Vendor negotiation strategies: How to secure better pricing and terms

- What is vendor negotiation?

- Why vendor negotiation matters

- Key vendor negotiation strategies

- Negotiating during economic uncertainty

- International vendor negotiation strategy

- Common mistakes to avoid in vendor negotiations

- Optimize your vendor negotiations with Ramp

Looking to improve procurement strategies, reduce costs, and foster strong, long-term supplier relationships? Learn the ins and outs of vendor negotiation. Mastering the negotiation process can help you secure better pricing and more favorable contract terms, as well as enhance vendor partnerships.

Let's take a closer look at what vendor negotiation is, why it's important, the strategies you can use to make it more effective and get better results, and common mistakes to avoid.

What is vendor negotiation?

Vendor negotiation is the process of discussing terms and conditions with vendors to reach mutually beneficial agreements. It goes beyond price reduction; successful vendor negotiations also cover payment terms, warranties, service level agreements (SLAs), and other essential contract elements.

A successful negotiation leads to cost savings, stronger supplier relationships, and better management processes.

Why vendor negotiation matters

Mastering vendor negotiation strategy can significantly impact your bottom line. Effective negotiations help you:

- Secure better pricing and reduce operational costs

- Establish favorable terms for contract renewals and SLAs

- Strengthen vendor relationships, paving the way for future partnerships

- Align business goals with your vendors for a win-win situation

Negotiation isn't just about getting the lowest price; it’s about building long-term relationships that support your business's ongoing success.

Key vendor negotiation strategies

To successfully navigate vendor negotiations, implement strategic approaches that secure better pricing and benefit the complete vendor management lifecycle. Steps include:

1. Build clear communication

Start with transparent communication. Clearly define your expectations, timelines, and quality standards. Open, honest conversations about what you need and what you can offer will lay the foundation for a successful negotiation.

Share your objectives and limitations with vendors.

Be up front about your goals and constraints, and regularly check in with your vendor to ensure alignment.

2. Conduct competitive research and get multiple quotes

When negotiating with vendors, gathering multiple quotes allows you to benchmark pricing and terms. Researching what others in your industry are paying for similar products or services gives you leverage in negotiating prices and securing better contract terms.

In addition to obtaining quotes, assess vendors based on their service quality, reputation, and ability to meet your unique business needs.

Use Ramp's free vendor directory when conducting competitive research.

Our vendor directory showcases SaaS tools across categories with insights powered by Ramp's proprietary spend data, helping you quickly compare options and strengthen your position during negotiations.

3. Understand your vendor's needs and build a win-win deal

Successful negotiations are about more than just your needs. Take the time to understand the vendor’s position, whether they’re focused on profit margin, timelines, or payment terms. Use this insight to build a solution that benefits both sides. Remember, vendors are more likely to offer better pricing or favorable terms if they see the deal as mutually beneficial.

Look beyond simple transactions.

Align your goals with the vendor’s to create a partnership rather than a transaction, and look for shared value that benefits both parties in the long term.

4. Negotiate non-price terms

While price is important, non-price terms such as payment schedules, warranties, and SLAs can have an equally significant effect on your business.

Making these elements part of your vendor negotiation strategy ensures you minimize the effect of recurring expenses on your cash flow while receiving the service your business needs. For example, negotiating longer payment terms or warranty periods can result in substantial cost savings over time.

If you’re working with a SaaS provider, negotiating SLAs can ensure that the vendor meets your uptime requirements and can help avoid potential revenue loss. By negotiating these terms, you safeguard your business operations in the long run.

Non-price terms

Aspects of the contract that don't involve price, such as payment schedules, delivery timelines, warranties, and SLAs.

5. Showcase your business to vendors

In many cases, vendors want to work with businesses that align with their long-term goals. Position your company as a valuable partner by emphasizing your strengths and future growth.

Show vendors that doing business with you will be mutually beneficial in the long run. For instance, if you're expanding your product line, vendors may be interested in providing better pricing to secure your long-term business.

Involve vendors in your goals to strengthen relationships.

Highlight the potential for long-term relationships and partnerships. Share your growth plans and explain how the vendor fits into them.

6. Use technology to streamline negotiations

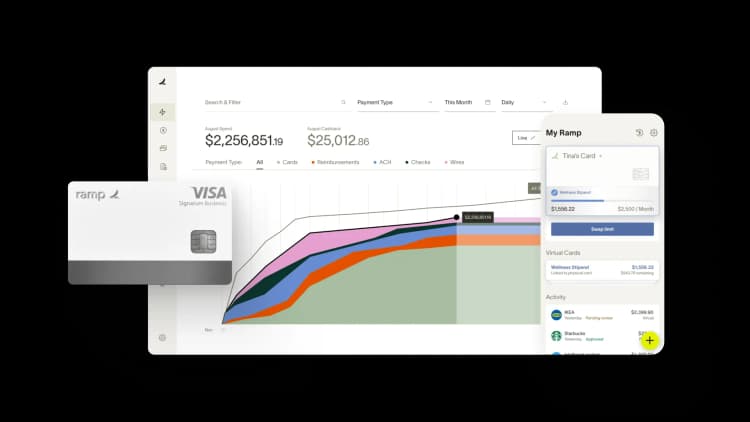

Leverage vendor management tools like Ramp to track KPIs and vendor performance metrics. Automation can help you streamline the vendor management process and ensure all negotiations are based on accurate, real-time data.

Using automated tools allows you to track contract terms, monitor SLAs, and support timely payments, which strengthens your relationship with vendors.

Use automation software.

Automation tools can help you track vendor contracts, SLAs, and payment terms. Follow contract management best practices when organizing and monitoring your vendor agreements.

7. Build long-term vendor relationships

Vendor negotiation isn’t a one-time event; it’s an ongoing process. Give your relationships a foundation of trust, transparency, and consistent communication. After the negotiation, continue nurturing the relationship by honoring agreements, addressing issues promptly, and working together to solve problems.

Strong relationships make future negotiations easier and can lead to even more favorable terms in contract renewals.

Regularly monitor vendor performance.

Set up quarterly reviews with your vendors to evaluate performance, discuss any changes in market conditions, and address issues before they escalate. This helps build a transparent and proactive relationship management strategy.

Negotiating during economic uncertainty

Negotiating during economic uncertainty, such as recessions or financial downturns, requires different strategies. Vendors may be more flexible in negotiations to secure long-term customers when they face financial pressures.

For example, during the economic uncertainty of the COVID pandemic in 2020, a survey published by Supply Chain Management Review revealed 64% of respondents reported an increase in supplier renegotiations.

Try negotiating payment terms during a financial slump.

Ask for longer payment terms—net 60, net 90—to ease cash flow challenges during economic hardship, and negotiate for price stability over the long term to ensure prices don’t fluctuate with market conditions. Also, vendors may be more willing to offer discounted prices or better terms if you commit to guaranteed purchases over a set period.

International vendor negotiation strategy

When negotiating with international vendors, consider additional factors such as local regulations, payment terms, and cultural differences.

For example, a U.S. company negotiating with a supplier in China might consider including delivery schedules and customs fees as part of the overall contract to avoid unexpected costs or delays.

Key considerations for international negotiations include:

- Regulatory compliance: Make sure the contract meets local legal and regulatory requirements. For example, European contracts must comply with GDPR when handling customer data.

- Cultural differences: Understand that various cultures may approach negotiations differently. In some countries, the focus is on long-term relationships; others may prioritize transactional deals.

- Currency and payment terms: Be aware of exchange rates and potential tariffs when negotiating payment terms with international vendors

These factors can significantly affect the structure of your agreements and the overall negotiation process.

Common mistakes to avoid in vendor negotiations

Be aware of these common pitfalls that can negatively impact your vendor negotiation strategy:

- Failing to research: Not benchmarking prices or understanding market rates can leave you at a disadvantage

- Ignoring non-price terms: Focusing solely on price may result in unfavorable payment terms, SLAs, or contract clauses

- Lacking clear goals: Entering negotiations without a clear understanding of your business needs can lead to poor outcomes

What's the best way to negotiate vendor pricing?

The best way to negotiate vendor pricing is by gathering multiple quotes, benchmarking pricing against industry standards, and understanding your vendor's costs and constraints. Tools like Ramp's Price Intelligence can reduce the manual effort here.

Optimize your vendor negotiations with Ramp

Vendor negotiation is a critical skill that can directly affect your business’s bottom line. By applying these vendor negotiation strategies, you can secure better pricing, more favorable contract terms, and long-term, successful vendor relationships.

Ramp integrates with your accounting software, automating the tracking and categorizing of every transaction. With real-time reporting and analytics, you can easily review your vendor contracts, monitor SLAs, and make data-driven decisions that improve cost savings across your procurement process.

Ready to take the next step in transforming your procurement strategy? Try Ramp’s interactive demo.

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide.” ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn’t just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn’t exist in Zip. It’s made approvals much faster because decision-makers aren’t chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits

“More vendors are allowing for discounts now, because they’re seeing the quick payment. That started with Ramp—getting everyone paid on time. We’ll get a 1-2% discount for paying early. That doesn’t sound like a lot, but when you’re dealing with hundreds of millions of dollars, it does add up.”

James Hardy

CFO, SAM Construction Group