How businesses can optimize their vendor payment systems for speed and efficiency

- Common vendor payment issues

- Solutions to improve the vendor payment process

- Combating zombie spending in the vendor payment process

Managing vendor payments is a task that requires more time and effort than most business owners realize. But because recurring expenses keep your business going, it’s well worth the effort to optimize. However, between SaaS subscriptions, contractors, equipment, supplies and more, it’s incredibly easy to lose sight of who you’re paying and how much you’re spending.

Fortunately, there are ways to anticipate and avoid vendor payment issues entirely. In this article, we’ll discuss common vendor payment pitfalls and explain how you can streamline your processes to gain more control over your business spending.

Common vendor payment issues

No matter where you are in your journey, being aware of potential challenges will help you identify and avoid complications. Let’s dive into hitches that can have the biggest impact on your business.

Lack of visibility into vendor spending

As you add new tools into your tech stack and establish new partnerships and teams, it becomes harder to keep track of renewals.

This is especially true if spending is happening across several cards and accounts. It’s even more difficult to gauge how much value you’re getting out of each service.

Security issues & interrupted service

A stolen or compromised credit card can disrupt your business in several ways, even after you receive a new card. You and your customers might experience interruptions in service while you manually update billing information with your vendors, which can lead to hours of lost productivity.

Frequently late payments

Delaying an invoice or two during the holidays is one thing, but chronically paying bills late results in interrupted services, upset contractors, and late fees.

Out-of-control zombie spend

Zombie spend is a term that describes how organizations sign up for a subscription using autopay features and forget to use it.

There are several reasons this might take place. In some instances, you’re testing out solutions and forget to cancel the options you didn’t choose. In others, a tool that is no longer needed automatically renews without anyone noticing. These situations get the best of us and they only multiply as you add people to your team and expand your SaaS solutions.

Solutions to improve the vendor payment process

The good news is that these common issues are avoidable. Implementing vendor management best practices will save you from the headaches of chasing after your subscription dollars and apologizing for late payments.

In the interim, here are some solutions to help you solve your vendor payment issues.

Gain visibility with centralized payments

The easiest way to gain visibility into your vendor payments is to keep your spending in one place. This gives you a full picture of your business finances and protects you from needing to consolidate all of your bookkeeping later on.

Whenever possible, choose payment systems that allow for multiple ways to process payments, including credit cards, ACH payments and checks.

Prevent security issues & service interruption with a virtual card

Virtual cards are uniquely generated credit card numbers that work for online purchases. They are associated with your physical card but provide more security because each number is associated with a specific purchase. This gives you ultimate visibility into and control over your spending, as individual numbers can be frozen without affecting other subscriptions.

Better yet, look for a virtual card that allows you to create one-time payments for vendors. This way, if your card is ever breached, you only need to worry about reaching out to that single vendor instead of dozens.

Pay bills on time with automatic bill payment

Predictable invoices for expenses like retainer agreements and rent payments are great candidates for finance automation. If you know that you will need a service or product to help you pay your bills on time in the future, and you don’t expect the amount to fluctuate, you’ll save time and stress by setting up a secure automatic bill payment.

Combating zombie spending in the vendor payment process

We mentioned zombie spend above as one of the biggest challenges associated with vendor payments. And while one $100 payment for SaaS you haven’t used in months doesn’t seem like a big deal, over time, these issues can compound.

What started out as a single charge turns into dozens of tools that you don’t even realize you’re paying thousands of dollars for a year. To that end, here are some solutions to help you with zombie spend in your vendor payment processes.

Negotiate for new payment terms or switch vendors as needs evolve

As your business grows, your needs will naturally change with it. When you’re negotiating with vendors, make sure you know where you stand in terms of spending. If you’re one of their bigger clients, they’ll want to keep you. If you decide you’re not getting enough bang for your buck, consider switching to a better fit.

Implement a review & approval process for all vendor bills

Monitoring expenses across teams gets hectic, especially when communication is happening via video-conferencing, email, Slack, Teams and more. If you don’t have a clear process for reviewing and approving spending, you might not catch unnecessary expenditures until it’s too late.

Luckily, you don’t have to wait until the end of the month to get visibility. Real-time expense management, allows you to see what’s happening in your business minute-by-minute.

Digitize invoices & contracts

If you receive paper invoices, scan and upload them into the same system where you’re receiving digital invoices. Keeping all your invoices in one place allows you to track whether each invoice is accurate and if it’s been paid. This simplifies workflows and prevents back-and-forth between team members.

Similarly, storing contracts digitally keeps you organized so you can see payment terms and details at a glance. Being able to pull up information quickly equips you and your team to negotiate terms, catch inconsistencies and make necessary transitions.

Conduct regular audits

While finance automation platforms give you the power to monitor every transaction, you probably have better things to do than constantly refresh your screen. But you’ll still want to regularly track business expenses so that you can properly evaluate your profit & losses, find opportunities to streamline spending and prepare for tax season.

A good rule of thumb is to sit down at least once a month to review your accounts.

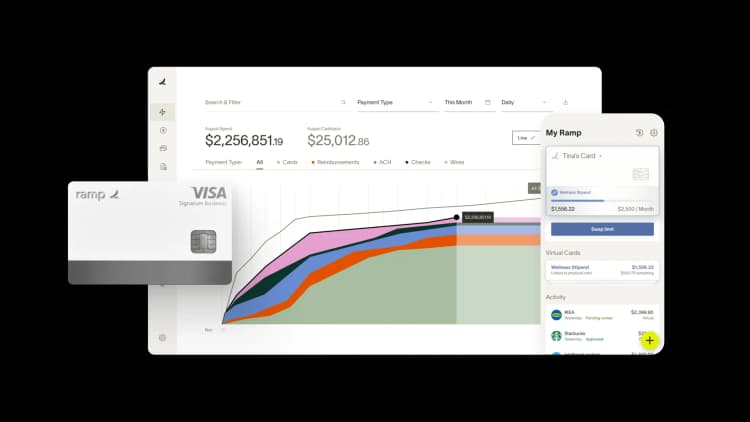

Streamline vendor payments and ensure transparency with Ramp

With Ramp Vendor Management, you get a single view of all of your vendor data.. Instead of guessing what you owe and when you owe it, Vendor Management provides a single view into every vendor detail, document, and transaction so you can get answers about your vendors quickly and easily.

Ramp also makes it easier to make confident buying and renewal decisions quickly. Our Price Intelligence feature gives you the data you need to negotiate and buy software with more confidence.

Price Intelligence uses real transactions to create benchmarks that give you a clearer idea of what your peers are paying for the same software. Businesses using Ramp are continually sharing their contracts to make Price Intelligence a trusted source, bringing the wisdom of the crowd to software costs.

Learn more about Ramp Intelligence here.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits