Activity-based budgeting: Definition and how to implement

- What is activity-based budgeting (ABB)?

- How to set up activity-based budgeting

- Examples of activity-based budgeting

- Pros and cons of activity-based budgeting

- Track activity-based budgets in real time with Ramp

To truly understand what your company is spending, it’s not enough to only know the financials; you need to know what the key cost drivers are behind those expenses. To help understand these drivers, activity-based budgeting can help. Typically used when transparency is required to reveal inefficiencies that may be compressing the company’s profit margin, ABB can create clarity around spending pain points.

In this article, we’ll explain what activity-based budgeting is and why it’s important for a better understanding of your financial picture. We’ll also review some of the pros and cons and explain how to implement ABB if it’s the right fit for your business. Like most budgeting or accounting practices, using activity-based budgeting requires a team effort, so it’s important to create alignment among your teams before getting started.

What is activity-based budgeting (ABB)?

Unlike creating a traditional operating budget, activity-based budgeting involves the recording, research, and analysis of the activities that generate costs for the company. It’s a more rigorous process than traditional budgeting, which adjusts according to inflation or business development. Companies generally implement ABB to find the cost drivers that are causing a company to overspend.

Examples of cost drivers are direct labor hours, customer contacts, engineering change orders, machine orders, and number of product returns. Each of these activities comes with a cost, and every company will be structured differently. With activity-based budgeting, a company can track each of those costs independently, providing greater budget transparency.

How to set up activity-based budgeting

The first step in setting up ABB is to identify the activities where money is being spent, then determine the number of units that activity requires. Best practices for this is to start with labor and materials costs, then do administrative costs. All these costs should be set up in a spreadsheet format and grouped based on commonalities.

For example, if a department requires three full-time employees, the number of units required would be 120 (hours worked) per week. If the cost per hour is $20, it equates to a weekly cost of $2,400. That’s a person-hour cost, so it should be grouped with other activities where the unit of measurement is the labor cost.

By breaking costs down in this manner, companies can determine where cuts can be made to increase profitability. In the scenario above, rather than simply cutting the department budget and expecting the department head to adjust, the numbers gleaned from ABB can facilitate research on how the number of person-hours can be reduced.

Examples of activity-based budgeting

Activity-based budgeting provides more accurate numbers for business expenses and calculating cost of goods sold (COGS). In traditional budgeting, a company with $4,000 in COGS from last month and an average sales increase of 10%, the COGS for the new month is estimated at $4,400. If sales exceed the monthly projection, that number will be off.

With activity-based budgeting, the cost per unit sold is used to calculate the budget. Let’s say in the example above that the $4,000 in monthly sales represents 800 units with a production cost of $5 per unit. Rather than estimating new month sales cost as a percentage, the company can calculate a per-unit cost increase. That 10% increase is now 80 units sold.

The difference may seem trivial, but in this case, ABB fills in additional business expense categories that can be used to cut costs and/or improve profitability. Can production costs be cut down? Can the number of units sold be increased? Having access to the more granular data provided by ABB can help facilitate better decisions in these areas.

Another example of ABB providing cost savings is maintenance and upkeep. In traditional budgets, these are entered as an estimated expense, leaving margin for inaccuracies and even abuse of funds. With activity-based budgeting, each maintenance call or upgrade is itemized based on its unit cost. This makes it easier to see where costs can be trimmed back.

Pros and cons of activity-based budgeting

Activity-based budgeting offers some clear advantages over traditional budgeting and zero-based budgeting. It provides more accurate cost data and gives a company insights for making business decisions that are simply not available with traditional budgeting. It’s also difficult to implement and maintain, so it requires a commitment from your entire team. Here are some pros and cons to consider:

Pros of activity-based budgeting

- Competitive edge: Using activity-based budgeting can cut unnecessary costs and allow a company to compete more effectively, particularly in price-sensitive markets. Reducing overhead gives a company more flexibility for expansion and product development.

- Viewing the business as a unit: ABB provides a single-unit view where costs are measured in units. Administration and sales might be different departments, but they can both be measured in hours. Manufacturing incorporates materials and production costs, but these are recorded on the company bottom line, not the department's.

- ABB eliminates bottlenecks: Activity-based budgeting reveals activities that are not necessary or redundant, providing justification to eliminate them. This makes the company more efficient and frees up employees to work on new projects or expand on existing ones.

- Improves customer relationships: When the company eliminates unnecessary activities and streamlines production costs, customer service improves. Business owners are able to see which activities directly affect profitability, so they tend to spend more time addressing customer concerns.

- Better tail spend management: Tail spend management is a term used to describe the analysis of high-volume, low-value expenses that clog up the transaction list and usually represent 20% or less of total spending. A common example of tail spend is print and packaging expenses. They fall outside the main purchasing processes and are often not effectively managed by the procurement team.

Cons of activity-based budgeting

- Complexity and understanding: The most significant drawback to activity-based budgeting is the complexity of the system and learning to understand it. Business owners, the executive team (if applicable), and all managers and accounting personnel need to fully understand it before it can be implemented.

- Resource-intensive: Everyone needs to be on board and each person involved will need to take on additional tasks. Time-consuming analyses are required, so employees may have to work extra hours to get them done. Owners will need to be more hands-on while this is happening.

- Implementation costs: The main implementation cost for ABB is the training for the employees involved, including upper-level management. This may require the addition of new people who have previous experience with activity-based budgeting.

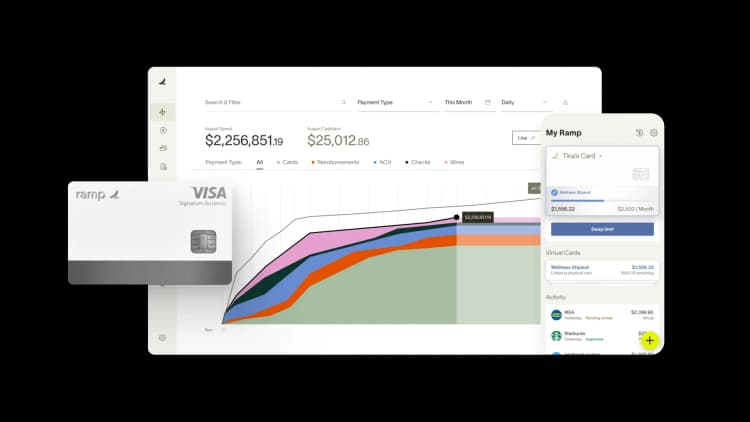

Track activity-based budgets in real time with Ramp

Activity-based budgeting promises granular cost visibility, but traditional tools make it nearly impossible to monitor spending against activity drivers as it happens. You end up waiting until month-end to discover which activities consumed more resources than planned, leaving no time to course-correct.

Ramp Budgets gives you real-time visibility into spending across any dimension you define, whether that's by activity, department, vendor, project, or custom fields that match your cost drivers. Instead of reconciling spreadsheets after the fact, you see exactly where money flows as transactions post.

Here's how Ramp helps you track activity-based budgets effectively:

- Create budgets for any activity: Set up budgets by department, vendor, category, or custom dimensions that align with your activity cost pools

- Monitor spending continuously: Track budget consumption in real time across cards, reimbursements, procurement, and accounts payable

- Alert stakeholders at key thresholds: Configure notifications when spending approaches limits so activity owners can adjust before overages occur

- Approve expenses with full context: See projected budget impact and remaining balance during expense review, giving approvers the information they need to make informed decisions

- Delegate ownership to activity managers: Give department heads and project leads direct visibility into their budgets so they can manage spending without waiting on finance for updates

This continuous visibility transforms activity-based budgeting from a planning exercise into an active cost management tool.

Learn more about how Ramp can help you track and control costs across every business activity.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°