What is zombie spend?

- What is zombie spend?

- Understanding the causes of zombie spend

- Business practices that can reduce zombie spend

- Stop zombie subscriptions before they drain your budget

Controlling your company's spending is more complicated than it might seem at first glance. Line item overhead and cost of goods sold (COGs) are easy to track, but what about those small, forgotten expenses, like subscriptions and recurring memberships? They seem insignificant and are often overlooked. But in reality, that’s a mistake since they can quickly add up.

In this article, we’re discussing zombie spend. It’s endemic to companies of all sizes and can easily wreak havoc on your businesses finances if stopgaps aren’t set up. Once it begins, zombie spend affects cash flow, one of your biggest and most important assets.

What is zombie spend?

One of the best examples of zombie spend is the unused SaaS subscription that’s been set on autopay with the company credit card. Employees will sometimes subscribe and either forget the existence of that subscription, sign up for a new piece of software, and never unsubscribe from the first one. Your company continues to pay for both, but there are no human users benefitting from it. That’s zombie spend.

The long-term issue with zombie spend is that it can show up in multiple areas. Recurring subscriptions and membership fees are the most obvious. Office supplies that are placed on auto-delivery are another. Have you checked your supply cabinets? If you’re overstocked on paper goods, it might be the result of automated orders. That’s zombie spend also.

This type of spending is difficult to detect because it could be buried in invoices that also include legitimate spending on supplies or subscriptions. Accounts payable departments don’t have safeguards to prevent that so your company may need to do a full spending audit to uncover it. We’ll get into that and solutions to prevent zombie spending below.

Understanding the causes of zombie spend

As we stated earlier, zombie spend is a common yet very preventable problem. Eliminating it starts with understanding what causes it in the first place. Here are some common spend management issues that may result in zombie spend:

1. Lack of spend control

If your business doesn’t have spend controls, you’re opening yourself up to reckless spending with very little oversight. That’s why it’s crucial to set up spend control policies early. When employees can charge anything to their company credit card, without an approval process of any kind, that leads to zombie spend. Once it happens the first time and gets through, expect the process to continue.

2. Out of date expense insights

Without real-time expense insights, the information your accounting department receives is out of date by the time it crosses their desk. That’s damage control, not prevention. Seeing expenses in real time allows you to have greater control over cash outflows. Certain expenses can be denied. Others can be made policy or eliminated in the next cycle.

3. No insights into your spending across categories

Expanding on the previous point, insights need to be categorized, but that’s impossible without having accurate expense categorization. If you aren’t properly categorizing your expenses, your insights into your spending are going to be blurred. This is a policy problem and a system issue. Miscategorization is common when it’s the employee’s responsibility to file expense reports.

4. Sticking to manual processes

Sticking to manual processes to track business expenses is a surefire way to leave yourself open to zombie spending. Manual reporting and reimbursement processes are not efficient. The employee could enter the wrong amounts, receipts for reimbursement may be unreadable, and accounting departments can often miss erroneous entries.

Business practices that can reduce zombie spend

Let’s chat about solutions. Now that you understand what zombie spend is and what causes it, we can dive into exactly what you can do to prevent it going forward. The following five areas are where most zombie spending can be prevented:

1. Spend control

Everything we’ve spoken about so far comes down to spend controls. If you can control what employees are purchasing with your company funds, you can eliminate zombie spend. This includes limiting where they can spend money, approving only certain categories of spending, and implementing spending limits to control cash outflows.

You may need to upgrade your entire expense system and modify company policies to achieve this. Issuing corporate cards to employees instead of relying on employees to use their own funds and submit for reimbursement gives you more control over the expense process. It also opens the door for automation and eliminates troublesome manual reports.

2. Real-time business expense tracking

Discovering an erroneous or zombie expense after it’s already been processed and reimbursed doesn’t save you any money. It might give you some insights to correct the behavior going forward if you happen to catch it. Otherwise, that pattern will repeat itself. Real-time business expense tracking creates the option of implementing spend controls in the moment.

For this to be effective, there needs to be a solid spending policy in place. If employees are only allowed to expense in certain categories, unauthorized expenses can be denied immediately, and employees can be notified so they don’t make the same mistake again. The spending policy backs up that decision. Ideally, it should be an easily accessible digital document, so all employees can review it at any time.

3. Spend analysis

Analyzing company spending can uncover areas of concern and might expose some of your zombie spending. The problem with most systems is that spend analysis requires extra steps that put a strain on personnel in your accounting and bookkeeping departments. Those extra steps can also be cost prohibitive, so many businesses do them infrequently or not at all.

Think about this from a manual reporting perspective. Reports are submitted and approved, reimbursements are authorized, and then you’re on to the next cycle. Spend analysis on those reports would start with consolidating them on a spreadsheet. Whose responsibility is that? Some expense software will do it for you. Others offer spending analysis tools.

4. Expense automation

Expense automation is your friend. Automating your expense system streamlines the accounting process for your company. A good example of this is reimbursement. If expenses are authorized and in policy, there’s no reason to delay reimbursement.

Several facets of an expense system can be automated, including spend controls. This is simple if you’re using corporate cards instead of personal credit cards for expenses. Look for a system where you can incorporate spending policies, spend controls, and reimbursement into one automated system. You’ll also want to be able to run automated expense reports and analysis.

5. SaaS management

How many times have you looked at your credit card statement and wondered, “What is that charge for?” Business accounting departments do the same thing, if they have a system in place that can detect that type of thing. That’s what we’re talking about today.

SaaS management should be handled by the company, not the individual employee. Spend controls can prevent them from signing up for subscriptions. Spending policies can forbid them. Business charge cards can be blocked from paying for them. If your employees need a SaaS subscription, explore it as an option for the whole company.

Stop zombie subscriptions before they drain your budget

Forgotten subscriptions and recurring charges can quietly drain thousands from your budget every month. Without visibility into who signed up for what—or whether anyone's still using it—these zombie expenses pile up fast, and finance teams waste hours hunting them down manually.

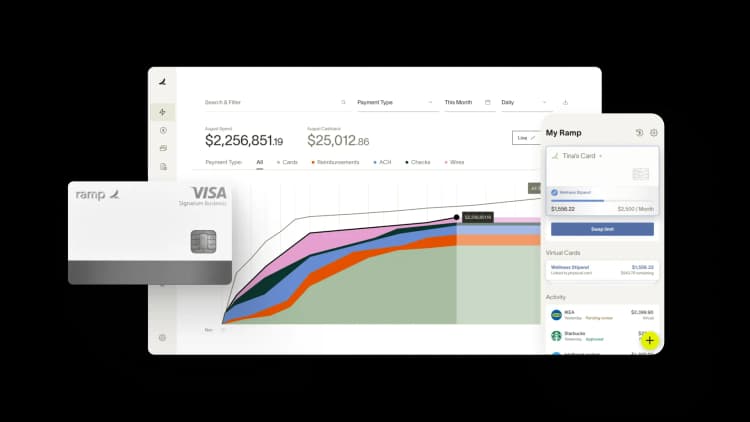

Ramp's accounting automation software surfaces every recurring charge automatically, so you can spot duplicates, flag unused tools, and cancel subscriptions before they renew. Ramp tracks all vendor spend in one place and alerts you when patterns shift or charges spike unexpectedly, giving you full control over what's active and what's wasting money.

Try a demo to see how Ramp helps finance teams reclaim budget from hidden recurring expenses.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits