Accounts payable reports: Types, examples, and best practices

- What is an accounts payable report?

- Where AP appears in financial statements

- Why accounts payable analysis matters

- Types of accounts payable reports

- 5 accounts payable reports and when to use them

- AP reporting best practices

- Use Ramp to manage your AP processes

- Why choose Ramp Bill Pay?

Your accounts payable report does more than track what you owe. It turns invoices into insights that guide cash flow management and help you stay audit-ready. With accurate AP reporting, you'll always know who gets paid and when.

The accounts payable landscape changes daily as invoices arrive and payments go out. That’s why real-time visibility matters. When you see the full picture of your obligations, you can time payments for maximum benefit while keeping vendor relationships strong.

What is an accounts payable report?

An accounts payable report is a point-in-time or period report that shows unpaid vendor invoices, including amounts, due dates, statuses, and aging. It turns raw details, such as invoice numbers, payment deadlines, and vendor information, into a structured format that helps you manage cash flow and make better financial decisions.

It’s important to distinguish between an accounts payable report and accounts payable reporting. A report is a single document you can run or export. Reporting refers to the ongoing process of tracking, analyzing, and communicating information about your company’s unpaid bills and vendor obligations.

What does an accounts payable report typically include?

You'll find the following information in an AP report, regardless of the type:

- Vendor name

- Invoice number and date

- Amount and currency

- Due date and payment terms

- Status (open, partially paid, disputed)

- Aging bucket (current, 1–30, 31–60, 61–90, 90+)

- Approver or owner

- General ledger code, class, or department

- Purchase order match status

These standard elements enable finance teams to effectively monitor cash flow, manage vendor relationships, and maintain accurate financial records.

Where AP appears in financial statements

Accounts payable data flows directly into your company’s financial statements. It shapes statutory reporting and short-term cash forecasts, and it gives stakeholders a clear view of your obligations.

Balance sheet

Accounts payable shows up as a current liability, representing money you owe suppliers within the year. The aging of those payables affects liquidity ratios and working capital, which lenders and investors use to judge financial health. Companies may also disclose large vendor concentrations or unusual payment terms in this section.

Cash flow statement

Changes in AP appear in operating activities. When AP goes up, it’s a source of cash; you’ve received goods or services without paying yet. For example, if AP increases by $200,000 in a month, operating cash also rises by $200,000. A drop in AP suggests faster payments or lower purchasing activity.

Notes

The notes expand on details you won’t see in the balance sheet, like vendor disputes, contingent liabilities, or unusual payment arrangements. They help readers understand the timing and risks tied to your payables.

Why accounts payable analysis matters

Regular AP analysis gives finance teams the visibility and control to manage vendors and optimize cash flow. Key benefits include:

- Cash visibility: Track days payable outstanding (DPO) and on-time payments to balance cash needs with vendor satisfaction. The average DPO across industries was 39 days in 2024, according to CFO.

- Avoiding costs: Prevent late fees and capture early-payment discounts

- Vendor relationships: Pay accurately and communicate proactively about delays or disputes

- Audit readiness: Keep clean subledger-to-GL tie-outs for external reviews

- Internal controls: Stop duplicate or overpayments with clear approval trails

- Scalability: Standardized reporting lets you handle more volume without adding headcount

Effective AP analysis lays the groundwork for stronger financial management, vendor trust, and growth at scale.

Types of accounts payable reports

Accounts payable teams rely on various reports to track invoices, manage cash flow, and maintain accurate financial records. Here are a few types of AP reports they might use:

- Open AP report: Shows all unpaid invoices, amounts, and due dates. Use it for weekly cash planning.

- AP trial balance report: Summarizes vendor subledger balances. Use it to tie to the general ledger at period end.

- Voucher activity report: Tracks voucher creation, approval, matching, and payment. Use it for audit trails and control testing.

- Credit adjustment report: Lists vendor credits, returns, and adjustments. Use it to apply credits promptly and avoid overpayment.

- Recurring invoice report: Flags scheduled vendor charges. Use it to forecast AP and recurring cash outflows.

- AP GL code report: Breaks down AP by GL account, class, or department. Use it for spend analysis and budget variance reviews.

- Real-time AP dashboard: Displays live metrics like days payable outstanding (DPO), on-time payment rate, and discounts captured. Use it for daily oversight.

These reports provide comprehensive AP oversight, from daily operations to strategic analysis, helping your finance team optimize vendor management and cash flow.

5 accounts payable reports and when to use them

These five reports provide the most actionable insights for managing liabilities, cash flow, and vendor relationships.

AP aging report

An AP aging report categorizes unpaid invoices by vendor and aging bucket, usually in 30-day intervals. It helps you prioritize payments and forecast cash needs.

Use it to:

- Identify which vendors to pay first

- Review upcoming 30-day obligations and improve AP forecasting

- Resolve past due balances quickly to avoid late fees

- Track on-time payment rates and DPO trends month over month

- Allocate cash to critical suppliers during shortages

Regular AP aging report analysis turns reactive payment habits into proactive financial management.

AP aging report example

Here's a simple example of an accounts payable aging report:

Vendor | Current | 0–30 days | 31–60 days | 61–90 days | 90+ days | Total AP balance |

|---|---|---|---|---|---|---|

Vendor 1 | $200 | -- | -- | -- | -- | $200 |

Vendor 2 | $3,400 | $125 | -- | -- | -- | $3,525 |

Vendor 3 | -- | -- | -- | $830 | -- | $830 |

You should be able to run an aging report by automatically pulling it from your ERP or accounts payable software using filters such as vendor, due date, or aging bucket.

AP reconciliation report

The AP reconciliation report matches your AP subledger to the general ledger. It highlights timing differences and recording errors so you can close the books accurately.

Steps to run it:

- Compare the AP subledger ending balance to the GL balance

- Investigate unmatched items (missing, duplicate, or misposted transactions)

- Post correcting entries as needed

- Export a period-end AP trial balance to confirm tie-outs

Payment activity report

A payment activity report summarizes business expenditures over a set period. It validates disbursements and supports audits.

You can segment payments by:

- Expense type (raw materials, supplies, loans, operations)

- Business unit (product lines, divisions, or regions)

- Vendor (to spot top suppliers or negotiate discounts)

- Transaction size (flag high-value items for review)

- Payment method (ACH, check, card, and exceptions)

Analyzing this data improves budget allocations and helps forecast future obligations based on historical spending patterns.

Discount report

A discount report shows which vendors offer early-payment discounts and tracks which were taken or missed.

Use it to:

- Prioritize vendors that provide discounts

- Compare suppliers based on discount terms

- Spot opportunities to negotiate new discounts

- Reduce costs by capturing savings over time

Vendor performance report

A vendor performance report summarizes how much each vendor has invoiced over a period and adds metrics to evaluate relationship quality.

It helps you:

- Track where most of your spend goes

- Spot overreliance on a single vendor

- Align payments with discount opportunities

- Measure lead times, defect rates, and SLA adherence

Regularly reviewing vendor performance reports helps you optimize supplier relationships and improve payment efficiency. Together, these AP reports give you full visibility into vendor relationships and payment processes for stronger financial control.

AP reporting best practices

Follow these AP reporting best practices to keep data accurate, controls strong, and processes efficient:

- Standardize vendor IDs, terms, and GL codes, and keep masters clean

- Enforce approvals and 2- or 3-way matching to prevent duplicates and fraud

- Schedule core reports (aging, open AP, payment activity) and share them routinely

- Reconcile subledgers to the GL every close and document tie-outs

- Capture discounts systematically and escalate disputes before they age into 90+ days

- Maintain audit-ready documentation, including voucher trails and approvals

- Automate intake with OCR or EDI, plus coding and exception alerts

Use Ramp to manage your AP processes

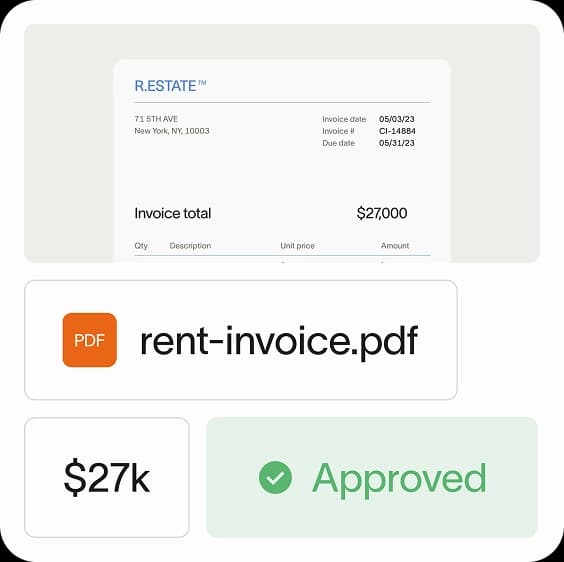

Reporting is an essential part of the AP process. Without reports, your data will be nothing more than numbers on a screen. Put those numbers to use by building reports that help you better understand your company’s financial health and cash position. That’s where Ramp Bill Pay comes in.

Ramp Bill Pay is autonomous AP software that turns manual tasks into touchless workflows. Four AI agents handle invoice coding, flag fraudulent payments before they go out, build approval summaries, and push card payments to vendors—taking your team out of repetitive AP work.

Run Ramp Bill Pay on its own, or connect it with Ramp's corporate cards, expense tools, and procurement platform for complete spend visibility. Companies switching to Ramp see up to 95% better oversight of their payables1. And, the platform's OCR hits up to 99% accuracy on invoice extraction while processing invoices 2.4x faster than legacy systems2.

Features include but are not limited to:

- Real-time invoice tracking: Monitor every invoice from receipt through payment

- Real-time ERP sync: Connect your vendor master data bidirectionally with 10 ERPs such as NetSuite, QuickBooks, Xero, Sage Intacct, and more for audit-ready books

- Reconciliation: Close books faster with automatic transaction matching

- Approval orchestration: Reduces clicks, improves visibility, and accelerates processing across reviewers

- Auto-coding agent: Analyzes historical coding patterns and invoice details like product IDs, descriptions, and shipping addresses to map expenses to the correct GL codes instantly

- GL coding: Map transactions to the correct accounts with AI-assisted recommendations

- Intelligent invoice capture: Extracts data across every line item with 99% OCR accuracy

- Automated PO matching: Verifies invoices against purchase orders with 2-way and 3-way matching to catch overbilling before payment

- Payment methods: Pay vendors via ACH, corporate card, check, or wire transfer

- Vendor Portal: Let vendors securely update payment details, view payment status, and communicate with your AP team

- Roles and permissions: Enforce separation of duties with granular user controls

Why choose Ramp Bill Pay?

Ramp Bill Pay reshapes how AP should perform—accurate data capture, autonomous operations, touchless processing, and fast workflows. Over 2,100 verified G2 reviews average 4.8 stars, with finance teams repeatedly citing it as one of the most straightforward AP platforms to implement.

Ramp Bill Pay functions as standalone AP software with everything built in. But teams that want to unify bills, card transactions, expenses, and procurement can also access Ramp's integrated spend management platform to bring everything into a single system.

Start with Ramp's free tier covering core AP automation, or upgrade to Ramp Plus at $15 per user monthly for expanded capabilities.

Get started with Ramp Bill Pay.

1. Based on Ramp’s customer survey collected in May’25

2. Based on Ramp's customer survey collected in May’25

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits