end tax planning for businesses

The actions you take before December 31 can meaningfully change your tax bill come April. Treat this as an annual checklist. These are time-sensitive moves that lose their value once the calendar turns.

Accelerate deductible expenses

Prepaying rent, insurance, supplies, or other deductible costs before year-end lets you claim those deductions in the current tax year. This works best when you expect lower income or fewer deductions next year.

You can also pay employee bonuses before December 31 to create additional deductible expenses in the current period. Just make sure any prepaid expenses meet IRS rules for the tax year you're claiming them in.

Defer income to the following year

If you're on cash-basis accounting, delaying invoices or using installment methods can push revenue into the next tax year. This is especially useful if you expect higher deductions or a lower tax rate next year.

Review your accounts receivable in early December to identify invoices you can send in January without disrupting client relationships or cash flow.

Review asset purchases and depreciation elections

Before the year closes, assess whether to take bonus depreciation on recent purchases or spread deductions over time based on your projected income. Equipment purchased and placed in service before December 31 may qualify for Section 179 or bonus depreciation.

If you've been considering a major equipment purchase, buying before year-end could provide a significant immediate deduction.

Maximize retirement plan contributions

Deadlines for employer contributions vary by plan type. Most employer-sponsored plan contributions must be made by December 31, but SEP-IRA and traditional IRA contributions can be made up until your tax filing deadline—typically April 15.

Review your contribution room now. Even a last-minute contribution can reduce your current-year tax liability.

Reconcile expense records and documentation

Gaps in documentation can disqualify legitimate deductions during an audit. Before year-end, review all expense records to confirm you have receipts, invoices, and business-purpose documentation for every deduction you plan to claim.

Expense management tools like Ramp auto-match receipts to transactions, so you're not spending December hunting for missing paperwork. If you've been tracking expenses manually, now is the time to close any gaps.

How to develop an effective tax strategy

If you don't have a formal tax strategy yet, here's a step-by-step process to build one. Even if you already have a plan in place, this framework can help you identify gaps.

1. Review financial statements and prior tax returns

Start by looking at what you paid, what you deducted, and where you may have missed opportunities. Pull your past 2–3 years of returns and look for patterns in income, expenses, and effective tax rates. This baseline tells you where you are and highlights the areas with the most room for improvement.

2. Identify available credits and deductions

Cross-reference your business activities against available federal and state credits. Many companies miss industry-specific incentives, R&D credits, or energy-related deductions because they don't realize they qualify. Build a checklist of every credit and deduction relevant to your business and review it annually.

3. Evaluate your business structure

Assess whether your current entity type still makes sense as revenue grows. Converting from a sole proprietorship to an S corp, or from an LLC to a C corp, can offer meaningful tax advantages, but each change has legal and administrative implications. This is a decision worth making with a tax professional rather than on your own.

4. Forecast future income and expenses

Project next year's revenue and costs to make informed timing decisions. Scenario planning helps you decide when to accelerate or defer income and expenses for the best tax outcome. Even rough projections are better than none; the goal is to avoid making December decisions with January information.

5. Implement tracking and documentation systems

Deductions require proof. If you can't document an expense, you can't claim it. Automate expense capture and categorization to maintain audit-ready records year-round rather than reconstructing them at tax time.

Ramp's automated receipt matching and real-time categorization keep your records clean without adding manual work to your team's plate.

6. Schedule regular reviews with tax professionals

Quarterly check-ins with your tax advisor beat an annual scramble every time. Tax professionals can flag legislative changes, identify planning opportunities, and help you adjust your strategy as your business evolves throughout the year.

Common tax planning mistakes to avoid

Even well-intentioned businesses make mistakes that cost real money or create compliance risk. Here are the most common pitfalls to watch for.

Missing available deductions and credits

Many businesses overlook R&D credits, energy incentives, or industry-specific deductions simply because they don't know they qualify. This is especially common for growing companies that haven't yet built a formal tax planning process.

Regularly review available credits against your business activities. What didn't apply last year might apply now.

Poor expense documentation

Incomplete or missing receipts can invalidate deductions you're otherwise entitled to. The IRS requires contemporaneous records, meaning documentation created at or near the time of the expense.

Automated expense tracking eliminates this risk by capturing receipts and matching them to transactions in real time.

Ignoring state and local tax obligations

Operating in multiple states creates nexus and filing requirements that vary by jurisdiction. Failure to comply can result in penalties, back taxes, and interest charges that add up quickly.

Stay informed about tax laws in every state where you have employees, customers, or physical presence, and work with advisors who understand multi-state compliance.

Waiting until year-end to plan

Reactive planning limits your options. By December, many of the most effective strategies—such as timing income, restructuring entities, or making retirement contributions—have a much narrower window or have closed entirely.

Year-round attention gives you the flexibility to make timing decisions when they actually matter.

Misclassifying business expenses

Incorrect expense categorization can trigger audits or disallow deductions. Common mistakes include classifying capital expenditures as operating expenses, or mixing personal and business costs.

Automated categorization tools reduce this risk by applying consistent rules to every transaction.

When to consult a tax professional

While you can handle many tax situations on your own, certain circumstances call for specialized expertise. Knowing when to bring in a qualified tax advisor can save you significant money and headaches.

- Complex business structures: Multiple entities, partnerships, or holding companies involve pass-through taxation, profit allocation, and specific reporting requirements that vary by structure. A tax professional can navigate these complexities and identify strategies you might otherwise miss.

- Multi-state or international operations: Whether you're conducting business overseas, have foreign subsidiaries, or employ workers across state lines, you'll face a maze of regulations, treaties, and reporting obligations. Specialized knowledge helps you avoid double taxation and maintain compliance across jurisdictions.

- Major transactions: Selling a business, major real estate deals, significant capital expenditures, or substantial investment gains can dramatically alter your tax situation. A tax advisor can help you time these events strategically and take advantage of available deductions or credits.

- Audit notices or compliance issues: If the IRS selects your return for examination, having an experienced professional handle communications and documentation protects your interests and improves the outcome

- Legislative changes: New tax laws may create opportunities or obligations you're unaware of. Tax professionals stay current with changing regulations and can adjust your strategy accordingly.

The investment in professional tax advice often pays for itself through identified savings, avoided penalties, and peace of mind. Rather than viewing tax preparation as an annual chore, consider it an opportunity to optimize your financial position with expert guidance. Partnering with a CPA, tax advisor, or financial advisor gives you the expertise to handle these complexities and meet your tax obligations with confidence.

How Ramp simplifies tax planning

Strategic corporate tax planning helps you manage your taxable income, minimize liabilities, and reinvest your savings into growth opportunities. By implementing effective strategies, you can reduce tax burdens and maintain compliance, creating a foundation for long-term success.

Ramp provides technology designed to simplify and enhance the entire tax planning process. With tools that automate expense management, improve financial reporting, and provide actionable insights, Ramp helps you stay compliant and optimize your tax strategies.

Ramp's financial tools are designed to streamline expense tracking and categorization, giving you more time to focus on strategic tax planning. By integrating technology like Ramp into your financial processes, your business can approach tax planning with confidence and efficiency.

Watch a demo video to see how Ramp can help you implement smarter financial practices that can help boost your business's growth and financial health.

FAQs

The five pillars are income timing, entity structure optimization, maximizing deductions, leveraging credits, and maintaining compliance documentation. Together, they form the foundation of a comprehensive tax strategy.

Tax planning is the legal, proactive process of minimizing liability using available strategies within the law. Tax avoidance refers to more aggressive tactics that may push legal boundaries—both are distinct from illegal tax evasion.

Quarterly reviews with your tax advisor let you adjust timing decisions, respond to legislative changes, and avoid year-end surprises. Annual reviews alone leave too many opportunities on the table.

Keep receipts, invoices, bank statements, mileage logs, and documentation of business purpose for all expenses claimed as deductions. Retain these records for at least 3 to 7 years depending on the deduction type.

Your entity type determines whether profits are taxed at the corporate or individual level, which credits and deductions apply, and how owner compensation is treated for tax purposes.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°