- What are net 30 accounts?

- How net 30 accounts build business credit

- Best net 30 vendors for new businesses in 2026

- How to qualify for net 30 accounts

- How to apply for net 30 accounts

- Best practices for managing net 30 accounts

- Alternatives to traditional net 30 accounts

- Use Ramp to stay on top of vendor payments

Net 30 accounts let your business buy goods or services now and pay the invoice within 30 days. When these vendors report your payment history to business credit bureaus, every on-time payment helps strengthen your credit profile.

Building strong business credit early opens doors to better financing terms, stronger vendor relationships, and clearer separation between business and personal finances. For new and growing companies, it’s one of the simplest ways to set up a solid foundation for long-term financial success.

What are net 30 accounts?

A net 30 account operates under net 30 payment terms, which give your business 30 days to pay an invoice after receiving goods or services. You place an order, receive what you need, and the vendor sends an invoice due 30 days later. This payment window helps smooth cash flow while keeping operations running.

Other payment terms you might encounter include:

- Net 60: Payment due 60 days after the invoice date. Typically offered to businesses with established credit.

- Net 90: Payment due 90 days after the invoice date. Common for large companies or long-term vendor relationships.

Vendors use these terms to build stronger customer relationships. You get the flexibility to purchase inventory or services up front, and they gain repeat, reliable clients. Many vendors also report your payment history to business credit bureaus, helping you build business credit over time.

How net 30 accounts build business credit

Net 30 accounts help build business credit when vendors report your on-time payment activity to the major business credit bureaus. Each payment that’s reported strengthens your credit profile and demonstrates your reliability as a borrower.

The main bureaus that track business credit are:

- Dun & Bradstreet

- Experian Business

- Equifax Business

- Creditsafe

Reporting policies can vary by vendor, so it’s worth confirming which bureaus each one reports to before you apply.

Once you’ve opened your first reporting accounts, your credit profile usually begins to appear within two to four months. Building a solid file typically takes six months to a year of consistent, on-time payments across several vendors. Over time, a positive payment history can improve your credit scores, raise your credit limits, and unlock better financing options.

Best net 30 vendors for new businesses in 2026

The following net 30 vendors help new and growing businesses build credit history while managing cash flow. Each vendor reports to at least one major business credit bureau and offers starter-friendly terms.

| Vendor | Reports to | Annual fee | Minimum purchase | Best for |

|---|---|---|---|---|

| Quill | D&B, Experian, Equifax | None | $100 | Office supplies, electronics, and breakroom essentials |

| Staples Business Advantage | D&B | None | $100 | Office supplies, IT products, and furniture |

| Crown Office Supplies | D&B | $99 | $30 | Office supplies and décor |

| Coast to Coast Office Supply | Experian | None | Varies | Office supplies and software |

| Office Garner | Creditsafe, Equifax | $69 | $50 | Office supplies, electronics, and website design |

| Newegg Business | D&B | None | $100 | Electronics, IT hardware, and office technology |

| Uline | D&B, Experian, Equifax | None | $100 | Packaging, shipping, and industrial supplies |

| Grainger | D&B | None | $50 | Industrial and maintenance products |

| HD Supply | D&B, Experian, Equifax | None | $10 handling fee on orders under $50 | Construction and property maintenance |

| The CEO Creative | Equifax, Experian | $49 | $50 | Website design and branding services |

| Wise Business Plans | Experian, Equifax, Creditsafe | $99 | $164 | Business planning and branding |

| Branded Apparel Club | Creditsafe, Equifax | $69.99 | $100 | Custom-branded apparel |

Office supply vendors

These vendors provide everyday business essentials and report to major bureaus, making them ideal for first-time applicants.

Quill

Quill offers a wide range of office supplies and breakroom essentials. It’s one of the easiest accounts to open for small businesses with limited credit history.

Key benefits:

- Product range: Paper, cleaning supplies, and office furniture

- Credit reporting: Reports to D&B, Experian, and Equifax

- Best for: Small businesses that want flexible starter terms

- Requirements: $100 minimum order; quick online application

Staples Business Advantage

Staples Business Advantage is a leading provider of office products, technology, and furniture. Its net 30 account helps companies manage expenses while building credit.

Key benefits:

- Product range: Office supplies, IT products, and furniture

- Credit reporting: Reports to D&B

- Best for: Businesses purchasing in bulk

- Requirements: Must be at least 90 days old and employ more than 20 people

Crown Office Supplies

Crown Office Supplies sells office products and home décor while offering accessible terms for new businesses.

Key benefits:

- Product range: Office supplies, electronics, and décor

- Credit reporting: Reports to D&B

- Best for: Startups looking to build credit quickly

- Requirements: $30 minimum purchase; $99 annual fee

Coast to Coast Office Supply

Coast to Coast Office Supply helps new businesses establish credit through straightforward net 30 terms and affordable requirements.

Key benefits:

- Product range: Office supplies and downloadable software

- Credit reporting: Reports to Experian monthly

- Best for: Businesses that need quick credit-building options

- Requirements: Business registration and tax ID number

Office Garner

Office Garner combines office supply sales with website design services, helping startups manage both operations and branding.

Key benefits:

- Product range: Office supplies, electronics, and design services

- Credit reporting: Reports to Creditsafe and Equifax

- Best for: Startups needing multi-purpose purchasing options

- Requirements: One-time processing fee and business registration

Newegg Business

Newegg Business specializes in technology and hardware, providing an easy way for IT-focused companies to make recurring purchases on credit.

Key benefits:

- Product range: Electronics, IT hardware, and office technology

- Credit reporting: Reports to D&B

- Best for: Tech-driven businesses

- Requirements: Existing Newegg Business account recommended

Industrial and maintenance suppliers

These suppliers are well-suited for companies that need shipping, industrial, or maintenance materials.

Uline

Uline offers packaging, shipping, and warehouse supplies. It’s accessible even to newer businesses and reports to multiple credit bureaus.

Key benefits:

- Product range: Packaging, janitorial, and warehouse supplies

- Credit reporting: Reports to D&B, Experian, and Equifax

- Best for: Businesses in shipping, manufacturing, or warehousing

- Requirements: Simple online application; initial purchase may be required

Grainger

Grainger provides industrial and maintenance products for companies that need reliable supply chains and flexible payment terms.

Key benefits:

- Product range: Industrial, electrical, and safety supplies

- Credit reporting: Reports to D&B

- Best for: Construction, manufacturing, and maintenance businesses

- Requirements: May request trade references for approval

HD Supply

HD Supply is a subsidiary of Home Depot that offers maintenance and operations supplies for commercial properties.

Key benefits:

- Product range: Plumbing, lighting, and janitorial equipment

- Credit reporting: Reports to D&B, Experian, and Equifax

- Best for: Construction and property maintenance professionals

- Requirements: Requires commercial bank reference

Business service providers

These vendors help small businesses build credibility and visibility while strengthening their credit profiles.

The CEO Creative

The CEO Creative provides branding and design services for startups seeking affordable credit-building options.

Key benefits:

- Product range: Website design, branding, and custom merchandise

- Credit reporting: Reports to Equifax and Experian

- Best for: Startups improving their online presence

- Requirements: $49 annual fee upon approval

Wise Business Plans

Wise Business Plans assists entrepreneurs with business planning, formation, and marketing services.

Key benefits:

- Product range: Business plans, LLC formation, and consulting

- Credit reporting: Reports to Experian, Equifax, and Creditsafe

- Best for: Startups seeking expert planning and professional services

- Requirements: $99 annual fee; $164 minimum purchase to maintain account

Branded Apparel Club

Branded Apparel Club specializes in custom-branded apparel and merchandise, offering net 30 terms for businesses of any size.

Key benefits:

- Product range: T-shirts, hats, and corporate apparel

- Credit reporting: Reports to Creditsafe and Equifax

- Best for: Companies that regularly order branded merchandise

- Requirements: $69.99 membership fee; $100 minimum order

How to qualify for net 30 accounts

Getting approved for net 30 accounts starts with having your business fundamentals in place and applying to vendors that fit your level of experience.

Basic business requirements include:

- Federal Employer Identification Number (EIN)

- Business bank account

- Business phone number and email address

- Physical business address (not a P.O. box)

Once these basics are covered, focus on vendors that align with your business stage and credit profile.

For new businesses

Several vendors welcome applicants without established credit history. Uline, Quill, and Grainger offer starter net 30 programs that rely more on documentation than credit scores, making them good first accounts.

First-time applicants should:

- Start with one or two accounts and expand gradually

- Choose vendors you'll use regularly

- Apply during business hours for faster verification

- Have business documents ready before applying

Begin with small purchases to demonstrate reliability, then increase order size as you build payment history with each vendor.

For established businesses

A strong business credit profile improves approval odds and credit limits. Vendors review your payment history, credit scores, and financials to determine terms.

Established companies often qualify for larger lines of credit with vendors such as Amazon Business, Home Depot Pro, and Sysco. These accounts may offer additional perks like volume discounts or dedicated account representatives.

How to apply for net 30 accounts

Applying for a net 30 account is straightforward when your business information is organized and ready to submit.

To apply:

- Research vendors that report to business credit bureaus and fit your industry needs

- Gather required documents such as your EIN, D-U-N-S number, business license, bank statements, and trade references

- Complete the vendor’s credit application online or by phone

- Submit supporting documents as requested

- Follow up within a few days if you haven’t received a response

Common application mistakes to avoid:

- Using personal contact information instead of business details

- Applying to too many vendors at once

- Leaving fields blank or submitting incomplete information

- Listing vendors as references before asking their permission

Most vendors process applications within three to seven business days. Smaller credit lines may be approved immediately, while larger limits can take up to two weeks. New businesses often experience longer approval times than those with established credit profiles.

Best practices for managing net 30 accounts

Managing your net 30 accounts effectively is what turns them from simple credit lines into long-term growth tools.

To build and maintain strong business credit:

- Pay invoices on or before the due date. Some vendors report early payments more favorably, so pay a few days ahead when cash flow allows.

- Start with two accounts, add another after three months of on-time payments, and gradually expand to five or six reporting vendors

- Keep detailed records of invoices, payment dates, and confirmation numbers

- Use a dedicated filing system or AP automation software to track upcoming due dates

- Track which vendors report to each business credit bureau so you can monitor progress across agencies

- Avoid maxing out credit limits or making only minimum payments when partial payments are allowed

- Never miss a payment deadline. Late fees increase costs and hurt your credit profile

- Stay within budget and only open accounts with vendors you plan to use regularly

Consistency matters more than quantity. Paying on time and maintaining just a few well-managed accounts can do more for your credit than opening many you can’t maintain.

Alternatives to traditional net 30 accounts

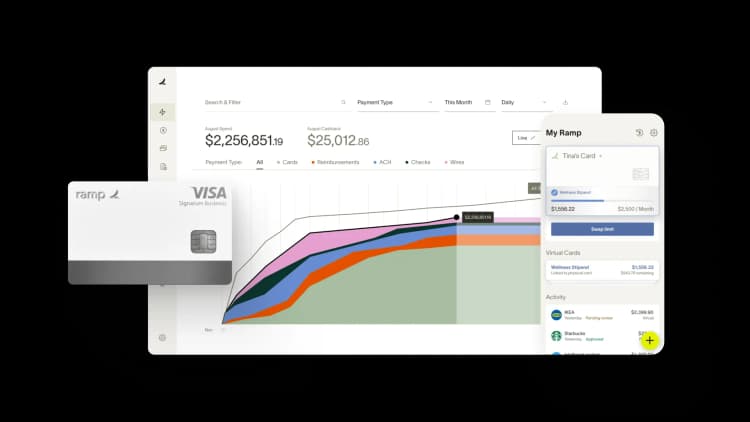

Business credit cards offer flexible purchasing power and can help build business credit faster than traditional vendor terms. Cards such as the Ramp corporate card provide spending limits, expense tracking, and automated credit reporting. They’re a good fit for companies that buy from multiple vendors instead of maintaining long-term supplier accounts.

Trade credit, on the other hand, extends beyond standard net 30 terms and often involves customized agreements with specific suppliers. Modern accounts payable tools such as Bill.com and Melio let you pay any vendor on credit, even if they don’t offer net 30 terms. These platforms give businesses more control over payment timing and cash flow.

Traditional net 30 accounts remain valuable if you regularly buy from the same vendors and want to build multiple trade lines. If your priority is flexible spending or faster access to higher credit limits, a business credit card or digital AP solution may be the better option.

Use Ramp to stay on top of vendor payments

Managing cash flow and building strong credit are critical for long-term success, and net 30 accounts are an excellent tool for doing both. They let your business make purchases now and pay later while building a solid credit history.

Ramp Bill Pay helps you stay on top of vendor payments and avoid late fees, strengthening both cash flow and vendor relationships. With powerful accounts payable automation, you can process invoices accurately and on time every month.

Try an interactive demo to see how Ramp customers process a month’s worth of accounts payable in minutes.

FAQs

Net 30 accounts contribute to your credit profile by reporting your payment history to major credit reporting agencies such as Dun & Bradstreet, Experian, and Equifax. Timely payments help improve your business credit score.

Missing a net 30 payment can result in late fees and negatively affect your business credit history. Be sure to pay on time to avoid penalties and damage to your credit profile.

To qualify for a net 30 account, you generally need an EIN, a registered business, and a business bank account. Vendors may also require a DUNS number and business history.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°