Introducing Ramp Bill Pay: Blazing fast bill payments to save you time and money

- Millions of businesses still pay bills by mailing checks. Why?

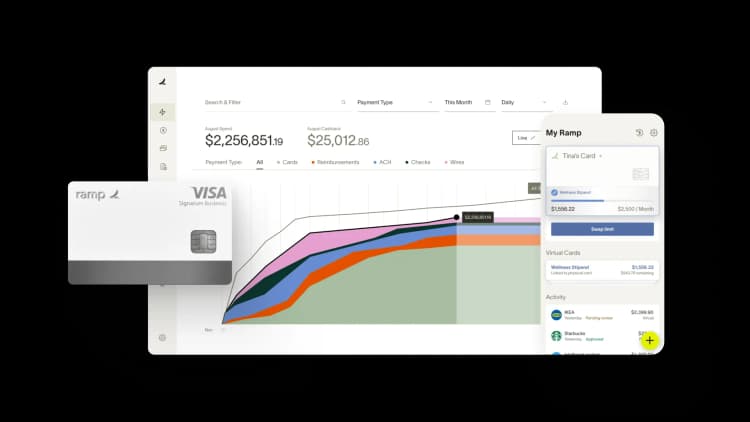

- Ramp Bill Pay: AP software you can trust

- All-in-one finance automation platform—for free

- Do better things with your time

You can now pay bills and run them through an approval process quickly and confidently through Ramp. A process that typically takes 15 minutes for a single bill takes under 60 seconds with Ramp's automated bill payment feature. We’ve sped up the steps through automation, all while keeping all the controls you need to protect your business. Ramp Bill Pay syncs with QuickBooks Online and Xero, with NetSuite and Sage support coming soon.

I’ve spent dozens of hours as Ramp’s accounts payable (AP) clerk during product development, paying bills directly through our bank as well as trying some of the other software offerings on the market. It was such an anxiety-ridden process, with a lot of room for costly errors like paying the same bill twice.

We built Ramp Bill Pay to make that anxiety disappear. Ramp helps you pay your invoices with ease while ensuring all the right controls are in place.

We think it’s pretty cutting-edge, but you don’t have to take my word for it:

“Ramp Bill Pay is mind-blowing. And I do not say that lightly.” - Bhagawat Rawat, VP of Operations and Finance, OneScreen

“Ramp Bill Pay is like magic.” - Nathaniel Manning, COO / Co-founder, Kettle

Millions of businesses still pay bills by mailing checks. Why?

It’s simple—finance teams often see manual workflows like having a single check signer as the easiest way to implement internal controls.

According to Wolfe Research, bill payments represent 75% of discretionary company spend on average. Get them wrong and you risk sending a significant portion of your company’s hard-earned dollars down the drain. There’s zero margin for error.

That’s why finance teams resort to manual checks and balances in hopes of catching issues like:

- Vendors charging you too much

- Your execs approving payments too late

- Your team adding the wrong payment details for the vendor

- You paying the same bill twice, or processing a fraudulent bill

- Your team classifying invoices to the wrong general ledger (GL) account, adding to the headache of the month-end close

But let’s face it, manual processes are just as error-prone. One typo and vendors might not get paid. And when you add more manual controls to your AP processes, the cost to process a vendor invoice goes up.

Why should it take $800 of your finance team’s time to pay a $400 invoice?

Ramp Bill Pay: AP software you can trust

Finance teams simply want assurance that they’re paying the right vendors, at the right time, and for the right amount. We designed Ramp Bill Pay with the goal of building that state of perfect trust.

It automates every part of the AP workflow, with features like:

- One-click bill creation, with critical invoice details automatically extracted

- Automatic detection of duplicate invoices

- Automatic collection of vendor payment details

- Automatic approval routing, with a full audit trail

- Flexible payment by cards, checks, or ACH

- Automatic syncs to QuickBooks or Xero, and categorization of individual line items

Create bills with one click

Easily forward invoices by email or upload PDFs in Ramp. We use AI to automatically transcribe your invoice and pull out important details like vendor name, line items, and due dates. No more manual data entry.

Automatically catch duplicate invoices

Our system compares invoices and flags any that are too similar to ones you’ve paid before.

Automatically collect vendor bank account numbers

A lot of vendors don’t include bank account numbers in their invoices. Ramp can automatically email them for this info—and follow up with them until they provide it. We’ll even automatically release payments if the vendor uploads bank details after your scheduled payment date. One less pesky admin task for you to worry about.

Route approvals through multiple control layers

Bills automatically get routed for approval based on their spend amount. Set up multi-level approval workflows to make sure they get reviewed by the right person. To make this even easier, you can manage all of this in Slack.

Upon final approval, the payment is automatically set to release on the day it’s been scheduled. Other software separate the duties between bill creator and payer by requiring the head of finance to log in daily to release payments. We provide the same control while cutting out the need for daily log-ins.

Pay with cards, checks, or ACH

Choose how you want to pay bills with your Ramp card. You can easily create a secure, one-time virtual card for the vendor, as part of the payment flow. It'll come with a pre-set spend limit that matches the bill amount and auto-lock once used or 60 days after the bill's due date.

For vendors who don’t take cards, you can pay by check or ACH. Once they pass our risk checks, we can pay your vendors as quickly as in two business days.

Automatically sync bills and categorize line items

Ramp automatically posts newly created bills to your GL, giving you real-time visibility into your liabilities. The software goes one step further and automatically maps line items to the right GL account for vendors you’ve paid before, saving you valuable time.

What’s more, Ramp can automatically combine multiple line items into one for customers if they all belong in a single GL category. (Try this the next time you get a bill from your lawyer with thirty line items that all belong to the same journal entry!)

All-in-one finance automation platform—for free

With Ramp Bill Pay, your finance team can finally swap their manual processes for software that offers tight AP control, unlocking significant time savings. With the average finance team processing over 150 bills per month through their bank, Ramp Bill Pay can save your team over 20 hours a month.

“Ramp Bill Pay is one of those things that really simplifies the process. And I like things that simplify the process, especially as we continue to grow. We don't have to add new full-time employees as we scale.” - Robert Phelps, Accounting Manager, WanderJaunt

Ramp Bill Pay also saves you money. Instead of paying for expensive, disjointed software, get bill pay, expense management, account automation, and reporting for free when you use Ramp.

Do better things with your time

At Ramp, our mission is simple: save businesses time and money by building smart automation that finance teams have long needed.

Ramp Bill Pay brings automation—and stress relief—to the AP function. No more manual data entry. No more mailing paper checks. No more lost approvals in your email. More features are on the way, including NetSuite & Sage support, international payments, W9 & 1099 support, and deeper reporting.

Ready to try it out? Learn more and sign up for Ramp today.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits