Companies spend billions on software each year and the average business using Ramp is managing hundreds of subscriptions at once. We’ve heard software eating the world, but it’s eating up our customer’s budgets too. It’s become nearly impossible to keep track of every service that its workforce has purchased, making wasteful spending rampant at most companies where you may have five different subscriptions for the exact same service. We expect this problem to only increase as more people than ever work remotely, and adopt new tools to keep them productive and collaborative.

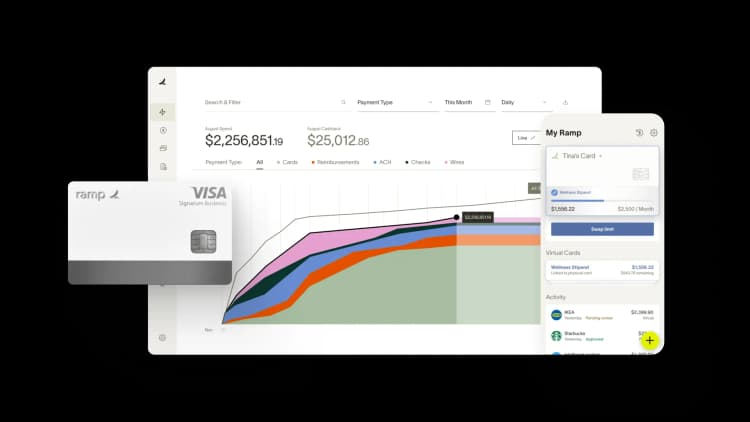

Ramp is here to help businesses regain control and implement critical vendor management best practices, while still empowering people to adopt the tools they need. Today, we’re excited to introduce Ramp Vendor Management, a new way to track and manage payments to all vendors across a company. With Ramp's Vendor Management platform, finance teams can:

- Get a birds eye view of all payments. Ramp will automatically identify and collect all vendors and contract owners in one place, notify when the next payment is due, and track how much has been spent with each vendor over time.

- Streamline purchasing. Ramp centralizes all requests and approvals for new vendors, eliminating "shadow IT" while empowering people to add the services they need in a simplified, controlled way.

- Eliminate wasted spend. On average, 38% of software licenses are inactive each month. Ramps makes it easy to spot any duplicate spending and set limits or rules around new vendors. We’ll even look for better deals with the vendors already in use, so businesses can save even more.

Tools that help people track and manage their subscriptions and recurring payments have long existed for individuals. Most are familiar with Mint, which helps people to keep an eye on recurring bills and subscriptions, so they can budget accordingly. We created Vendor Management because we believe businesses should be empowered with this same sense of transparency and simplicity, without needing to manage several different spreadsheets and services.

Ramp is excited to empower finance teams to cut down on spend by predicting the future. Vendor Management takes us one step further on our journey to be the only corporate card that actually strengthens a businesses finances. On average, a company with 100 employees that uses Ramp saves $15,000 a month today. We measure our success on our ability to increase this number over time, and we believe Vendor Management will be an important step in that direction!

If you’re a business that would like to get started with Ramp, sign up today.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits