4 of the best net 60 vendors to build business credit in 2025

- What are net 60 vendors?

- Types of net 60 payment terms

- What to look for In net 60 vendors

- 4 best net 60 vendors for businesses

- How to negotiate net 60 terms with your current vendors

- Importance of net 60 vendors

- Alternatives to using net 60 vendors

- Control business spending with net 60 vendors and Ramp

When it comes to building a formidable business credit profile, one of the easiest and fastest routes is through vendor credit. This form of trade credit allows businesses to procure goods or services with various payment terms. In an exciting twist for entrepreneurs and business owners seeking to establish a robust financial strategy in the year ahead, a handful of Net 60 vendors are now available ─ and some even offer invoice payment terms as generous as Net 90 or beyond.

Unlike traditional bank loans or lines of credit, which often require stringent application processes and may carry high-interest rates, vendor credit offers a direct opportunity for businesses to secure products or services on mutually agreed-upon payment terms. Read on to discover why the significance of these Net 60 vendors cannot be overstated.

What are net 60 vendors?

Net 60 vendors are suppliers or service providers offering payment terms, allowing customers to pay for their products or services within 60 days of purchase. This extended payback period, known as "Net 60," provides businesses additional flexibility in managing their cash flow.

Net 60 vendors typically cater to business-to-business (B2B) transactions and play a crucial role in trade credit, an essential aspect of building business credit. By utilizing net payment terms like Net 60 accounts, businesses can conserve their working capital while acquiring the necessary goods or services to operate efficiently.

One of the key advantages of working with net 60 vendors is the opportunity for interest-free financing. Unlike traditional loans or credit cards, where borrowing comes with interest rates that increase costs over time, net payment terms allow businesses to access capital without incurring extra financial charges. This interest-free financing further aids companies in maintaining healthy cash flow positions and uninterrupted operations.

Types of net 60 payment terms

Net 60 payment terms allow businesses to manage cash flow while accessing necessary products and services. These terms provide an extended payment window and include various discount options for early payments. Let's explore the different net 60 payment term types and understand how they can benefit businesses seeking credit options.

Standard net 60 terms

The most common type of net 60 payment term is straightforward—customers have 60 days from the invoice date to make full payment without incurring interest charges. This tradeline provides businesses with an interest-free financing option if invoices are settled on time before the due date.

Limited discounts

Some vendors may incentivize prompt payments by offering discounts to customers who settle their invoices before the due date. These discounts are typically represented in fraction form:

Payment Terms | Discount Details |

|---|---|

3/10 net 60 | Pay within 10 days for a 3% discount, or full payment due in 60 days |

2/10 net 60 | Pay within 10 days for a 2% discount, or full payment due in 60 days |

1/10 net 60 | Pay within 10 days for a 1% discount, or full payment due in 60 days |

In all cases mentioned above, failing to take advantage of these discounted payment terms does not result in interest charges; instead, the customer pays the full invoice amount within sixty days.

What to look for In net 60 vendors

Several factors should be carefully considered when searching for a Net 60 vendor to establish trade credit and build your business's financial foundation. Evaluating potential vendors based on the following criteria can help you make informed decisions:

- Reliability: Look for vendors with a track record of consistently and timely delivering quality products or services. Assess their reputation by checking reviews, testimonials, and references from other businesses in your industry.

- Credit Reporting: Verify whether the vendor reports payment data to credit bureaus. This is crucial as timely payments will positively impact your business's credit profile and help establish a strong credit history.

- Early Payment Incentives: Determine if the vendor offers discounts or incentives for early payments. These discounts can represent significant savings, allowing you to maximize cash flow while building relationships with vendors who appreciate prompt payment.

- Industry Reputation: Research the vendor's standing within your industry. Consider their experience working with businesses like yours and ensure they understand your industry's needs and requirements.

- Alignment with Business Goals: Evaluate how well the vendor aligns with your business goals and objectives. Consider factors like product quality, pricing structure, customer support, and additional value-added services that align with your strategic vision.

- Relationship-Building Strategies: Look for vendors willing to foster long-term relationships rather than engaging in purely transactional interactions. Building rapport with vendors can lead to enhanced support, extended payment terms, or increased trade credit limits.

Factor | Considerations |

|---|---|

Reliability | Look for vendors with a track record of delivering quality products or services on a consistent and timely basis. Check reviews, testimonials, and references from other businesses in your industry. |

Credit Reporting | Verify whether the vendor reports payment data to credit bureaus. Paying on time can positively impact your business's credit profile and establish a strong credit history. |

Early Payment Incentives | Determine if the vendor offers discounts or incentives for early payments. These discounts can save money, help maximize cash flow, and build strong relationships with vendors. |

Industry Reputation | Research the vendor's standing in your industry. Make sure they understand your business's needs and have experience working with businesses like yours. |

Alignment with Business Goals | Evaluate how well the vendor aligns with your business goals, considering product quality, pricing structure, customer support, and additional value-added services. |

Relationship-Building Strategies | Look for vendors willing to foster long-term relationships. Building rapport can lead to enhanced support, extended payment terms, or increased trade credit limits. |

Credit Terms | What are the credit terms and payment methods? Does the vendor offer an early payment discount? |

Reputation | Research the vendor's track record and reviews. |

Industry Fit | Does the vendor cater to your type of business or industry? |

Credit Limits | What is the credit limit and how does it align with your financial needs? |

Remember that while net 60 accounts for new businesses are beneficial, analyzing each vendor individually based on these factors is essential rather than relying solely on their net payment terms.

4 best net 60 vendors for businesses

Finding the right net 60 vendors is crucial for businesses looking to manage cash flow, access inventory, and establish credit. Here is a list of net 60 vendors that offer attractive payment terms and valuable services tailored to meet the needs of small businesses.

These vendors offer flexibility for small business owners and give them the tools to establish business credit. Depending on your industry, each vendor offers unique pricing and credit options:

1. Supplied

Supplied is a no-minimum purchase order wholesale supplier known for its inventory based on the latest trends. Targeting boutique shop owners who may not have substantial funds to invest in merchandise, Supplied offers a unique "mix and match" approach. This means buyers can order various items without being restricted to bulk quantities. They source directly from manufacturers and ship everything in one package. With net 60 payment terms, businesses can place orders now and receive invoices later.

2. Faire

Faire is an online wholesaler renowned for its diverse range of products suitable for small businesses. Their Net 60 program allows brick-and-mortar shops operating physical retail locations to take advantage of extended payment terms. They consider factors such as payment history, sales performance, business type, and location when determining vendor credit limits.

3. Abound

Abound is well-regarded among net 60 wholesale vendors due to its flexibility and support for retailers beyond traditional brick-and-mortar stores. With brand-specific minimums as low as $30 per order, Abound accommodates businesses with varying inventory needs. However, it's important to note that they don't conduct business with stores on third-party marketplace sites like Amazon or eBay.

4. Creoate

Creoate is a wholesale marketplace boasting more than 6,500 brands. They offer a product catalog comprising 7,174 items, spanning categories such as food and beverages, stationery, pet food and treats, and fashion accessories. Creoate allows returns for unsold products within a 60-day window.

How to negotiate net 60 terms with your current vendors

Negotiating net 60 terms with your current vendors can be a beneficial strategy to improve cash flow and establish stronger credit terms. Here are some essential steps and strategies to consider when approaching your vendors for improved payment terms:

- Build a strong business history: Vendors are more likely to consider extending net 60 payment terms if they have a proven track record of timely payments, consistent business history, and established credibility. Maintain good relationships with your vendors by paying invoices promptly and fostering open communication.

- Maintain good credit: Just like with personal credit, having a strong business credit profile increases your chances of negotiating favorable payment terms. Regularly monitor your business credit scores, minimize outstanding debt, and pay bills on time to demonstrate financial responsibility.

- Research vendor policies: Familiarize yourself with each vendor's policies regarding payment terms, discounts, and trade credit options. Understanding their standard practices will help you craft a persuasive negotiation proposal.

- Showcase value: Highlight the value you bring as a customer by outlining the volume of business you generate for the vendor or expressing loyalty to their brand. Explain how extended payment terms would benefit both parties by improving cash flow or allowing you to scale operations effectively.

Propose Gradual Adjustments: In certain situations where switching amongst net 30/60/90 vendors might seem too drastic, propose intermediate steps such as Net 45 initially before eventually transitioning to Net 60 payment terms. This gradual approach gives the vendor time to assess the arrangement while easing into longer payment cycles.

Importance of net 60 vendors

Net 60 vendors are crucial in helping businesses navigate the complex landscape of cash flow management and credit building. Here are some key reasons why Net 60 business accounts are must-have:

- Balancing Cash Flow: One of the primary benefits of working with Net 60 vendors is their extended payment horizon. By providing up to 60 days to settle invoices, these vendors provide much-needed flexibility in managing cash flow fluctuations. This additional time allows businesses to allocate funds strategically, ensuring they meet their financial obligations while maintaining operational efficiency.

- Extending Payment Horizons: Traditional payment terms like Net 30 accounts can create challenges for businesses, especially when revenue generation takes longer, or unexpected expenses arise. Net 60 vendors alleviate this pressure by granting extra time for payment without incurring interest charges. This extension can be instrumental in alleviating short-term financial constraints and providing breathing room for businesses to fulfill other critical needs.

- Establishing Credit History: Building a strong credit history is essential for any business wanting to secure loans or access future financing opportunities. Net 60 vendors contribute significantly to this process by reporting payment information to business credit bureaus. Timely payments under these terms demonstrate reliability and responsible financial behavior, ultimately enhancing the business's creditworthiness.

- Financial Flexibility: Working with Net 60 vendors offers businesses greater flexibility in managing their finances and pursuing growth strategies. The ability to delay payments while receiving goods or services enables organizations to invest available capital into revenue-generating activities such as marketing campaigns, expansion plans, or product development initiatives.

- Fostering Growth Strategies: Accessing products or services from Net 60 vendors allows enterprises to fuel their growth ambitions without immediate upfront costs impairing cash flow dynamics. By leveraging vendor credit, businesses can acquire inventory, equipment, or resources necessary for expansion before generating sufficient revenue.

Alternatives to using net 60 vendors

When managing cash flow and accessing credit, businesses have alternatives to relying solely on net 60 vendors. Here are some options worth considering:

Financing Option | Description |

|---|---|

Business credit cards | Business credit cards provide a convenient and flexible purchase method while earning rewards or cashback. They often come with introductory 0% APR periods, allowing businesses to defer payments interest-free for a limited time. |

Business lines of credit | Similar to personal lines of credit, business lines of credit offer a predetermined amount that can be borrowed as needed. Interest is only charged on the funds you draw from the line, making it a flexible financing option for covering expenses without restricting payment terms. |

SBA loans | The US Small Business Administration (SBA) offers low-interest loans to eligible small businesses, providing access to capital for various purposes such as expansion, equipment purchases, or working capital. SBA loans typically have longer repayment terms and competitive interest rates. |

Branded retailer credit cards | Many major retailers provide branded credit cards that offer perks, discounts, or special financing options exclusively for their customers. These cards can be helpful if your business relies heavily on specific suppliers or wants additional benefits associated with brand loyalty. |

Ramp |

Control business spending with net 60 vendors and Ramp

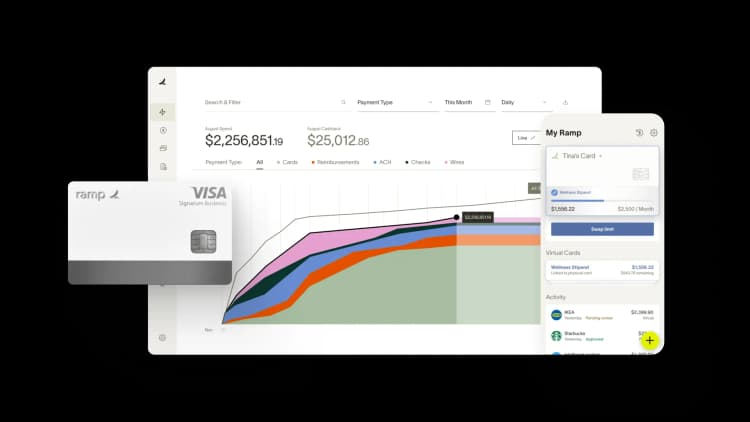

Efficient management of business expenses is crucial for maintaining financial stability and building a solid credit score. In addition to utilizing net 60 vendors, businesses can benefit from leveraging Ramp's innovative spend management platform.

Ramp shares the same objective as net 60 vendors—enabling efficient spending strategies that support long-term growth. With Ramp's comprehensive suite of tools and features, businesses gain enhanced control over their spending while optimizing cash flow management. Using Ramp's intuitive expense tracking and monitoring capabilities helps businesses identify areas where unnecessary expenses occur—such as zombie subscriptions or maverick spending. This allows for better resource allocation, cost reduction, and improved financial decision-making.

Furthermore, utilizing Ramp contributes to establishing a solid credit score for your company. Ramp partners with leading financial institutions to issue corporate cards that report payment data to commercial credit bureaus. Making on-time payments through Ramp helps build a positive credit history, laying the foundation for future financing opportunities at favorable terms.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits