Are business credit card payments tax deductible?

- Understanding business credit card tax deductions

- Which credit card expenses are tax deductible?

- Are credit card fees tax deductible?

- Best practices for tracking business credit card expenses

- How to claim credit card deductions on your taxes

- Common mistakes to avoid

- Use Ramp to simplify your business spending

You swipe your business credit card for office supplies, client meals, and software subscriptions throughout the year. When tax season arrives, it’s not always clear which of those credit card charges actually qualify as deductible business expenses.

Here’s the short answer: Your credit card payment itself isn’t deductible, but the underlying business purchases are. The IRS only allows deductions for ordinary and necessary costs that support your business, not the act of paying your credit card bill. The challenge is understanding which expenses qualify, which don’t, and how to report everything correctly at tax time.

Understanding business credit card tax deductions

A business tax deduction reduces your taxable income by the amount you spent on legitimate business expenses. The IRS allows you to deduct ordinary and necessary costs required to operate your company, from office rent to employee salaries.

What often causes confusion is the difference between a credit card payment and a business purchase. Paying your credit card bill isn’t a deductible event—it’s simply moving money from one account to another. The deductible expense occurs when you make a qualifying business purchase.

For example, buying $500 of printer paper creates a deductible business expense. Paying the $500 credit card bill two weeks later does not create an additional deduction. Many business owners mistakenly treat both the purchase and the payment as deductible, which leads to errors during tax filing.

Which credit card expenses are tax deductible?

Most business purchases you charge to your credit card are fully deductible as long as they meet the IRS standard for ordinary and necessary business expenses.

- Office supplies: Paper, pens, printer ink, folders, and desk organizers

- Software subscriptions: Accounting tools, project management platforms, design programs, and cloud storage

- Professional services: Legal fees, accounting costs, consulting services, and freelance contractors

- Advertising and marketing: Social media ads, Google Ads campaigns, promotional materials, and website hosting

- Business insurance: General liability coverage, professional liability, property insurance, and workers' compensation

- Office rent and utilities: Monthly rent payments, electricity, internet service, and phone lines

- Equipment and tools: Computers, printers, specialized machinery, and industry-specific tools

- Shipping and postage: Package delivery, mailing supplies, and courier services

- Employee wages and benefits: Salaries, bonuses, health insurance contributions, and retirement plan matching

- Vehicle expenses: Gas, maintenance, repairs, and insurance for business vehicles

The IRS applies the “ordinary and necessary” test to every business expense. Ordinary means the expense is common in your industry. Necessary means it’s helpful and appropriate for your operations.

Partially deductible expenses

Some expenses have percentage limits. Business meals are generally 50% deductible when you dine with clients, prospects, or employees to discuss work matters. If you spend $100 on a client lunch, you can deduct $50. Restaurant meals provided to employees during work hours also qualify for 50% deduction.

The Tax Cuts and Jobs Act of 2017 eliminated most entertainment deductions starting in 2018. Taking a client to a concert or sporting event is no longer deductible, even if business is discussed. Company holiday parties and employee recreation events remain 100% deductible as employee benefits.

Travel meal expenses

Meals during overnight business travel are 50% deductible. Per diem allowances also qualify at 50%. If you attend a conference where meals are included in the registration fee, those meals follow the same 50% limit.

For example, if you spend $200 on dinner with a potential client, you may deduct $100. Track the full amount spent and apply the appropriate percentage when completing your return.

Non-deductible credit card charges

Certain purchases never qualify as business deductions, even when charged to your business credit card:

- Personal expenses: Groceries, personal clothing, family entertainment, and household items

- Commuting costs: Daily travel between home and your regular workplace

- Personal vacations: Family trips, leisure travel, and non-business accommodations

- Life insurance premiums: Personal coverage policies for yourself or family members

- Political contributions: Campaign donations and political organization dues

- Fines and penalties: Traffic tickets, tax penalties, regulatory violations, and late payment fees

Mixed personal and business use requires careful allocation. If you use your cell phone 70% for business and 30% personally, you can deduct only 70% of the bill. The same principle applies to vehicles, home offices, and equipment. Keep detailed records showing how you calculated the business percentage for each mixed-use expense.

Can you write off credit card debt?

No, you can’t deduct credit card debt itself. However, you may deduct the business-related expenses that created the debt, along with any interest charged on those purchases. If the balance includes personal expenses, that portion is not deductible.

Are credit card fees tax deductible?

Credit card interest and many fees associated with legitimate business purchases can be deductible, depending on how you use the card.

Credit card interest counts as a deductible business expense when you carry a balance on charges made for business purposes. The IRS treats this interest the same way it treats other financing costs, such as bank loan interest or equipment financing charges.

Several types of credit card fees may qualify for business tax deductions:

- Annual fees: The yearly cost to maintain your business credit card account

- Foreign transaction fees: Costs for purchases made in other currencies or countries

- Cash advance fees: Charges for withdrawing cash from your credit card

- Balance transfer fees: Costs for moving debt from one card to another

Note: Late payment fees aren’t deductible. The IRS classifies them as penalties, which cannot be written off.

Calculating interest deductions requires tracking which charges generated the interest. If you spent $5,000 on business expenses and carried that balance for three months at 18% APR, you’d pay roughly $225 in interest. That full $225 becomes a deductible business expense on your tax return.

The type of credit card matters for tax purposes. Business credit cards issued in your company’s name make deduction tracking straightforward, since interest and fees on these cards typically qualify as business expenses when the card is used exclusively for business.

Personal credit card interest

Personal credit cards complicate deductions even when you use them for business purchases. The IRS generally doesn’t allow interest deductions on personal credit cards, regardless of what you bought. You can deduct the underlying business purchases, but the interest is treated as nondeductible personal expense.

Mixed-use cards require careful allocation. If you charge $3,000 in business expenses and $2,000 in personal expenses on the same card, 60% of the interest becomes deductible business interest, while 40% is nondeductible. Track your purchases each month to maintain accurate percentages.

Sole proprietors face additional complexity because the IRS views their business and personal finances as connected. Using a dedicated business credit card helps maintain clear boundaries and simplifies your tax preparation.

Is an annual credit card fee tax deductible?

Annual fees can be deductible if the card is used solely for business purposes. These fees are typically categorized under “Other deductions” on your business tax return. If the card is used for both personal and business expenses, only the business portion of the fee is deductible.

Best practices for tracking business credit card expenses

Proper expense tracking protects your deductions and makes tax preparation easier. Good records help prevent audit issues and give you a clearer view of where your business spends money.

Separating business and personal expenses

A dedicated business credit card creates the cleanest separation between personal and company spending. This one step simplifies bookkeeping, protects you during audits, and reduces the risk of misclassifying expenses.

Mixing personal and business charges on the same card creates unnecessary work. You’ll spend time sorting each purchase, and the IRS may disallow deductions if you can’t clearly demonstrate business purpose. Banks may also adjust your credit limit or restrict business card benefits if they detect personal use.

Accidental personal charges happen. When they do, document them immediately, reimburse your business account for the amount, and record the transaction as personal. This paper trail shows you’re keeping a clear boundary between personal and business activity.

Documentation and recordkeeping requirements

The IRS requires documentation to support every business expense deduction you claim:

- Credit card statements: Monthly statements showing all transactions and payment history

- Receipts: Itemized receipts for purchases over $75; keeping all receipts is ideal

- Business purpose notes: Who, what, when, where, and why

- Mileage logs: Required for business travel if you deduct vehicle expenses

- Meeting documentation: Names and business relationships for people present at business meals

Keep these records for at least three years after filing. The IRS can audit returns up to three years back—or up to six if they suspect substantial underreporting. Holding records for seven years provides extra protection.

Adequate proof of business purpose goes beyond having a receipt. A $200 restaurant charge should include notes about who attended and what was discussed. Software subscription receipts should show how the tool supports your operations. Travel expenses should include the business reason for the trip.

Digital records carry the same legal weight as paper. Scanning receipts and storing them in a cloud-based system keeps everything searchable and safe from loss, fire, or damage.

Using expense tracking tools and software

Modern tools reduce bookkeeping time and improve accuracy.

- Accounting software platforms: QuickBooks, Xero, and FreshBooks offer expense tracking with credit card integration

- Receipt scanning apps: Ramp, Expensify, Receipt Bank, and Shoeboxed digitize and store receipts automatically

- Bank-provided tools: Many business credit cards include built-in expense categorization and reporting features, including Ramp’s corporate card

- Spreadsheet templates: Excel or Google Sheets can work for simpler needs

Automated categorization learns from past transactions and sorts new charges into tax categories. Instead of manually coding each entry, you review and approve the system’s suggestions.

Connecting your credit card to your accounting software removes manual data entry. Transactions flow in automatically, giving you real-time insight into spending trends, helping you spot errors, and keeping your books up to date.

How to claim credit card deductions on your taxes

How you report business credit card deductions depends on your business structure and the tax forms you file.

For sole proprietors and single-member LLCs

Sole proprietors and single-member LLCs report business credit card expenses on Schedule C, which attaches to Form 1040. Schedule C lists common business expense categories, and credit card purchases should be assigned to the appropriate lines:

- Line 8—Advertising: Marketing costs, promotional materials, and online ad campaigns

- Line 18—Office expense: Supplies, postage, printing, and related office items

- Line 21—Repairs and maintenance: Equipment repairs, building maintenance, and vehicle service costs

- Line 22—Supplies: Materials and supplies consumed during operations

- Line 24a—Travel: Airfare, hotels, rental cars, and other business travel expenses

- Line 24b—Deductible meals: Business meals at 50% of the actual cost

- Line 25—Utilities: Phone, internet, electricity, and other business utility expenses

- Line 27a—Other expenses: Software subscriptions, professional dues, bank fees, and deductible credit card interest

Report credit card interest on Line 16a as business interest expense. Annual credit card fees typically go on Line 27a under “Other expenses.” Keeping your categorization consistent from year to year helps avoid unnecessary audit questions.

Single-member LLCs file the same way as sole proprietors unless they elect corporate tax treatment. The LLC structure provides liability protection but doesn’t change how the IRS treats the entity for tax-reporting purposes.

For corporations and partnerships

Partnerships file Form 1065 and issue Schedule K-1 forms to each partner. Business credit card expenses reduce partnership income, and each partner’s share of the deduction appears on their K-1.

S-corporations file Form 1120-S. As with partnerships, deductions reduce the corporation’s income before it flows through to shareholders on a K-1. Shareholders cannot deduct business credit card expenses on their individual returns; the corporation claims them directly.

C-corporations file Form 1120 and pay tax at the corporate level. Credit card expenses reduce the corporation’s taxable income. Shareholders report only dividends they receive, not corporate-level deductions.

Multi-member LLCs follow partnership taxation rules by default and file Form 1065 unless they elect to be treated as an S-corp or C-corp. Always confirm your entity’s tax election before filing so that deductions are reported in the correct place.

Common mistakes to avoid

Business owners often make avoidable mistakes when deducting credit card expenses. These errors can lead to denied deductions or trigger unnecessary IRS scrutiny.

- Deducting personal expenses: Groceries, personal clothing, and family entertainment don’t qualify as business costs

- Missing documentation: Failing to keep receipts, statements, or notes about business purpose

- Deducting credit card payments instead of purchases: The payment itself isn’t deductible; only the underlying business expense is

- Claiming 100% of partially deductible expenses: Meals are generally limited to 50%

- Double-dipping: Deducting both the purchase and the card payment, or claiming the same expense across multiple tax returns

- Mixing business and personal use without allocation: Only the business portion of mixed-use expenses (like cell phones or vehicles) is deductible

- Ignoring the ordinary and necessary test: Lavish or irrelevant expenses may be rejected during review

The IRS flags certain patterns as audit risks. High meal and entertainment expenses, rounded numbers, and deductions that seem disproportionate to income can draw attention. Double-dipping is also a common trigger. When deductions are denied, the IRS may assess additional taxes and interest. Penalties can reach 20% of the underpayment for negligence or 75% for fraud, although the latter applies mainly to intentional evasion.

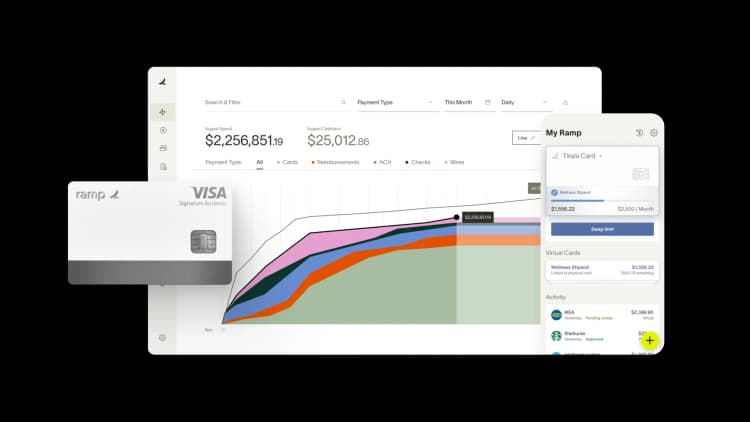

Use Ramp to simplify your business spending

Staying compliant at tax time starts with clean, trackable business expenses. Ramp helps you get there faster. With a corporate card and finance automation platform in one, Ramp gives you the tools to manage spending, enforce policies, and close your books with confidence.

Here’s what you get with Ramp:

- Corporate cards with built-in spend controls

- Automatic expense categorization and receipt matching

- Real-time visibility into employee and department spend

- Seamless integrations with QuickBooks, NetSuite, and more

- Smart alerts and approval workflows to prevent overspending

Ramp makes it easier to separate personal and business expenses, organize your records, and stay audit-ready all year long. If you want a faster, more reliable way to manage business spending, Ramp does the heavy lifting.

Try Ramp’s expense management software to see how much time and money you could save.

This article is for informational purposes only and does not constitute legal or tax advice. Tax rules can vary based on your business structure, location, and specific circumstances. Consult a qualified tax professional to ensure you’re meeting IRS requirements and maximizing your eligible deductions.

FAQs

No, you can’t deduct credit card debt itself. However, you may deduct the business-related expenses that created the debt, along with any interest charged on those purchases. If the balance includes personal expenses, that portion is not deductible.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°