Best business budgeting software tools for 2026

- What is business budgeting software?

- Why finance teams are moving beyond spreadsheets

- 7 essential features of budgeting software

- Best business budgeting software by company size

- Best options for small businesses (1–50 employees)

- Best options for mid-market companies (50–500 employees)

- Best options for enterprise (500+ employees)

- How budgeting software integrates with your financial stack

- Business budgeting methods

- How to choose the right business budgeting software

- Common budgeting software implementation mistakes to avoid

- Track budgets in real time with Ramp

Business budgeting software helps companies plan, track, and forecast budgets as spending, headcount, and complexity grow.

Instead of relying on spreadsheets, these tools centralize budget data, automate updates, and give finance teams real-time visibility into how actuals compare to plans. For modern businesses managing cards, invoices, and reimbursements across teams, budgeting software provides the structure and control spreadsheets can’t.

What is business budgeting software?

Business budgeting software links financial plans to actual spending through automated tracking, real-time reporting, and collaborative workflows. It replaces manual spreadsheet-based budgeting with systems that update continuously as transactions occur. Core functions typically include:

- Budget creation and planning across departments

- Real-time expense tracking and monitoring

- Forecasting and scenario planning

- Variance analysis (budget vs. actual)

- Automated reporting and dashboards

- Multi-departmental collaboration

Instead of treating budgeting as a static annual exercise, budgeting software enables finance teams to adjust plans dynamically as business conditions change.

How budgeting software differs from accounting software

Budgeting software and accounting software serve different purposes. Accounting software records what has already happened, while budgeting software helps teams plan, monitor, and adjust future spending.

Accounting tools focus on historical accuracy and compliance. Budgeting tools focus on forward-looking planning, collaboration, and decision-making. Many businesses use both, with budgeting software sitting on top of accounting data.

| Function | Budgeting software | Accounting software |

|---|---|---|

| Primary purpose | Plan and manage future spending | Record and report past transactions |

| Time orientation | Forward-looking | Historical |

| Core outputs | Budgets, forecasts, scenarios | Financial statements, ledgers |

| Update frequency | Continuous or rolling | Periodic (monthly, quarterly) |

| Collaboration | Designed for multiple budget owners | Typically limited to finance and accounting |

| Scenario modeling | Yes | No |

| Compliance and audit | Limited | Core function |

Budgeting software doesn’t replace accounting systems. Instead, it uses accounting data as an input to help finance teams make informed decisions about what happens next.

Why finance teams are moving beyond spreadsheets

As companies grow, budgeting becomes harder to manage in spreadsheets. More teams, more spend categories, and more frequent plan changes create complexity that spreadsheets weren’t designed to handle.

Finance teams move beyond spreadsheets because they need:

- Faster planning cycles: Annual or quarterly budgets are too slow for changing business conditions

- Clear ownership: Department leaders need visibility into and accountability for their own budgets

- Fewer errors: Manual formulas and links increase the risk of mistakes as models grow

- Real-time visibility: Leaders need to see how actual spending compares to plan throughout the period

- Better collaboration: Budgeting requires coordination across finance, department owners, and leadership

Budgeting software addresses these needs by centralizing data, automating updates, and making budgets easier to manage as the business scales.

7 essential features of budgeting software

The right budgeting software does more than store numbers. It helps finance teams plan proactively, collaborate with stakeholders, and adjust budgets as conditions change. When evaluating tools, look for these core capabilities.

- Budget creation and planning: Build budgets across departments, projects, or cost centers with clear ownership and structure

- Real-time expense tracking: Automatically pull actuals from accounting systems, cards, and other spend tools to keep budgets up to date

- Forecasting and scenario planning: Model changes in revenue, headcount, or spend to understand how different decisions affect the business

- Variance analysis: Compare budget vs. actuals to identify gaps early and take corrective action

- Collaboration and approvals: Enable multiple budget owners to submit inputs, review changes, and approve updates with clear audit trails

- Committed spend and future obligations: Track purchase orders, contracts, and planned spend so budgets reflect what is already committed, not just what has been paid

- Mobile access and alerts: Give budget owners visibility into spend and notifications when budgets are at risk, without requiring them to log into a spreadsheet

Best business budgeting software by company size

Different businesses have different budgeting needs based on their size, revenue, and operational complexity. The right budgeting software should match how many people are involved, how budgets are managed, and how often plans change.

| Tool | Best for | Company size | Pricing model | Free trial or demo | Real-time spend tracking | Forecasting and scenarios |

|---|---|---|---|---|---|---|

| Ramp | Budgeting tied directly to spend management | Mid-market | Free and paid tiers | Demo available | Yes | Limited |

| QuickBooks Online | Basic budgeting within accounting | Small | Subscription | Trial available | Limited | No |

| Xero | Simple budget tracking with accounting | Small | Subscription | Trial available | Limited | No |

| Float | Cash flow forecasting | Small to mid-market | Subscription | Trial available | No | Yes |

| Centage | Structured budgeting and planning | Mid-market | Subscription | Demo available | No | Yes |

| Abacum | Collaborative FP&A workflows | Mid-market | Custom | Demo available | No | Yes |

| PlanGuru | Forecasting and modeling | Small to mid-market | Subscription | Trial available | No | Yes |

| Prophix | Advanced planning and CPM | Mid-market to enterprise | Custom | Demo available | No | Yes |

| Sage Intacct | Budgeting within financial management | Mid-market to enterprise | Custom | Demo available | Limited | Yes |

| Anaplan | Connected enterprise planning | Enterprise | Custom | Demo available | No | Yes |

| Workday Adaptive Planning | Enterprise planning and forecasting | Enterprise | Custom | Demo available | No | Yes |

Best options for small businesses (1–50 employees)

Small businesses need budgeting tools that are easy to set up, affordable, and closely integrated with accounting software. At this stage, the goal is usually visibility and control rather than complex forecasting.

QuickBooks Online

QuickBooks Online includes built-in budgeting tools that let small businesses create annual budgets based on historical data or from scratch.

Users can compare actual income and expenses against budgeted amounts through standard reports, making it easier to spot variances and adjust spending. It works best for straightforward budget tracking tied closely to accounting data.

- Best for: Small businesses already using QuickBooks for accounting

- Key features: Budget vs. actual reports, integration with QuickBooks accounting data, basic forecasting, cash flow projections

- Limitations: Limited collaboration and flexibility compared to dedicated budgeting tools

- Pricing: Budgeting available in Plus tier and above, starting at $115/month

Xero

Xero offers basic budgeting features that allow businesses to create budgets by account, track performance, and generate variance reports. Users can manage multiple budgets, import budget data, and monitor results through built-in financial reports.

Xero is best known for its accounting capabilities, including strong bank reconciliation and invoicing. Its budgeting tools are functional but relatively simple.

- Best for: Small businesses using Xero for accounting and simple budget tracking

- Key features: Budget creation by account, budget vs. actual reporting, multi-currency support

- Limitations: Limited customization and reporting depth

- Pricing: Budgeting included in all plans, starting at $25/month

Float

Float is a cash flow forecasting and budgeting tool designed to work alongside accounting platforms like Xero and QuickBooks. It focuses on visual forecasts and scenario modeling to help businesses plan for future cash positions.

By syncing automatically with accounting data, Float keeps forecasts up to date and makes it easier to test different assumptions without rebuilding models.

- Best for: Cash-focused small businesses that prioritize forecasting

- Key features: Cash flow forecasting, scenario planning, budget tracking, automatic data sync

- Limitations: Less comprehensive expense-level budgeting

- Pricing: Starting at $47/month

Best options for mid-market companies (50–500 employees)

Mid-market companies have typically outgrown spreadsheets but don’t need full enterprise planning systems. At this stage, budgeting software needs to support multiple departments, real-time visibility, and scalable workflows.

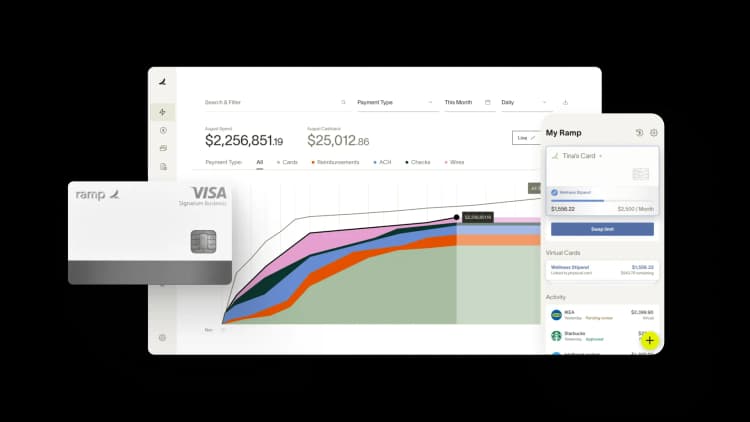

Ramp

Ramp is a corporate card and spend management platform with built-in budgeting capabilities. It allows finance teams to set department-level budgets, apply spending limits, and track usage in real time as transactions occur.

Because budgeting is embedded directly into Ramp’s expense management workflows, actual spending is automatically categorized and reflected against budgets. This makes it easier to enforce controls and spot issues before budgets are exceeded.

- Best for: Mid-market companies that want budgeting tied directly to spend management

- Key features: Real-time budget tracking, automated categorization, budget alerts, committed spend visibility, native accounting integrations

- Why it stands out: Budgets update automatically across cards, bills, reimbursements, and procurement without manual syncing

- Pricing: Free plan available; Plus and Enterprise tiers for advanced features

Centage (formerly Planning Maestro)

Centage is a budgeting and financial planning platform built for mid-market teams that need structured forecasting and collaboration. It integrates with accounting systems to pull historical data and automate variance reporting.

Centage supports driver-based budgeting, rolling forecasts, and approval workflows, making it easier for departments to participate without heavy IT involvement.

- Best for: Mid-market teams that need collaborative budgeting with minimal technical overhead

- Key features: Driver-based planning, rolling forecasts, automated consolidation, variance analysis

- Limitations: Requires separate tools for expense management and payments

- Pricing: Starting at $1,750 per month, billed annually

Abacum

Abacum is a financial planning and analysis platform designed for mid-market teams that need collaborative budgeting, forecasting, and reporting without relying on spreadsheets. It centralizes financial data from existing systems and makes it easier for finance teams and business stakeholders to work from a shared plan.

Abacum emphasizes usability and collaboration, allowing budget owners to contribute inputs while finance maintains control over models, assumptions, and approvals. The platform supports rolling forecasts and scenario planning to help teams adapt plans as conditions change.

- Best for: Mid-market companies that want collaborative budgeting and forecasting workflows

- Key features: Budgeting and forecasting, scenario planning, role-based access, integrations with accounting systems

- Limitations: Does not include native spend management or expense controls

- Pricing: Custom pricing; demos available

PlanGuru

PlanGuru focuses on budgeting and forecasting flexibility, offering multiple methods for building plans. These include historical analysis, growth-based projections, and unit-driven models tied to operational metrics.

It supports scenario comparisons, rolling budgets, and detailed financial projections, making it a good fit for teams that need strong modeling without enterprise complexity.

- Best for: Growing companies that need dedicated forecasting and modeling

- Key features: Cash flow forecasting, scenario analysis, financial statement projections

- Limitations: Limited real-time spend tracking

- Pricing: Starting at $99/month for the cloud version

Prophix

Prophix is a corporate performance management platform that provides advanced budgeting, planning, and forecasting capabilities. It supports multi-entity consolidation, driver-based planning, and multi-level approval workflows.

The platform integrates with ERP systems to automate data collection and supports continuous planning beyond annual budget cycles.

- Best for: Mid-market and enterprise teams with dedicated FP&A functions

- Key features: Driver-based planning, workflow automation, advanced reporting, scenario modeling

- Limitations: Steeper learning curve and administrative overhead

- Pricing: Custom pricing

Best options for enterprise (500+ employees)

Enterprise organizations require budgeting software that can handle complex structures, multiple entities, and advanced security and governance needs.

Sage Intacct

Sage Intacct supports detailed, multi-dimensional budgeting across departments, locations, and entities. Users can manage multiple budget versions and scenarios while automating variance reporting.

Its strength lies in combining budgeting with robust accounting and financial management capabilities.

- Best for: Organizations with complex, multi-entity financial operations

- Key features: Multi-dimensional budgets, automated allocations, real-time reporting

- Limitations: Longer implementation timelines and higher administrative effort

- Pricing: Custom pricing

Anaplan

Anaplan is a connected planning platform designed for large organizations that need highly customizable budgeting and forecasting models. Its in-memory calculation engine supports complex, multi-dimensional scenarios at scale.

Anaplan excels at linking financial plans with operational drivers across the business.

- Best for: Enterprises that need connected planning across multiple functions

- Key features: Advanced scenario modeling, cross-functional planning, scalable architecture

- Limitations: Complex implementation; typically requires consultants

- Pricing: Custom pricing

Workday Adaptive Planning

Workday Adaptive Planning provides enterprise-grade budgeting and forecasting with collaborative workflows and flexible modeling. It integrates with ERP and HR systems to automate data collection and support workforce planning.

The platform supports multi-dimensional budgets and complex organizational structures.

- Best for: Large organizations already using Workday or similar enterprise systems

- Key features: Driver-based modeling, cross-functional planning, extensive customization

- Limitations: Resource-intensive setup and ongoing management

- Pricing: Custom pricing

How budgeting software integrates with your financial stack

Integration quality often determines whether budgeting software delivers value or becomes another data silo. The right setup ensures budgets stay accurate as transactions occur across systems.

Most budgeting tools integrate with other systems in one of three ways:

- Native integrations: Pre-built connections maintained by the software vendor; typically the most reliable option

- API integrations: Custom-built connections that require technical resources to implement and maintain

- Third-party middleware: Tools such as Zapier that connect systems but can add complexity and latency

At a minimum, budgeting software should integrate with your accounting system and core spend tools like cards and bill pay. Depending on your business, integrations with systems such as your HRIS or customer relationship management (CRM) platform can also support workforce and revenue planning.

Ramp simplifies this by combining budgeting with spend management in a single platform. Budgets automatically reflect spending from cards, bills, and reimbursements without requiring separate integrations or manual data syncing.

Business budgeting methods

Different budgeting methods suit different business models and management styles. Understanding these approaches helps you choose software that supports how your organization plans and controls spending.

| Method | Description | Best for | Software selection |

|---|---|---|---|

| Top-down budgeting | Leadership sets overall targets and departments allocate spending within those limits | Stable businesses focused on cost control | Allocation features that cascade targets across departments |

| Bottom-up budgeting | Departments propose budgets based on operational needs, which finance consolidates and reviews | Organizations prioritizing accuracy and buy-in | Collaborative input tools and consolidation workflows |

| Zero-based budgeting | Each budget cycle starts from zero and requires justification for all expenses | Companies aiming to eliminate inefficiencies | Granular expense tracking and justification workflows |

| Incremental budgeting | Prior-year budgets serve as the baseline with adjustments for growth or inflation | Stable businesses with predictable spending patterns | Tools that adjust historical figures and track variance |

| Driver-based budgeting | Budgets are built using business drivers like headcount or revenue | Dynamic organizations needing flexible planning | Robust modeling and scenario planning capabilities |

Your budgeting method should guide which software features matter most. Choose tools that align with how your organization approaches budget planning, not just how budgets are recorded.

How to choose the right business budgeting software

Selecting budgeting software requires a clear understanding of your needs, constraints, and growth trajectory. Use the steps below to evaluate tools based on how your organization actually budgets and spends.

- Document your current pain points: Identify where budgeting breaks down today, such as manual data entry, slow updates, limited visibility, or email-based approvals

- Evaluate your existing technology stack: List your accounting software, cards, bill pay tools, and any systems the budgeting tool must integrate with, including multi-entity or multi-currency requirements

- Define your user requirements: Determine who will use the software, from finance to department heads and executives, and assess how technical those users are

- Assess implementation and support needs: Consider how quickly you need to be live and what level of onboarding, training, and ongoing support the vendor provides

- Calculate total cost of ownership: Look beyond subscription pricing to include implementation, integrations, training, and ongoing maintenance

Involve real users early

Request demos from two to three shortlisted vendors and include department heads and finance team members in evaluations. Software adoption matters as much as features.

Common budgeting software implementation mistakes to avoid

Most budgeting software failures come from implementation missteps, not the software itself. These common mistakes are avoidable with proper planning and realistic expectations.

- Choosing features over usability: A feature-rich tool delivers little value if teams don’t adopt it. Prioritize usability and adoption over an exhaustive checklist

- Underestimating integration complexity: Validate integrations during evaluation, not after purchase, and account for setup and testing time in your timeline

- Skipping change management: Software alone won’t fix budgeting problems. Plan for training, communication, and user adoption as part of implementation.

- Leaving out budget owners: Involve department leaders early by including them in demos and requirement gathering to drive buy-in

- Failing to define success metrics: Set clear goals before implementation, such as faster cycle times, improved forecast accuracy, or more timely reporting

Avoiding these pitfalls helps teams realize value faster and reduces friction during rollout.

Track budgets in real time with Ramp

Choosing the right budgeting software comes down to matching capabilities to how your business actually spends money. For many mid-market companies, the hardest part isn’t creating budgets but tracking them in real time across cards, bills, reimbursements, and procurement.

Ramp unifies corporate cards, expense management, bill pay, and procurement with built-in budgeting. Instead of stitching together multiple tools, finance teams get a single source of truth for all company spending.

With Ramp, you get:

- Real-time visibility: See budget utilization as transactions happen

- Automated categorization: Reduce manual data entry and reconciliation

- Committed spend tracking: Get visibility into pending purchase orders

- Department-level ownership: Let budget owners manage their own spend

- Smart alerts: Receive notifications before budgets are exceeded

The result is less time spent chasing data, better spending decisions by teams, and clearer insight for leadership without waiting for month-end close.

Try an interactive demo to see how Ramp turns budgeting from a periodic exercise into a real-time control system.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits