Payroll journal entry: Examples and best practices

- What is a payroll journal entry?

- Types of payroll journal entries

- How to record payroll in the general ledger

- Examples of payroll journal entries

- Best practices for payroll journal entries

- Common payroll journal entry mistakes to avoid

- Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

Correctly recording payroll journal entries is essential for compliance, accurate paychecks, and confident financial planning. Each payroll expense journal entry helps you keep track of wages, taxes, and deductions so your records stay clean and audit-ready.

In this article, we break down what goes into a payroll journal entry, walk you through examples of payroll journal entry formats, show you how to record them step-by-step, and share tips for avoiding mistakes that can cost you time and money.

What is a payroll journal entry?

A payroll journal entry records wages, taxes, and deductions in your company’s general ledger. It tracks payroll liabilities, employee compensation, and tax withholdings, helping you document payroll-related transactions correctly. Recording these transactions accurately keeps payroll processing smooth and helps your business stay compliant with IRS regulations.

Every payroll processing cycle requires at least two journal entries:

- An entry to record gross wages, tax withholdings, and deductions. This includes payroll expenses such as salaries, health insurance, and retirement plans.

- An entry that records payments to employees and tax agencies, reducing outstanding liabilities once you pay wages and taxes

Using payroll software automates this process, reducing discrepancies and improving functionality. Platforms such as QuickBooks integrate payroll with accounting, making it easier to track payroll transactions without manual errors. Automation helps you record every pay period properly, preventing missing entries or misclassified expenses.

Types of payroll journal entries

There are several types of payroll journal entries, each serving a specific purpose in payroll accounting.

Initial recording of payroll

This entry records employee earnings and deductions when you process payroll. It includes:

- Gross wages, which reflect the total earnings before deductions

- Payroll taxes, including federal, state, and local tax withholdings

- Payroll deductions for benefits such as health insurance and retirement plans

- Employer contributions to benefits and payroll tax expenses for Social Security, Federal Insurance Contributions Act (FICA), and state unemployment taxes

The general ledger records these amounts as payroll liabilities until you pay wages.

Accrued wages and payroll liabilities

If payroll is earned but unpaid at the end of a pay period, you record an accrued wages entry. This ensures you recognize expenses in the correct accounting period, even if you haven’t disbursed cash yet.

The unpaid wages remain in a liability account until your company issues employee paychecks or direct deposit. You typically use accrued payroll entries:

- At month-end or year-end, when payday falls in the next accounting period

- When preparing financial statements on an accrual basis

- For adjusting entries before closing the books to reflect all earned wages and associated payroll liabilities

Payroll tax expense entry

As an employer, you pay additional taxes beyond employee withholdings, which you must record separately. This includes:

- FICA taxes (Social Security and Medicare)

- Federal unemployment and state unemployment taxes

- Employer-paid portions of health insurance or other required benefits

Tracking these payments in the general ledger ensures that payroll reports remain accurate and you settle all liabilities on time.

Manual payment entry

A manual payment entry records the transaction if you pay payroll by check instead of direct deposit. You also use this type of entry to correct payroll errors from previous entries or to issue one-time payments outside the normal pay period. Manual entries help maintain accurate payroll liabilities and expense records even when exceptions occur.

Reversing payroll journal entries

Mistakes happen, and when they do, a reversing entry corrects payroll errors from past accounting periods. You often make these entries at the start of a new period to reverse accruals or adjustments from the previous period, ensuring that financial statements and payroll reports accurately reflect payroll expenses and liabilities.

How to record payroll in the general ledger

Accurately recording payroll in the general ledger helps you properly account for wages, taxes, and deductions in your company’s financial statements. Each pay period, you must track wages, payroll liabilities, and tax obligations. Follow these steps to keep payroll records accurate:

Step 1: Record gross pay

Start by recording the total wage expense before deductions. This includes salaries, hourly wages, bonuses, and other earnings.

Entry: Debit the wage expense account to reflect employee compensation.

Step 2: Record payroll deductions

The next step is to account for employee payroll deductions, including:

- Taxes (federal income tax, state income tax, Medicare, Social Security)

- Benefits (health insurance, retirement plan contributions)

- Garnishments (child support, wage garnishments, court-ordered deductions)

Withhold these amounts from employee earnings and record them as liabilities until you’ve paid them to the appropriate agencies.

Entry: Credit liability accounts for all withholdings, including taxes, benefits, and garnishments.

Step 3: Record net pay distribution

After deductions, employees receive their net pay, either by direct deposit or physical paycheck.

Entry: Credit the cash account or bank account for the total amount paid to employees.

Step 4: Record employer taxes

As an employer, you need to contribute payroll taxes as well, recording them separately from employee withholdings.

Entry: Debit the payroll tax expense account. Credit payroll liabilities for employer-paid taxes such as FICA, federal unemployment, and state unemployment taxes.

Step 5: Double-check and reconcile payroll liabilities

Before closing payroll records, review all payroll reports to ensure totals match your company’s financial statements. Confirm that each payroll liability, including taxes, benefits, and garnishments, is paid or scheduled for payment, and that you clear the corresponding liability accounts. This prevents discrepancies and ensures compliance with tax and benefit obligations.

Examples of payroll journal entries

Below are practical examples showing how different payroll journal entries look in a company’s general ledger.

Manual payroll entry example

Let’s say you run payroll for one employee with the following amounts for the pay period:

- Gross pay: $2,000

- Federal income tax withheld: $200

- Social Security tax withheld (6.2%): $124

- Medicare tax withheld (1.45%): $29

- Health insurance premium (employee deduction): $100

- Net pay: $1,547

The following journal entry shows how you record the payroll during processing. It records the gross pay, withholdings, and the cash payment to the employee:

Account | Debit | Credit |

|---|---|---|

Wages expense | 2,000 | |

Federal income tax payable | 200 | |

Social Security tax payable | 124 | |

Medicare tax payable | 29 | |

Health insurance payable | 100 | |

Cash (net pay) | 1,547 |

Accrued payroll entry example

If a pay period ends on December 31 but payday is January 3, you’ll need to record accrued wages to include them in the correct accounting period. Let’s assume:

- Gross wages earned but unpaid: $5,000

- Federal income tax withheld: $500

- Social Security tax withheld (6.2%): $310

- Medicare tax withheld (1.45%): $73

The following journal entry records the accrued payroll on December 31. This ensures you record the wages in December, even though payment will happen in January:

Account | Debit | Credit |

|---|---|---|

Wages expense | 5,000 | |

Federal income tax payable | 500 | |

Social Security tax payable | 310 | |

Medicare tax payable | 73 | |

Wages payable | 4,117 |

Reversing entry example

On January 3, when you actually process the payroll, you first reverse the accrual to clear it from your books. Then, record the actual payroll journal entry for that payment using the real amounts, which should match the accrual unless you need to make adjustments:

Account | Debit | Credit |

|---|---|---|

Federal income tax payable | 500 | |

Social Security tax payable | 310 | |

Medicare tax payable | 73 | |

Wages payable | 4,117 | |

Wages expense | 5,000 |

Best practices for payroll journal entries

Consider the following best practices to help your business track payroll liabilities and maintain organized records:

Automate and organize your records

Stop tracking payroll manually. It's time-consuming and prone to errors. Modern payroll software such as QuickBooks does the heavy lifting for you, automatically recording wages, withholdings, and benefits.

Keep detailed documentation of employee wages, transactions, and employer contributions, including all tax elements (federal, state, and payroll taxes). This organization not only saves time but also gives you peace of mind knowing your entries are accurate and you're ready for tax season.

Have Ramp do the heavy lifting.

You can save hours on payroll management by connecting your existing payroll software with Ramp. Instead of manually reconciling benefit payments or tracking down contractor fees at month-end, let Ramp's accounting automation handle the categorization and syncing for you.

Maintain regular financial checks

Make it a habit to compare your payroll reports with financial statements after each pay period. Verify that your payroll transactions align with recorded expenses and make sure you're using the right accounts for different types of payroll costs.

Place employee wages under your salaries expense account, and keep employer-paid taxes in their own liability accounts. This clear structure makes it easier to catch discrepancies early, before they turn into bigger problems.

Set a consistent schedule and track deadlines

Create a fixed schedule for your payroll journal entries, whether biweekly or monthly, and stick to it. This routine helps prevent forgotten entries and ensures you meet tax payment deadlines.

Also, keep track of your payroll liabilities and payment due dates for all tax types and payroll. Consider setting up automated reminders through your payroll software to avoid costly late fees and maintain smooth operations.

Common payroll journal entry mistakes to avoid

Mistakes in payroll journal entries can lead to tax penalties and misclassified expenses, not to mention inaccurate financial statements. Avoid these common errors to keep your payroll records accurate:

- Don't forget to record accrued wages: If you haven’t paid employees who have earned wages by the end of a pay period, record those wages in a liability account as accrued wages. Once you pay, adjust the entry to reflect the payout.

- Make sure to classify accounts correctly: Record payroll deductions for health insurance, retirement plans, and tax withholdings separately in liability accounts until you pay them. Avoid mixing expense and liability accounts, as this can distort your financial statements and cause tax reporting errors.

- Always reconcile with bank transactions and liability accounts: Always compare paychecks and direct deposit transactions to your cash or bank account to ensure you paid the correct amounts. Also, regularly reconcile payroll liability accounts to verify that you’ve paid all amounts withheld to the appropriate agencies or vendors.

- Remember to record employer payroll taxes: As an employer, you must record payroll tax expenses for taxes you owe, including Medicare taxes, FICA, and federal unemployment taxes. Forgetting these entries can result in tax compliance issues.

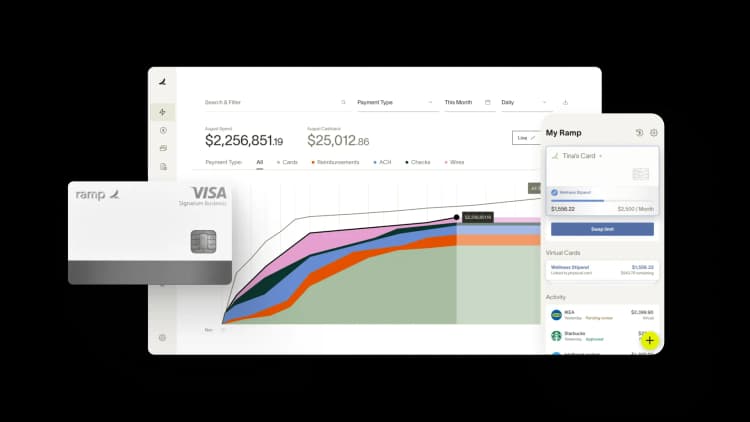

Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

Month-end close is a stressful exercise for many companies, but it doesn’t have to be that way. Ramp’s AI-powered accounting tools handle everything from transaction coding to ERP sync, so teams close faster every month with fewer errors, less manual work, and full visibility.

Every transaction is coded in real time, reviewed automatically, and matched with receipts and approvals behind the scenes. Ramp flags what needs human attention and syncs routine, in-policy spend so teams can move fast and stay focused all month long. When it’s time to wrap, Ramp posts accruals, amortizes transactions, and reconciles with your accounting system so tie-out is smoother and books are audit-ready in record time.

Here’s what accounting looks like on Ramp:

- AI codes in real time: Ramp learns your accounting patterns and applies your feedback to code transactions across all required fields as they post

- Auto-sync routine spend: Ramp identifies in-policy transactions and syncs them to your ERP automatically, so review queues stay manageable, targeted, and focused

- Review with context: Ramp reviews all spend in the background and suggests an action for each transaction, so you know what’s ready for sync and what needs a closer look

- Automate accruals: Post (and reverse) accruals automatically when context is missing so all expenses land in the right period

- Tie out with confidence: Use Ramp’s reconciliation workspace to spot variances, surface missing entries, and ensure everything matches to the cent

Try an interactive demo to see how businesses close their books 3x faster with Ramp.

FAQs

To fix an error, record an adjusting journal entry that reverses the incorrect amounts and adds the correct figures. Then, document the change and keep supporting records for audit purposes.

Payroll liabilities are amounts you owe but haven’t yet paid, such as employee tax withholdings, benefit deductions, and employer payroll taxes. They remain on your books until you remit them to the appropriate agencies or vendors.

A payroll report summarizes employee pay, tax withholdings, deductions, and employer contributions for a specific period. Your business should use these reports for compliance, financial tracking, and preparing tax filings.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits